Original title: “In a volatile market, is the continuous decline filled with emotion or a substantial sell-off?| WTR 2.24》

Original source: WTR Research Institute

This week’s review

This week, from 2 17 to 2 24, the highest price of rock sugar oranges is around $99475, and the lowest price is close to $93388, with a fluctuation of about 6.53%.

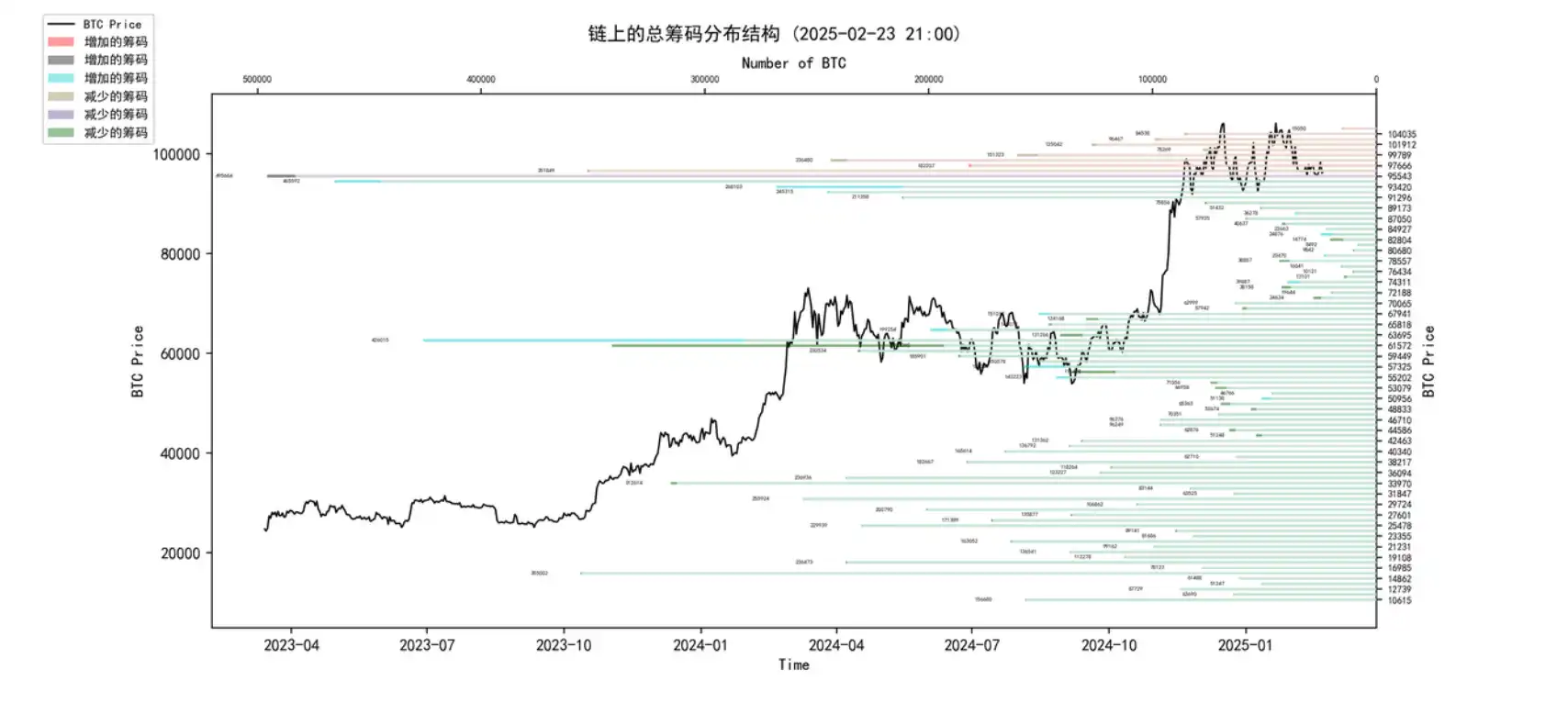

Looking at the chip distribution chart, there will be a large number of chips traded near about 95000, and there will be a certain amount of tension or pressure.

·Analysis:

1. 60,000 – 68,000 approximately 1.52 million pieces;

2. 90,000 – 100,000 approximately 2.75 million pieces;

·The probability of falling within 87000 to 91000 in the short term is 60%;

·Among them, the probability that it will not exceed 110000~115000 in the short term is 40%.

Important news

Economic News

1. The minutes of the Federal Reserve’s January meeting showed that members believed at the January meeting that “it may be appropriate to consider suspending or slowing down balance sheet shrinkage until the debt ceiling issue is resolved.”

2. Federal Reserve Bank Goors: PCE inflation data is unlikely to be as alarming as CPI. Once inflation falls, interest rates can fall further.

3. Federal Reserve Coogler expects a PCE inflation rate of 2.4%(previous value of 2.6%) and a core PCE inflation rate of 2.6%(previous value of 2.8%).

4. Federal Reserve Bostick said: Despite the great uncertainty, the Federal Reserve should still be able to cut interest rates by 25 basis points twice this year.

5. Fed Goolsberg: PCE inflation data is unlikely to be as alarming as CPI. Once inflation falls, interest rates can fall further.

Encrypt status message

1. According to Sovalue statistics, there are already several state districts in the United States that are initiating legislative procedures related to BTC reserves. Among them, five state bills have been formally accepted by the House and are under committee review, forming operational draft laws.

2. The U.S. law allowing Utah to invest in BTC has been passed by a state Senate subcommittee and will now go to the Senate for first and third readings before a final vote.

3. The BTC reserve bill has been passed in the House, so if it is approved in the Senate, Utah Republican Spencer Cox will only have to sign the bill and BTC can become a reserve asset.

4. FOX Business reporter Eleanor Terrett said that the U.S. Securities and Exchange Commission (SEC) is often interested in pledges and even requires industry insiders to provide a memorandum detailing different types of pledges and their advantages. Regulators are expected to issue guidance on pledges soon because it is a topic they are actively participating in the discussion.

5. QCP Capital stated that since Trump took office, multiple ETF applications related to Zeecoin-related have been submitted to the U.S. Securities and Exchange Commission (SEC). It is unclear whether this will provide a catalyst for Trump to position the United States as a global cryptocurrency and pave the way for further approval of ETFs in 2025.

6. On the options side, Delta implied volatility has shifted towards call options of all maturities, indicating that the market is preparing for the second phase of the market. As inflation concerns eased, the S & P 500 index hit a new record, and the US dollar index fell back to 107 flat. The macro background seems to be increasingly biased towards risky assets.

7. According to the Wall Street Journal: The U.S. Securities and Exchange Commission (SEC) has agreed to drop a lawsuit against Coinbase, which seeks to regulate the company as a stock exchange. The dropping of the lawsuit marks the end of years of the SEC’s tough stance on the crypto market and may boost sentiment in the cryptocurrency market that was previously accused of being a securities.

8. Bybit’s multi-signed address was hacked, and ETH worth about US$1.429 billion (about 514,000 ETH) was stolen. Bybit CEO responded: “Bybit has solvency and can bear the loss. 70% of the withdrawals have been processed. The peak of the run is over.”

· Future insights:Used to observe our current situation; market/bear market/structural changes/neutral state

· Mid-term exploration:Used to analyze what stage we are currently at, how long this stage will last, and what situation we will encounter

· Short-term observations:Used to analyze short-term market conditions; as well as insight into certain directions and the possibility of certain events occurring under certain conditions

Future insight

Short-term speculator costs

·Total spot selling pressure

·Weight selling pressure

·Examples of participants in the period

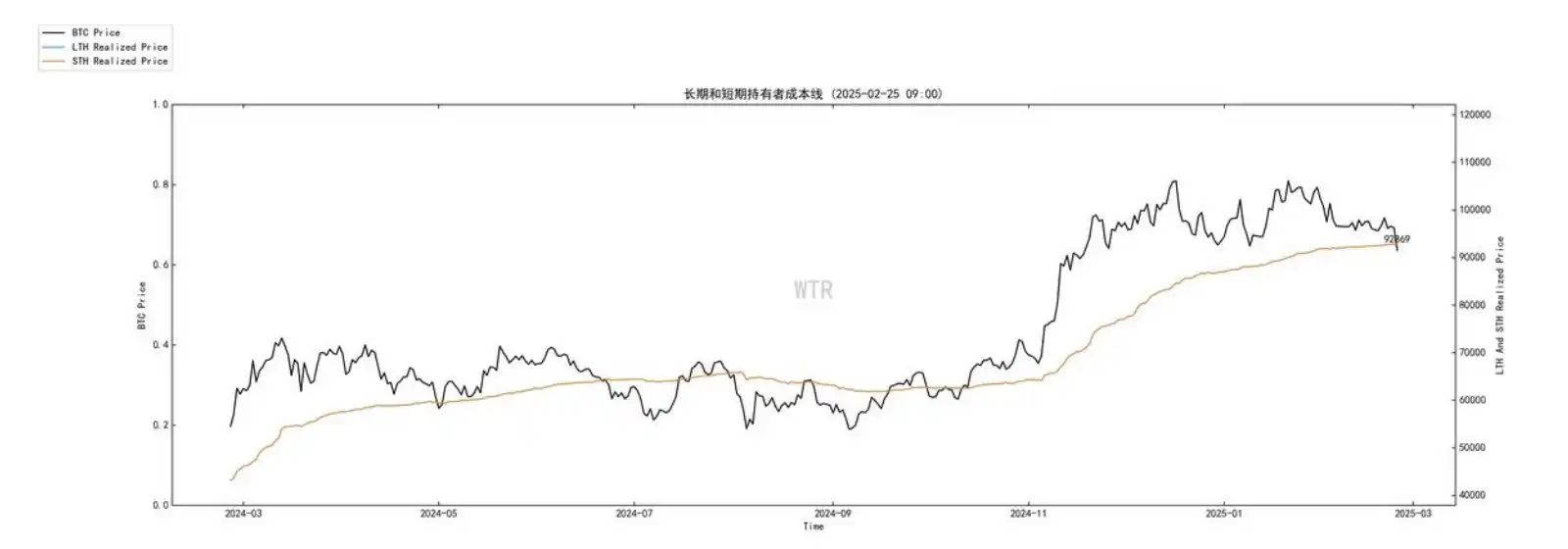

(Short-term speculator costs below)

Falling below the cost of short-term speculators may cause losses for most short-term speculators. Usually, in this case, they are due to reasonable factors

The reason for this will reduce sales or lay down flat production, because the selling pressure will be reduced and the cost will be shared with part of the purchase to produce some support.

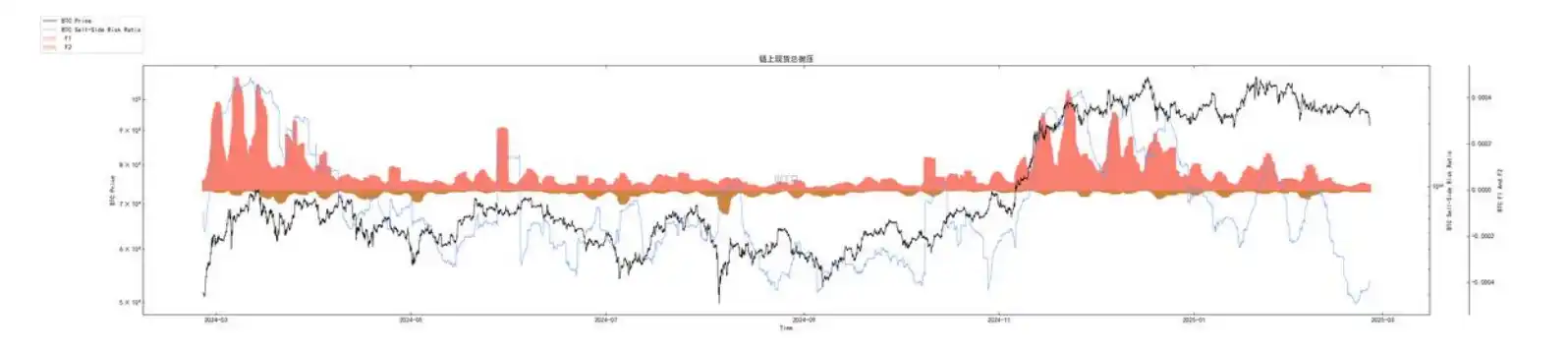

(The figure below shows the total selling pressure of spot goods)

Although spot selling pressure has increased slightly, the overall situation is still at a low level in the past year.

There are not many substantial sales in the market, which should be due to reasonable factors and the spread of emotions.

(The figure below is weighted selling pressure)

Weight selling pressure is also slowly decreasing and approaching the low area.

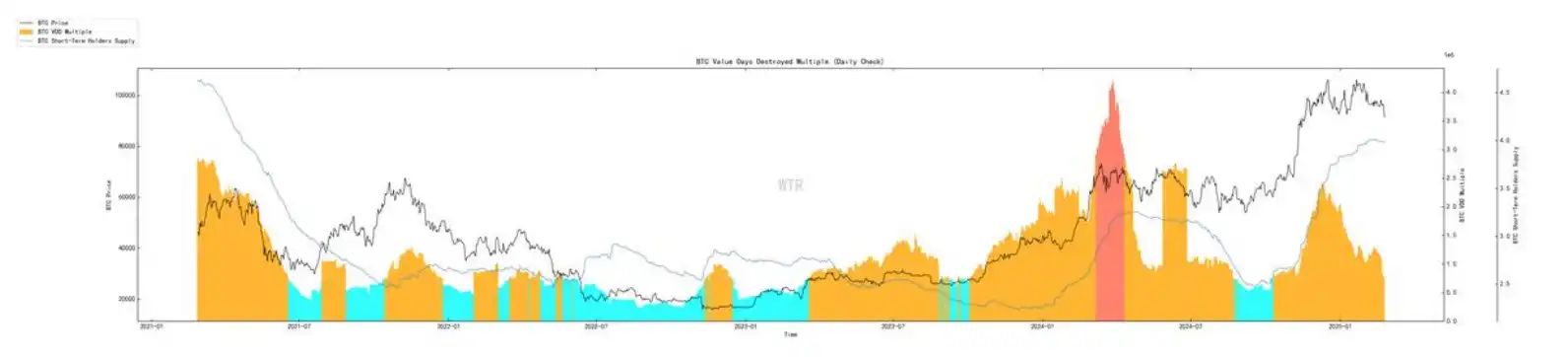

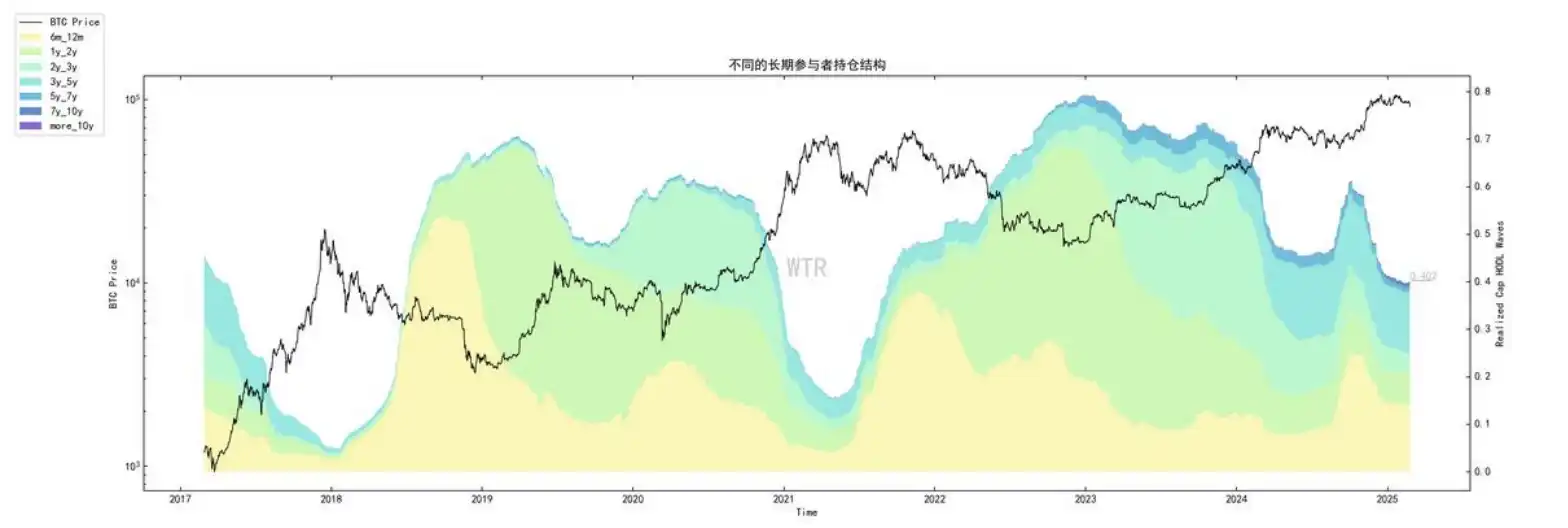

(The figure below shows an example of participants in the period)

There has been a slight rebound among participants in the first quarter, and participants in the first quarter are relatively optimistic about the market at the current stage.

mid-term exploration

· BTC Exchange Trend Net Head

· ETH Exchange Trend Net Head

·Liquidity supply

·Increase emotional positivity

·Futures clearing structure

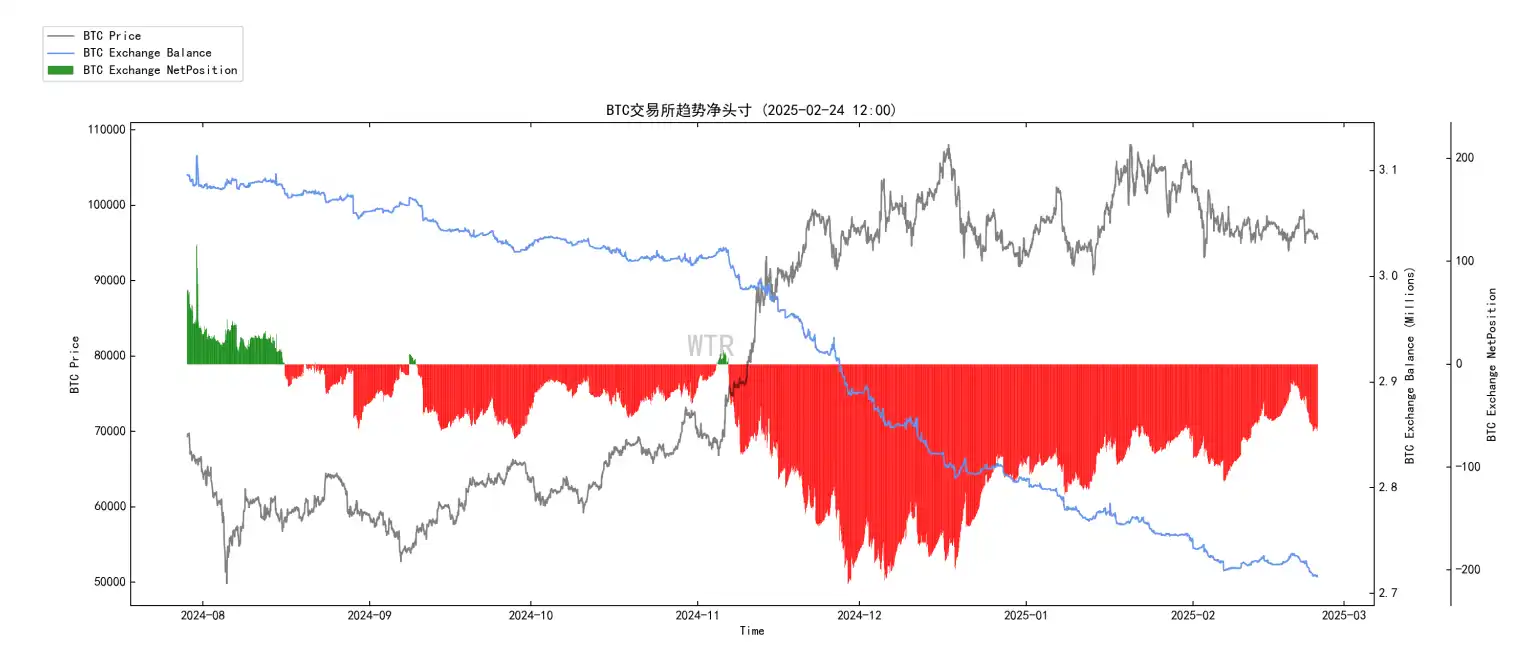

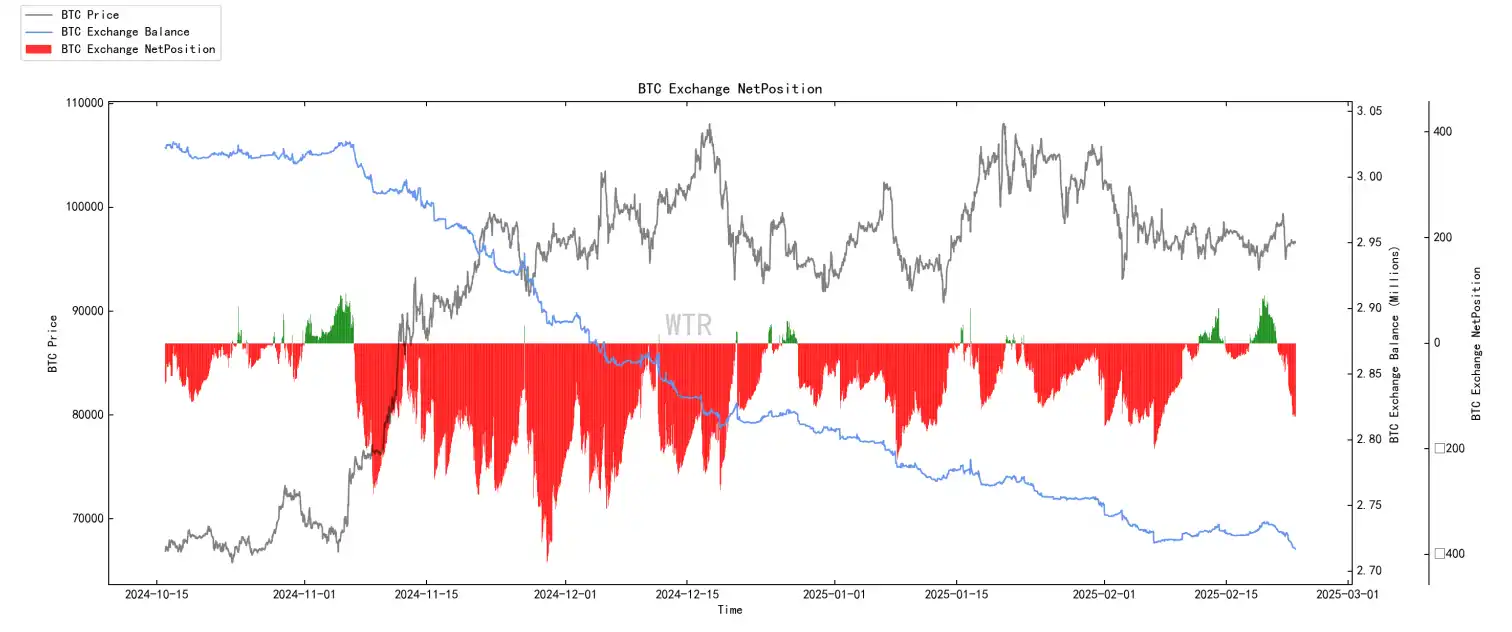

(The figure below shows the net trend of the BTC exchange)

The net trend of the BTC exchange is still a cumulative trend. It may be that the market is gradually moving away from the situation of frequent trading of BTC, and is now turning more to accumulation.

Under current conditions, we must also consider the liquidity contained within the exchange.

Perhaps the current risk condition is not the buyer hoarding BTC, but whether liquidity is sufficient to support the market price.

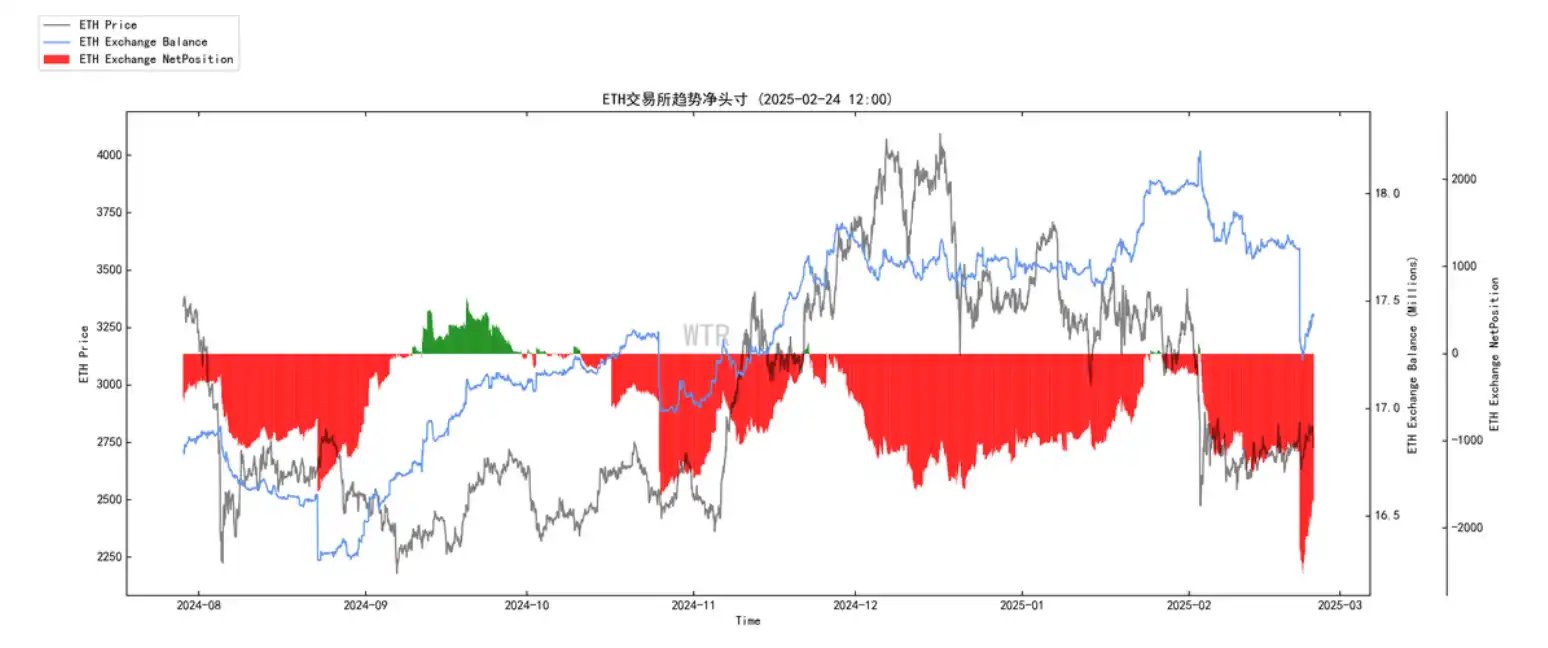

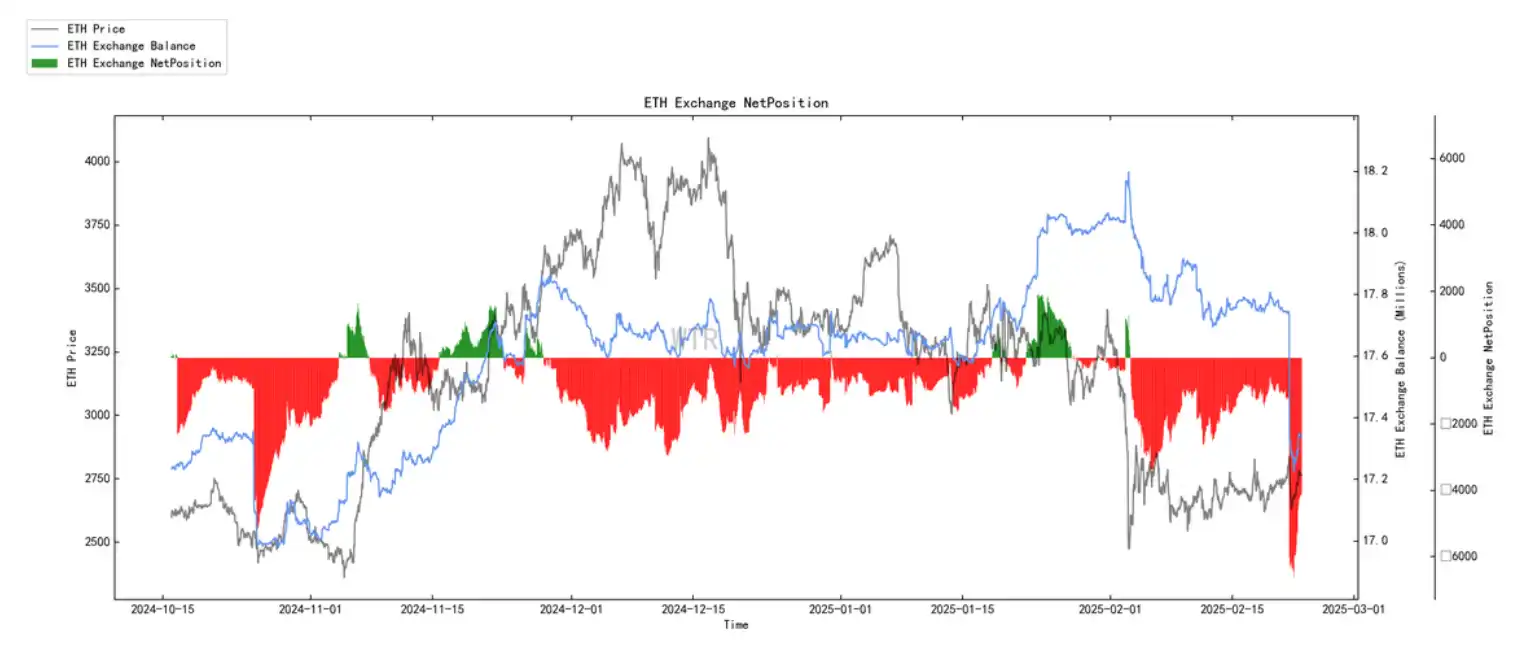

(The figure below shows the net trend of ETH exchange)

The current accumulation status of ETH is slowing down, and there may be a certain possibility of potential selling pressure even if a certain amount of money is transferred.

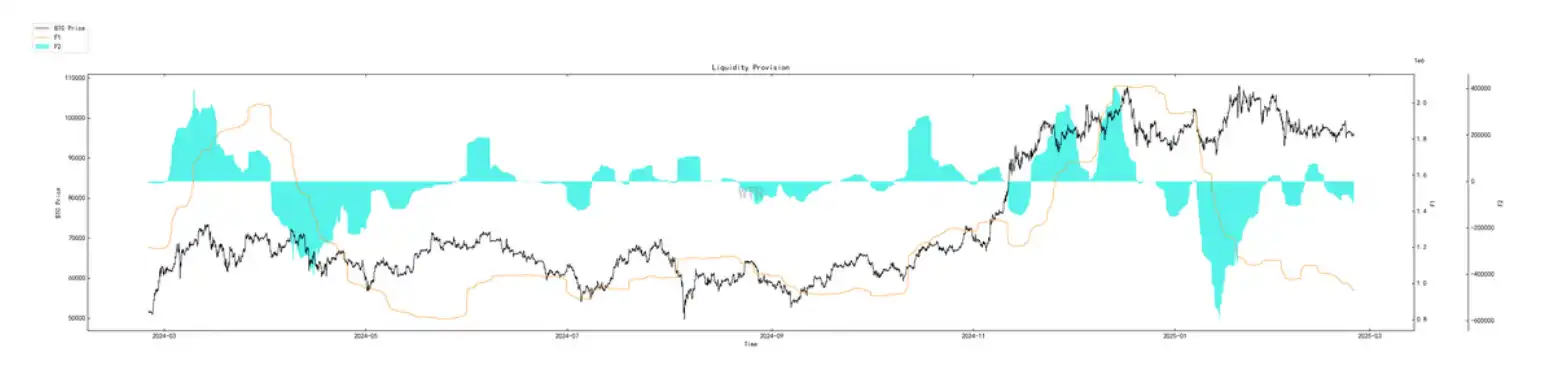

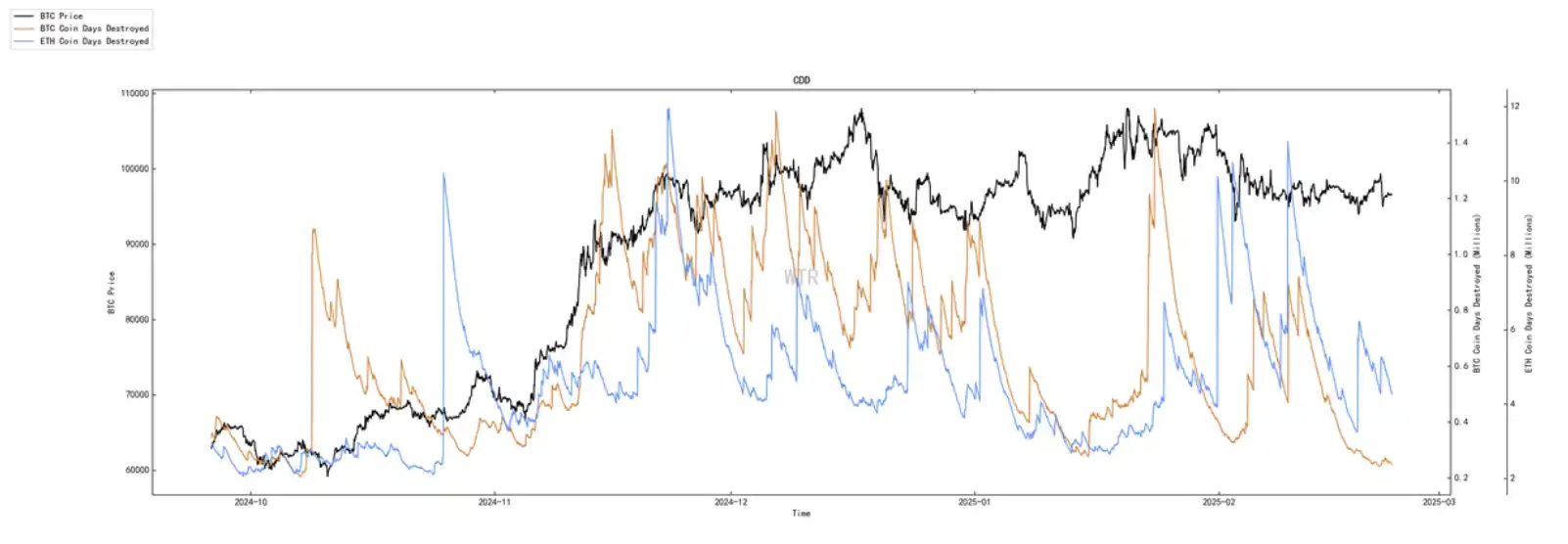

(The figure below is liquidity supply)

The current liquidity of BTC is poor and is also in the process of declining. Maybe when liquidity is better, market conditions will improve.

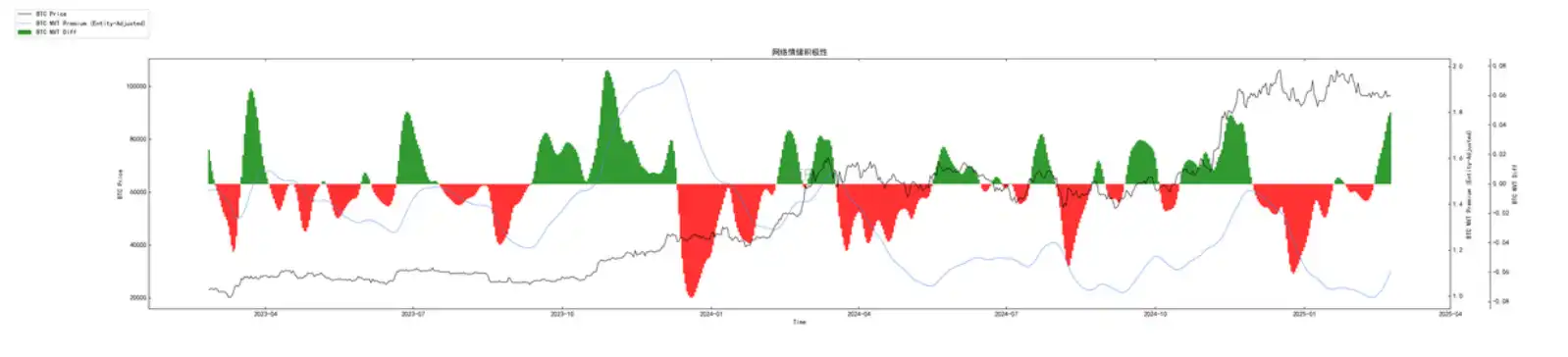

(The picture below shows emotional enthusiasm)

The mood in the network remains relatively calm, and the enthusiasm in the field may still be very weak.

(The futures clearing structure is shown below)

The clearing structure has previously been shown to be a long-term clearing with a higher rate, and the market will stabilize after the current clearing trend stops.

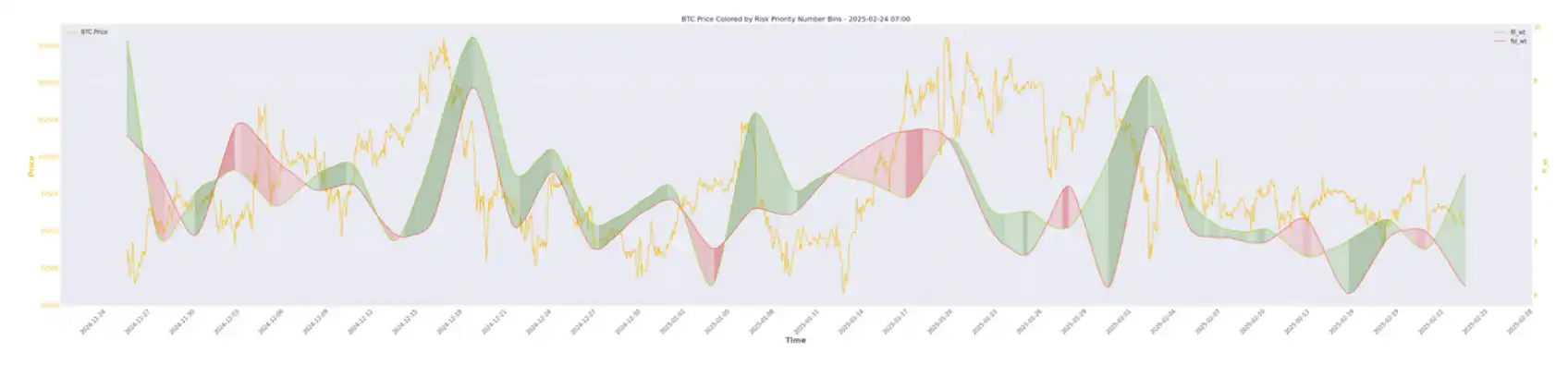

short-term observation

·Derivative product risk factor

·Option intention to sell

·Derivative trading volume·Option implied volatility

·Profit and loss transfer

·New and active addresses

·Crystal Sugar Orange Exchange

·Yutai Exchange net head

·Weight selling pressure

·Global purchasing status

·Net head of stablecoin exchanges

·Offline exchange data

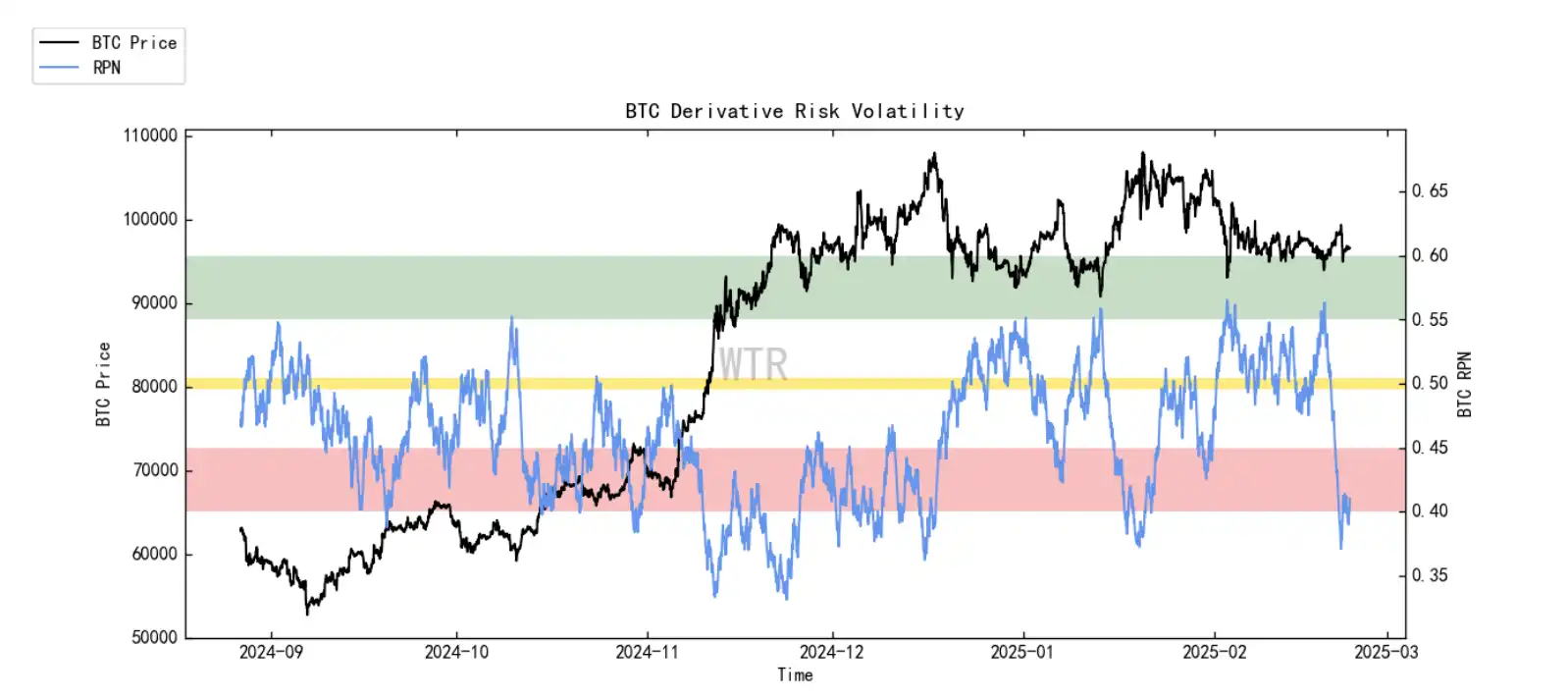

Derivative product rating: The risk coefficient is in the red range, and the risk coefficient of derivative products is higher.

(The figure below shows the risk factor of the derivative product)

The risk coefficient has entered the red range for the first time since the BTC volatility, which means that the liquidation risk of derivatives long positions has increased significantly this week.

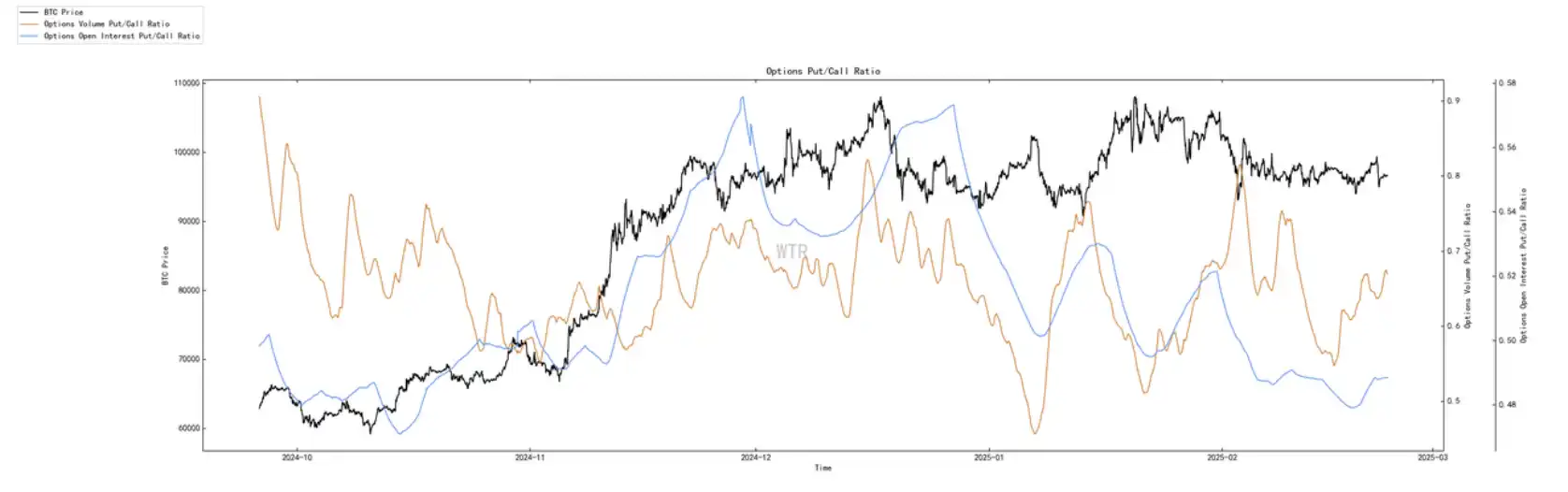

(Option intention transaction in the chart below)

Put options are low and trading volumes are low.

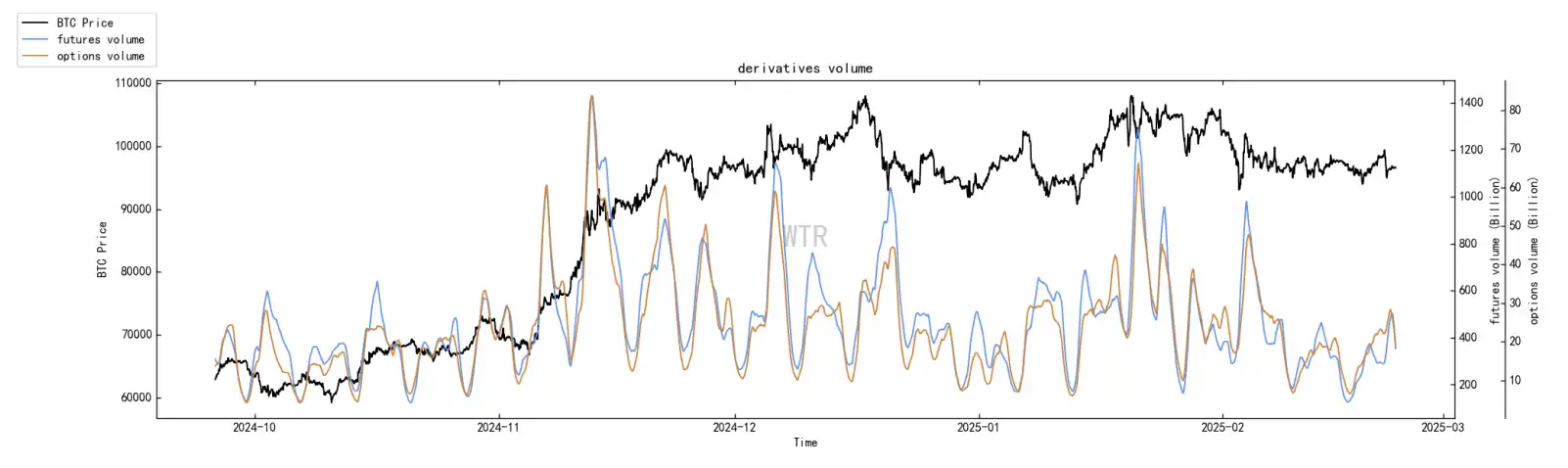

(The chart below shows the trading volume of derivative products)

The trading volume of derivatives has continued to decrease since the continued shocks, indicating that market activity has decreased.

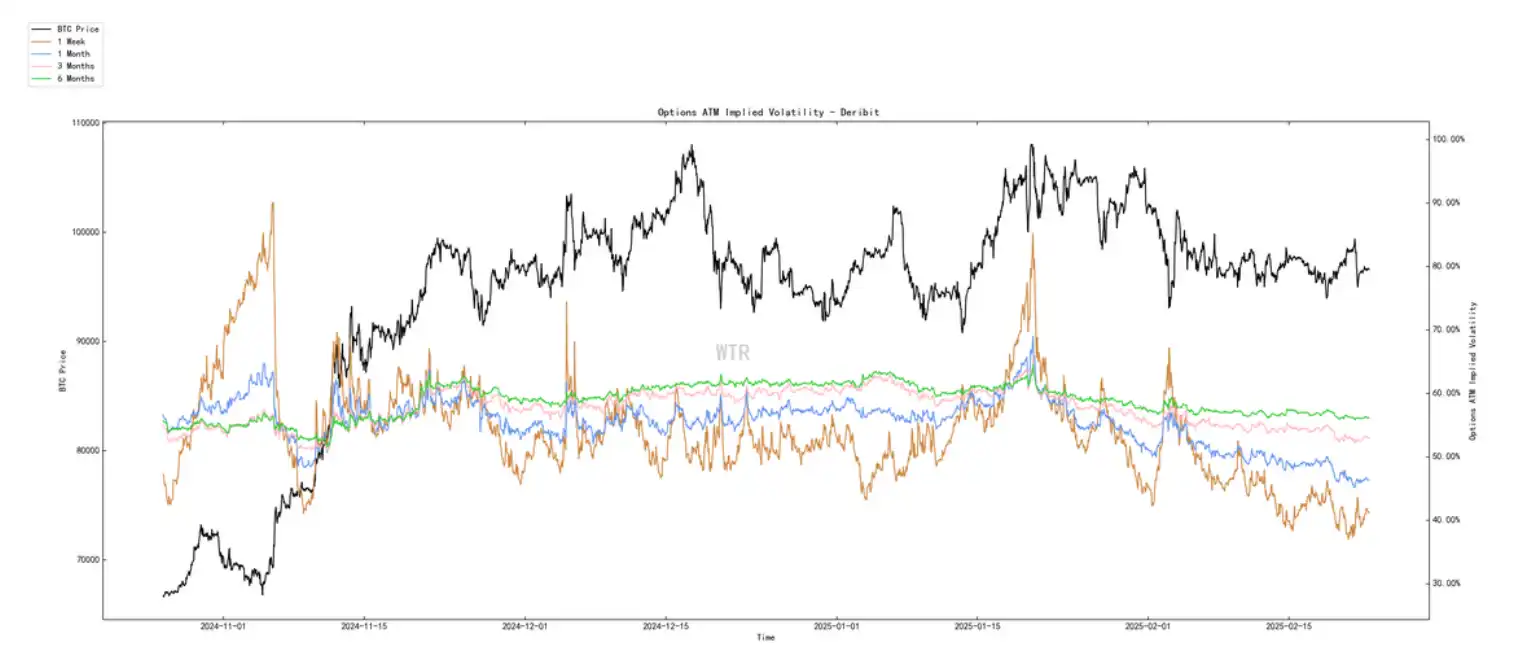

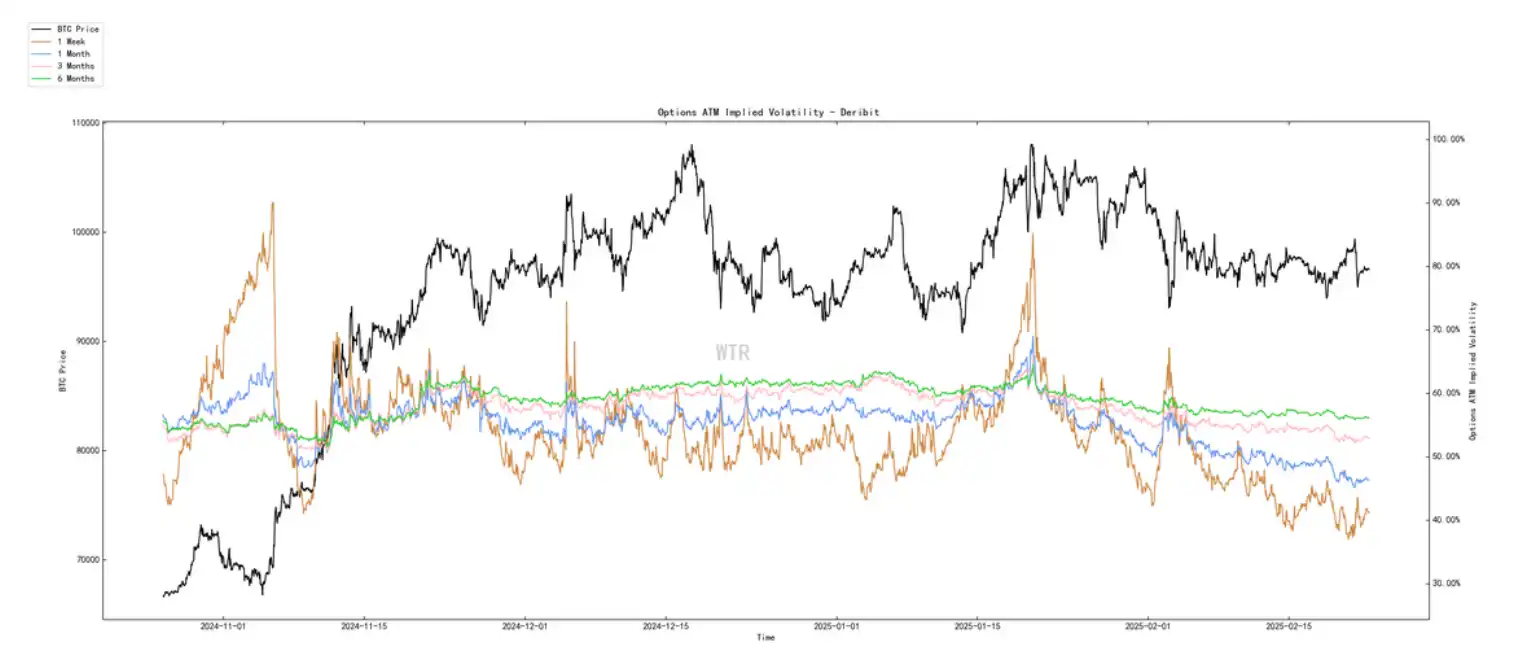

(The chart below shows the implied volatility of options)

The implied volatility of options fluctuates too much in the short term.

Emotional state rating: neutral

(The figure below shows profit and loss transfers)

Currently, market positivity (blue line) and panic selling (orange line) are at extremely low levels. The market is expected to remain in volatile mode.

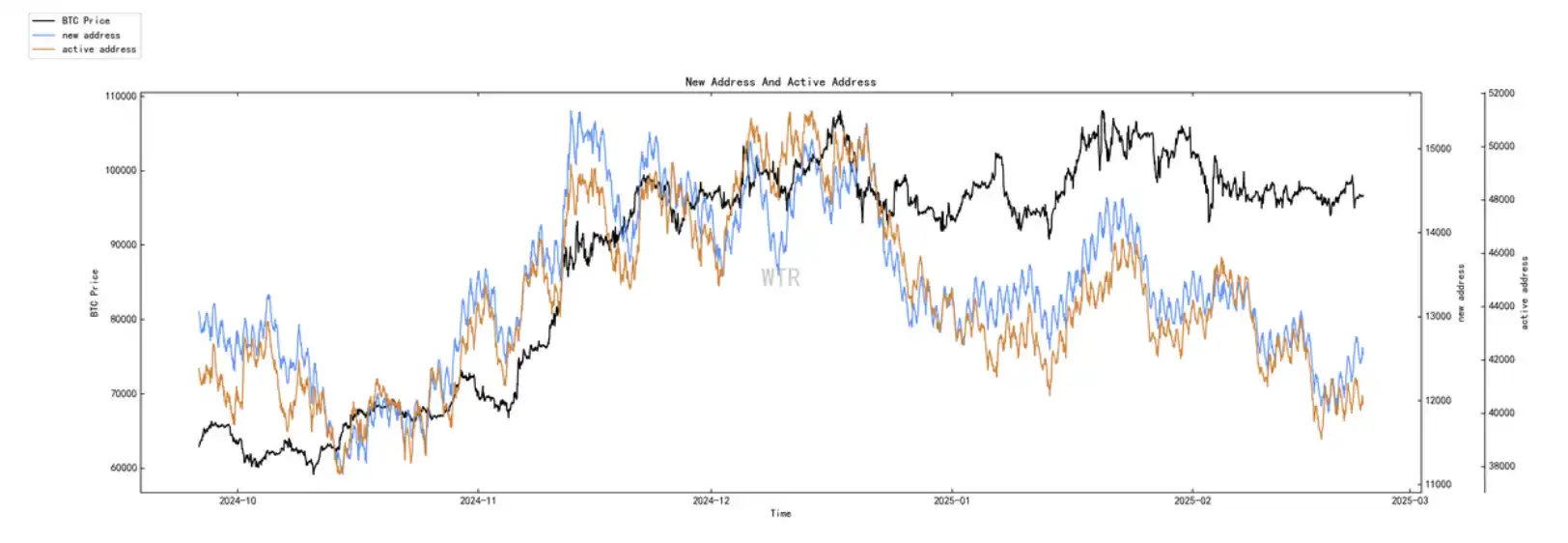

(New addresses and active addresses in the figure below)

New and active addresses are low.

Spot and selling structure ratings: BTC and ETH are in a state of large outflow accumulation.

(The picture below is the net head of the Rock Sugar Orange Exchange)

The net head of the BTC exchange has accumulated a large and sustained outflow.

(The figure below is the net head of E-Pacific Exchange)

The net head of the ETH exchange has continued to accumulate large outflows.

(The figure below is weighted selling pressure)

The current situation is heavy selling pressure.

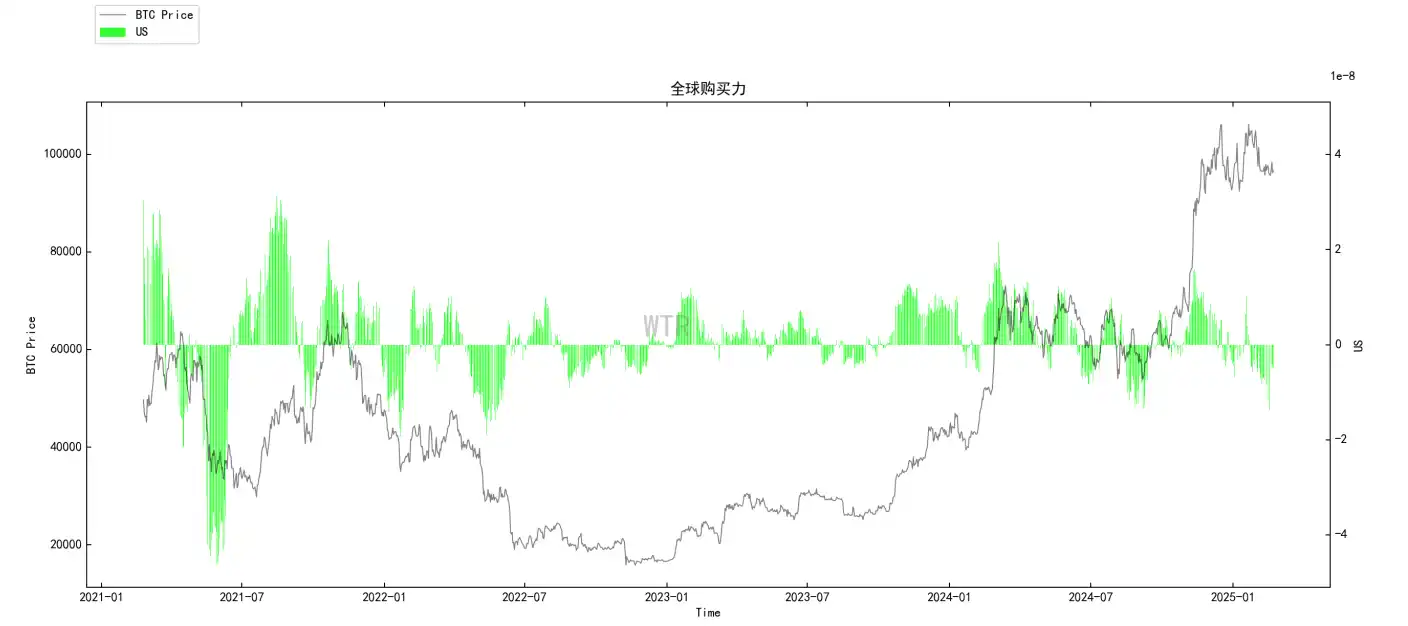

Buy Rating: Global purchases are in a state of loss, and stablecoin purchases are unchanged from last week.

(The picture below shows global purchase status)

Current purchases are in a state of loss.

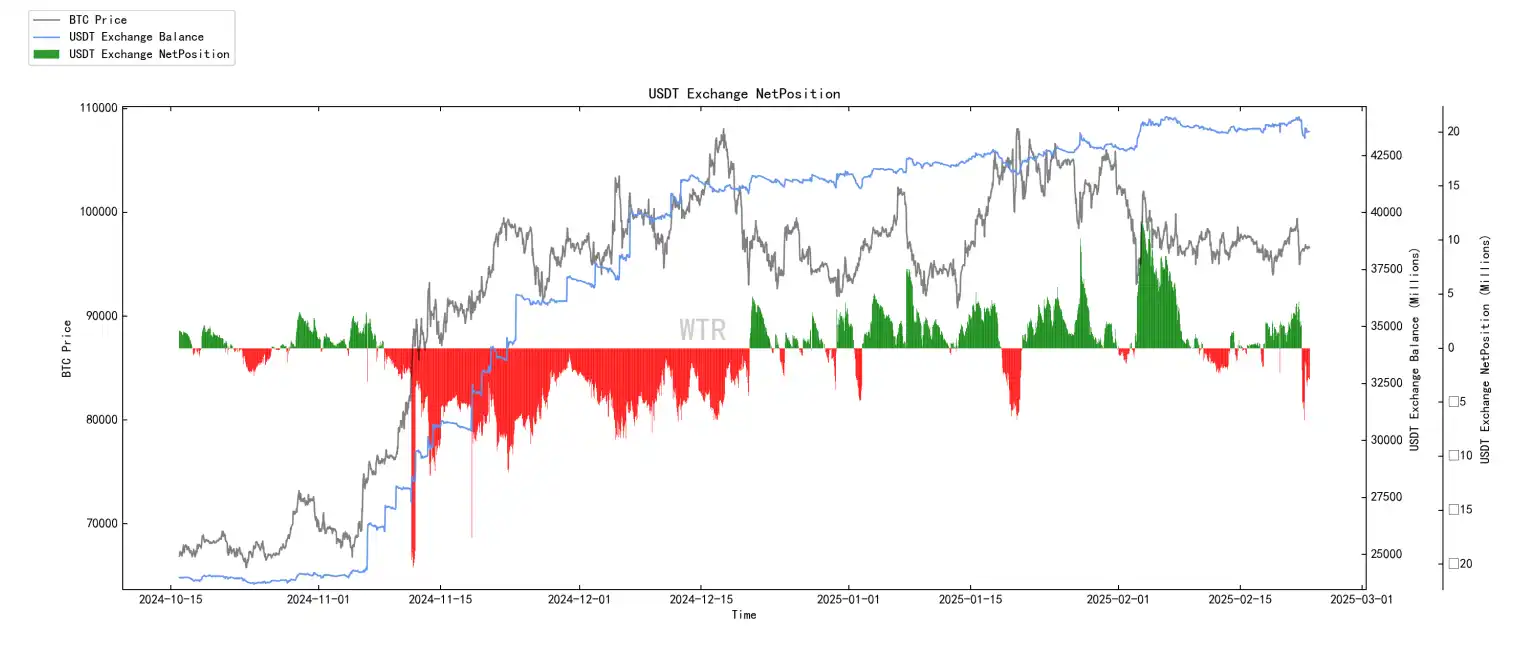

(The figure below is the net head of the USDT Exchange)

Stable coin purchases remained unchanged from last week.

Off-chain transaction data rating:

At 93000, there is an intention to buy; at 100000, there is an intention to sell.

(The figure below is Coinbase’s offline data)

There is willingness to buy at prices around 90000~93000; there is willingness to sell at prices around 100000~110000.

(The figure below is Binance’s offline data)

There is willingness to buy at prices around 90000~93000; there is willingness to sell at prices around 100000~110000.

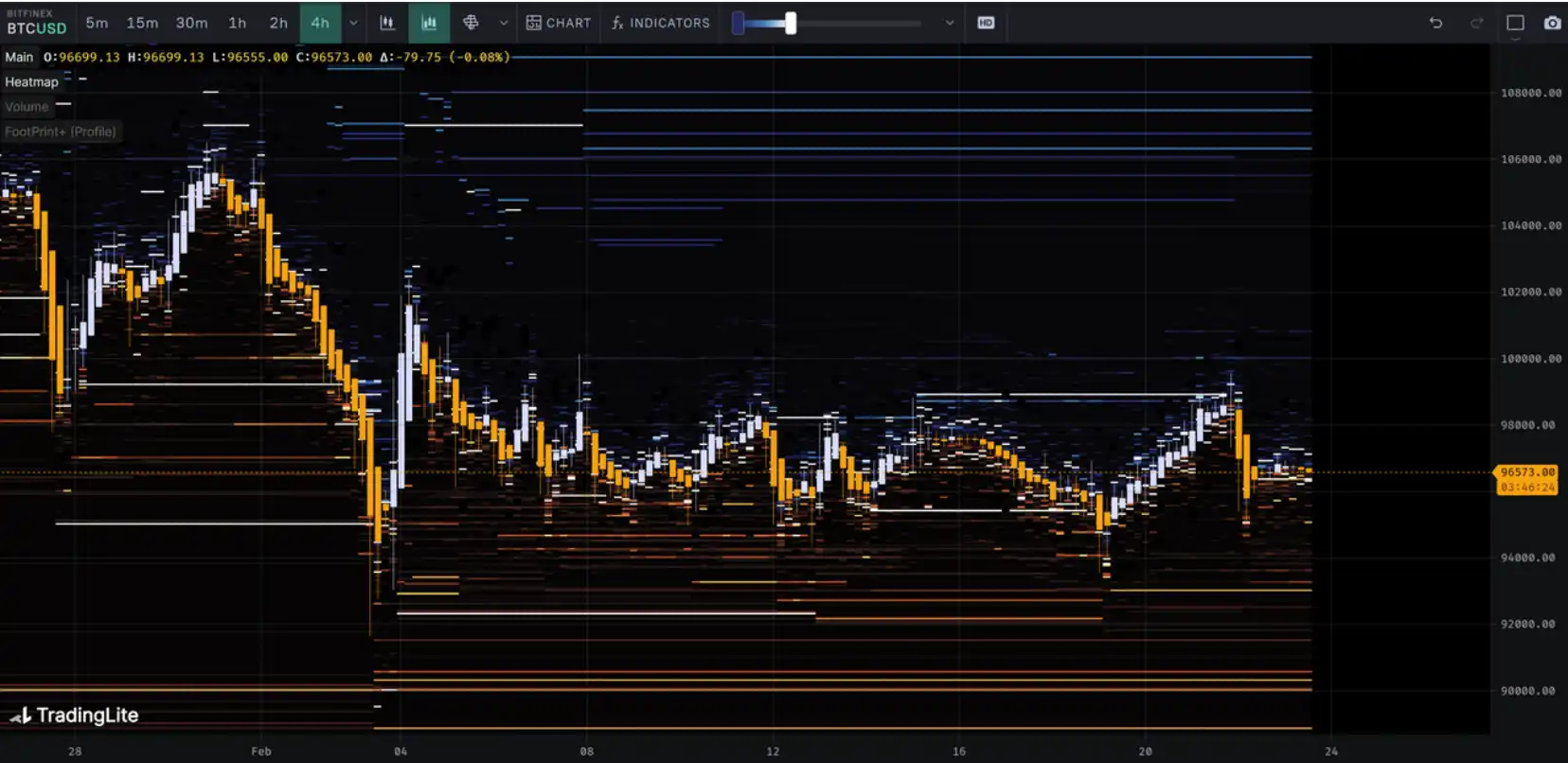

(The figure below shows Bitfinex offline data)

There is willingness to buy at prices around 90000~93000; there is willingness to sell at prices around 100000~110000.

Summary of this week:

Message Summary:

1. The recovery was interrupted, but the real substantial selling pressure did not come from customer theft, but from the FTX compensation incident.

2. The first phase of FTX’s compensation period may last for 3 4, with a maximum of US$6.5 – 7 billion, and the next phase will be after 5 30.

3. On a macro level, the Federal Reserve’s intention to cut interest rates seems to be gradually increasing. It may cut interest rates twice this year, and it may be accompanied by a pause and contraction of the balance sheet.

4. The overall macro fundamentals in the future are still relatively good.

Insights on the chain:

1. The market has fallen below the short-term speculator cost line and may be reluctant to sell, further reducing market selling pressure;

2. The total spot selling pressure is still at a low level in the past year;

3. Weight selling pressure is close to a nearly one-year low;

4. There was a slight rebound among participants in the current period.

·Market tone:

There has been no substantial change in the chain, but the emotions are sluggish and confused.

Mid-term exploration on the chain:

1. BTC is at an accumulation pace;

2. ETH accumulation trend is suspended;

3. Weak liquidity supply;

4. The current mood in the field is still low;

5. The current situation is in the trend of long liquidation and needs to wait for stability.

·Market tone:

hovering

Currently, liquidity is weak, BTC remains relatively stable, and the dangerous end may be biased towards original sectors such as ETH.

Short-term observations on the chain:

1. The risk coefficient is in the red range, and the risk of derivative products is relatively high.

2. The newly added active addresses are in the lower and lower levels.

3. Market sentiment rating: neutral.

4. The net head of the exchange overall shows that BTC and ETH are in a state of large outflows.

5. Global purchases are in a state of loss, and stablecoin purchases are unchanged from last week.

6. Off-chain trading data shows an intention to buy at 93000; an intention to sell at 100000.

7. The probability of falling within 87000 to 91000 in the short term is 60%; the probability of falling within 110,000 to 115,000 in the short term is 40%.

·Market tone:

There are very few new accumulated chips in the current price chain, and the cost line for short-term holders is also stagnant around 92K, indicating that although there is no panic in the current market, short-term market demand/positivity has reached an extremely low state. Expectations will continue to fluctuate this week.

This article is from a submission and does not represent the views of BlockBeats.