① The supply side recovered rapidly, and the decline in pig prices widened after the holiday;

②9-day 7-board Hangjin Technology is expected to have a net loss of 850 million yuan to 980 million yuan in 2024;

③ Gold prices plunged at a high level last Friday, and COMEX gold futures fell 1.76%.

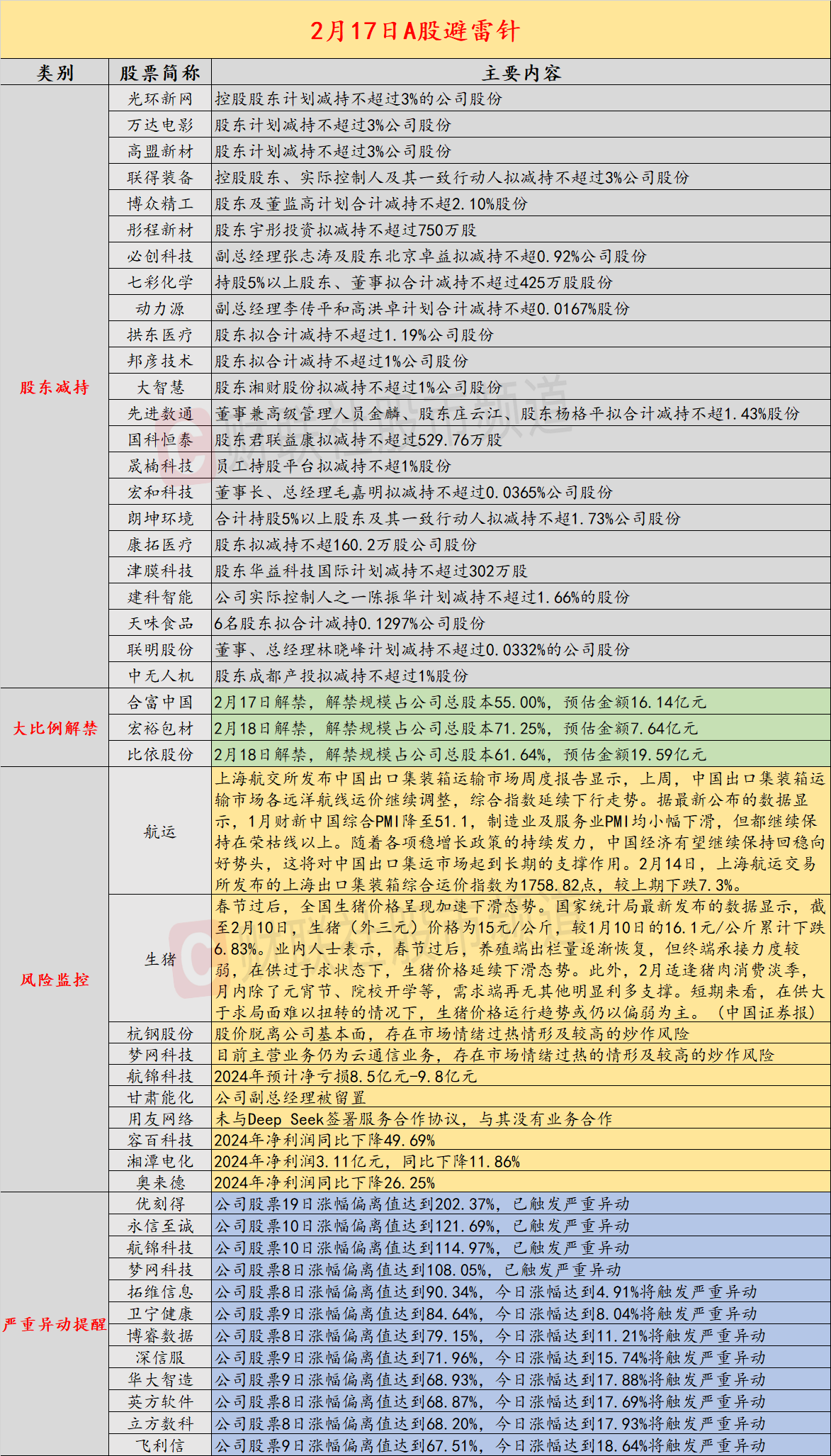

Introduction:Cailian invested in the lightning rod on February 17. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) The Shanghai Air Exchange report shows that the export container transportation market is slowly recovering, and market freight rates continue to decline;2) The supply side is recovering rapidly, and the decline in pig prices has widened after the holiday; the company’s key concerns include: 1) 8 Lianban Hangzhou Steel Co., Ltd. warns of risks, the stock price is divorced from the company’s fundamentals, and there is an overheating of market sentiment and a high risk of speculation; 2) 9-day and 7-board Hangjin Technology expects a net loss of 850 million yuan to 980 million yuan in 2024; key concerns in overseas markets include: 1) gold prices plunged high last Friday, and COMEX gold futures fell 1.76%;2) WHO reports show that the monkeypox epidemic continues to spread around the world.

economic information

1. The weekly report on China’s export container transportation market released by the Shanghai Air Exchange shows that last week, freight rates on various ocean routes in China’s export container transportation market continued to adjust, and the composite index continued its downward trend. According to the latest released data, Caixin China’s comprehensive PMI fell to 51.1 in January, and the PMI of the manufacturing and service industries both declined slightly, but both continued to remain above the boom-bust line. With the continued efforts of various policies to stabilize growth, China’s economy is expected to continue to maintain a positive momentum, which will play a long-term supporting role in China’s export consolidation market. On February 14, the Shanghai Export Container Composite Freight Index released by the Shanghai Shipping Exchange was 1,758.82 points, down 7.3% from the previous period.

2. After the Spring Festival, the national pig price showed an accelerated decline. The latest data released by the National Bureau of Statistics shows that as of February 10, the price of live pigs (foreign three yuan) was 15 yuan/kg, a cumulative decrease of 6.83% from 16.1 yuan/kg on January 10. Industry insiders said that after the Spring Festival, the output at the breeding end gradually recovered, but the terminal acceptance was weak. In the state of oversupply, the price of live pigs continued to decline. In addition, February coincides with the off-season of pork consumption. During the month, except for the Lantern Festival and the opening of colleges and universities, there is no other obvious support on the demand side. In the short term, while the oversupply situation is difficult to reverse, the operating trend of live pig prices may still be mainly weak. (China Securities Journal)

3. Data from China Iron and Steel Industry Association show that in early February 2025, key statistics showed that the steel inventories of steel enterprises were 16.21 million tons, an increase of 860,000 tons from the previous ten days, an increase of 5.6%: an increase of 3.84 million tons from the beginning of the year, an increase of 31.0%: an increase of 3.62 million tons from the same month, an increase of 28.8%; an increase of 80,000 tons from Tongdian last year, an increase of 0.5%, and a decrease of 1.82 million tons from Tongdian the previous year, a decrease of 10.1%.

Company warning

1. 8 Lianban Hangzhou Steel Co., Ltd.: The stock price is divorced from the company’s fundamentals, and there is an overheating of market sentiment and a high risk of speculation.

2. 8 Lianban DreamNet Technology: Currently, its main business is still cloud communications business, with overheated market sentiment and high hype risks.

3. Hangjin Technology: An estimated net loss in 2024 is 850 million yuan to 980 million yuan.

4. Halo Xinwang: The controlling shareholder plans to reduce its shares in the company by no more than 3%.

5. Wanda Film: Shareholders plan to reduce their shares in the company by no more than 3%.

6. Gao Meng New Materials: Shareholders plan to reduce their shares in the company by no more than 3%.

7. Liande Equipment: The controlling shareholder, actual controller and its concerted action plan to reduce their shares in the company by no more than 3%.

8. Bozhong Seiko: Shareholders and directors and supervisors plan to reduce their shares by no more than 2.10%.

9. Tongcheng Xincai: Shareholder Yutong Investment plans to reduce its holdings by no more than 7.5 million shares.

10. Bithuang Technology: Deputy General Manager Zhang Zhitao and shareholder Beijing Zhuoyi plan to reduce their shares in the company by no more than 0.92%.

11. Qicai Chemical: Shareholders and directors holding more than 5% of the shares plan to reduce their holdings by no more than 4.25 million shares.

12. Power source: Deputy General Managers Li Chuanping and Gao Hongzhuo plan to reduce their shares by no more than 0.0167%.

13. Gongdong Medical: Shareholders plan to reduce their shares in the company by no more than 1.19% in total.

14. Bangyan Technology: Shareholders plan to reduce their shares in the company by no more than 1% in total.

15. Great wisdom: Shareholder Xiangcai shares plans to reduce its shares by no more than 1% of the company’s shares.

16. Advanced Digital Communication: Director and senior manager Jin Lin, shareholder Zhuang Yunjiang, and shareholder Yang Geping plan to reduce their shares by no more than 1.43% in total.

17. Guoke Hengtai: Shareholder Junlian Yikang plans to reduce its holdings by no more than 5.2976 million shares.

18. Shengnan Technology: The employee stock ownership platform plans to reduce its shares by no more than 1%.

19. Honghe Technology: Chairman and General Manager Mao Jiaming plans to reduce the company’s shares by no more than 0.0365%.

20. Langkun Environment: Shareholders holding a total of more than 5% of the shares and those acting in concert plan to reduce their shares in the company by no more than 1.73%.

21. Kangtuo Medical: Shareholders plan to reduce their holdings of no more than 1.602 million shares of the company.

22. Jinmo Technology: Shareholder Huayi Technology International plans to reduce its holdings by no more than 3.02 million shares.

23. Jianke Intelligent: Chen Zhenhua, one of the company’s actual controllers, plans to reduce his shares by no more than 1.66%.

24. Tianwei Food: Six shareholders plan to reduce their shares in the company by a total of 0.1297%.

25. Lianming Shares: Director and General Manager Lin Xiaofeng plans to reduce his shareholding in the company by no more than 0.0332%.

26. China drone: Shareholder Chengdu Industrial Investment Corporation plans to reduce its shareholding by no more than 1%.

27. Gansu Nenghua: The company’s deputy general manager was detained.

28. UFIDA Network: It has not signed a service cooperation agreement with Deep Seek and has no business cooperation with it.

29. Rongbai Technology: Net profit in 2024 will decrease by 49.69% year-on-year.

30. Xiangtan Electrochemical: Net profit in 2024 will be 311 million yuan, a year-on-year decrease of 11.86%.

31. Alaide: Net profit in 2024 will decrease by 26.25% year-on-year.

Overseas warning

1. Last Friday, the three major U.S. stock indexes closed mixed, with the Nasdaq up 0.41%, the S & P 500 down 0.01%, and the Dow down 0.37%. Meta rose more than 1%, recording 20 consecutive gains on the daily line. Its share price continued to hit a record high, with a total market value of US$1.87 trillion. The company plans to invest heavily in AI humanoid robots. Nvidia rose more than 2%, while Apple and Nike soared more than 1%. Intel fell more than 2%, rising more than 23% this week, the largest weekly gain since January 2000; Amazon, Google, Tesla, and Microsoft fell slightly. Airbnb rose more than 14%, the largest increase in a year.

2. Last Friday, COMEX gold futures fell 1.76% to US$2,893.7 per ounce;COMEX silver futures fell 0.22% to US$32.655 per ounce.

3. The latest monkeypox epidemic report released by the World Health Organization shows that the epidemic caused by the monkeypox virus Ib branch continues to spread, and travel-related cases have occurred in many countries. According to the monkeypox epidemic report released by the WHO on the 13th, as of the end of last year, 124753 confirmed cases had been reported in more than 100 countries and regions around the world, with 272 deaths.