Explore the current dilemma of the crypto market and the market impact of large-scale liquidity release in 2025.

Written by: Hedy Bi, Lola Wang| OKG Research

OKG Research has specially planned to launch a series of special topics on “Trumponomics” to provide in-depth analysis of the future trends and core logic of the crypto market with the continuous advancement of Trump’s 2.0 New Deal.

This article is the fourth article in a series of special topics on “Trumponomics” specially planned by OKG Research.

In 2025, Trump’s “America First” strategy will stimulate domestic economic growth by promoting trade protectionism, promoting the return of industries, reforming taxes, and increasing military spending. The focus is on strengthening the independence of U.S. manufacturing, technology and energy sectors, while at the same time improving export competitiveness. The core goal of this series of policies is to promote the recovery of the U.S. economy, while reducing dependence on foreign production and capital, and enhancing the U.S.’s dominant position in the global economy.

As these policies continue to advance, especially the large-scale fiscal expenditures and deficit problems caused by promoting military expenditures and large-scale infrastructure construction cannot be ignored. Coupled with the existing pressure on U.S. debt and potential inflation expectations, investors may begin to try different risk hedging assets. Cryptographic assets have become a fulcrum for the choice of “Trumponomics”.

Despite the continued inflow of institutional funds, actual funds cannot bring dopamine to the market because investor expectations have now become the main variable determining the direction of the market. This article is the fourth article in the 2025 special topic Trumponomics by OKG Research, which explores the current dilemma of the crypto market and the market impact of large-scale liquidity releases in 2025.

A crypto market struggling for liquidity

Driven by Trump economics, the United States ‘self-sufficiency and industrial revitalization policies are facing high inflation and high debt pressures. Although the U.S. macro CPI/PPI data from February 12 to 13 did not trigger large market fluctuations, the reason was that these data were still superficial indirect data rather than direct data. For institutional funds, the market is more digesting previous expectations. The real market positive occurred when the Ministry of Finance released liquidity in early February. This actual operation injected substantial momentum into the market and promoted the rise of risky assets.

Specifically, the inflow of institutional investors is more like the realization of expectations and the redistribution of existing funds in the market based on it.In a macro report released by OKG Research last weekend, the author proposed that for the market,“Limited liquidity” and “precise reconfiguration” of the marketThe current focus on Bitcoin is due to the change in the trading behavior of the main players behind it.Institutional investors tend to hold and concentrate them for a long time, so the flow of ETFs rarely overflows to other assets, which is one of the main reasons why the “copycat season” that investors are looking forward to is delayed.

However, although the minutes of the Federal Reserve meeting on February 19 emphasized the stance of not rushing to cut interest rates, this did not have a significant impact on U.S. stocks. By observing the market,Expectations of not cutting interest rates for the time being seem to have been digested, or the market has begun to advance expectations trading on “suspending or slowing down balance sheet reduction”.

However, it cannot be denied that no matter how expectations change, they are based on macroeconomic conditions, and expectations do not amount to a “big bet” on the macro level. What we have observed so far isThe Fed’s monetary policy will still face two major pressures. High inflation and high debt levels will make the Fed’s monetary policy more cautiousThis means that the Fed may avoid excessively loose monetary policy even in the face of slowing economic growth.

A new round of “liquidity manifestation” in the crypto market may have arrived

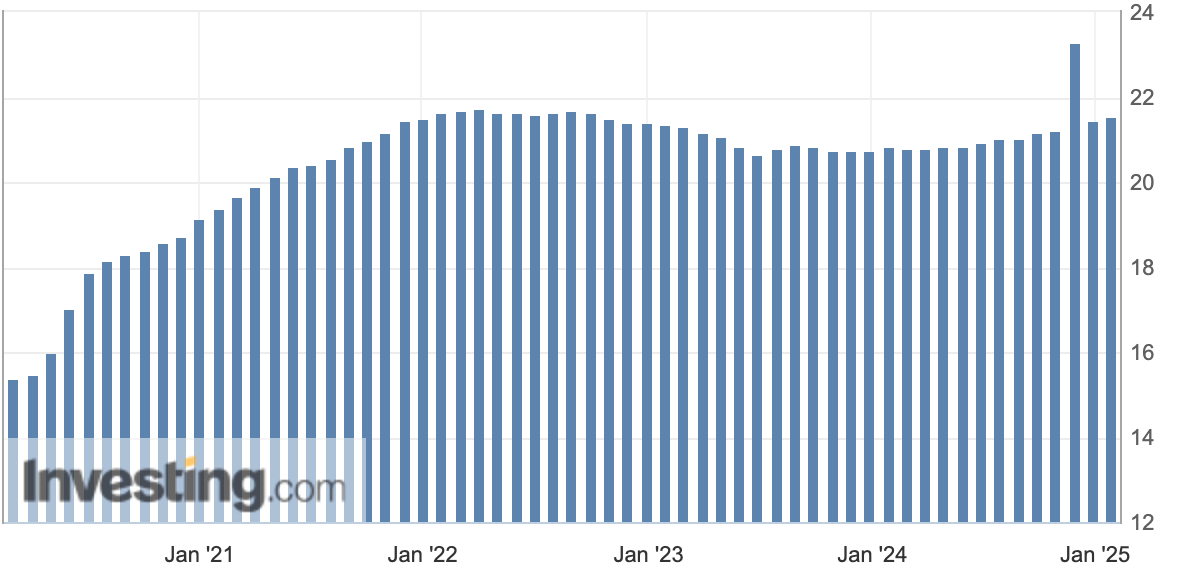

Although at present, the United States will not implement large-scale quantitative easing (QE) in 2025 as it did in 2018 and 2020, that is, by purchasing treasury bonds and government debt assets and injecting them into the market to stimulate economic growth. But in the short term, in response to the U.S. debt ceiling issue, the TGA has begun to inject liquidity into the market this week.

Historically, whenever the U.S. government faces a debt ceiling problem, the market has often experienced short-term liquidity release (from the TGA), which in turn drives up the prices of various assets, especially risky assets. The U.S. Treasury’s “Treasury General Account”(TGA) is an important tool used by the government to manage daily cash flow. The balance of this account will be adjusted based on the government’s revenue and expenditure. When faced with debt ceiling restrictions, the Treasury usually reduces the supply of treasury bonds and uses funds in the TGA account to maintain normal government operations.

In fact,Changes in TGA balances directly affect the liquidity of financial markets. Every time there is a large-scale release of liquidity, the increase in risky assets, especially crypto assets, will respond.For example, from mid-2020 to the end of 2021 (when monetary policy is superimposed), Bitcoin has increased by about 6 times. During this period, the growth of M2 in the United States also reached 40%+, which is the fastest growth period for M2 in five years.

During the first half of 2022 to the first half of 2023, the Bitcoin price during the liquidity release phase of the TGA showed a certain lag. During this period, the price of Bitcoin increased by about 100% from the lowest point to the highest point. However, from the beginning of liquidity release to the end of the period, the overall price of Bitcoin increased by about 10%.

According to forecasts in Goldman Sachs ‘latest report,The first round of short-term TGA injection liquidity in 2025 will be approximately US$150 billion to US$250 billion.It is expected to last into the summer until a new agreement is reached. This is the first round of foreseeable liquidity releases. There are also other institutions conducting analysis,It is believed that the first round is expected to inject a total of approximately US$600 billion in liquidity.

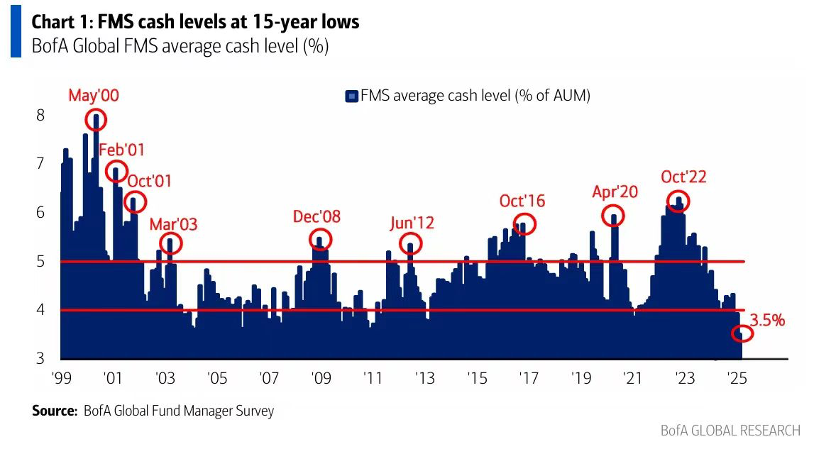

According to Bank of America’s latest macro analysis report, global fund managers ‘cash holdings fell to a low of 3.5% in February 2025, reflecting investors’ increased risk appetite-they prefer stocks to cash and bonds.This increase in risk appetite coincides with the current timing of TGA liquidity release. In other words, most of this round of short-term liquidity injections is expected to flow into risky asset markets, including crypto assets.The direction of investors ‘capital flows and their preference for risky assets may further drive the rise of the crypto market.

Not QE, better than QE?

Under the framework of Trumponomics, the strategy of promoting U.S. priority not only relies on means such as trade protectionism and industrial return, but also relies on the strong support of fiscal and monetary policies. In order to achieve self-sufficiency and stimulate the domestic economy, the Trump administration prefers to use fiscal instruments such as the TGA (Treasury General Account) and, if necessary, liquidity injection through monetary policy instruments to promote economic growth.

Unlike quantitative easing (QE), a long-term monetary policy tool, the TGA’s liquidity release is a one-time, short-term operation. By reducing government bond issuance and using funds in TGA accounts to respond to short-term liquidity needs, the government can quickly inject market liquidity. Although this injection can push up risky assets in the short term, due to the strong temporary nature of the injection of TGA funds, liquidity may be quickly recovered at a later stage, which may in turn bring about a tightening effect on market liquidity.

In contrast, QE is a means for the Federal Reserve to expand its balance sheet for a long time by purchasing assets (such as treasury bonds) and continue to inject funds into the market, aiming to stabilize financial markets and stimulate economic growth. The long-term and sustainable nature of QE is in sharp contrast to the short-term nature of TGA. To achieve its goals of industrial rejuvenation and competitiveness improvement, the Trump administration needs to use the TGA to inject liquidity in the short term, while relying on monetary policy easing measures to support the economy in the long run. However, the TGA’s short-term liquidity release may also conflict with the Federal Reserve’s monetary tightening direction. As the government continues to increase debt, it may cause uncertainty in the market and thus affect the implementation of overall economic policies.

Overall, the Trump administration has injected new vitality into the market through the TGA’s short-term liquidity release. Although this release is not a long-term monetary easing policy like quantitative easing (QE), it is enough to drive the rise of risky assets such as crypto assets in the short term. For the crypto market, short-term capital inflows are undoubtedly a rare opportunity, but the ensuing tightening liquidity effect and U.S. debt problems still require attention. Long-term economic stability still depends on the effective coordination of fiscal and monetary policies under the framework of Trumponomics. In the coming months, the monetary and fiscal policy tools adopted based on this framework will largely determine the performance of the crypto market.