I’ll drink this milk, do whatever you want!

Write an article:Lao Mao

Under the fierce hammer of the big shadow pillar at the weekly level, it is very dangerous to take out this milk.

Although 99% of my content in the past 10 years has emphasized investing in Bitcoin, someone just took out an extra one percent and added leverage to kill himself, and then said in the comment section that he had not made a fortune because he listened to me.

In addition, my milk is for the real Hodler. These people don’t need my milk in the first place. I give them this milk is just an encouragement in difficult times. It is equivalent to giving a loving hug and is not investment advice. For other masters who have the ability to make money in bands or even bear markets, this milk is not suitable for you. Please let go.

The last time I wrote an article about Bitcoin, it was when Bitcoin dropped from more than 60,000 to around US$18888. Some people probably still remember what I wrote.

Let’s talk about my subjective feelings first. Although it is rumored that several legendary giants and trading masters have cleared their bitcoins, this has nothing to do with me. I firmly believe that this bull market is not over and is not a reason. The reasons are as follows:

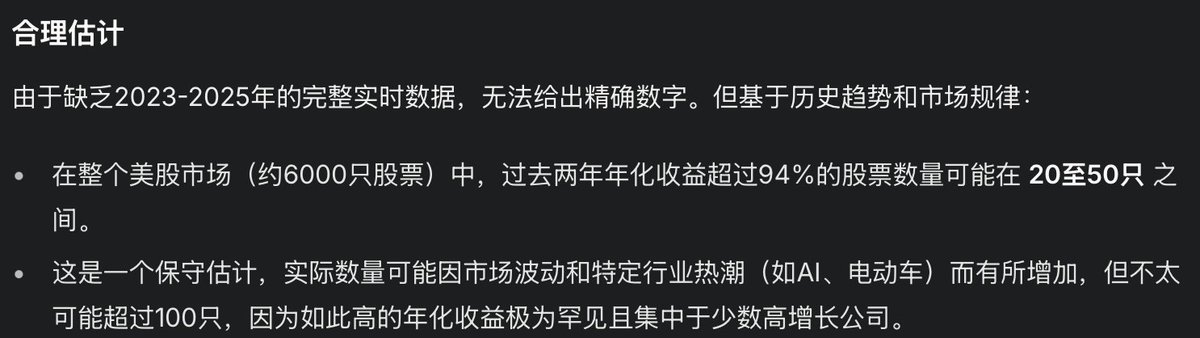

1. Not crazy. If this is a bull market, this is a bull market that is too rational and conservative. According to today’s currency price, although Bitcoin’s annualized return in the past two years has reached an astonishing 94%, according to Grok’s analysis (as shown in the figure below), dozens of stocks have also achieved such an increase. The high-risk investment return of Bitcoin is only equivalent to a relatively good U.S. stock. As for other varieties, how dare you call it a “bull market?” For the first time, Bitcoin has become the obedient appearance of U.S. stocks. Let me not talk about how high it can rise, at least the extent of its decline will be limited. If you want to drink warm milk, don’t fall too exciting. It is also a taste.

2. Although Wall Street took over the offer and the ETF went online, the power of the water release cycle has not yet been shown. Bitcoin has at most gone into a sluggish bull market, and water release must be the main theme of the fiscal policies of various governments in the next step. Surviving the dry season and welcoming the flood bull market is what Hodler deserves.

3. Please must correctly understand the meaning of the Trump administration’s cryptocurrency “reserve”. If you don’t understand these two words deeply, you don’t understand them deeply. It is said that the gold reserves in the United States have not moved for decades. If a considerable amount of bitcoins are locked and not moved, given the current amount of bitcoins that can be traded, this is a big deal. This alone is enough to make the recent fluctuations a small crease in the future horizon. Once the U.S. government reserves are opened, other countries will not be stupid. Progressive follow-up is almost inevitable. Reserve policies are only divided into “yes” and “no”, and there is no difference between size and size. As long as there is a beginning, it will be an arms race for reserves, and it must be a long-term competition with no end in sight. Bitcoin, as an asset that the U.S. government needs to legislate for reserves, currently has a market value that is only equivalent to a U.S. stock. If the future market value is likely to remain at this state, no country’s government will have a need for reserves. The reason why we need to reserve, there is only one purpose: Avoid losing the right to speak in the process of sharply rising assets. This is a reserve of power. You can call Trump a confused bastard, but the behavior of the world’s strongest country, you actually believe that they are just a sloppy team playing around. This may be a bit unserious.

4. The last point is that the various bull market indicators I have collected over the years with the goal of cycles. I dare not say that there is absolutely no element in them, but I tried my best to proactively abandon the parts related to boats and swords. Even so, this round of sluggish bull market has reached 30% of the reasonable space guided by comprehensive indicators. I don’t know if I am the only one who thinks it is not worth selling. Even if I have to sell it, it feels like it is selling at a low price. I am not sure I can buy it cheaper after selling it. So I can only Hodl, at the current price, go up or down.

Ten years as a professional elevator manager, treating each other in fine clothes, and being with you without regrets.

Remind again that all the above contents are not investment suggestions. Based on this operation, you will be responsible for losing money. If you earn the initiative, I will 50 🙂

I don’t promise anyone freedom of wealth. Freedom of wealth will always be my own business. If I hope to rely on anyone else’s views to invest, the outcome will not be too good.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern