Today, Sister Sa’s team turned their attention from the mainland to Hong Kong and talked about the judicial precedent recently set by the Hong Kong High Court in the field of cryptocurrencies.

The coming to power of the king is bound to mean the prosperity of the cryptocurrency market, and the appearance of prosperity will also bring undercurrents. A few days ago, Sister Sa’s team took stock of the judicial decisions related to cryptocurrencies that have relatively guiding significance or significant influence in the mainland in recent times. Today, Sister Sa’s team turned their attention from the mainland to Hong Kong to talk about the recent actions of the Hong Kong High Court in the field of cryptocurrencies. Judicial precedents set.

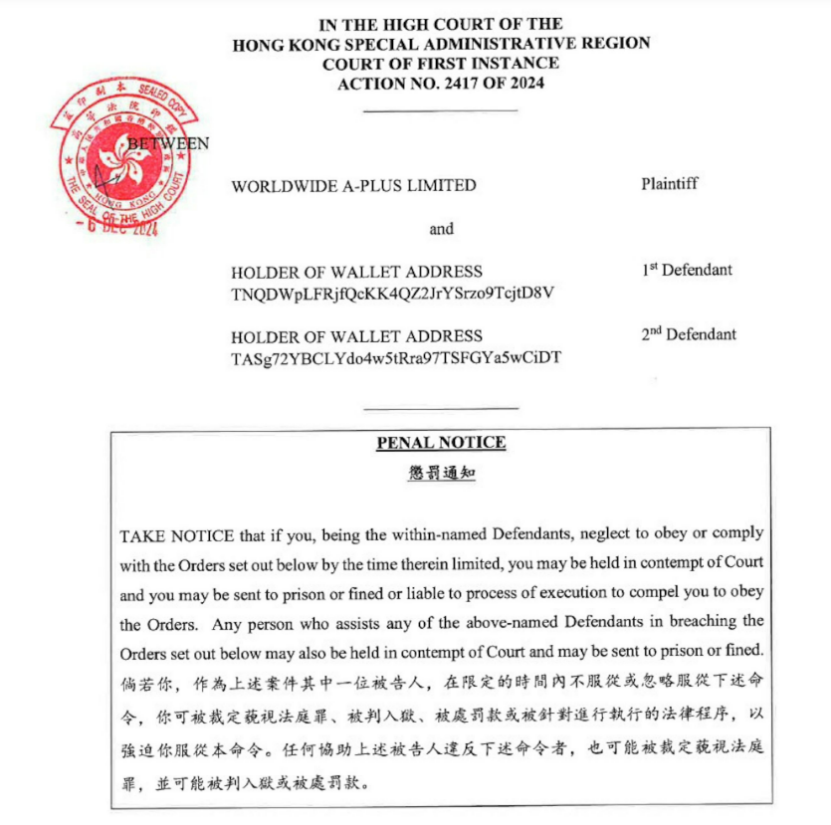

01. The Hong Kong High Court uses blockchain to continue issuing injunctions on cryptocurrency wallets?

The injunction issued by the Hong Kong High Court late last year is estimated to have been seen by old friends in the cryptocurrency community.

The case itself is not complicated. The plaintiff of the case, Company W, is a private limited company established in Hong Kong in March 2015. The company’s main business is marketing consulting. The company was defrauded of nearly 2.6 million USDT by telecommunications fraud in December last year. After the person in charge of the company realized that he had been defrauded, he immediately contacted the High Court of Hong Kong through his lawyer and requested that the two holders of Tron wallet addresses holding the stolen money involved be issued an injunction to freeze the assets in their wallets.

Just a few days later, Deputy Judge Douglas Lam of the Hong Kong High Court issued the above-mentioned asset freeze injunction and issued the injunction to the two wallet addresses involved through a technology company called M. The whole process was like flowing water. Since all cryptocurrency transaction details will be recorded on the blockchain, if someone transacts with the above two cryptocurrency wallets involved in the case, they will see the injunction recorded on the blockchain. This practice can be regarded as a disguised form. An “inscription” technology, which is like carving the word “stolen money” into the cryptocurrency wallet involved in the case.

Under Hong Kong law, violations of an injunction can be found in contempt of court, imprisonment or penalties. This injunction basically blocked the liquidity of cryptocurrency in the two cryptocurrency wallets involved in the case, preventing the plaintiff from experiencing greater losses.

02. Why is this matter of great significance

Due to the anonymity of blockchain technology and cryptocurrency itself, the cost for law enforcement agencies to track the real person behind the cryptocurrency wallet is extremely high (the extremely high cost does not mean that it is impossible. In fact, police in China and the United States have the ability to track the real person behind the cryptocurrency wallet. However, the cost of handling cases is disproportionate to the loss. Therefore, relevant technology and manpower will not be used in small and micro criminal cases involving currency due to the cost of handling cases).

In fact, in the vast majority of civil currency-related disputes in Hong Kong, the aggrieved party even only knows the other party’s cryptocurrency wallet address and cannot know the other party’s clear identity. It will become extremely difficult to prosecute and it will be impossible to resolve through legal channels. Relief. The Hong Kong High Court approved the direct issuance of injunctions to two wallet addresses through blockchain technology, directly solving the problem of “only knowing the wallet but not knowing the real person” in currency-related disputes. It can also be seen from the content of the injunction that this time, the Hong Kong High Court directly wrote two wallet addresses in the “Defendant” column, which can also be regarded as solving the litigation problem caused by the anonymity of cryptocurrency.

03. Will cryptocurrencies no longer be “safe” in the future?

Recently, during Sister Sa’s team’s exchanges with old friends, some old friends lamented: First, they chose to invest in cryptocurrency because the investment prospects of cryptocurrency are really good, and secondly, they took a fancy to “anonymizing” wallets. Assets can be made more “safe”. Once you are involved in legal proceedings, you can at least “preserve” some property. In fact, many old friends have this idea. If “security” is understood in this way-that is, it does not mean reducing the risk of theft or damage, but rather allowing holders of virtual coins to get rid of the “entanglement” of judicial authorities as much as possible, then Sister Sa’s team can say bluntly–Yes, cryptocurrencies are no longer “safe”.

This time, the Hong Kong High Court directly accused the cryptocurrency wallet address and issued an injunction to the cryptocurrency wallet address directly through a technology company. In fact, it created a precedent worldwide-even if the exchange or stablecoin issuer does not cooperate, the judiciary can still issue judicial orders directly to the wallet address to broadcast to all addresses that intend to trade with the wallet involved-if you dare to trade, it will break the law and will be punished accordingly.

Since then, Hong Kong’s judiciary has not only been able to issue injunctions against clearly identified individuals or companies in cryptocurrency disputes. Even anonymized wallets can do this. I have to admit that Hong Kong is already at the forefront of issuing legal notices on tokenization. I believe that foreigners involved in cryptocurrency disputes in the future can also issue similar injunctions through Hong Kong technology companies and law enforcement agencies to recover losses. The space for the idea of using the anonymity of cryptocurrencies to escape judicial control and sanctions has become increasingly small.

04. Write at the end

Step 1: Determine that cryptocurrencies constitute “property”. The most important milestone for the Hong Kong judiciary in the protection of cryptocurrencies can be said to be the Gatecoin case in early 2023. In this case, the Hong Kong Court of First Instance ruled for the first time that cryptocurrency is “property” under Hong Kong law and can then be regulated by relevant laws protecting private property. The Gatecoin case provides legal certainty and demonstrates that the judicial position of the courts in China Hong Kong is consistent with that of other major common law jurisdictions (including the United Kingdom, The British Virgin Islands, Singapore, Australia, New Zealand, Canada and the United States) that treat cryptocurrencies as “property.” This is the brightest move by the Hong Kong judiciary in the field of cryptocurrencies in recent years.

Step 2: Introduction of the stablecoin bill. stablecoins are a bridge between traditional finance and blockchain technology. Hong Kong’s stablecoin bill proposes a relatively complete compliance path and compliance requirements for legal currency pegged stablecoin, which directly protects the financial security of stablecoin holders and institutions. This step is an important step in connecting Hong Kong’s traditional financial field and technology finance field.

Step 3: Protect cryptocurrency assets through blockchain technology. This step is what this article lists. That is to say, based on the anonymity of the blockchain itself, the plaintiff is not required to know the true identity of the defendant. As long as there is a wallet address, an injunction can still be sent to the wallet address. This step can be said to be an important part of improving judicial protection. It is also a major change in the traditional judicial system in the field of financial technology. It directly breaks the problem that Hong Kong could not follow legal channels to provide relief since it could not know the identity of cryptocurrency scammers.