Commonality among losers: lack of technology, information advantages, retail investors who blindly chase up gains and kill losses, and project parties who fail to adapt to regulatory changes.

Author: Professor Shuo said

Today in 2025, as the overall market value of crypto is too high, everyone will find it more and more difficult to make money. Even the vast majority of people around you are losing money. They can’t help but be curious as to who is making money in the market. Make money on it, and then take a look at it from the comments of netizens, hoping to find the right one.

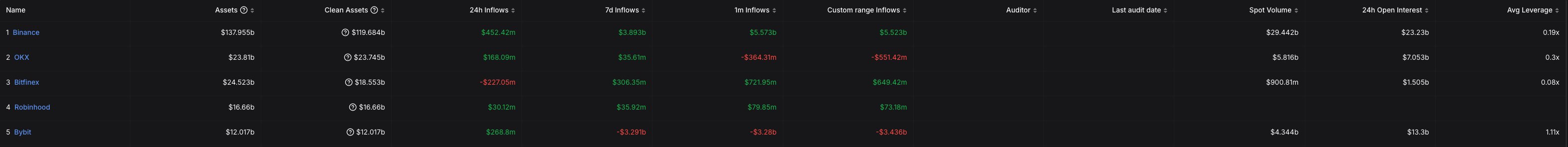

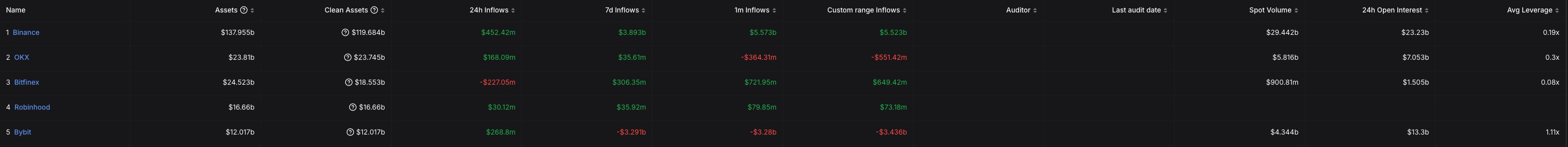

1. Centralized Exchange (CEX)

-

Profit logic: Trading fees: During bull markets, trading volume surged (such as after Bitcoin halved in 2024), and fee income doubled; bear markets relied on derivatives (contracts, options) to hedge demand to maintain revenue. Coin fees and project incubation: Hot projects (such as Meme coins, RWA tracks) pay high coin-deposit fees, and some exchanges participate in early investment (such as OKX Ventures); lending and financial services: earn interest margins through user asset accumulation (OKX Financial Management);

-

Typical case: Binance accounted for more than 60% of derivatives trading volume in Q4 in 2023, and spot trading volume in the early stage of the bull market (2024) rebounded to an average of US$30 billion per day;

- Revenue: Think about the theft of @Bybit_Official, which proved that the annual revenue exceeded 1.5B. You can imagine that the revenue would be higher. Thinking about it would be exciting for other exchanges to add it up;

Most people’s transactions still take place in CEX, their money is also placed in CEX, and their financial management is also held in CEX;

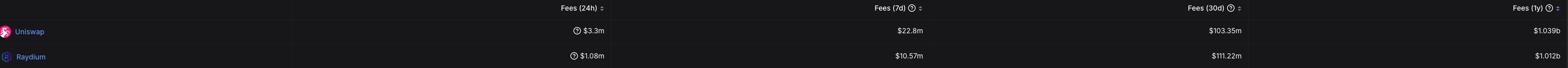

2. Decentralized Exchanges (DEX) and Liquidity Providers (LPs)

-

Profit logic: Transaction fee sharing, LPs of head DEX (such as Uniswap, Jupiter, Ray, Meteora) earn 0.3%-0.25% transaction fees, especially during the Meme coin hype period (such as the monthly trading volume of DEX on the Solana chain in 2024 will exceed US$10 billion);

-

Strategic adaptability: LP needs to avoid unpredictable losses, and there is a high probability of returning to zero for those with high volatility (such as choosing stable currency pairs or assets with low volatility);

The total transaction volume of DEX in 2024 will be approximately US$22,000 to US$2.5 trillion, which has already set a record;

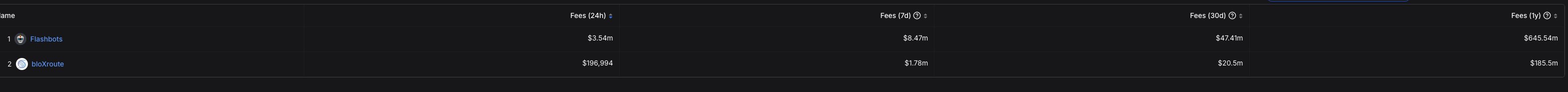

3. MEV (arbitrage, clearing, clip)

-

Profit logic: arbitrage and clearing, making profits from on-chain spreads (such as the price difference between CEX and DEX) and DeFi clearing events (the total profit of MEV in 2024 exceeds US$2.5 billion); sandwich attack (clip): Pre-and post-trading for retail investors in large transactions (Ethereum accounts for 15% of MEV profits after the merger);

-

Technical barriers: Relying on high-performance nodes and algorithm optimization, the annual income of head searchers can reach tens of millions of dollars;

In simple terms, when CZ comes to BNBChain to buy meme, 70% will be caught by others. Every time a stock breaks down on the chain, someone will pick up the body;

4. High-frequency trading Bot

-

Profit logic: cross-exchange price spreads and new coins fluctuate online (for example, the price spread reaches 20% within 5 minutes after Coinbase’s listing of tokens reaches 20%); Meme coin sniper: Capture early trading signals through on-chain monitoring tools (such as GMGN, OKX)(for example, 2024 BOME will increase by 100 times in 3 hours). Buy Meme quickly: Buy promising meme quickly by trading Bot (such as GMGN) and get on the bus first (such as most of Trump’s early adopters used GMGN)

-

Risk: Need to deal with chain congestion, Gas fee fluctuations and MEV clamps;

In short, if bots don’t make money, you won’t see so many people wanting to build bots, and you won’t see various activities organized by GMGN;

5. Project parties with cash flow business

- Profit logic: In the name of airdrops, many projects trick a large number of users into swiping transaction volume to earn GAS consumption, such as LINEA, project parties are responsible for selling services such as KAITO, and project parties are responsible for helping to issue coins, such as @pumpdotfun;

-

Risks: Regulatory pressures (such as the SEC’s lawsuit against Pump) and project sustainability;

Some project parties don’t actually need to issue coins, but they need data to do better and earn 10 years of money in one year, so they issue coins;

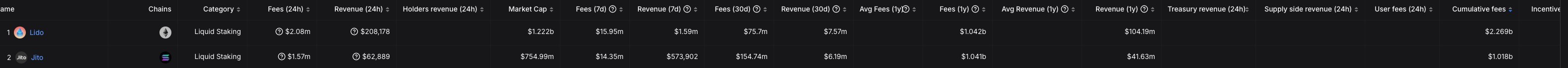

6. Pledge and node operator

-

Profit logic: PoS income, the annualized income of pledge after the merger of Ethereum is stable at 4%-6%, the Cosmos ecological pledge APY is generally 8%-15%, and the Solana ecological pledge APY is generally 4%-5%; Retaking new paradigm: EigenLayer, Solayer, Jto and other agreements superimpose pledge income on other chains (TVL will exceed US$5 billion in 2024).

-

Trend: Liquidity pledged derivatives (LSD) such as Lido account for more than 30% of the market;

For ETH’s giant whale, it is highly recommended to watch bnbchain because of ensuring revenue from droughts and floods. In addition, node operators can really give priority to packaging their nodes.

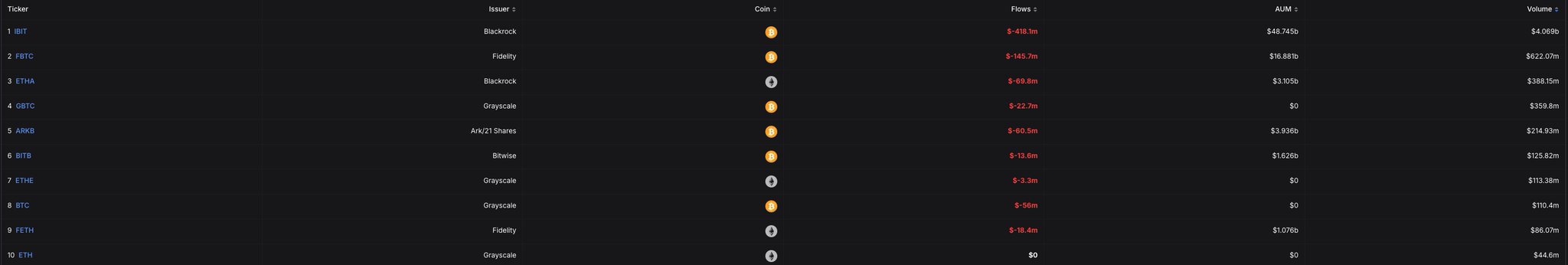

7. Compliance service providers and infrastructure providers

-

Profit logic: After the passage of Bitcoin and Ethereum ETFs, the annual management fees of BlackRock and other ETFs are huge, as well as various service fees for compliance, etc.; on-chain compliance tools: Chainalysis and Elliptic provide anti-money laundering solutions for institutions, and security departments such as Slow Fog audit projects;

No one will think that Gray has earned too little management fees over the years, and BlackRock has been attracted to it, and then quickly became the number one ETF in holding positions;

8. The SEC and ministries of justice

- Profit logic: Fines. The U.S. Department of Justice fined more than US$4 billion from @binance’s former CEO last year. The SEC fined various exchanges. Recently, it confiscated US$420 million in illegal gains from a fine of US$8200w. There are other exchanges that have not disclosed the amount of fines;

-

Risks and challenges: All countries are staring at this piece of meat, while the United States eats the whole world. Especially after trump came to power, it supported crypto and the SEC also began various reconciliations and uncertain policies;

The United States can impose fines of tens of billions a year, and local governments can also make up for fiscal deficits once a year. Everyone wants to generate income;

9. Market Maker

-

Profit logic: It is divided into active market makers and passive market makers. Most of them make money based on price differences. Some are only responsible for providing liquidity and others are responsible for pulling orders and shipping. Moreover, most market makers have negative handling fees. You can also get rebates on exchange fees; simply put, even Citadel plans to enter the crypto industry, and you can know how high profits are;

-

Risks and challenges: regulatory pressure, technological competition, strategic competition, insufficient liquidity;

How many market makers in traditional industries have begun to enter the crypto industry? Do you think they have been influenced? They are attracted by profits;

10. Mining Machine manufacturers

-

Profit logic: Selling mining machines is a main theme, especially when POW becomes the present, hardware sales and iteration, hosting services and ecological cooperation, technology licensing and derivative business. After all, don’t forget that Bitmain almost became a chip company;

-

Risks and challenges: The imbalance between supply and demand caused by the collapse in market prices, the dependence of supply chains on TSMC, etc., regulatory and compliance requirements;

Whenever BTC or a certain POW mining coin skyrocket, the price of mining machines also rises steadily. Only with good relationships can you buy things, and the relationship between supply and demand is prone to changes;

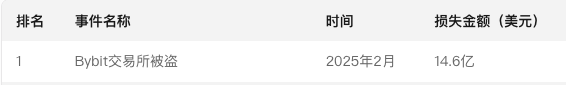

11. hackers

-

Profit logic: Illegal profits in the cryptocurrency market through technical loopholes and strategic attacks are all cost-free transactions. As long as the technology is good, you can make money at will;

-

Risks and challenges: Technological countermeasures have been upgraded, currency mixers have been increasingly sanctioned, legal sanctions and transnational crackdowns, and internal spoils have exposed themselves;

Hackers have no capital. Many hackers want to join a rich company and steal from themselves. They all get rich quickly, but no one dares to steal the general’s money because they will die;

12. Project MeMecoin and the Cabal

-

Profit logic: industrial issuance and harvesting, market manipulation and insider trading, the conspiracy formed by KOL cooperates with project parties and even acts as project parties to directly order high-level shipments, allowing fans to take over the offer, which basically becomes industrialization and can be launched in batches., adding up a little makes a lot;

-

Risks and challenges: There are also regulatory issues that people will defend their rights offline if they cut too much, and there will be legal risks if they lose money if they shout too much;

Think about how many people want to join the Cabal, and you will know. You think the memecoin you play is community, but it turns out to be all Cabal;

13. information arbitrageur

-

Profit logic: When new or breaking news is posted on an exchange, you can operate it immediately. For example, if a news posted on an exchange is one second faster than a person, it may make several times more money than a person;

-

Risks and challenges: The success of the equation has caused everyone to start rolling around, whether it is the speed of the api or the buying speed of the interface. Moreover, they are also worried that the direction will be reversed when they hit the line. I still remember the time when the contract hit why and cheems hit;

Think about how many people follow the equation’s API to rush for what it sends, how many people want to be the next equation, and you will know how much money you can make;

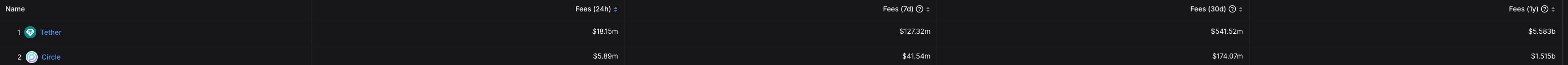

14. stablecoin hairdressers

-

Profit logic: reserve investment income, fee income, zero-cost capital pool, essentially legal currency digital arbitrage;

-

Risks and challenges: regulatory risks, liquidity risks, systemic risks;

Everyone who knows and those who don’t know that just by depositing US dollars into stable currencies, an interest margin will be a large gain, not to mention other gains;

15. A small number of VC institutions

-

Profit logic: If you invest at a low valuation, there will be tokens that can be sold after TGE. If the opening and unlocking time is not long enough, the high probability is to make a profit;

-

Risks and challenges: The project party modifies the rules at will, whether it is unlocking or valuation, the project party directly RUG, etc.;

In fact, very little money has been made in this round of vc. After all, few people have the same bargaining power as Dovey. In addition, many of the projects in this round are cs and can modify the terms at will, so the probability of making money is very low;

16.KOL

-

Profit logic: project promotion, KOL ROUND’s participation, sharing the cake with the project party, joining the cabal or even creating the cabal themselves, some people can even directly divide the quota with the project party, and become the boss directly;

-

Risks and challenges: Credit collapse, legal compliance, don’t forget that at Dongda, you can open the box for you if you push a zeroing project;

This round, I heard that KOL can directly ask the project party for a 1% starting quota, and can even directly use its own influence to coerce the project party to listen to me. Therefore, at the Hong Kong conference, it was found that KOL is the top existence among them;

Key commonalities: core characteristics of profit-makers

-

Technical advantages: MEV searchers and Bot developers rely on algorithms and infrastructure (such as low-latency nodes);

-

Market sensitivity: Early investors and project parties accurately capture track movements (such as 2023 BRC-20, 2024 RWA and AI);

-

Anti-cyclical: CEX and compliance service providers resist the bear market through diversified businesses (lending, custody);

-

Scale effect: head exchanges and market makers rely on capital and liquidity to monopolize gains;

-

Influence advantages: Head VCs and head KOL use their own influence advantages to engage in an attention-focused economy;

-

Cost advantage: Whether it is $Trump or memecoin’s cabal, they are basically no-cost transactions, so there is no loss of money at all;

risks and challenges

-

Regulatory uncertainty: U.S. lawmakers have filed a request that serving public officials not be allowed to issue coins, and the SEC has gradually begun to reconcile with everyone;

- Technical vulnerabilities: Cross-chain bridge attack (Poly Network was stolen of $250 million in 2023), contract vulnerability (Curve pool was attacked by lightning loans in 2024), exchange theft (bybit was recently stolen of more than $1.5 billion due to @safe issues);

-

Volatility in market sentiment: political currency hype bubbles (for example, the market value of TRUMP briefly exceeded US$80 billion in 2025 and then plunged 85%);

-

Cyclicity: According to the cyclical nature of the market, the money-making effect will also change. The last round of DeFi, this round of AI, and the next round is unknown;

summary

The core groups that make money are:

-

Infrastructure monopolies (CEX, LSD agreements);

-

Capital Giant Whale (stablecin hairdressers, market makers);

-

Technology-driven players (MEV, Bot);

-

Track catchers (early investors, project parties);

-

Beneficiaries of compliance dividends (licensed exchanges, auditors);

-

Concentrated influence (well-known VCs, celebrities, KOL);

Commonality among losers: lack of technology, information advantages, retail investors who blindly chase up gains and kill losses, and project parties who fail to adapt to regulatory changes.

To be honest, after writing writing, I found that I didn’t lose so much money here. I felt that I was a bit awesome. So many people made crazy money, and most of the money was taken away and not left in the circle. How can I rectify it???

This round of project parties really may not make money, especially many project parties that people think are making money. After all, doing projects is a metaphysical question. Whether you can succeed depends on nothing else, but on your fate.

It’s already written, and I hope everyone can help you add it. By then, I will open a separate one to see who earns the most from each position in this cycle, provided that the brothers really like watching it and make more comments.🤣

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern