The 2024 Q413F filing shows that Bitcoin is accelerating its institutionalization. Although the current position ratio is still low, its market position will be further consolidated as more institutions enter and increase their allocation.

Author: @samcallah

Compilation: Vernacular blockchain

These institutions include banks, hedge funds, registered investment advisers (RIAs), family offices, endowments, pensions, sovereign wealth funds and other asset management companies. Here are some of the main findings:

1. What is the 13F file?

Before we delve into it, I want to clarify what exactly the 13F document is. Each quarter, large investment companies with assets under management exceeding $100 million must file a 13F file with the U.S. Securities and Exchange Commission (SEC) to disclose their holdings of U.S. stocks and equity-related assets, such as ETFs, REITs (real estate investment trusts), options and convertible bonds.

It is important to note that the 13F document only contains institutions ‘long positions in U.S. stocks and equity-related assets.

Therefore, it does not include the following assets: bonds, real estate, commodities, precious metals, raised investments (such as hedge funds, venture capital, etc.), futures, spot bitcoin, cash, foreign stocks/currencies, and short positions.

Therefore, the 13F document cannot fully reflect the institution’s overall investment portfolio.

We cannot know the proportion of the institution’s holdings in other asset classes, nor can we determine whether a long position is only used to hedge short positions elsewhere.

I emphasize this because next I will discuss the size of Bitcoin holdings in these 13F documents. However, please note that these data only reflect the institution’s allocation of U.S. stocks and related assets.

In fact, these institutions ‘Bitcoin holdings may be smaller than the report suggests, provided they also invest in other asset classes.

A prime example is the recent disclosure by the Abu Dhabi Sovereign Wealth Fund of its holdings of $IBIT (iShares Bitcoin Trust), one of the most exciting 13F filings to date.

But the key is… the asset under management (AUM) disclosed in the 13F filing is only US$20 billion, while the fund’s actual total AUM is as high as US$302 billion. In other words, the positions declared by the 13F only account for approximately 6.6% of the fund’s total assets.

This makes sense because the fund invests in multiple asset classes around the world, far beyond the U.S. stock market.

As a result, Bitcoin’s actual share of its total investment portfolio is only 0.1%, rather than 2.1%. But even so, this is still a very positive development.

With this in mind, the median Bitcoin position of all institutions in these 13F filings is only 0.13%.

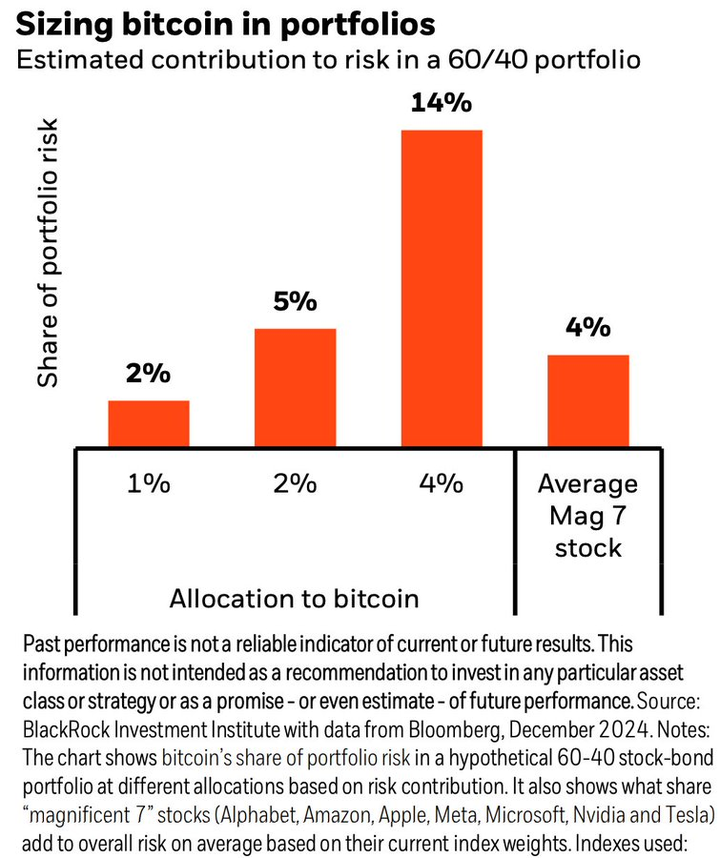

This ratio is very small… but it is a good sign. This suggests that Bitcoin’s adoption in institutions is still at a very early stage. It is worth reminding that BlackRock recently recommended allocating 1-2% of assets to Bitcoin.

However, among these investment companies, a few institutions have significantly higher bitcoin allocation ratios than their peers. Coincidentally, their managers are all among the industry’s top asset management experts and have proven and excellent investment performance.

2. Information worthy of attention

Here are some of the most eye-catching 13F filings that deserve special attention…

1) Horizon Kinetics

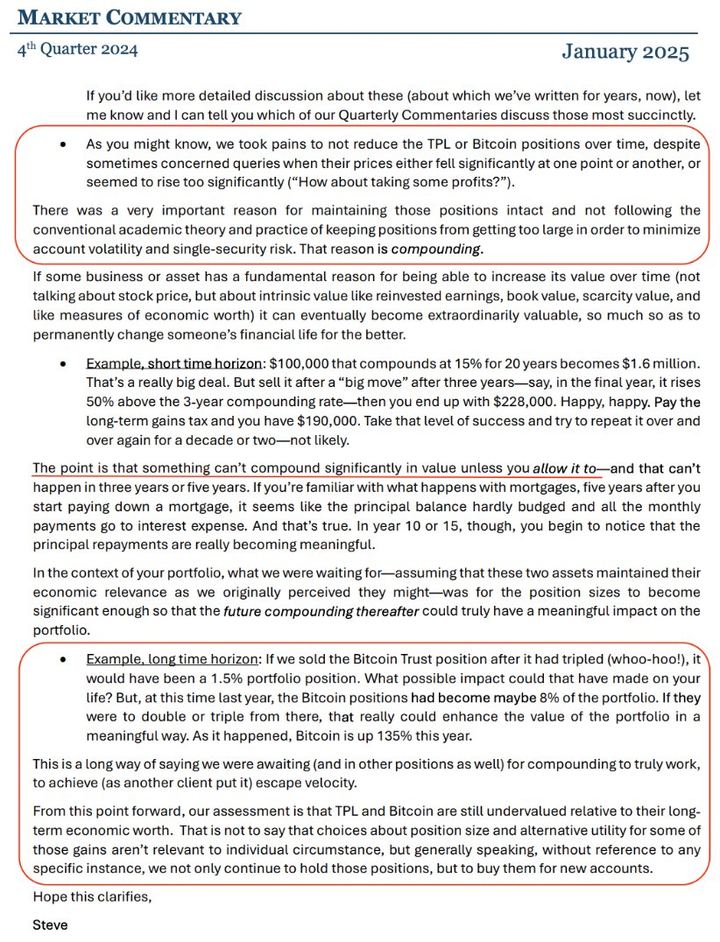

Horizon Dynamics ‘second-largest position is Bitcoin (16.16%), with an exposure of approximately US$1.3 billion. The company is led by Murray Stahl, one of the most prominent figures in the investment world. In its Q4 2024 comments, the company explained why they did not rebalance their Bitcoin holdings.

2) Bracebridge Capital

The company’s largest position is Bitcoin (23.6%), with an exposure of approximately US$334 million.

Bracebridge Capital, led by Nancy Zimmerman, specializes in managing assets for foundations, pensions, high net worth individuals (HNWIs), and is responsible for managing part of the portfolio of Yale University and Princeton University, two of the best-performing endowments of the past 20 years.

3) Tudor Investment Corp

Tudor’s largest position is Bitcoin (1.625%), with an exposure of approximately US$436 million. This declaration has made some headlines and is indeed worthy of attention.

Paul Tudor Jones is one of the greatest investors of his generation. Last month, he also talked about why he still holds Bitcoin.

4)Fortress Investment Group The company’s fourth largest position is Bitcoin (11.2%), with an exposure of approximately US$70 million. Notably, Abu Dhabi’s sovereign wealth fund (Mubadala) acquired a 68% stake in Fortress last year and became its controlling shareholder.

So, in fact, this is just a further deployment by the United Arab Emirates on Bitcoin.

5) Brevan Howard

The company’s second-largest position is Bitcoin (8.74%), with an exposure of approximately US$1.4 billion. Brevan Howard’s team has been a staunch supporter of Bitcoin for years, and the large macro hedge fund clearly understands the art of long-term holding (HODLing).

In the bear market in 2022, Bitcoin plunged 50%, but billionaire Alan Howard still expressed a firm view…

6) Discovery Capital Management

The company’s fifth-largest position is Bitcoin (4.6%), with an exposure of approximately US$68 million. Discovery is led by Robert Citrone, who has worked with Julian Robertson and George Soros and is a minority shareholder of the Pittsburgh Steelers.

He once explained why he cared about Bitcoin.

7) Jericho Capital

The company’s fifth-largest position is Bitcoin (5.4%), with an exposure of approximately $378 million. Jericho, led by Josh Resnick, has a staggering growth trajectory-from $36 million in 2009 to more than $7 billion in assets under management today.

8) Hudson Bay Capital Management

The company holds a 0.15% Bitcoin position with an exposure of approximately US$44 million. But what’s really interesting is not this position, but the fact that the notorious Bitcoin short seller Nouriel Roubini turns out to be a senior consultant to the company.

Fortunately, they didn’t listen to his Bitcoin advice!

9)The big news here from the State of Wisconsin Investment Board is that the state’s pension fund’s Bitcoin holdings more than tripled in the final quarter.

Q2: Positions of US$99 million, 2,898,051 shares (0.26%)

Q3: Positions of US$104 million, 2,889,251 shares (0.26%)

Q4: Positions of US$321 million, 6,060,351 shares (0.82%)

Add the position winner!

10)State of Michigan Retirement System

But Wisconsin is not the only state to increase its holdings in Bitcoin-Michigan’s pension funds have almost doubled their Bitcoin holdings.

Q2: Positions of US$6.6 million, 110,000 shares (0.03%)

Q3: Positions of US$6.9 million, 110,000 shares (0.03%)

Q4: Holding US$9.3 million, 100,000 shares (0.05%)

The scale is still small, but it is growing!

11)Emory University

The university’s second-largest position is Bitcoin (32.3%), with an exposure of approximately US$22 million. The endowment fund’s Bitcoin positions remained unchanged from the previous quarter, which means that despite the price of Bitcoin rising by about 50%, they did not proactively adjust their positions.

Emory University opted to continue to hold (HODL).

12) Pine Ridge Advisors

The company’s second-largest position is Bitcoin (18.4%), with an exposure of approximately $209 million. I don’t know much about this company, but the reason why I mention it is because for a family office of this size, the bitcoin allocation is quite concentrated.

By the way, this is their entire official website interface-so you know they are indeed the “regular army”.

13) Capula Management

The company’s second-largest position is Bitcoin (5.4%), with an exposure of approximately $936 million. Europe’s fourth-largest hedge fund is led by Yan Huo, who was formerly head of JPMorgan’s fixed income trading division.

Their investment strategy is innovative and low-correlation investments, so it’s no wonder they are long Bitcoin.

14) Cresset Asset Management

Bitcoin has become the top 30 positions of Cresset, one of the largest and leading independent registered investment advisers (RIAs) in the United States. Cresset is increasing its Bitcoin holdings every quarter:

Q2: Position of US$33.7 million (0.14%)

Q3: Position of US$53.9 million (0.21%)

Q4: Position of US$107.5 million (0.51%)

This is worth paying attention to measure the investment trend of its Financial Advisor (FA) in Bitcoin.

You may have noticed that I did not mention some well-known institutions that hold large amounts of Bitcoin ETFs, such as:

Millennium (US$2.6 billion, 1.28%)

Jane Street ($2.4 billion, 0.52%)

Susquehanna ($1 billion, 0.16%)

DE Shaw ($869 million, 0.64%)

Citadel ($446 million, 0.08%)

Point72 ($155 million, 0.34%)

This is because these institutions are mainly quantitative funds and market makers. Their algorithms don’t care about what the transaction is, whether it’s IBIT, META, GE, SPY or TLT, they’re just looking for arbitrage opportunities and market inefficiencies.

As a result, they are not long-term holders, and I suspect that many institutions ‘Bitcoin positions may be net-neutral, which makes their exposure less interesting to me.

That being said, I still appreciate their trading activity in the market. Their participation improves market efficiency and makes the market run more smoothly by narrowing bid-ask spreads, deepening order books, and improving liquidity.

The same applies to some large banks that hold Bitcoin ETFs:

JPMorgan: $964,000 (0.0001%)

Goldman Sachs: $2.3 billion (0.37%)

Wells Fargo: $375,000 (0.0001%)

Bank of America: $24 million (0.002%)

Morgan Stanley: $259 million (0.02%)

Banks such as JPMorgan Chase are Authorized Participants (APs) in many Bitcoin ETFs and also assume the role of market makers. It is perfectly normal for APs to hold part of the ETF shares on the balance sheet because they are responsible for creating and redemption of ETF shares.

Market makers also need to hold a certain number of ETF shares to better provide liquidity, promote market transactions, improve pricing efficiency, and ensure the accuracy of ETF prices.

In addition, banks are currently subject to regulatory restrictions from the Federal Reserve and are prohibited from holding bitcoin on their own balance sheets on a proprietary basis. For specific regulations, please refer to this official document: the Federal Reserve Statement.

However, with the withdrawal of SAB-121 regulations, the regulatory environment is changing. Among these banks, Morgan Stanley stands out most-in August last year, it became the first large bank to allow financial advisers to recommend Bitcoin ETFs to clients.

Goldman Sachs has also been active, providing Bitcoin exposure to high-net-worth clients through its asset management arm for years. But if its trading desk holds Bitcoin, I suspect it is more likely to be running a market-neutral arbitrage strategy (such as basis trading), which means it is not really a net long position.

As bank supervision evolves, how these large banks adjust their Bitcoin positions and expand their participation in the Bitcoin market in the next few quarters will be a trend worthy of close attention.

This point deserves special attention.

3. Summary

Overall, these 13F filings show that Bitcoin is gradually becoming an institutional asset. Currently, the market size and liquidity of Bitcoin are large enough to accommodate these institutional investors.

As new investment tools continue to be introduced, these institutions will have more ways to gain Bitcoin exposure, and institutional adoption will accelerate.

In this post, I introduce some of the pioneers of institutions entering Bitcoin, but the trend is still in its very early stages, which means there are still huge opportunities in the future.

Institutional investors, who manage trillions of dollars, are still just dabbling in the Bitcoin market. According to my research: Of the 8190 13F filings last quarter, only about 19% disclosed long positions in Bitcoin. As more institutions enter the market, or existing institutions increase their allocation, Bitcoin’s capital inflows will push its price up and even completely change its investor structure.

原文链接