Grayscale believes that Bitcoin has unique advantages in accelerating the world’s transition to renewable energy.

Written by Zach Pandl

Compiled by: Luffy, Foresight News

-

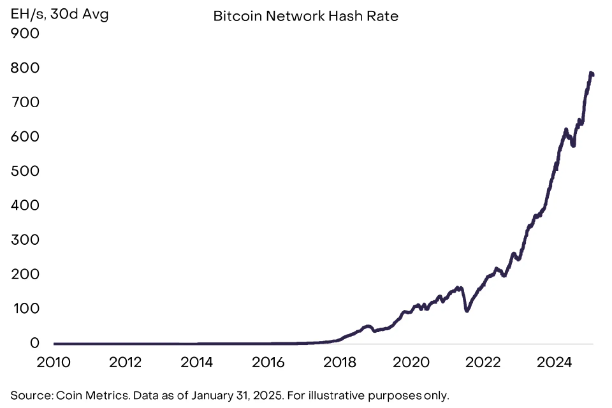

Bitcoin has become a global cryptocurrency system thanks to the competitive process of mining. The mining mechanism ensures normal updates of the blockchain and coordinates economic incentives across the network. Today, the Bitcoin mining network is huge, generating more than 700 “hashes” per second (Note: 1 Jing = 10 trillion, 10^18) times.

-

Bitcoin miners earn their income from newly issued bitcoins and online transaction fees. Their expenditures cover equipment, electricity and other operating costs. Many miners also hold Bitcoin on their balance sheets, and a growing number of miners are expanding into artificial intelligence (AI) and high-performance computing (HPC) services.

-

Grayscale Research estimates that Bitcoin mining accounts for 0.2% of global electricity consumption; clean energy accounts for a higher proportion of the electricity consumed by Bitcoin mining compared to other industries. Bitcoin mining may help accelerate the achievement of environmental goals, especially in areas such as methane emissions.

Bitcoin is a decentralized computer network that stores US$2 trillion in value. The realization of this modern miracle relies entirely on mining: network participants compete for the right to add the next block to the blockchain and receive a reward. Today, Bitcoin mining operations are staggering, turning real energy into digital security. The computing power used to protect the Bitcoin blockchain is like a digital “vault door”. It is with this mechanism that an autonomous computer network can become a global digital currency system. The expertise, capital expenditures and ongoing operating expenses required to operate Bitcoin mining facilities, as well as the highly competitive nature of the industry, help maintain the decentralization of the Bitcoin network while making attack costs prohibitively high.

Investing in publicly traded Bitcoin miners can reap revenue from block output and, over time, are expected to generate revenue growth from growing online transaction fees. In fact, most listed Bitcoin miners adopt diversified business models, and many companies hold the bitcoins they have dug on their balance sheets or even buy bitcoins on the open market. Currently, bitcoin mining companies have also begun to engage in data center operations for artificial intelligence and high-performance computing to diversify their businesses.

modern miracle

Although Bitcoin mining is technically complex, the concept is simple. Dedicated computers compete with each other to guess a random number, and the computer that guesses the right number first wins the right to update the blockchain (i.e.,”dig up the block”). The winning miner will receive the newly issued bitcoins and transaction fees for the block (i.e., the “block reward”).

There are no shortcuts in this race. For example, there is no algorithm that can find the right number faster, and Bitcoin miners can only compete by brute force. This process can be viewed as a game of probability. Miners keep guessing until they find the right answer, which is like rolling a multi-sided die until the desired number appears. Therefore, the probability of winning depends on the number of guesses the miner can make per second (“dice rolls”). The operator with the largest number of machines and the most efficient machines also has the most guesses and the greatest chance of winning block rewards.

From a technical perspective, the winning result is not just a random number, but a “hash value” of this number combined with other data. In computer science, a hash function is a mathematical operation that converts arbitrary data into a string of characters, or a hash value. For example, using the hash function in the Bitcoin network, the hash value of the word “Bitcoin” is: b4056df6691f8dc72e56302 ddad 345d65 fead3ead9299609a826 e2344 eb63 aa4.

Therefore, the task of Bitcoin miners is to quickly generate hashes: guess a random number, calculate its hash value (combining the random number with other data), and then check to see if it is correct.

It is estimated that today there are approximately 5 – 6 million Bitcoin miners that generate hashes on a staggering scale (see Figure 1). Over the past 90 days, the average rate at which Bitcoin miners collectively generated hashes was 765 EH/s (765 Beijing hashes per second). In other words, Bitcoin miners guess random numbers and calculate their hash value more than 700 times per second on average. To make this number more intuitive, it is estimated that there are approximately 7.5 grains of sand and 10 insects on earth.

Figure 1: Bitcoin miners generate hashes on a huge scale

Generating such a large number of hashes is expensive, but this is the key. To compete for rewards, mining operators need to purchase specialized machines and other hardware and pay ongoing power and maintenance costs. So, by generating the correct hash, miners provide a “proof of work” that shows that they have invested financial resources and can be trusted to update the blockchain.

Attacking Bitcoin means defeating the existing Bitcoin mining industry. In theory, if a malicious actor controls 51% of the network’s hash rate and is thus able to mine most blocks, he can disrupt the network (for example, double spend bitcoins or censor certain transactions). In a paper, researchers estimated that a one-hour 51% attack on the Bitcoin network as of February 2024 would cost between $5 billion and $20 billion. In fact, no actor has the financial incentive to invest these resources, and the Bitcoin network has other defense mechanisms in addition to mining.

Bitcoin mining business model

Bitcoin miners ‘income is equal to the new block rewards they earn from mining, while their operating expenses come from the electricity consumed to run machines and generate hashes (which may also include maintenance, pool fees, and other operating expenses). Therefore, the goal of Bitcoin miners is to generate the most hashes per second at the lowest possible cost.

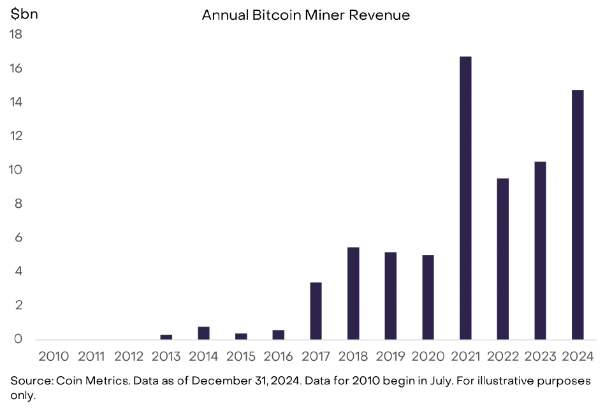

In 2024, miners obtained a total of approximately 230,000 bitcoins, worth nearly US$15 billion at current prices. Compared with 2014, it has increased by about 19 times, with a compound annualized growth rate of 34%(see Figure 2). Every four years, the rate of new Bitcoin issuance declines in an event known as the “Bitcoin Halving”. Although issuance declined in terms of bitcoin, mining revenue has increased over time due to the rise in bitcoin’s dollar-denominated price. In the future, the increase in mining revenue may come from the increase in Bitcoin prices and the increase in online transaction fees.

Figure 2: Bitcoin mining revenue grows over time

The operating expenses borne by miners are mainly in the form of electricity consumed to run the machines. Each operator negotiates its own power purchase agreement, and these agreements vary widely around the world. For ease of illustration, we can build a simplified chart of the overall economic situation of Bitcoin miners by assuming one electricity cost and ignoring other costs. For example, Figure 3 compares the income of Bitcoin miners to estimates of total electricity costs assuming a price of $0.05 per kilowatt-hour. The difference between revenue and power costs can be seen as a simplified measure of miners ‘operating profit margins. Miners benefit when the dollar value of block rewards increases; and when the dollar cost of generating hashes increases, miners suffer.

Figure 3: Miner operating profit margins reflect the gap between block rewards and power costs

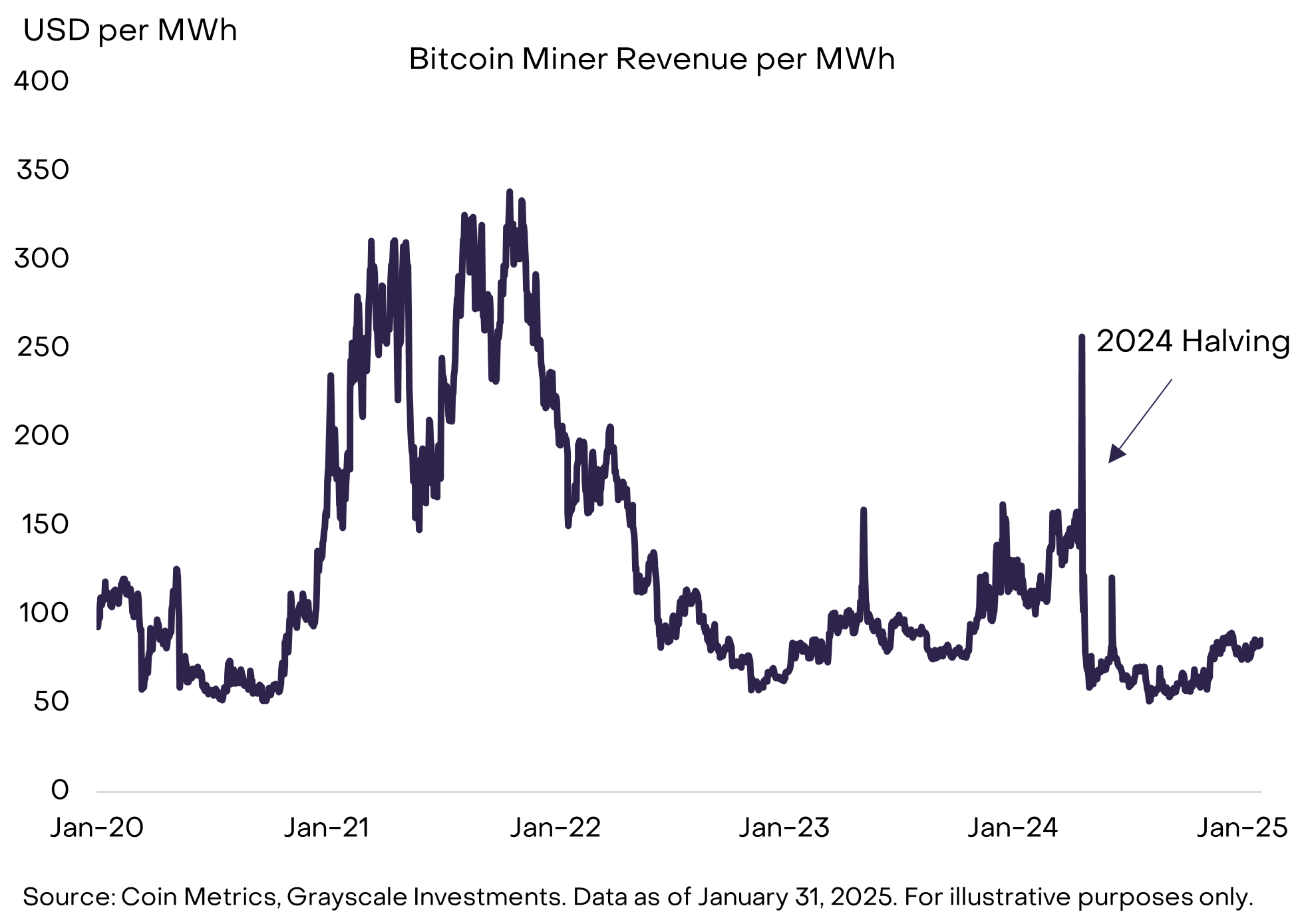

Given that the electricity costs faced by miners around the world vary, a more intuitive measure might be the dollar value earned for a certain amount of electricity consumed, such as miners ‘income per megawatt hour (MWh). Mining industry participants often mention the closely related concept of “hash price”, which is calculated by the ratio of daily miner income to the network hash rate. Although the concepts are very similar, hash prices tend to decline as miners become more efficient. Therefore, miners ‘income relative to electricity consumption may more accurately reflect changes in miners’ economic conditions over time. Figure 4 shows Bitcoin miners ‘income per megawatt hour per day. Over the past two years, this estimate has remained broadly stable despite significant fluctuations around the halving in 2024.

Figure 4: Miner income per megawatt hour has been roughly stable over the past two years

Invest in Bitcoin mining companies

Investing in the shares of publicly listed mining companies allows you to enter the Bitcoin economy through the securities market. Bitcoin miners ‘business models may be increasingly diverse, but they all involve core businesses of generating hashes, mining blocks, and obtaining block rewards. Due to differences in power costs, non-power operating expenses and other factors, the actual cost of obtaining block rewards varies for each mining company. In the third quarter of 2024, the average cost of producing Bitcoin for the largest listed mining companies ranged from US$34,000 to US$59,000 (see Figure 5). The average price of Bitcoin during the quarter was $61,000.

Figure 5: Production costs vary among different mining companies

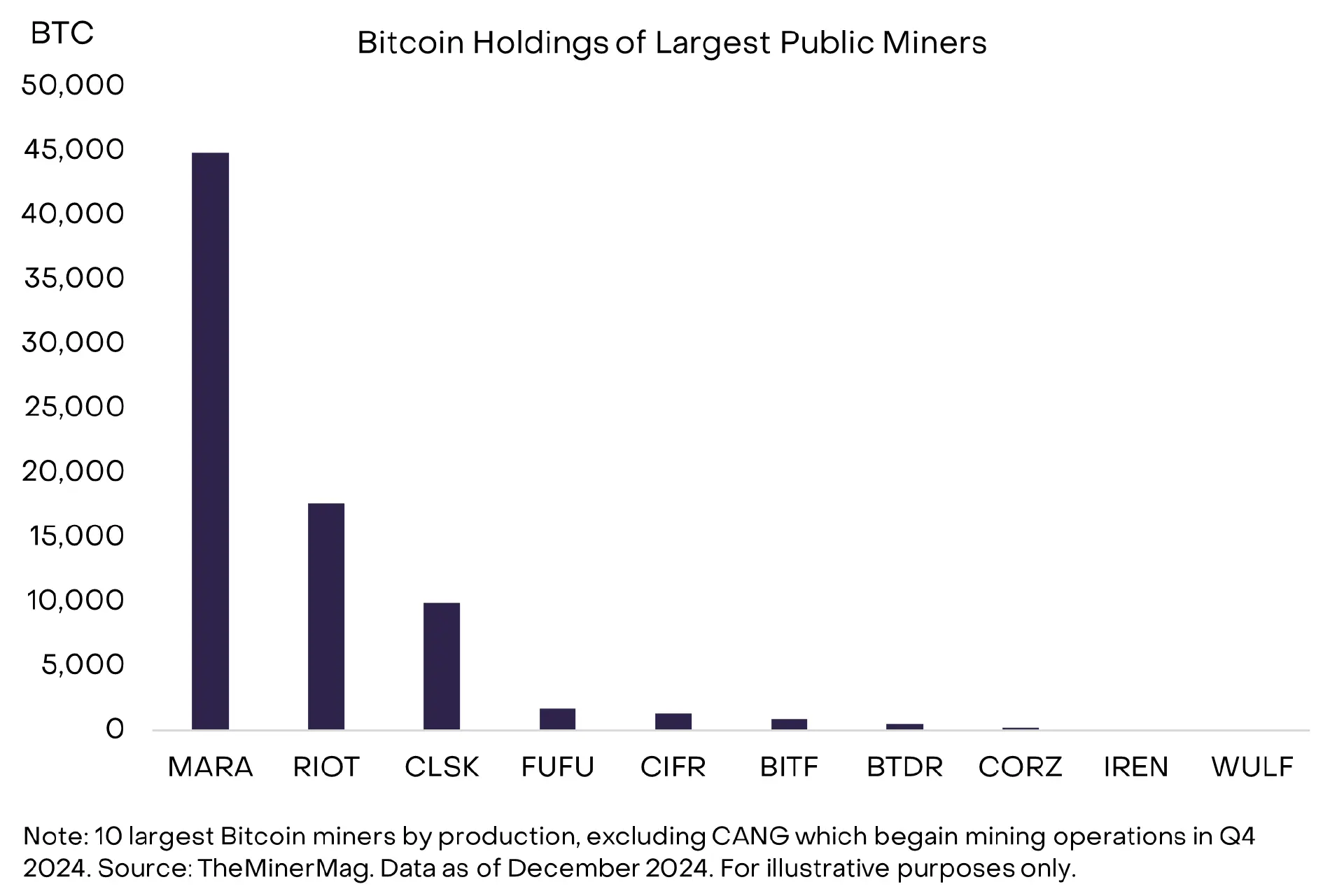

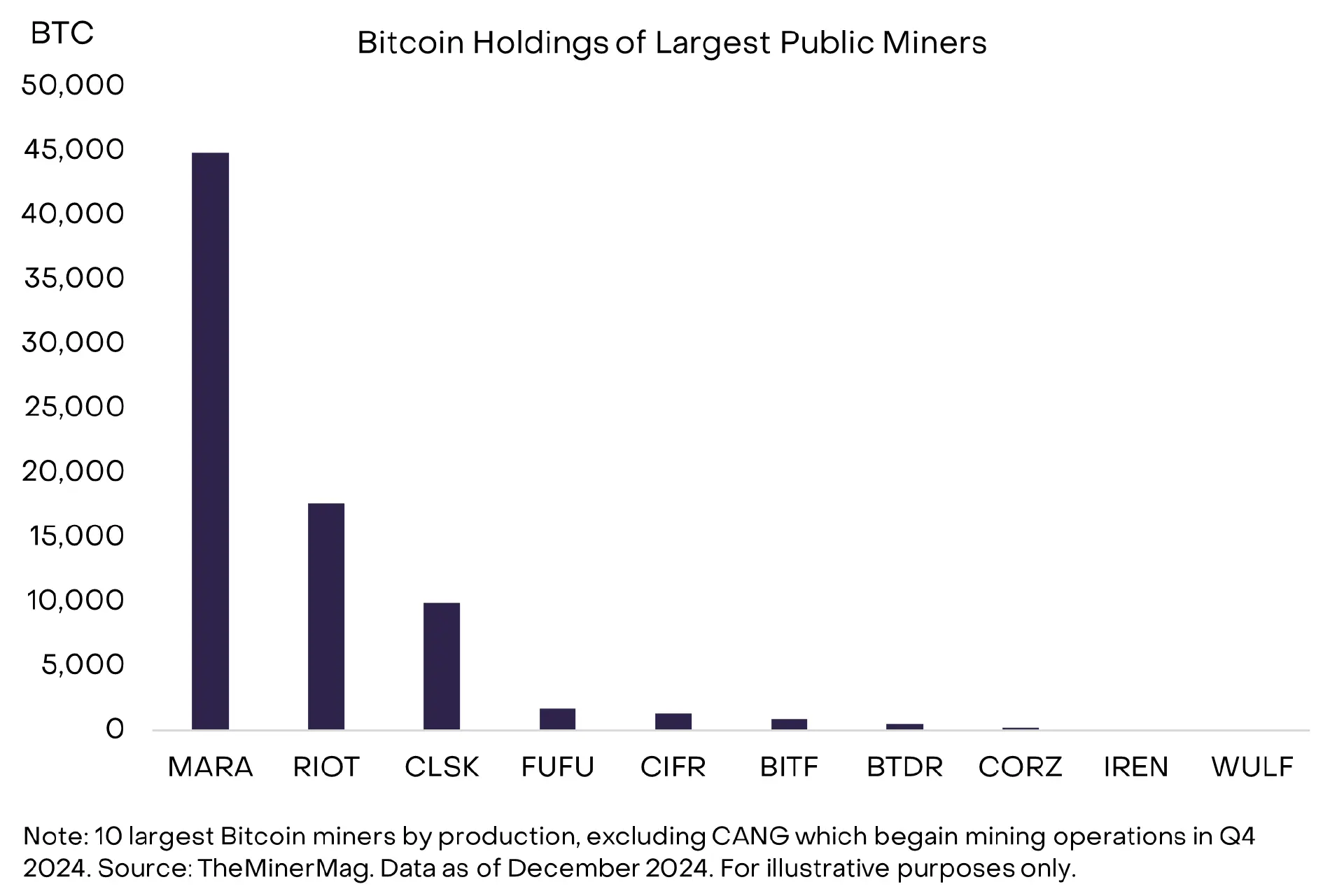

Bitcoin miners also hold bitcoin on their balance sheets differently. Some mining companies will liquidate block rewards immediately, some will retain block rewards, and some will even buy more bitcoin on the open market. Naturally, when bitcoin prices change, differences in balance sheet policies can have a significant impact on the financial performance of listed mining companies (see Figure 6). That being said, many factors can affect the risk profile of individual mining companies. Mining companies with relatively high Bitcoin holdings on their balance sheets are not necessarily more risky than mining companies rewarded by clearing blocks.

Figure 6: Some mining companies hold Bitcoin on their balance sheets

Recently, Bitcoin miners have begun to venture into areas such as artificial intelligence and high-performance computing (HPC) services, where demand for data center infrastructure is growing rapidly. For example, Goldman Sachs research estimates that data center power demand (excluding cryptocurrency-related components) may increase by 160% between 2023 and 2030. Bitcoin miners may have a competitive advantage in supplying the artificial intelligence/high-performance computing market because of their access to low-cost electricity and related infrastructure. In early 2024, Core Scientific, the third-largest listed mining company by market value, announced that it had signed a long-term contract with CoreWeave, a specialized artificial intelligence Infrastructure services provider. Since the announcement of the deal between Core Scientific and CoreWeave in June 2024, several other listed mining companies have also taken steps to expand their business into the artificial intelligence/high-performance computing space.

Bitcoin mining and sustainability

Bitcoin mining consumes real economic resources, electricity, to create decentralized digital security. The success of Bitcoin as a digital currency system means that mining now consumes a lot of electricity. Bitcoin is a unique energy consumer and already uses a significant proportion of clean energy resources. Grayscale Research believes that over time, mining may make a positive contribution to the green energy transformation.

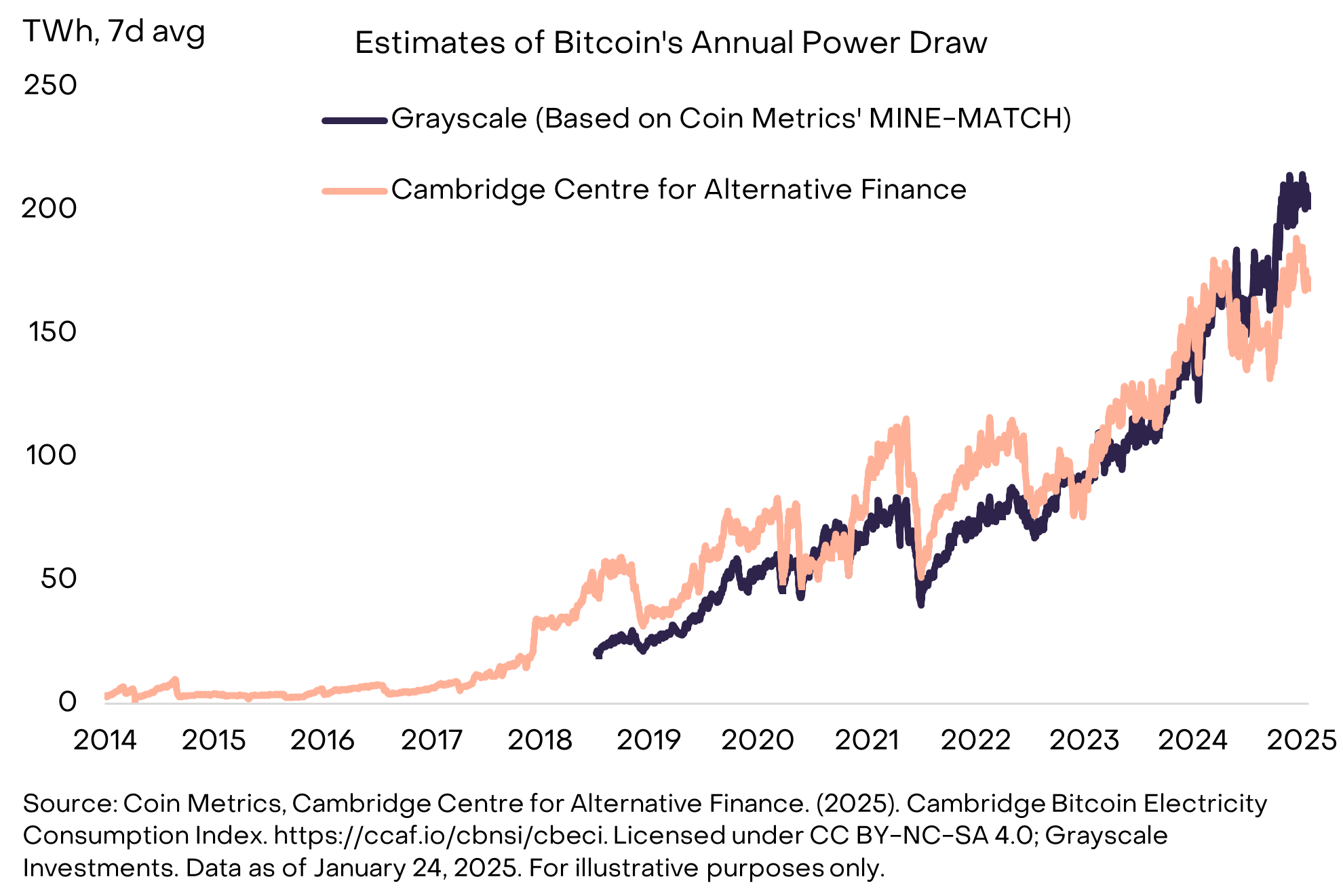

Based on Coin Metrics, we estimate that over the past 12 months, the Bitcoin network’s electricity consumption rate has been approximately 175 terawatt hours (TWh, note: 1TWh=1 million KWh). This is comparable to estimates for the Cambridge Alternative Financial Center (see Figure 7). According to data for 2023 (the latest available year), Bitcoin’s energy consumption accounts for 0.2% of the world’s total electricity consumption (taking into account power losses during transmission). According to Cambridge Alternative Finance, data centers consume about 200 TWh of electricity every year, and data center energy consumption is expected to rise due to the use of artificial intelligence models.

Figure 7: Bitcoin mining consumes electricity to create digital security

Compared to the typical residential or business user, Bitcoin is a unique energy consumer. Bitcoin mining is modular, mobile, geographically independent, interruptible and highly sensitive to changes in electricity prices. As a result, miners can often do business where low-cost clean energy resources are available. It is estimated that approximately 50% – 60% of the electricity used by the Bitcoin mining industry comes from sustainable energy (including nuclear energy). In the United States and globally, sustainable energy accounts for approximately 40% of power generation. Using 2023 data and assuming that sustainable energy accounts for 50% – 60% of Bitcoin’s electricity consumption, we estimate that Bitcoin mining accounts for 0.2% – 0.3% of global power-related carbon dioxide emissions.

Grayscale research believes that Bitcoin mining will help accelerate the application of renewable energy production in the next few years. Due to its unique attributes, Bitcoin mining encourages investment in renewable energy infrastructure development, especially in areas where there are no transmission lines connected to major population centers. Bitcoin mining can also help stabilize power grid demand that would otherwise fluctuate due to consumption patterns and weather, as it does in the Texas Power Reliability Board system. In addition, start-ups like Sustainable Bitcoin Protocol have created market mechanisms to incentivize the use of clean energy and reward reductions in methane emissions. Addressing methane emissions could become a particularly important way for Bitcoin miners to contribute to achieving environmental goals. Also, companies like Crusoe Energy have developed ways to use excess natural gas rather than emit it, converting it into electricity and supplying it to Bitcoin miners.

In the next few years, the growth of technology applications will generate huge demand for electricity, from digital assets, artificial intelligence and other industries. Grayscale believes that Bitcoin contributes to the healthy operation of global power infrastructure and has unique advantages in accelerating the transition to renewable energy compared to many other industries.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern