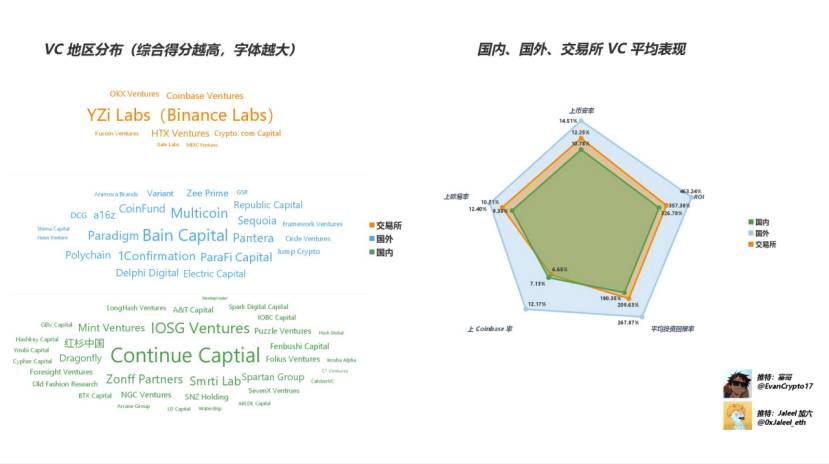

The output of foreign VC investment is higher than that of domestic VC, and the output of VC investment under the exchange ranks between the two.

Author: Sego (@EvanCrypto17)

Forgiveness and forgetfulness for 48 hours, a must-see data collection for Web3 players.

Among so many VCs in Web3, which VC has the best vision? Which VC projects have the highest yields? Which VC’s are it more cost-effective for ordinary players to invest with in the early stages? Which project to choose? What are domestic and foreign VCs? Do projects invested by foreign VCs have greater potential?

Issues such as issues are what we retail investors are most concerned about, and they are also what primary market players (Mao Party) want to pay attention to most.

In this article, we use the most intuitive data to reveal the answers to these questions one by one.

All data comes from online disclosures. We have screened a total of 65 VCs, including 23 foreign VCs, 34 domestic VCs, and 8 VCs under the exchange.

The result will prevail. The best result for VC investment is that the token is sold to a certain big firm.

Although we know that some projects can be profitable without issuing coins, this is not a game that ordinary players can enter.

Therefore, we give the following dimensions as judgments:

Quantity:

Total VC investments

Project currency issuance

Currency security on the project

OKX number on project

Number of Coinbases on the project

Success rate:

Project currency security rate = number of currency security deposits/total number of investments

Easy rate of projects entering Europe = number of OKX entries/total investment number

Project Coinbase rate = number of Coinbases on projects/total investment

Judgment conditions:

Comprehensive score = 2 * trading rate +1 * trading rate on Coinbase

Currency security has the largest volume, so the weight is 2

Average project return (ROI)= 15 * Coinbase rate + 10* Coinbase rate + 10 * Coinbase rate

ROI is based on the assumption that the average profit is 15 times from the initial investment in Binan, 10 times from the average profit in Europe, and 10 times from the average profit in Coinbase. Each project is different, so the average value is taken here.

Let’s talk about the conclusion first

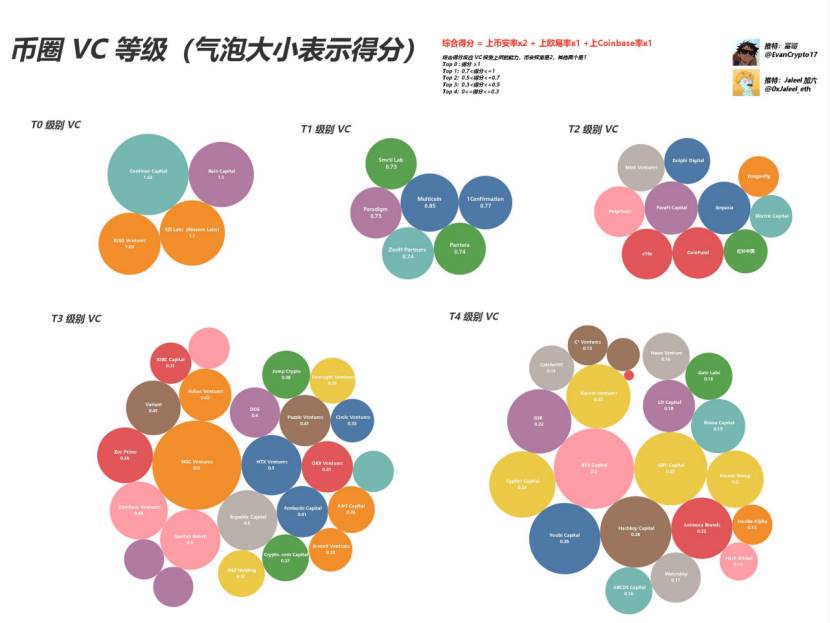

According to the gap in comprehensive scores, we divided VCs into five levels: T0, T1, T2, T3, and T4. The higher the ranking, the better the VC’s vision. We follow these VCs and invest our efforts to make the primary market more cost-effective.

VC level:

T0 level VCs include YZi Labs (formerly Binance Labs), Continue Captial, IOSG Ventures, and Bain Capital

T1 level VCs include Multicoin, Pantera, 1Confirmation, Smrti Lab, and Zonff Partners

T2 level VCs include Polychain, ParaFi Capital, Dragonfly, Sequoia China, Delphi Digital, Electric Capital, Mint Ventures, and CoinFund

T3 level VCs include Framework Ventures, NGC Ventures, SNZ Holding, Coinbase Ventures, OKX Ventures, etc.

T4 level VCs include Animoca Brands, GSR, Hashkey Capital, Waterdrip, LD Capital, etc.

Regional VC investment output and income ranking:

VCs under foreign VC exchanges Domestic VCs

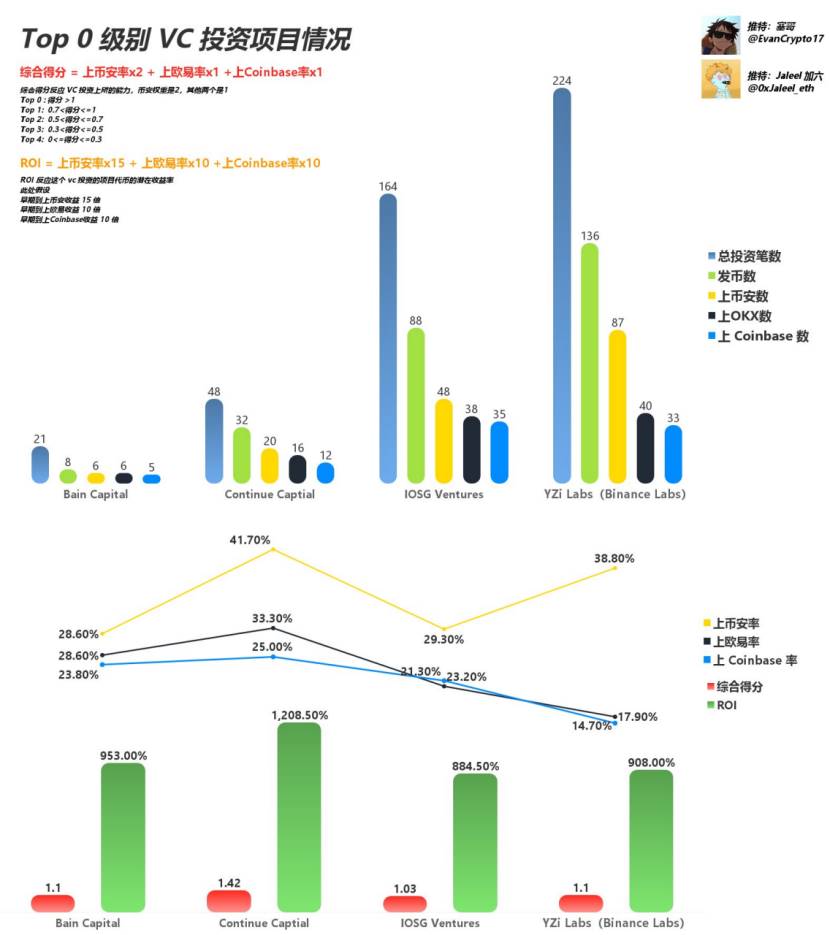

T0 level VC

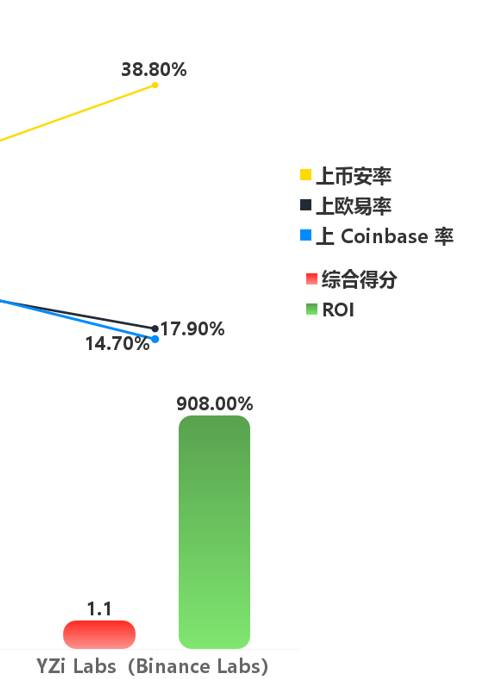

T0 level VCs include YZi Labs (formerly Binance Labs), Continue Captial, IOSG Ventures, and Bain Capital.

The comprehensive score is 1 and the average ROI is 8 – 12. We invest in these VC projects invested in the early stage, and we can basically get big results. The probability of making money with a single currency A7 and A8 is very high.

The detailed data is shown in the figure:

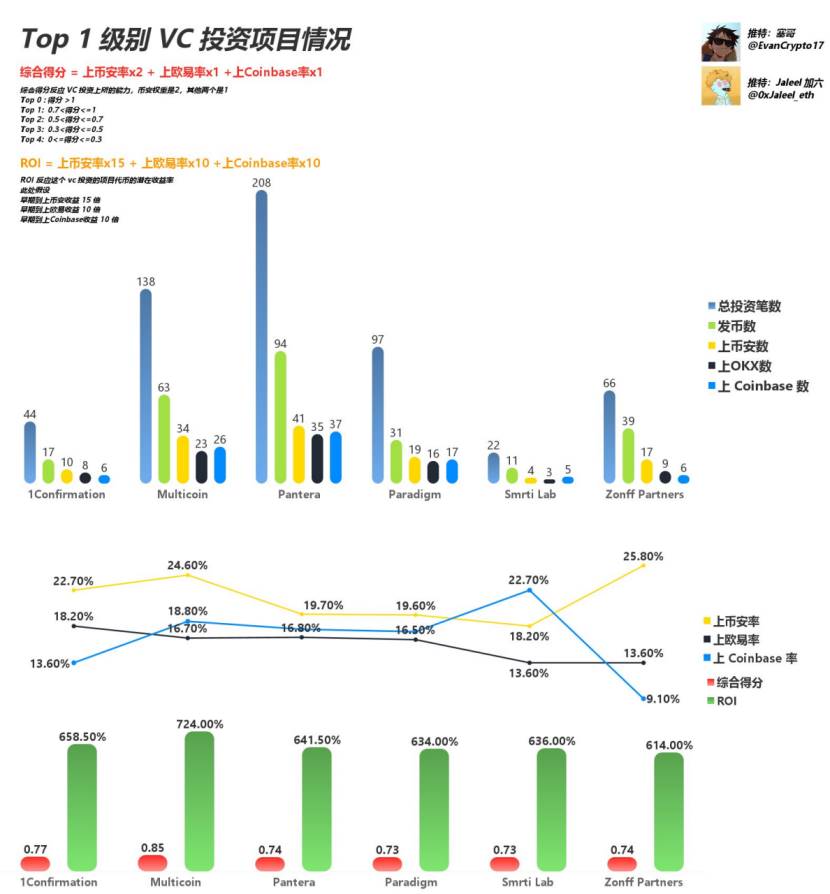

T1 level VC

T1 level VCs include Multicoin, Pantera, 1Confirmation, Smrti Lab, and Zonff Partners.

The comprehensive score is between 0.7 and 1, and the average ROI is between 6 and 7.5. We have invested in these VC projects in the early stage, and the returns are also very good. A6.5 is also a good result.

The detailed data is shown in the figure:

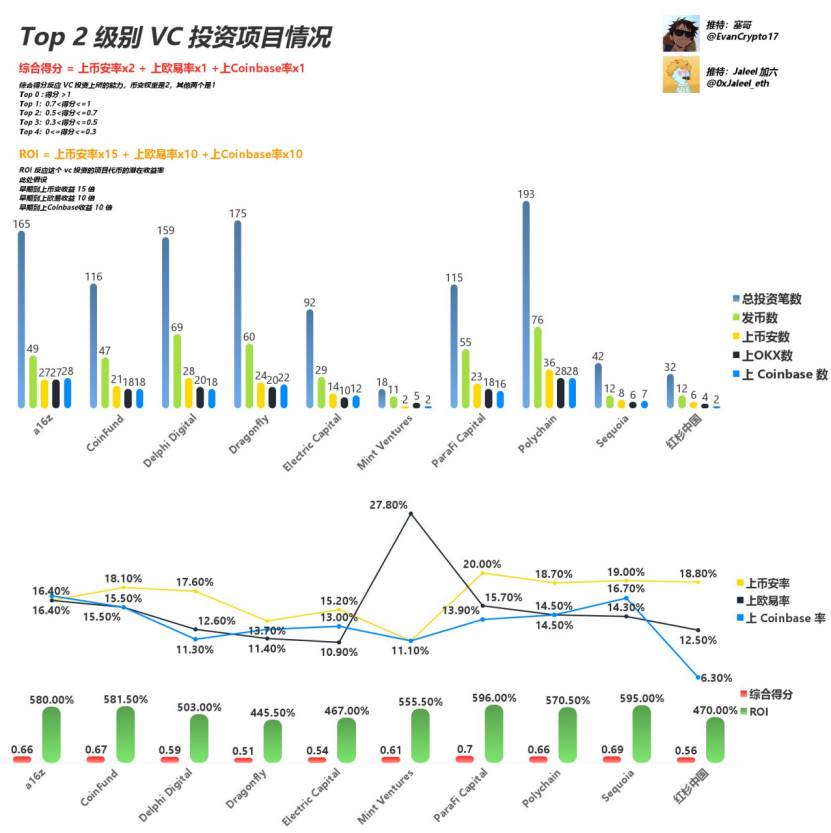

T2 level VC

T2-level VCs include Polychain, ParaFi Capital, Dragonfly, Sequoia China, Delphi Digital, Electric Capital, Mint Ventures, and CoinFund.

The comprehensive score is between 0.5 and 0.7, and the average ROI is between 4 and 6. We have invested in these VC projects in the early stage, and the income is a little unstable, but we may have a chance to try it.

The detailed data is shown in the figure:

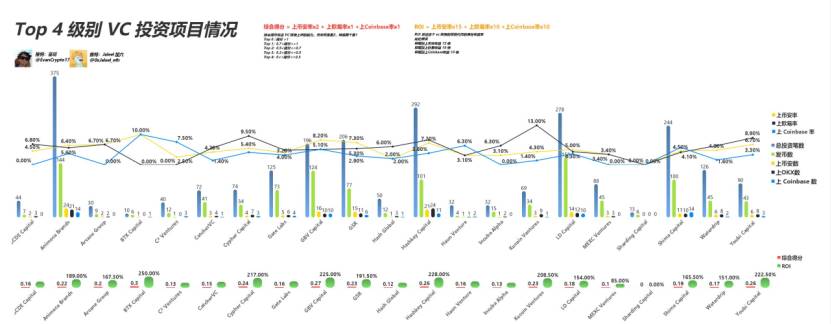

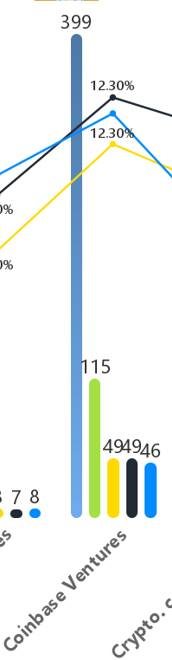

T3 level VC

T3 level VCs include Framework Ventures, NGC Ventures, SNZ Holding, Coinbase Ventures, OKX Ventures, etc.

The comprehensive score is 0.3 – 0.5, and the average ROI is 2.5 – 4.5. We have invested in these VC projects in the early stage, but the returns are a little unstable and the return rate is not high.

The detailed data is shown in the figure:

T4 level VC

T4 level VCs include Animoca Brands, GSR, Hashkey Capital, Waterdrip, LD Capital, etc.

The comprehensive score is between 0 – 0.3 and 0 – 2.5. The average ROI is between 0 – 2.5. We have invested in these VC projects in the early stage, and the returns are not very optimistic and the probability of success is small.

The detailed data is shown in the figure:

Attached egg

Binance and Ouyi have a higher probability of investing in their own businesses.

The probability of projects invested by Coinbase being successful in the three companies is similar.

summarize

Starting from the data, we found that the VCs that we usually hear are very powerful, such as a16z, Coinbase, Dragonfly, Polychain, etc., actually have no reference value for us ordinary people.

The VC brand played in some projects may be used to trick ordinary players.

In fact, in our analysis, the projects that VCs at T0 and T1 levels participate in are what we should really pay attention to and invest in.

The output of foreign VC investment is higher than that of domestic VC, and the output of VC investment under the exchange ranks between the two.

When considering that the value of a project is not worth the initial investment, we look at which levels the participating VCs correspond to and comprehensively judge the data listed. This has great reference value for us to compete in the first-level market.

Once again, this article only discusses the output ratio that ordinary players invest with VC, and ranks them accordingly. It does not involve the comprehensive strength and other aspects of the company and brand represented by VC!

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern