This article will introduce some risk-adjusted revenue opportunities worth noting.

Author:Charlie

Compiled by: Shenchao TechFlow

In the current market environment, using stablecoins to gain profits is one of the effective ways to meet challenges and achieve growth. This article will introduce some risk-adjusted revenue opportunities worth noting (in no particular order).

HLP (Hyperliquidity Provider)

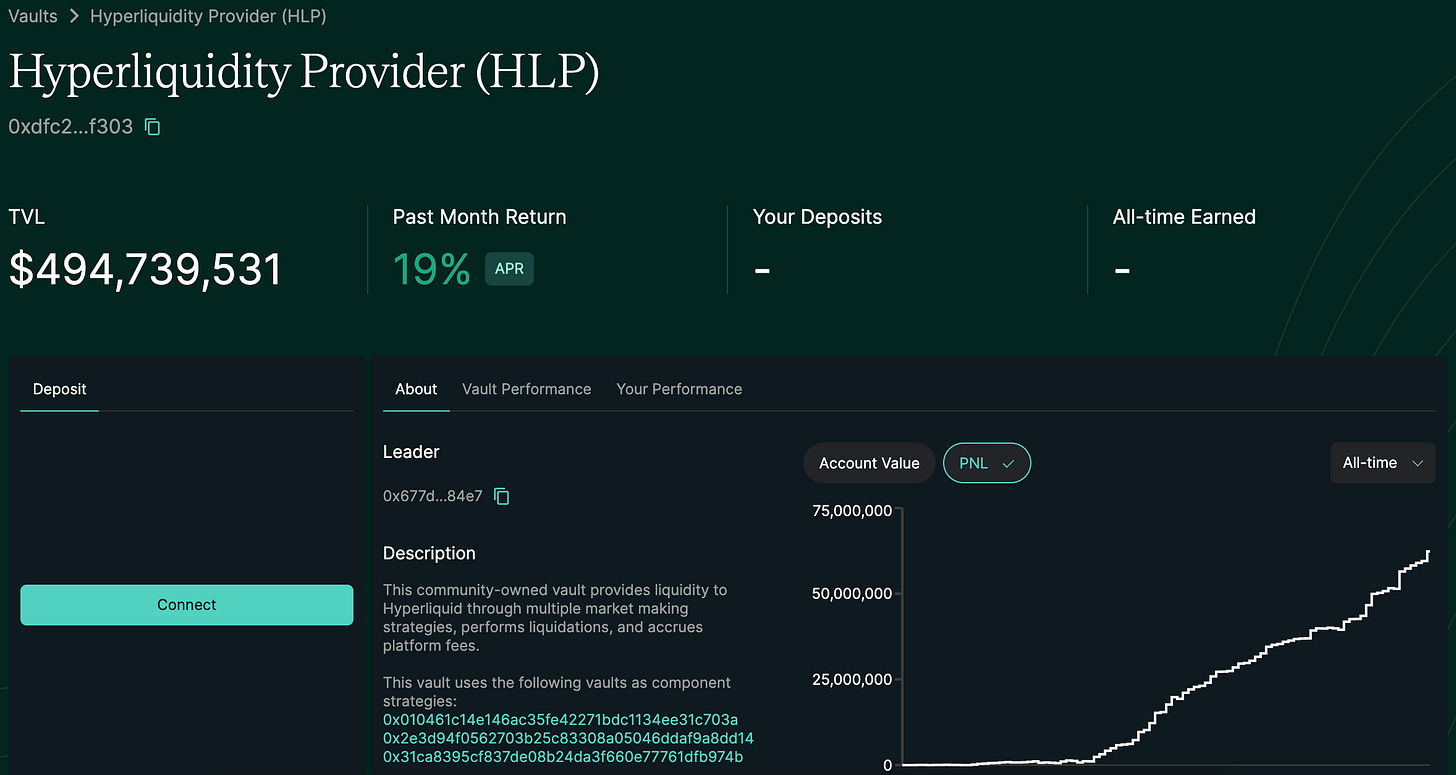

Currently, the Hyperliquid platform’s Hyperliquidity Provider (HLP) vault provides a yield of 18.61%, which is a continuously and stable source of return. According to official descriptions, HLP provides liquidity to Hyperliquid through a variety of market-making strategies, while performing clearing operations and accumulating platform transaction fees.

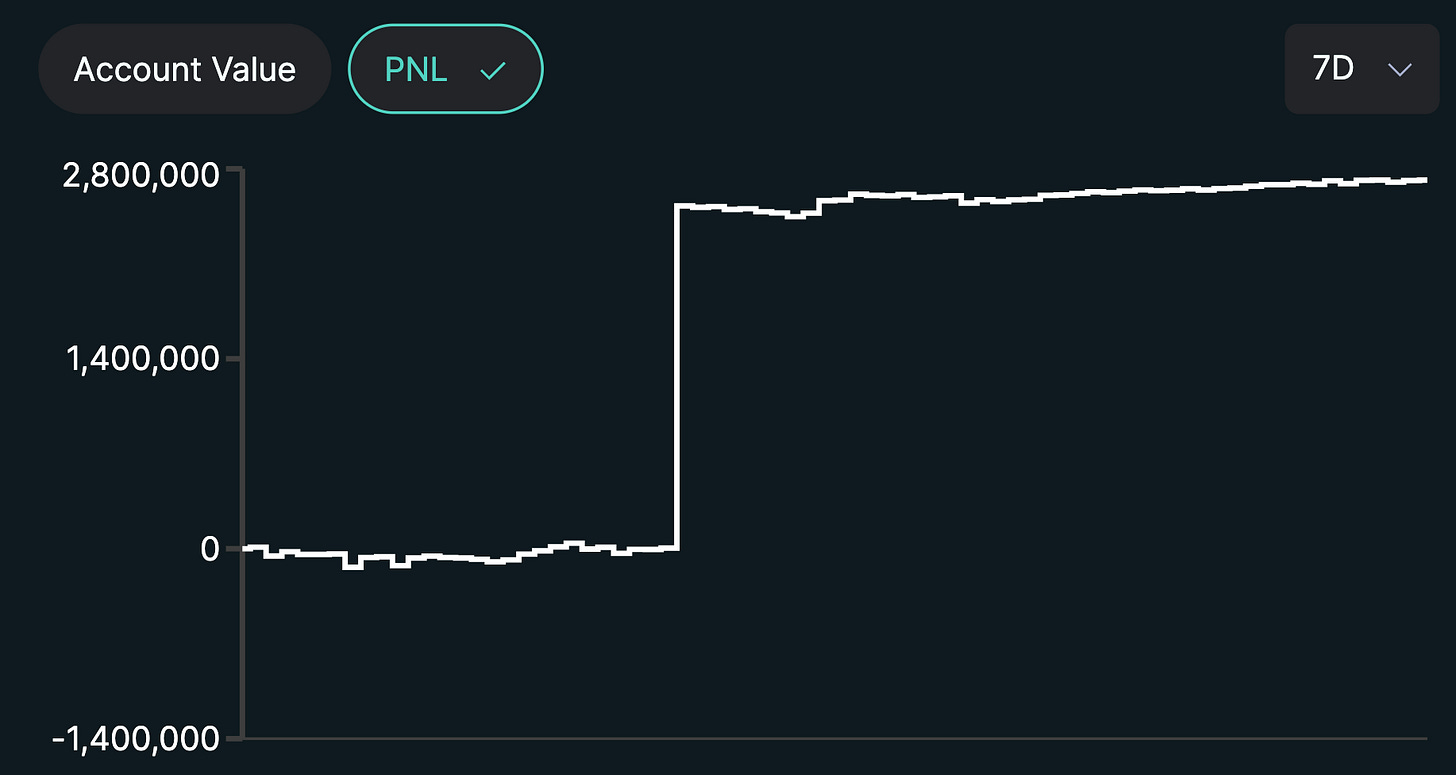

It should be noted that the earnings performance of HLP is usually uneven. Earnings may remain flat or grow slightly over time, but during liquidation events, significant one-day returns tend to occur:

However, because the operating mechanism of HLP is relatively closed and depositors rely entirely on the professional capabilities of the Hyperliquid team, there is a certain black swan risk (that is, potential losses that may be caused by extreme events). However, it is trustworthy that the data shows that traders lose money on average, so in the long run, HLP vault may be able to continue to be profitable. In addition, depositors need to pay attention to the fact that funds need to be locked for 4 days after being deposited in HLP before being withdrawn.

Sky Money

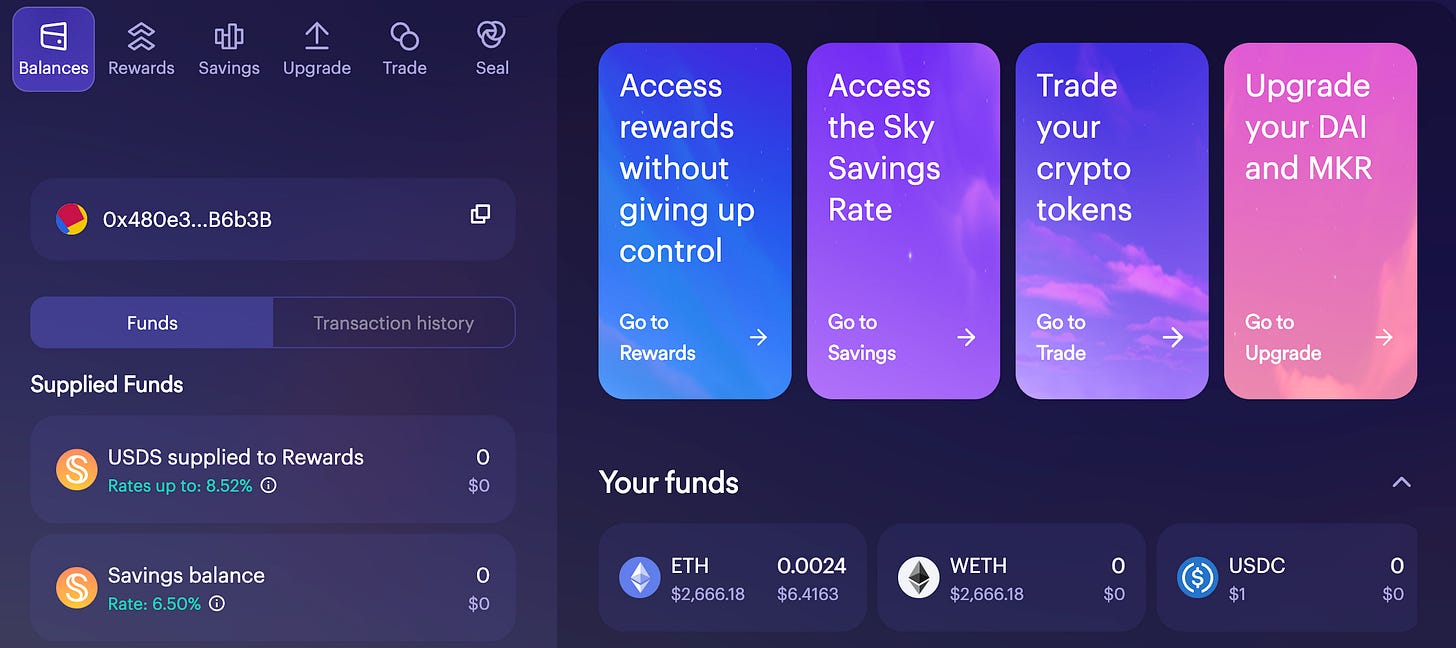

Sky Money is a new brand of MakerDAO and currently offers stablecoin depositors the following two options:

-

Depositing it into the Rewards Vault will earn 8.52% of the proceeds and will be paid in the form of SKY.

-

Depositing a Savings Vault earns a 6.5% return and is paid in the form of USDS (this is also the new DAI savings rate).

In contrast, the high returns of reward vaults are clearly more attractive, and the risk levels of the two options are comparable. Depositors who deposit in the reward vault can also accumulate SKY tokens, which we believe is currently undervalued by the market. Choosing to hold and accumulate SKY rather than simply mining and selling may bring additional growth potential to nominal yields.

Ethereal

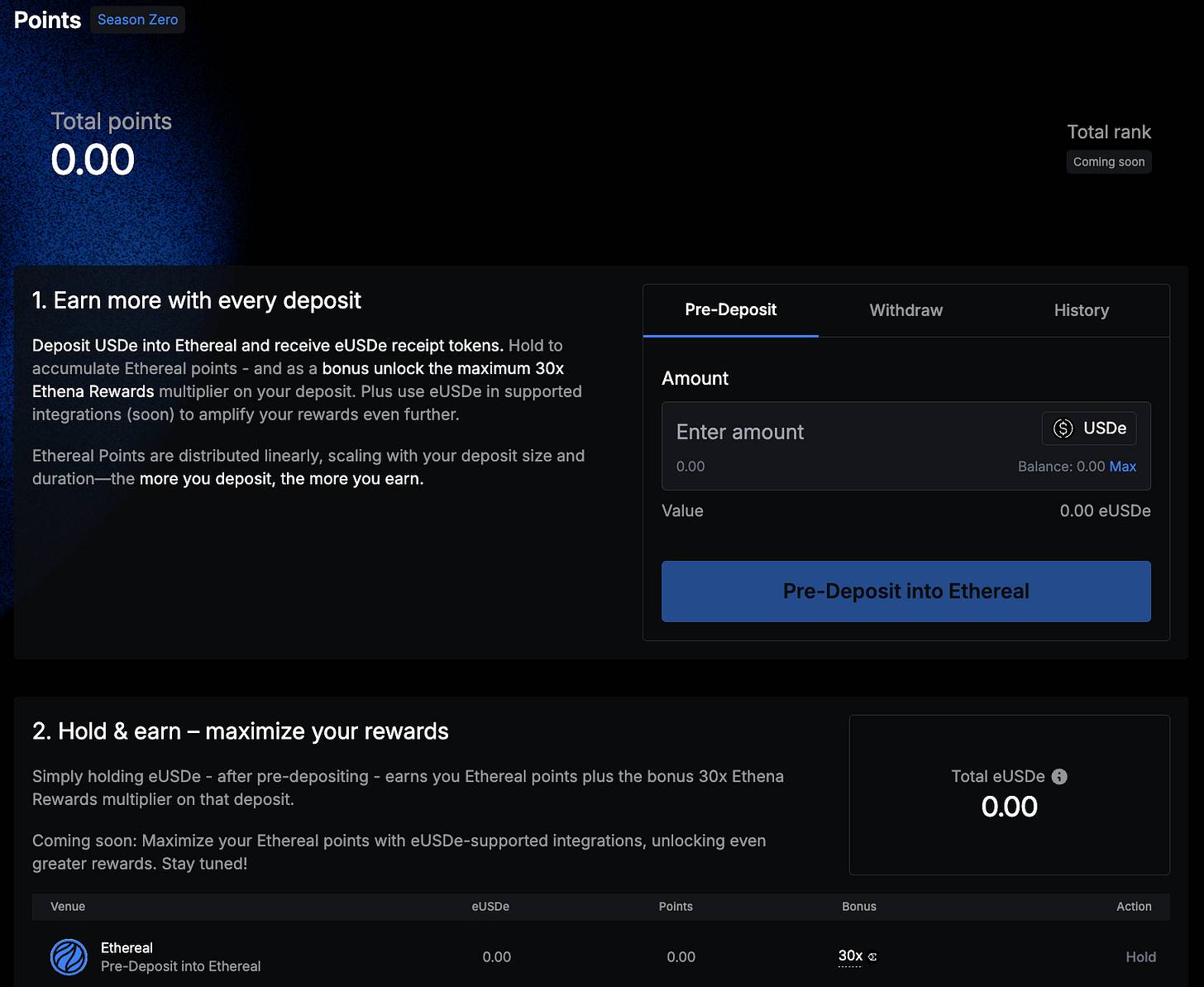

Ethereal is a decentralized perpetual contract trading platform with close ties to and support the Ethena team. It is reported that the platform will be launched on the Ethena Network and become a tool used by the Ethena team to hedge long spot positions, thereby reducing the flow of funds to centralized exchanges (CEX).

Currently, Ethereal is launching a points campaign called Season Zero, where users who deposit to USDe can accumulate Ethereal points and receive 30 times the Erena reward (the specific benchmark is unclear, but it can be assumed that part of the $ENA token will be rewarded to depositors).

The annualized rate of return (APR) for this opportunity is currently unclear, but I expect it to be between 15% and 20%, depending on the issue price of the Ethereal token. Because the revenue information is not transparent enough, this may pose certain risks from the perspective of opportunity costs. But anyway, I think this is an opportunity to watch in the stablecoin earnings portfolio.

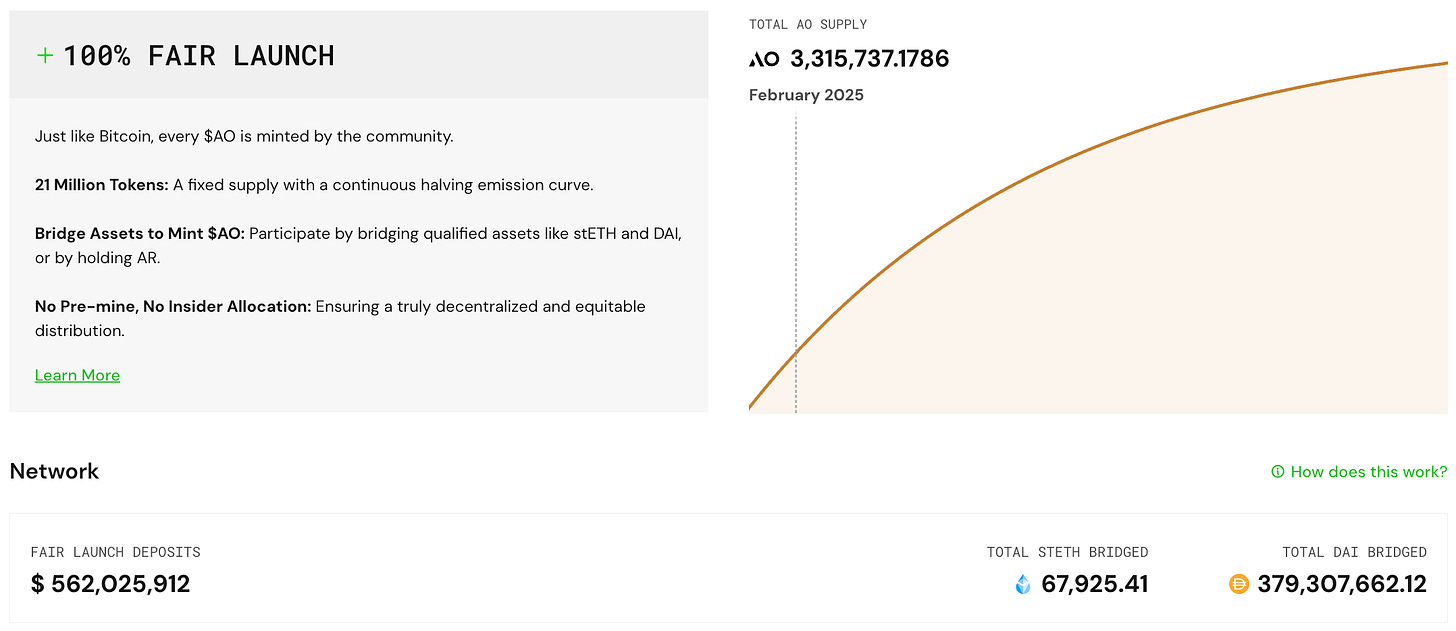

AO

AO remains a low-key project for many market participants. We actually reported on this as early as May 2024. AO has long been running mining activities similar to pre-deposits, but with the completion of recent token generation events, its annualized rate of return has been confirmed:

1 DAI earns 0.004424 AO per year, so based on the current AO price ($32.49), the APR is 14.37%.

Similar to Sky and Ethereal, mining AO can currently earn good profits by mining and selling, and you can also choose to hold AO. If you choose to hold, there may be greater value-added potential in the future, providing additional room for growth for the current APR.

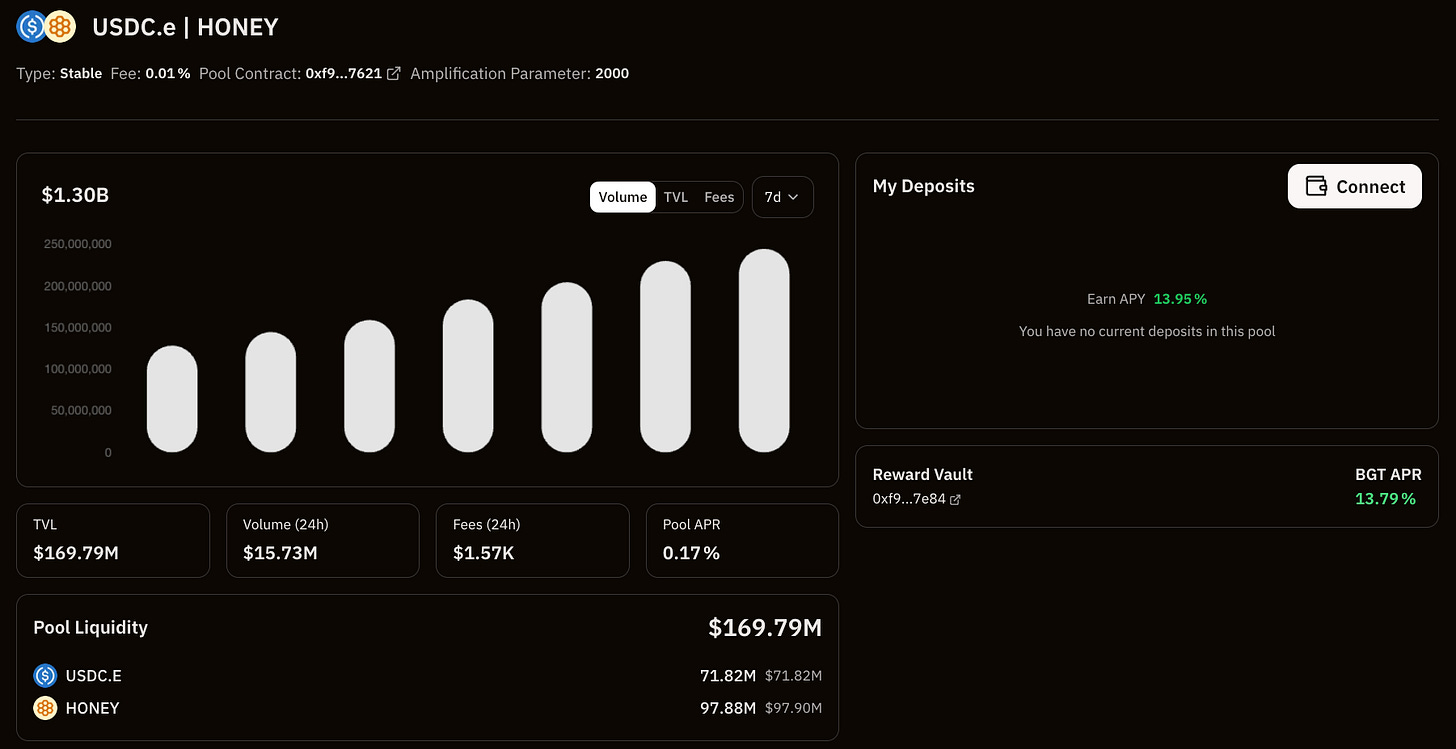

Berachain

Berachain native DEX offers some interesting opportunities, such as the USDC.e/HONEY fund pool, which currently pays a 13.79% yield in the form of BGT. BGT is a soul-bound token (non-transferable), but can be redeemed for BERA at a 1:1 ratio. Miners can choose to sell immediately to achieve the current APR, or accumulate BGT and bet on the future development of the Berachain ecosystem, which has been heating up recently.

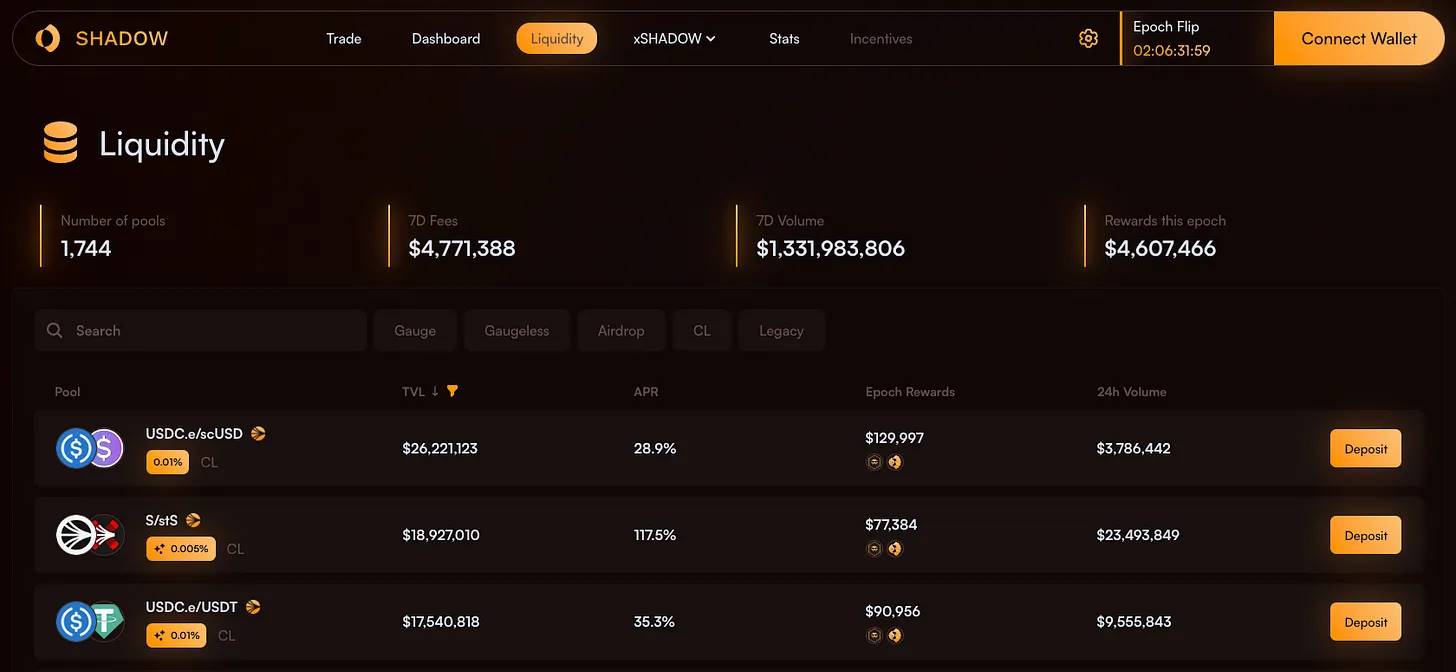

Sonic

Sonic is conducting a massive airdrop mining campaign, distributing hundreds of millions of dollars in S tokens to stimulate ecosystem growth. This creates some unique opportunities for revenue miners and deserves further attention and research.

Shadow Exchange It is a native decentralized exchange (DEX) in the ecosystem and provides many attractive stablecoin investment opportunities. Among them, the following two options are particularly worthy of attention:

-

USDC.e/scUSD: Annualized rate of return is 28.9%

-

USDC.e/USDT:The annualized rate of return is 35.3%

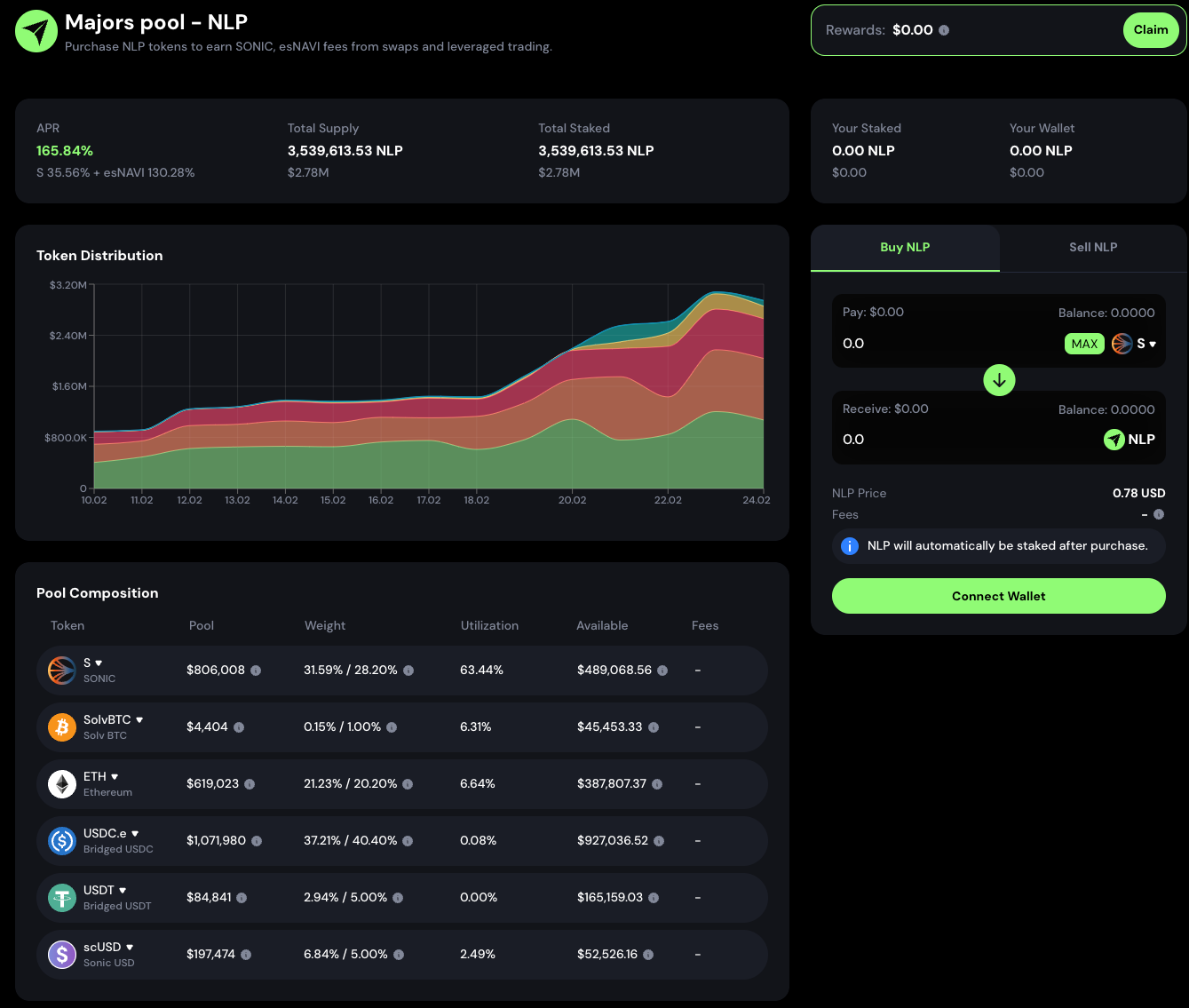

Navigator Exchange It is a fork project based on GMX and also launched a GLP/JLP-like product called NLP. What needs to be noted for this product is that since its investment portfolio contains S, BTC and ETH, it may face certain price fluctuation risk (Delta risk). Currently, NLP offers the following rates of return:

-

35.60%, paid in the form of S tokens

-

131.71%, paid in esNAVI tokens

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern