This farce may be just the tip of the iceberg, but only transparency and accountability can clear the obstacles for the long-term development of the encryption ecosystem.

Author: Alex Liu, Foresight News

Chain clues source: Bubblemaps

Recently, heated discussions about “insider manipulation” broke out in the crypto community around the LIBRA token briefly endorsed by Argentine President Javier Milei and the MELANIA token associated with U.S. First Lady Melania Trump. Blockchain data analysis company Bubblemaps used cross-chain transfer records and time pattern analysis to expose for the first time that the behind-the-scenes teams of these two projects were actually the same group of people through on-chain real evidence, and made profits through “sniper transactions” and liquidity extraction. More than 100 million US dollars.

Background: From the presidential platform to the collapse controversy

Libra token’s “presidential farce”

Argentine President Millay met with Hayden Davis, the project’s technical consultant, on January 30, 2025, and promoted the Libra token on social media, sparking market fanaticism. However, within hours of the launch of the token, the project party withdrew US$87 million in USDC and SOL from the liquidity pool, causing the price to plummet by more than 80%. Millay subsequently deleted the tweet and launched an anti-corruption investigation, but it has caused huge losses to investors.

Market data source: GMGN

The project’s internal shirking responsibility: KIP Protocol claims to be only responsible for technical supervision, while Hayden Davis of market maker Kelsier Ventures accused the president’s team of “temporary remorse” and causing panic.

Melania token’s “political gimmick”

In January 2025, the market value of the Melania token endorsed by Melania Trump exceeded US$10 billion on its first day of launch, but then quickly collapsed due to insider selling, and the market value shrank to less than US$2 billion. Its model is highly similar to LIBRA, both relying on celebrity effects to attract retail investors, and then harvesting through liquidity.

Market data source: GMGN

Evidence: The “harvesting chain” controlled by the same team

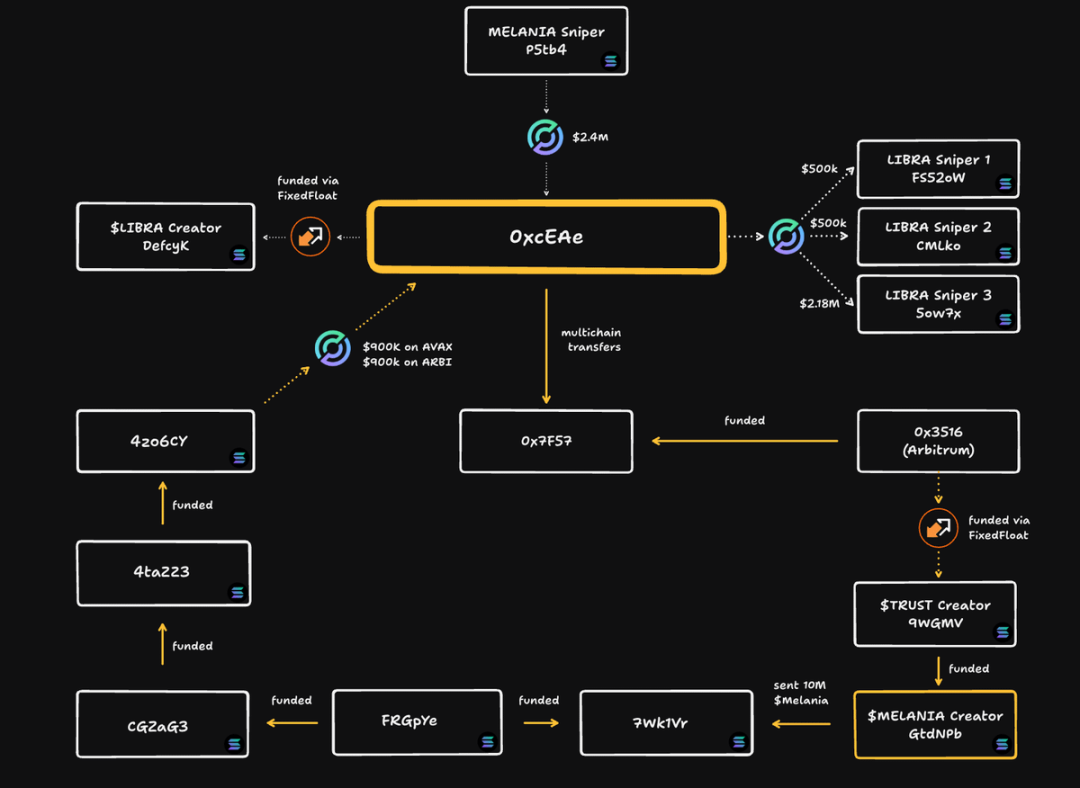

Bubblemaps ‘analysis reveals the following chains:

Melania token’s “self-directed and self-directed”

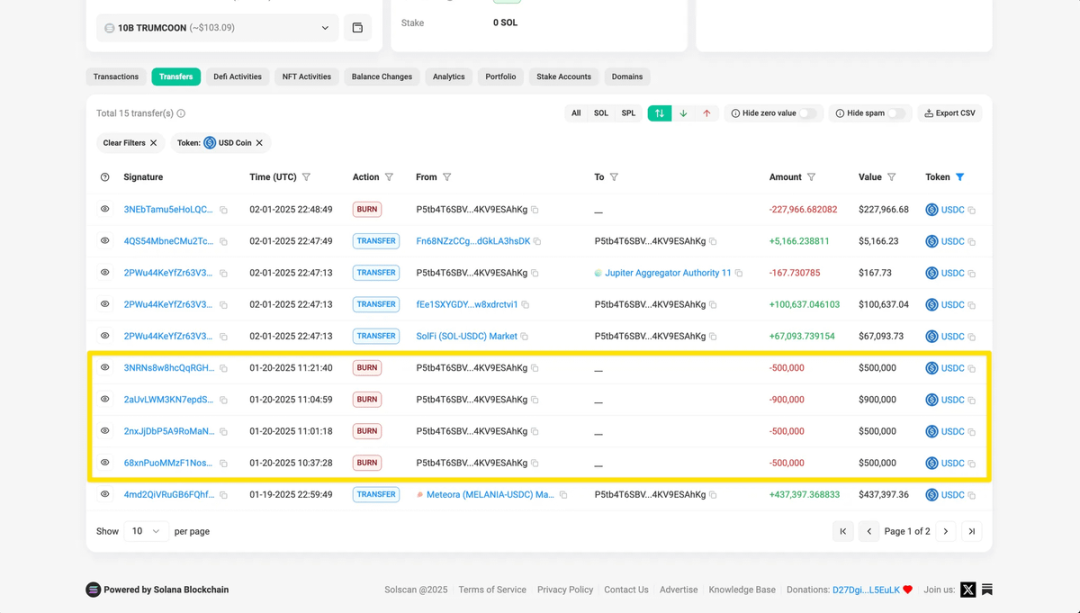

Address P5tb4 made a profit of US$2.4 million by sniping Melania tokens, and then transferred the funds to 0xcEA through a Cross-Chain Agreement (CCTP). The latter was confirmed to be the creator associated address of Melania tokens.

The team used internal information to buy tokens in advance and sell them at high prices, forming a typical “pumping and selling” model.

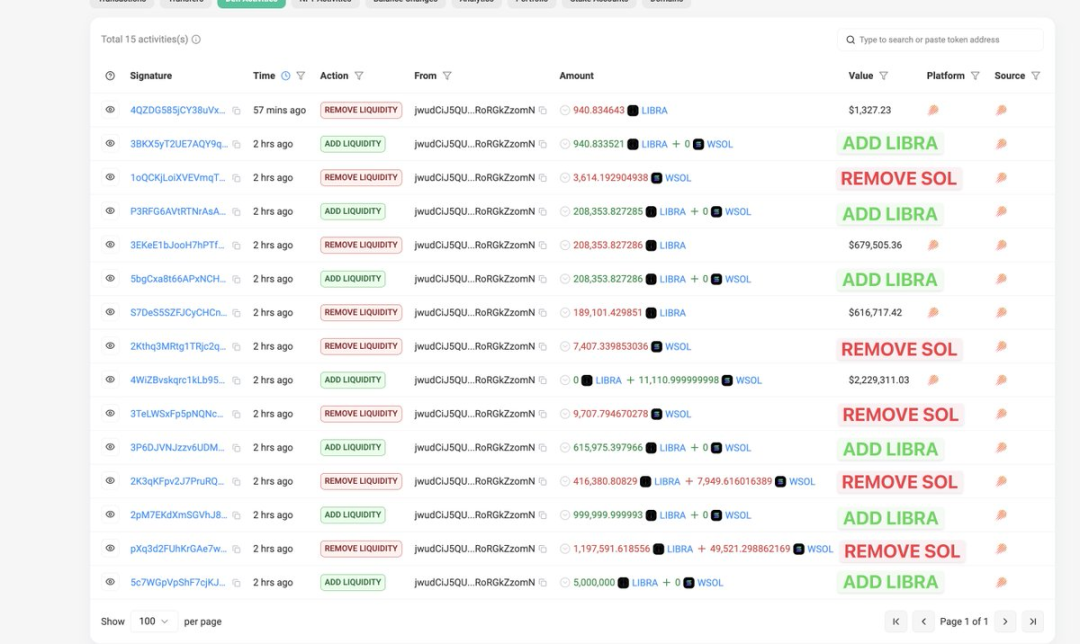

Libra token’s “same script”

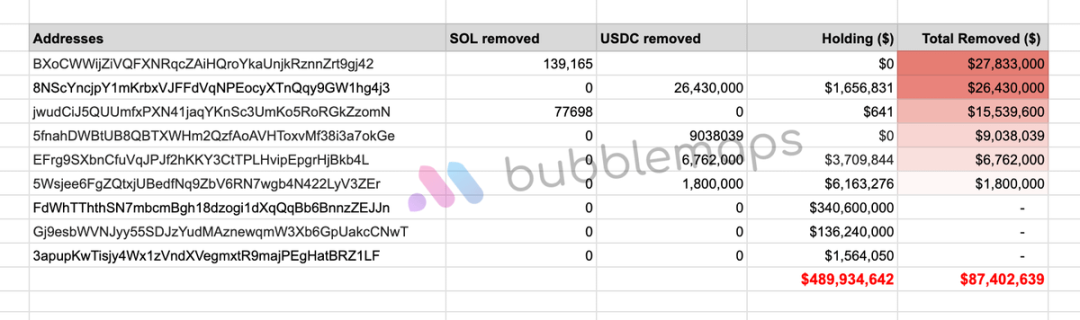

The address 0xcEA reappeared, providing financial support to DEfcyK, the creator of the Libra token, and conducting a “rush transaction” on Libra through multiple associated wallets, making a profit of US$6 million. At the same time, the Libra team withdrew $87 million from its liquidity pool, further exacerbating the collapse.

On-chain data shows that the wallets that purchased Libra in the early days highly overlapped with Melania tokens, and were all associated with Rug Pull projects such as TRUST, KACY, and VIBES, indicating that the same gang has manipulated multiple tokens for a long time.

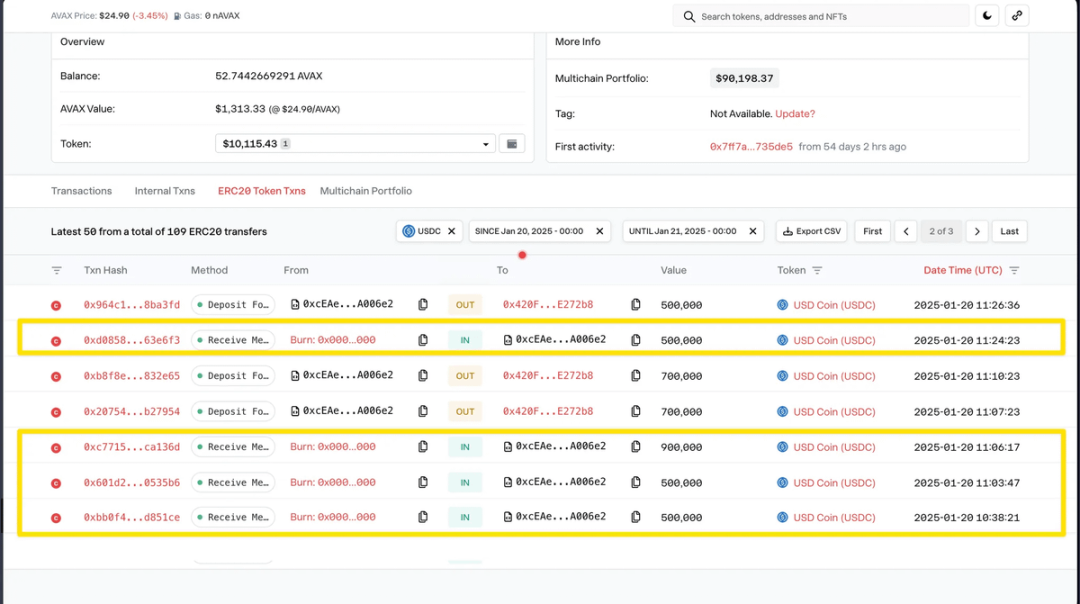

“ironclad evidence” of cross-chain capital flows

By analyzing on-chain records such as Solana and Avalanche, Bubblemaps found that 0xcEA addresses frequently used cross-chain protocols to transfer funds, concealing the true flow direction. For example, profits from Melania tokens are converted to USDC through CCTP and then flow into Libra’s creator wallet.

Related parties and interest networks

Key figures and institutions

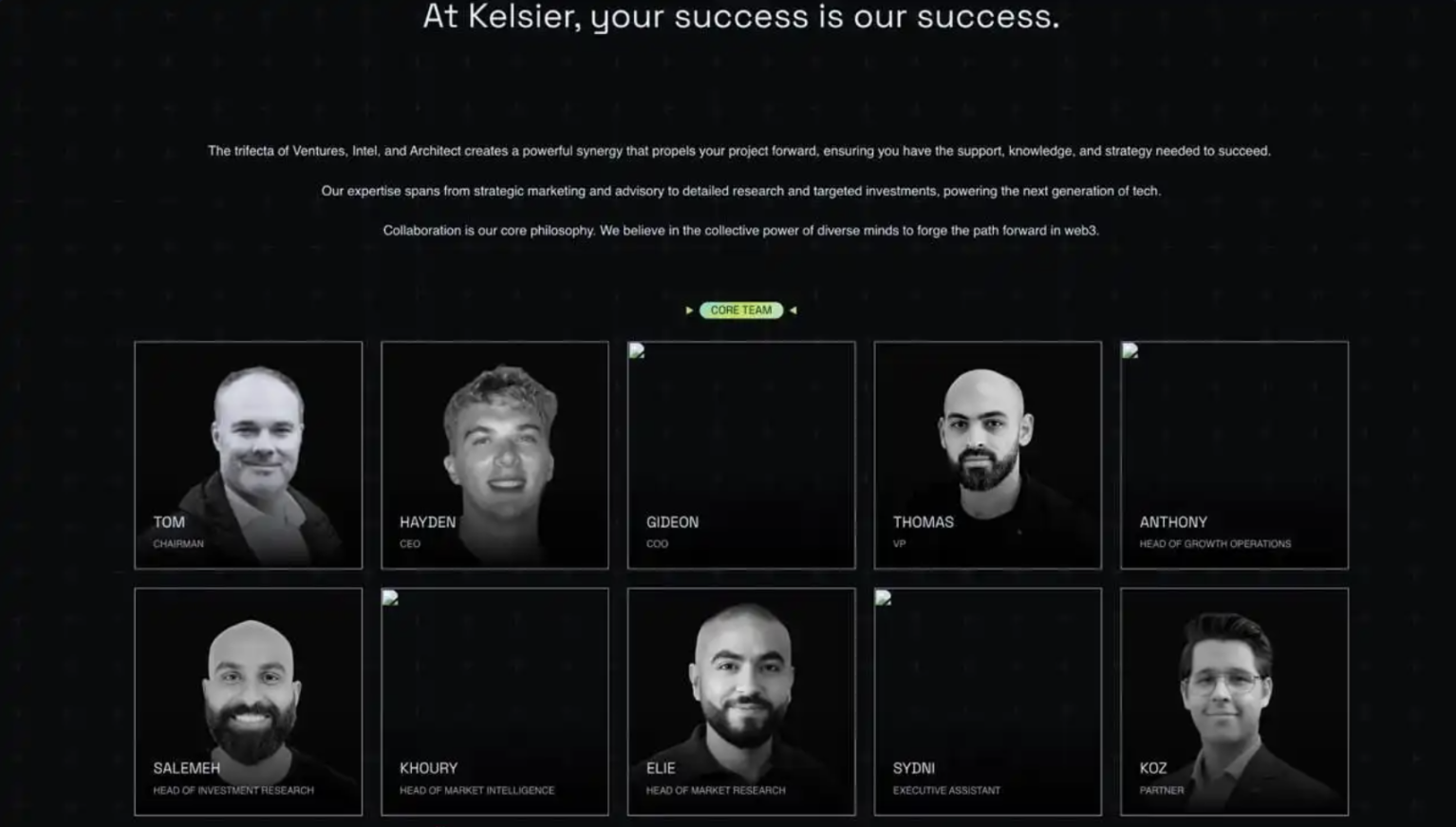

Kelsier Ventures: Alleged as a market maker for Libra, its founders, the Hayden Davis family (father Tom Davis, brother Gideon Davis), are called a “family-style criminal group” by Crypto KOL.

KIP Protocol: Although it denies participating in the token offering, its representative Julian Peh was implicated by Hayden Davis as a scapegoat.

The gray chain of “celebrity endorsements”

Members of the Millay government were exposed to accept bribes to promote the token platform. For example, Millay’s cronies charged $5 million to help the president promote LIBRA.

Community reflection and supervision calls

The “crisis of trust” in the crypto community

Developer Farokh called for the disclosure of all KOL lists that charge marketing fees, while KOL Dave Portnoy revealed that he had inside information, further exposing industry corruption.

The founder of Lambda Class in Argentina pointed out that such incidents have seriously damaged the reputation of the country’s crypto industry and many integrity builders have been implicated.

Urgent needs for regulation and transparency

The Argentine government has established an inter-departmental investigation team to integrate financial, anti-money laundering and other institutions to hold accountable.

Industry experts have called for the strengthening of the application of on-chain monitoring tools and the development of disclosure rules for celebrity endorsements of tokens to reduce information asymmetry.

Greed games and warnings

The Libra and Melania token incident reveals the darkest side of the crypto market: the triple trap of celebrity aura + insider manipulation + liquidity fraud. Bubblemaps ‘on-chain analysis not only provides victims with evidence of accountability, but also rings alarm bells for the community:

- Be wary of “political endorsement” tokens: Celebrity platforms are often short-term hype signals rather than value support.

- Strengthen on-chain investigation capabilities: Ordinary investors can use tools to track the wallets and capital flows of large households and identify suspicious patterns.

- Promote industry self-discipline: Project parties need to disclose token allocation and liquidity management plans to reduce information black boxes.

This farce may be just the tip of the iceberg, but only transparency and accountability can clear the obstacles for the long-term development of the encryption ecosystem.