Policy uncertainty is high this year, and we must continue to wait for more benefits to materialize before we can reverse the market’s short-term recession expectations.

Author: Jinze, pretending to be in the flower street

97% of the S & P 500 ‘s 2024 results have been released. Today, I want to give you an advance analysis of the profitability and potential investment points.

Overall earnings in the fourth quarter increased by 18.2% year-on-year, the highest quarterly earnings increase since 2021. Revenue growth of 5.3%, which is lower than earnings growth, reflects that corporate profit margins are improving, which is a very healthy sign. (This article will focus on earnings that have a greater impact on valuation, so revenue will be ignored)

market anomalies

First of all, we started with an abnormal phenomenon. The revenue numbers were good, but the market responded negatively.

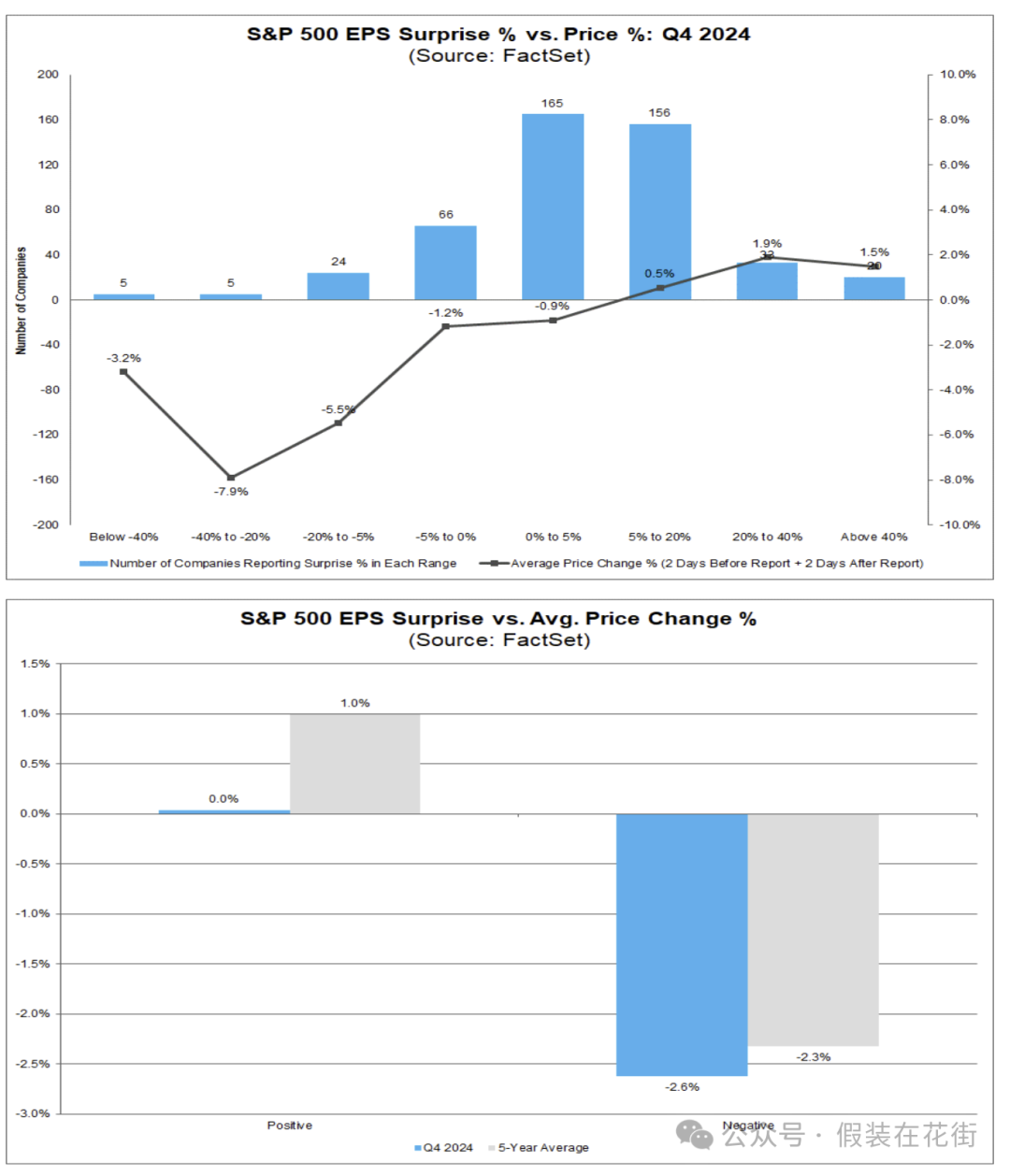

Most companies ‘profits were better than expected, but the revenue surprises were slightly insufficient:

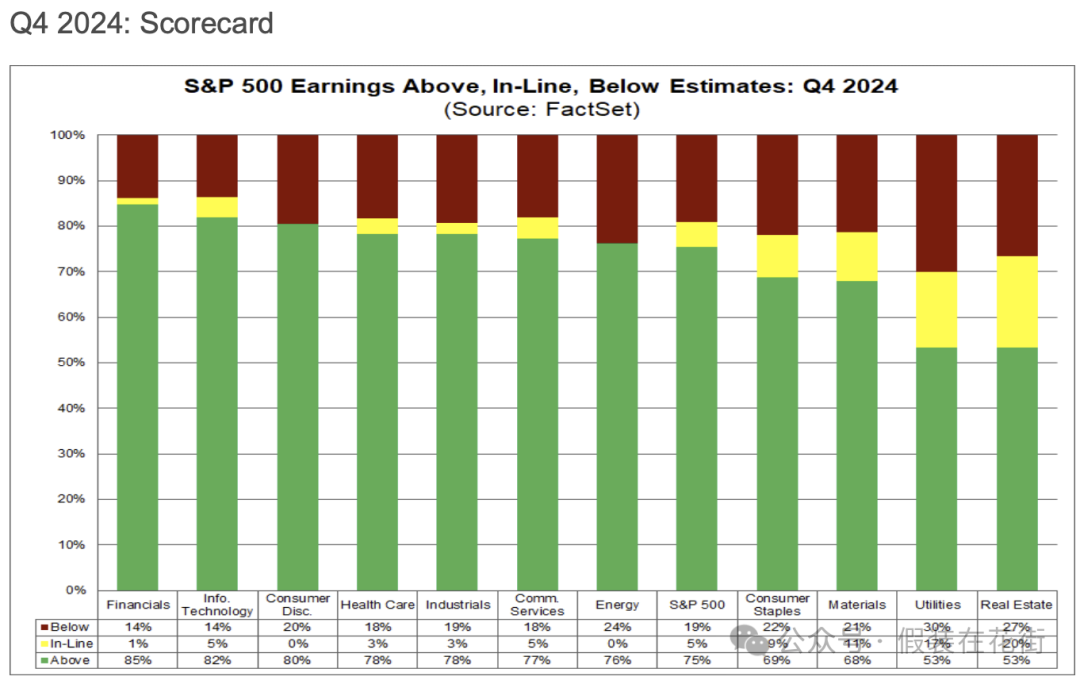

● Among them, 75% of companies ‘earnings per share (EPS) were higher than analysts’ expectations and slightly lower than the average of 77% over the past five years;

● The proportion of companies with revenue exceeding expectations was only 63%, which was significantly lower than the five-year average of 69%;

Abnormal market reaction:

● Positive surprises without premium: The average change in the company’s share price exceeded expectations by 0% and was lower than the five-year average (+1.0%).

● Increased negative penalties: Stock prices of companies that failed to meet expectations fell by an average of 2.6%, higher than the five-year average (-2.3%).

In other words, investors are currently taking a wait-and-see attitude towards good news, but are particularly sensitive to bad news. This is obviously because the market has already digested optimistic expectations in advance, and the stock price valuation is at a high level. It is a better choice to stay in the pocket when there is insufficient marginal (surprise) benefits.

Currently, the two growth sectors of technology and optional consumption enjoy high valuation premiums (forward PE is around 26 – 7 times), which is the highest among all industries, indicating that investors have high expectations for their high profit growth in the next few years. However, high expectations also mean that valuations could compress quickly if growth falls short of expectations (as has occurred in recent weeks).

For example, the market has recently become worried that technology companies ‘large investment/return in AI will not meet expectations, and high stock prices will face downward revaluation pressure. Recently, the market has shown a punitive reaction to failing to meet expectations (the average share price of companies whose earnings fall short of expectations is-2.6%), which warns us to be extra cautious about sectors with overdrawn valuations. Once there is a mismatch between fundamentals and expectations, the correction in the high-valuation sector may be deeper.

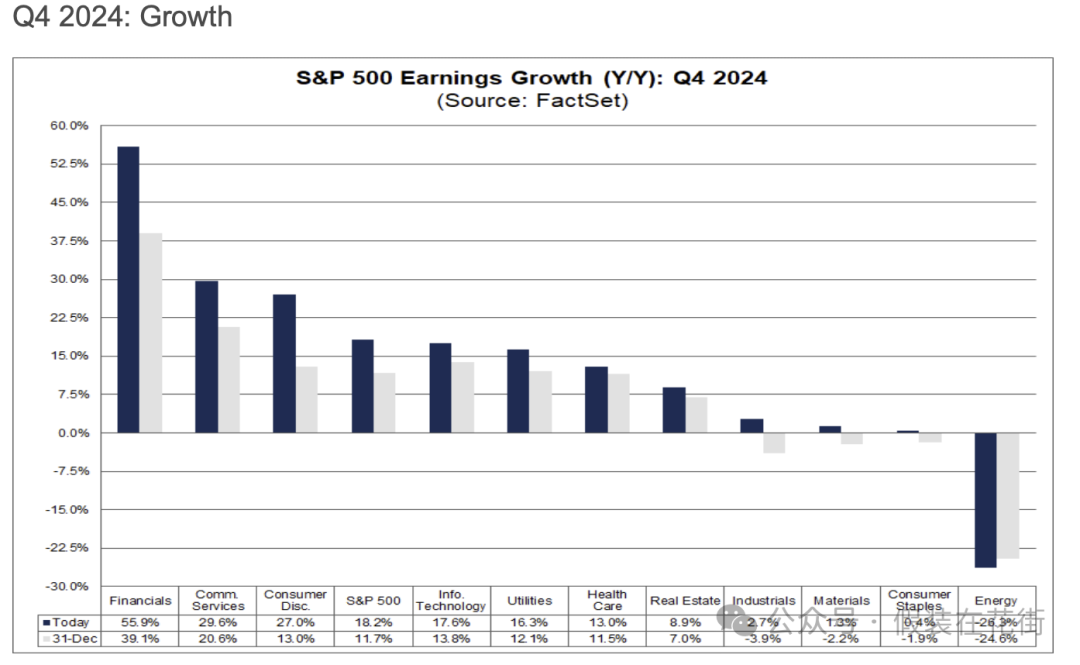

Profit growth is generally good, with the exception of energy

Ten of the eleven sectors in the S & P industry achieved year-on-year profit growth, with six sectors experiencing double-digit growth rates.

● The financial sector benefited from the base effect of the banking industry, with a year-on-year growth rate (+56%).

● The profit growth rates of the communications services and optional consumer sectors also reached approximately 30% and 27% respectively.

● The information technology sector grew by approximately 17.6% year-on-year, driven by the profits of large technology companies.

● Defensive industries such as utilities and health care also recorded double-digit growth (ranging from approximately 10% to 16%).

● The only exception is the energy sector, where earnings fell by approximately 26% year-on-year due to a high base last year and falling commodity prices.

Note here that there are one-time factors in the exceptionally high growth of the financial sector, mainly due to the 216% year-on-year surge in banking profits. Due to one-time expenditures such as FDIC special evaluation fees in the same period last year, profits were low. This year, the base is low and the growth is extremely prominent. If the banking industry is excluded, the financial sector’s profit growth rate will drop significantly from 55.9% to 25.3%(still very high).

But overall, the general environment is very favorable for the financial sector. Expansion of net interest margins, stock bull market, and high consumer enthusiasm have led to strong demand for loans. On the financial track, only insurance profits have shrunk due to the well-known rise in claims caused by natural disasters.

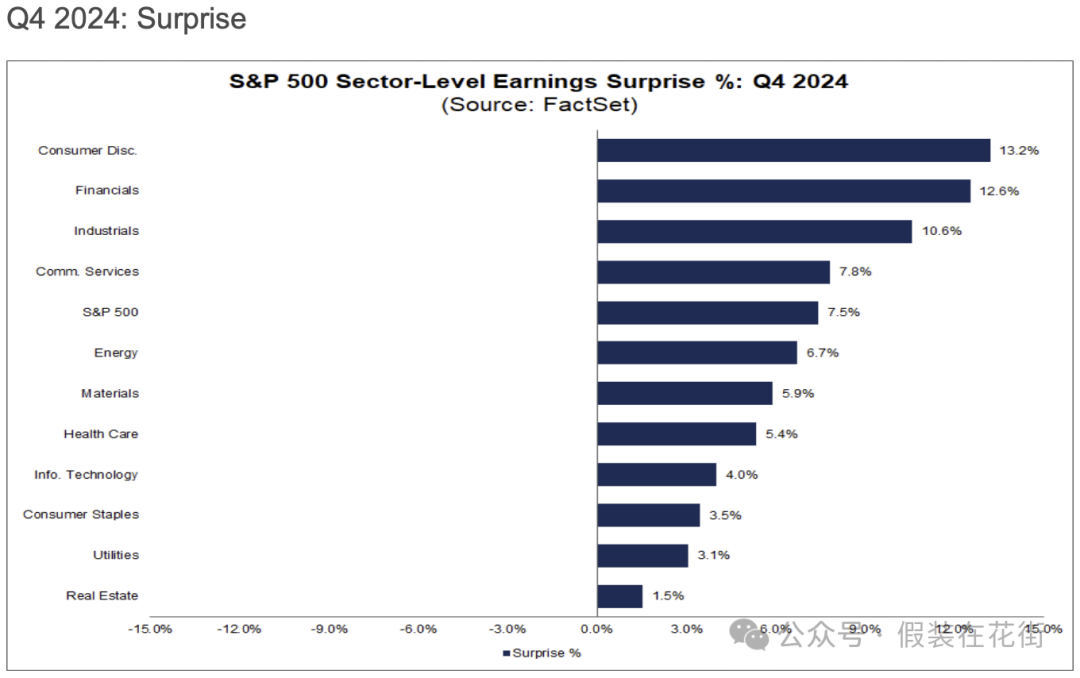

Profit surprise situation (marginal marginal surprise decline)

● The strongest profit surprise industry: The optional consumer sector recorded an EPS surprise margin of +13.2%(actual profit was 13.2% higher than expected), ranking first among all industries.

A number of companies in this sector performed well, such as Amazon.com ** fourth quarter earnings per share of $1.86, far exceeding expectations of $1.49, Norway Cruises ($0.26 vs. $0.11), and Wynn Resorts ($2.42 vs. $1.34).

● Overall earnings in the financial sector exceeded forecasts by 12.6%, representing companies such as Berkshire Hathaway ($6.74 vs $4.62), Goldman Sachs Group ($11.95 vs $8.21), and Morgan Stanley ($2.22 vs. $1.70).

● The unexpected margin of EPS in the industrial sector was about +10.6%, with Uber’s profits surging ($3.21 actual vs $0.50 expected), Axon ($2.08 vs. $1.40), GE Aerospace ($1.32 vs. $1.04), Southwest Airlines ($0.56 vs. $0.46) and others performing well.

● The communications services sector also performed well, with overall profits approximately 7.8% higher than expectations. Among them, leading companies such as Disney ($1.76 vs $1.45) and Meta($8.02 vs $6.76) also delivered significantly exceeding expectations.

● Relatively backward sectors: The proportion of companies in the real estate and utilities sectors whose profits exceeded expectations was only about 53%, significantly lower than the average

valuation level

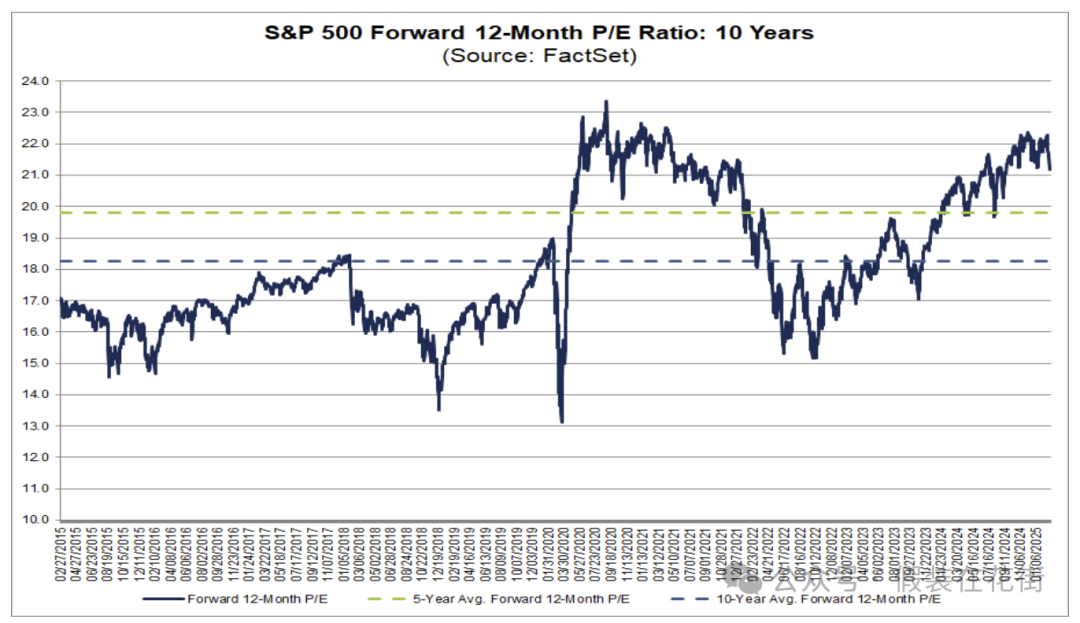

The S & P 500 ‘s latest forward-looking 12-month price-to-earnings ratio is approximately 21.2 times, above the five-year average of 19.8 times and above the 10-year average of 18.3 times.

However, compared with the end of last year, the index’s forward-looking PE has dropped slightly from 21.5 times. This is due to the decline in index prices this year, and the increase in future profit expectations by 1.1% during the same period. Profit growth has absorbed part of the valuation.

The recent correction can be supported by the historical average between 18.3 and 19.8 times, and the corresponding SP500 point is 4,964 to 5,371 (considering the closing price of 5778 on March 4, it will be safer for the market to gradually intervene after another 7.5% fall)

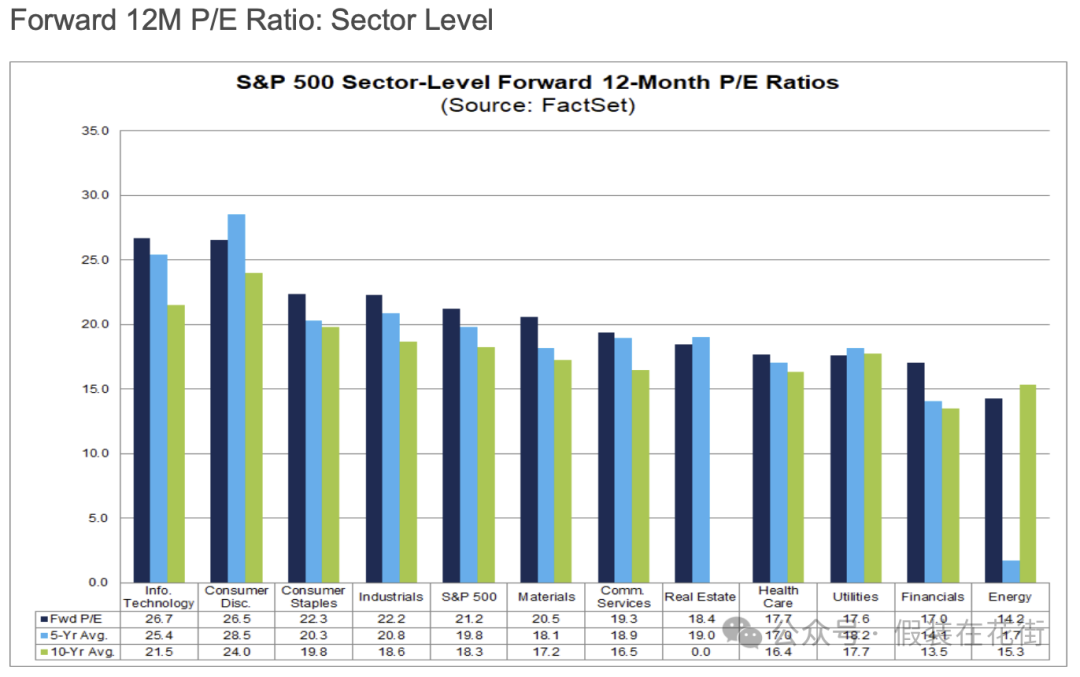

At the industry level, the valuation levels of different industries are differentiated:

-

The information technology (approximately 26.7 times) and optional consumption (approximately 26.5 times) sectors currently have the highest forward-looking P/E, reflecting the high expected premium investors have given to their future growth;

-

Correspondingly, the forward-looking P/E of the energy sector is only about 14.2 times, the lowest among all sectors.

-

Others such as the financial sector are moderately valued (about 16 times), and the public utilities, medical care and other defense sectors are in the range of 17 to 18 times.

-

Overall, the current valuations of most industries are higher than their respective historical averages, and current prices need to be absorbed through continued growth in future profits.

The blue bars in the figure below represent the current forward-looking P/E, while the green and gray bars represent the historical level of the sector respectively. The current valuation (blue bars) of most industries is higher than its historical average.

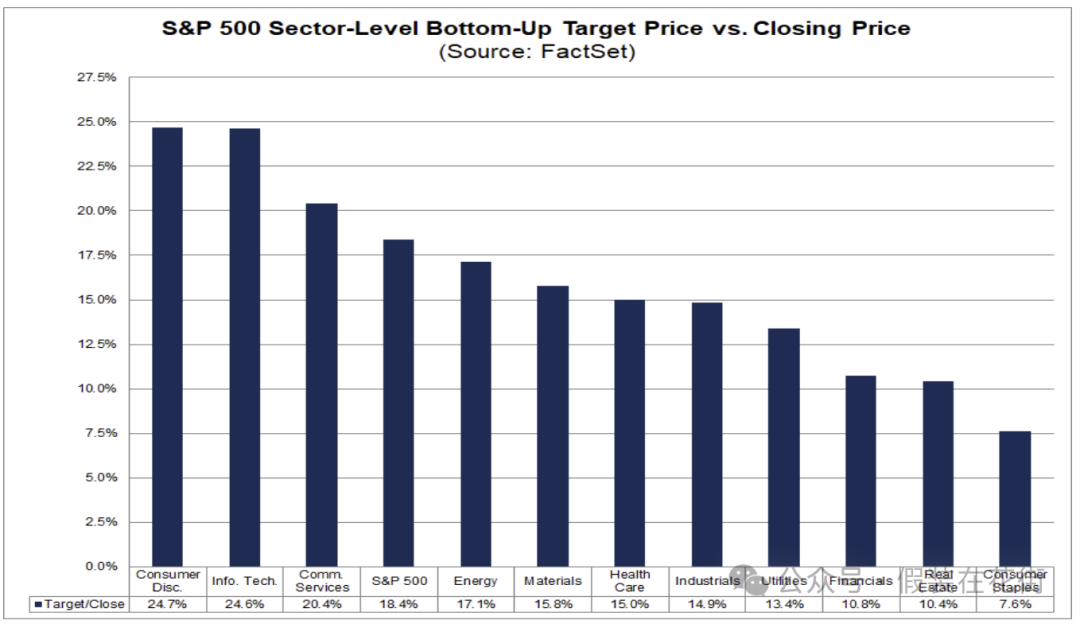

Analysts now have a 18.4% upside potential for the S & P 500 target price of 6938 and the closing price at the end of February (5861), with consumer services (+24.7%) and technology (+24.6%) leading the way, and consumer necessities (+7.6%) are the weakest expected.

change in margin

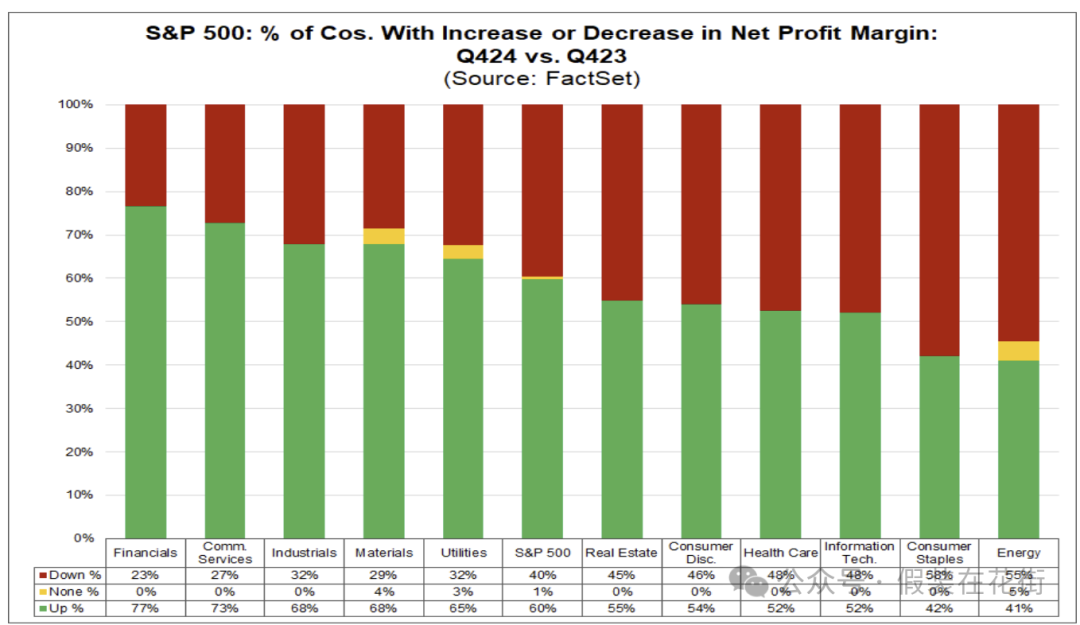

The improvement in net profit margins can confirm the high quality of corporate profits and even the U.S. economy.

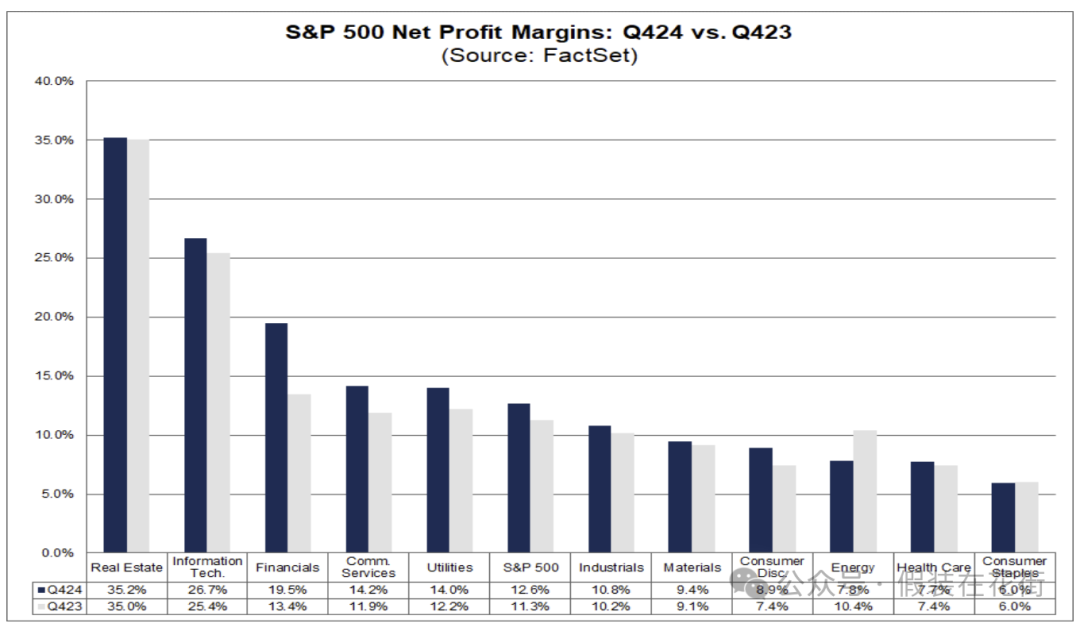

The S & P 500’s fourth-quarter net profit margin rose to 12.6%, up from 12.2% in the previous quarter and significantly higher than 11.3% in the same period last year.

Profit margins in most industries expanded year-on-year, and the net interest rate of the financial sector jumped sharply from 13.4% in the same period last year to 19.5%, the industry with the largest increase.

Industries such as communication services and optional consumption have also achieved significant improvements in profit margins (for example, communication services have increased from 11.1% to around 14.2%).

On the other hand, the net interest rate of the consumer necessities (daily consumption) industry was only 6.0%, which was the same as the same period last year without any improvement.

The net interest rate of the energy sector fell to 7.8% from 10.4% last year, making it the only industry to experience a year-on-year decline.

60% of the S & P 500 companies reported an increase in profit margins and 40% reported a decline in profit margins, mainly in the essential consumption and energy industries.

Although six sectors still have net interest rates below their five-year averages (for example, the net interest rate of the health care industry is 7.7%, which is lower than its five-year average of 9.6%), the overall trend is positive: companies have generally improved profitability during the quarter through measures such as price increases and cost reductions.

This increase in profit margins lays a more solid foundation for future earnings growth, and long-term investors should prioritize industries and companies with rising profit margins and pricing power.

2025 Outlook Changes

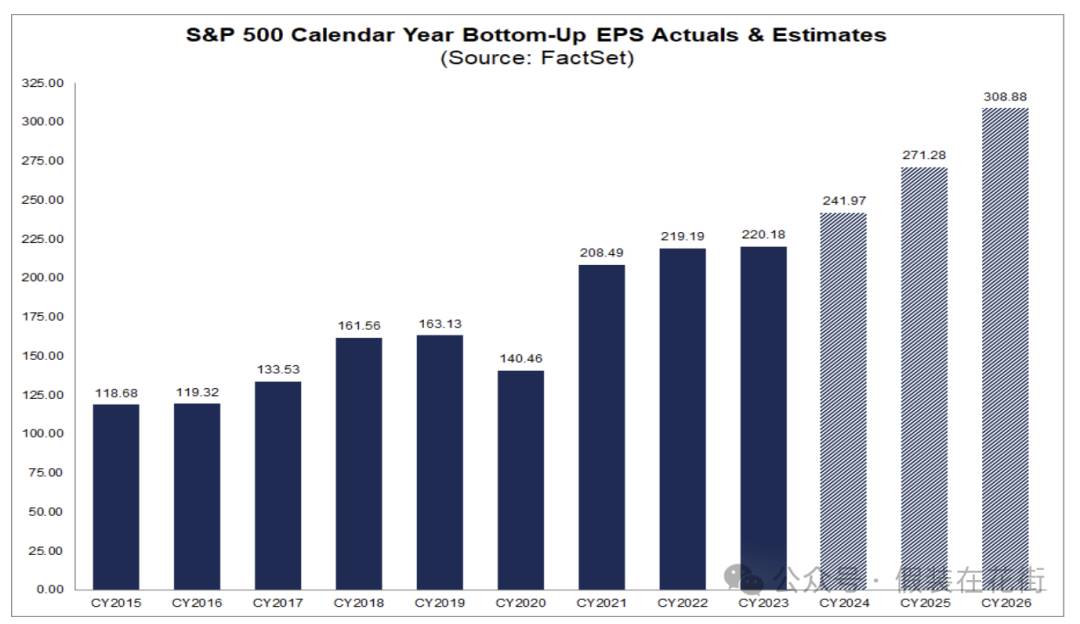

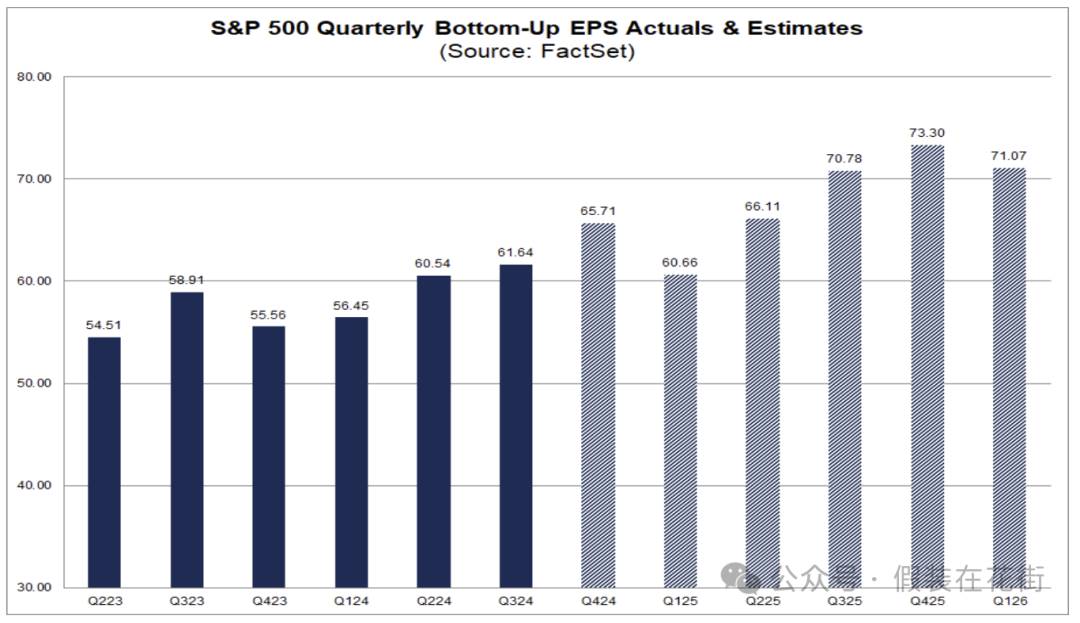

Currently, the market generally expects the S & P 500 index earnings growth to maintain rapid growth in 2025 and 2026.

According to analysts ‘consensus forecast, the profit growth rate of S & P 500 companies will rise from 10.4% in 2024 to approximately 12% in 2025, and further rise to approximately 14% in 2026.

It should be noted that these growth expectations assume that the macro economy can avoid recession and maintain moderate expansion, otherwise expectations may be lowered.

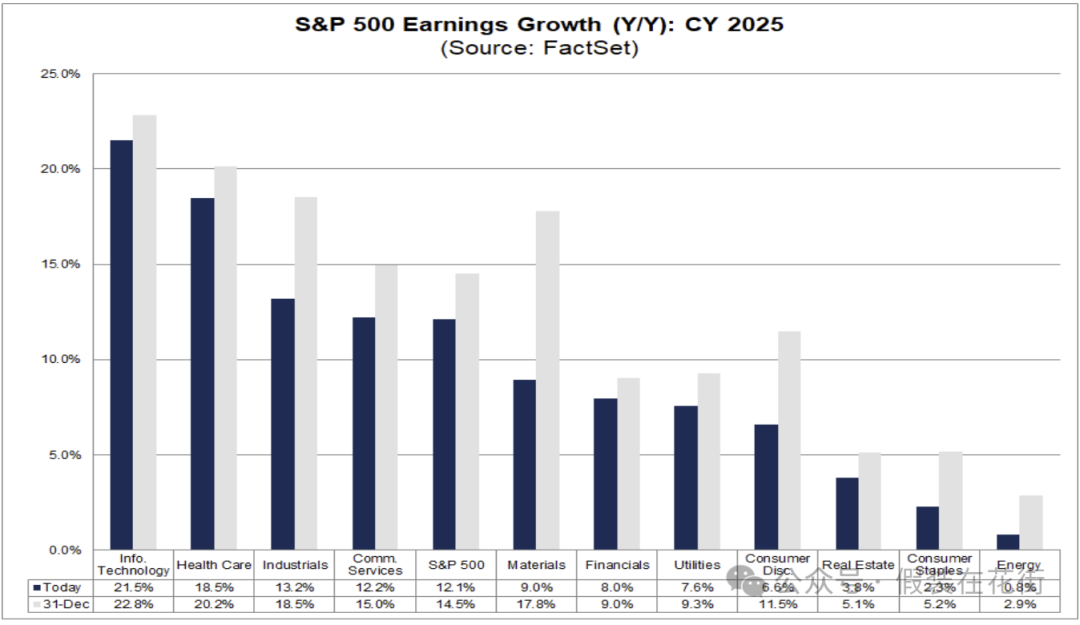

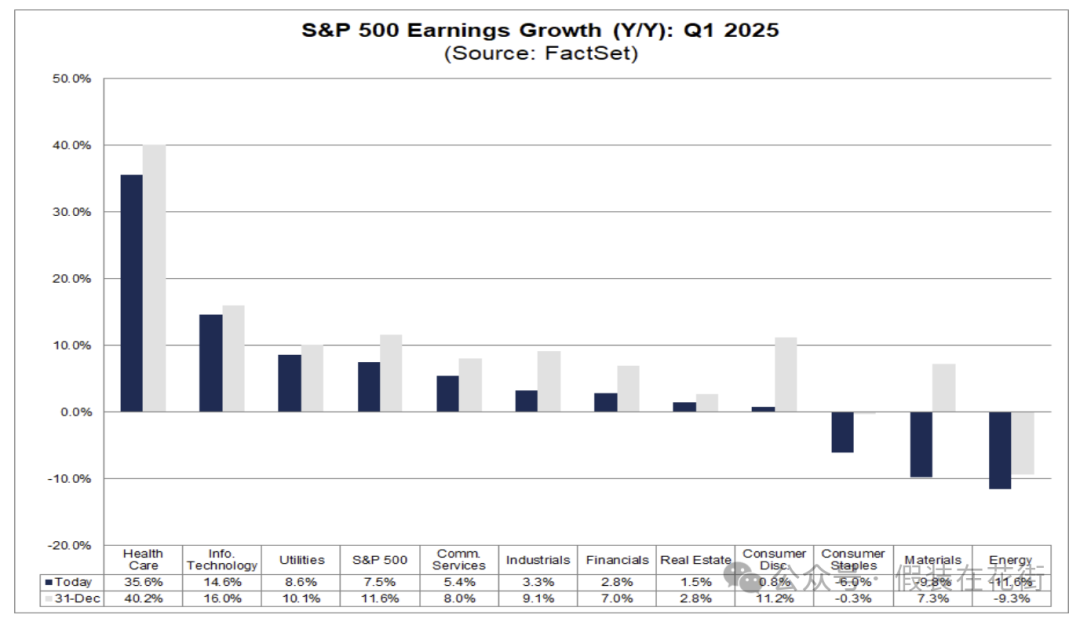

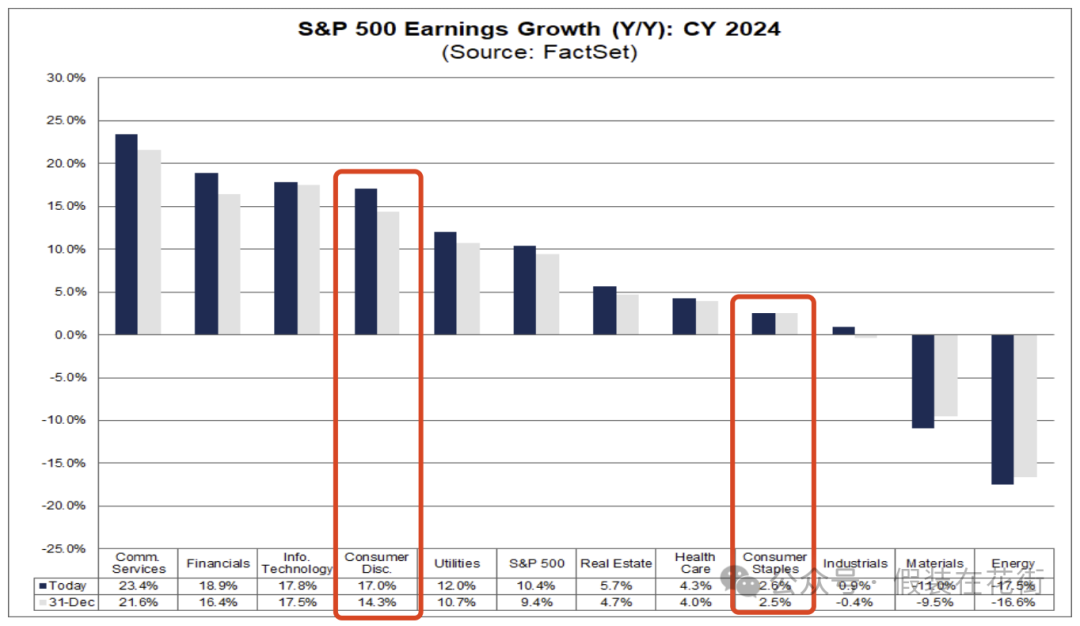

The industries that analysts are most optimistic about in 2025 are IT+21.5%, Health +18.5%, and Industry +13.2. Among them, expectations have been lowered compared with the end of last year. The major reductions are raw materials, necessities, and optional consumption:

However, it should be noted that despite the improvement throughout the year, the SP500 earnings forecast for the first quarter of 2025 is particularly low. Recently, the Q1 performance guidance announced by the company itself dropped by 3.5%, a decline exceeding the 5-year, 10-year and 15-year average.

In addition to the seasonal actions of companies that like to proactively lower market expectations at the beginning of the year to allow performance to exceed expectations later, market concerns about inflation and tariffs, especially those that rely on international markets or production/purchase channels, and significant declines in the materials and consumer industries seem to confirm this:

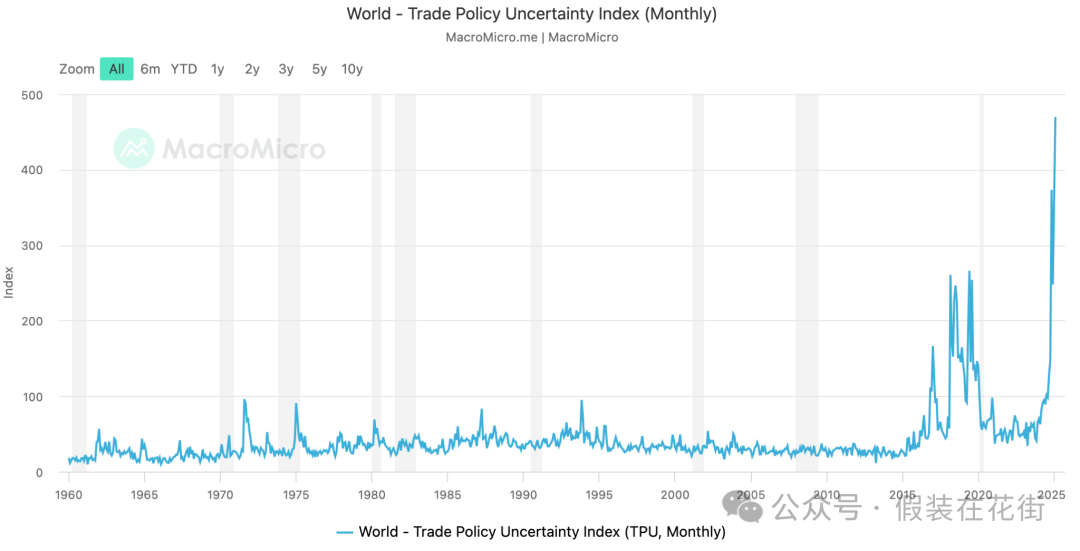

Higher tariffs not only directly increase corporate costs, but also fill the supply chain and demand prospects with uncertainty. Many experts worry that once a new round of tariff retaliation breaks out among major economies, corporate profits will face a substantial blow. This macro-level tension rose to an all-time high in the first quarter:

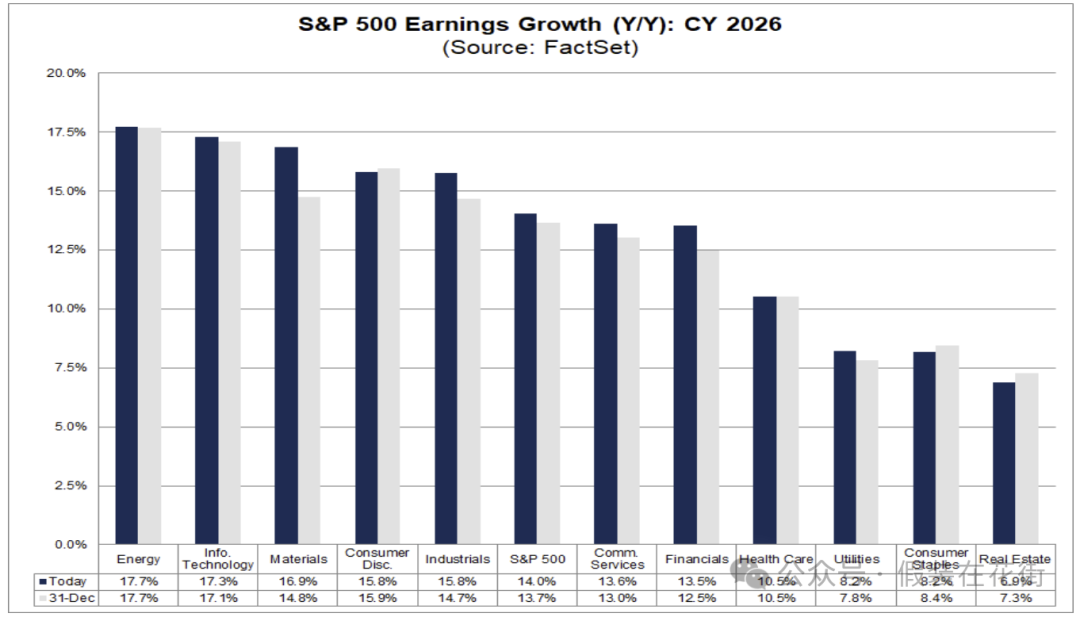

In contrast, analysts are much more optimistic about 26-year forecasts. The recent increase in uncertainty has not/has not shaken the market’s long-term confidence:

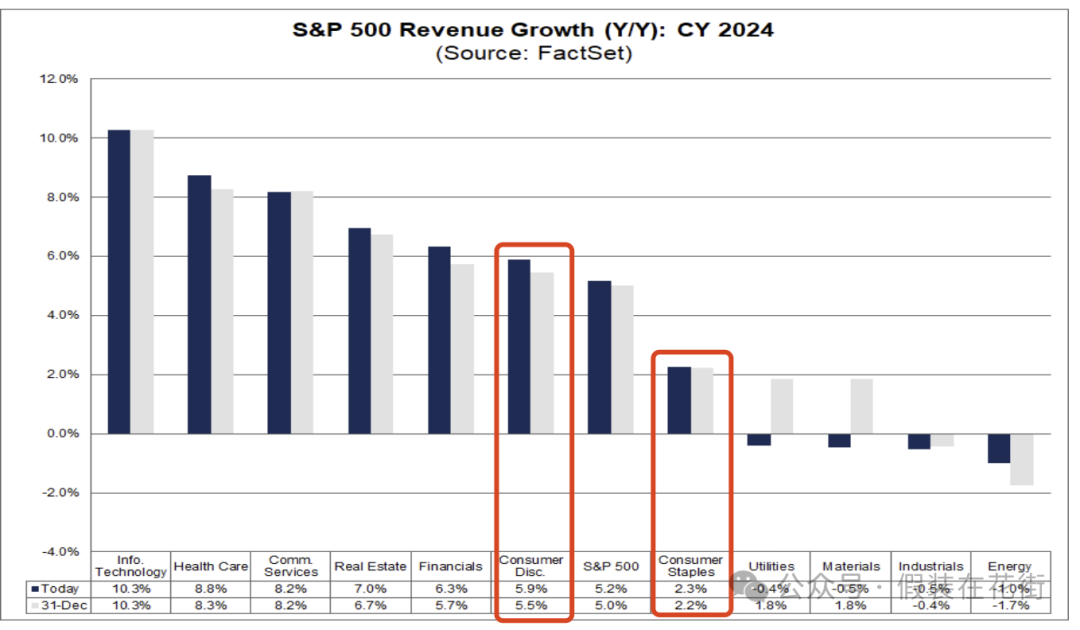

Contradictory picture: growth of consumer necessities stagnates, and optional consumption grows strongly

Last year’s earnings data showed stagnant growth in consumer necessities sectors such as food, beverages and household goods, while consumer optional sectors such as automobiles, luxury goods and entertainment performed strongly.

Full year industry revenue, optional 5.9% vs. required 2.3%

Comparison of profit growth, optional 17% vs. required 2.6%

Observation of individual stocks can also be more intuitive to understand. For example, Pepsi only increased slightly by about 0.42% year-on-year, Coca-Cola increased by 3%, P & G only increased by 2%, and Johnson & Johnson & Johnson & amp

I think there may be two main reasons for the deviation here

1. Income gap leads to differentiation of consumption structure:

Wealthy families have benefited from the appreciation of the stock market and real estate, rising net assets and greater willingness to consume, allowing them to invest more in optional consumption such as luxury goods, tourism, and entertainment, which has promoted the popularity of tourism, leisure and other industries. For example, companies such as Royal Caribbean Cruises and DraftKings performed well in 2023 because consumers shifted more spending to travel and entertainment.

Low-income households, on the other hand, are reducing non-essential expenditures under the pressure of inflation and debt. Low-income groups are becoming more frugal in terms of necessities. Under the pressure of inflation, they are buying discounted goods: in areas such as daily necessities such as food and cleaning supplies, consumers tend to choose cheaper private brands. Brands replace well-known brands. This limits the room for companies to raise prices for essential consumer goods, so although U.S. wage growth will outperform inflation in 2024 and boost consumers ‘real disposable income, consumers will start to buy less and cheaper, making it difficult for sales of essential goods to improve.

U.S. retail sales data in 2024 shows that spending by high-income households has increased significantly. After inflation adjustment, their commodity consumption has increased by nearly 17% compared with before the epidemic, while low-income households have increased by only 7.9%.

Therefore, while inflation suppresses low-end demand, economic growth releases high-end demand. The macro environment is generally favorable for optional consumption and relatively drags down necessary consumption.

2. Corporate profitability and pricing strategies:

The profit growth of consumer essential goods companies is hampered by limited pricing power. In the early days of inflation, these companies used to increase profits by raising prices, but by 2024, as consumer resistance increases, the space for essential goods companies to raise prices will narrow. For example, General Mills’s sales in the first half of fiscal year 2024 fell by 3%. Although it raised a price by 4% to barely increase revenue by 1%, it had to reduce its full-year revenue growth to 1% or remain flat. This shows that it is difficult for essential goods companies to continue to replenish quantities at prices, and shrinking sales almost offset the gains from price increases. Cost pressures and promotional competition have caused profit margins to stagnate and profit growth to a standstill.

In contrast, optional consumer goods companies have greater profit elasticity. The recovery in demand in 2024 has allowed many optional consumer companies to restore pricing power or achieve economies of scale. For example, Amazon achieved earnings per share of $1.86 in Q4, much higher than $1.00 in the same period last year, significantly exceeding expectations. Not only Amazon, but also other industries in the sector are generally improving: for example, the profit of the comprehensive retail industry increased by 87% year-on-year, and the automotive industry increased by 13%. Revenue in Q4 of the consumer optional goods segment increased by about 6% year-on-year, but profits surged by 26%, which means that the company has successfully transmitted costs and improved profit margins. Many optional consumer companies have expanded unit profits through price increases or cost controls. Even in price-sensitive areas, the rebound in consumption has brought about operating leverage effects (for example, cruise ships and airlines have turned from losses to profits), and overall profit margins have improved significantly.

Investment inspiration

◆ Adjust return expectations and focus on cash flow: After two consecutive years of high returns of 20%+, the future growth of U.S. stocks may moderate. Valuations are already at high levels, making it difficult to replicate the surge driven by valuation expansion in the past two years. Investors should lower their expectations for the overall increase in the index in 2025 and pay more attention to endogenous returns such as profit growth and dividends. Market returns will depend more on whether companies can fulfill Wall Street’s double-digit profit growth expectations.

Policy uncertainty is high this year, especially since Trump’s policies that are negative for the economy are implemented in the short term, such as

Tariffs, layoffs, spending cuts, decoupling, driving out low-end labor, etc.;

However, most of the support for growth remains in rhetoric or progress is slow:

For example, further reduce corporate taxes, exempt certain income taxes (such as tips and overtime pay), and even reduce individual taxes as a whole; only the energy and technology industries have relaxed some policies, which has limited benefits to the overall economy;

We must continue to wait for more positive results to materialize before we can reverse the market’s short-term recession expectations.

Otherwise, if valuations continue to shrink and offset by earnings growth, the stock market may experience zero or negative returns. Therefore, investors must be mentally prepared: be cautious and optimistic, do not rely too much on the inertia of the bull market, and hold for a longer period of time to wait for profits to be cashed. At the same time, pay attention to the return structure, shift from pursuing capital gains to taking into account dividend gains, and obtain stable cash flow in volatile markets.

Opportunities and risks in specific industries

◆ Short-term performance pressure and interest rate sensitivity in the public utilities sector. As a high-dividend defense sector, utilities are extremely sensitive to changes in interest rates. In the current environment where interest rates are expected to fall, its dividend appeal may rebound. However, if interest rates rise further or AI demand is expected to cool down, they may be under double pressure.

◆ Growth in the consumer necessities sector is stagnant and lacks upward drive. Profit growth in consumer necessities industries (such as food and daily necessities) basically stagnated. In the fourth quarter, profit fell slightly by about-1% year-on-year and profit margins showed no improvement (maintained at 6.0%). This sector has the lowest proportion of buy ratings given by company analysts among any industry (approximately 41%). Under the pressure of inflation, tariffs, and layoffs, necessity companies face difficulty in passing on costs, unclear growth prospects, and limited profit margins. However, if the economy slows down significantly or even shows signs of recession in the future, its stable cash flow and anti-cyclical characteristics will provide downside protection. At the same time, after the current valuation correction, the dividend yields of some leading stocks are relatively attractive, which is suitable for long-term defense against the cold winter layout.

◆ Profits of the financial sector have grown rapidly and profit margins have increased significantly. The valuation of the sector is only about 16 times forward P/E, which is low among various industries. As long as the fundamentals are not too bad, the combination of relatively low valuations makes the financial sector attractive in the long run even if interest rates fall slightly.

◆ Large technology companies in the information technology sector are expected to continue to lead earnings growth, and the surprising results of chip and software giants such as NVIDIA and Microsoft provide support for the industry. Although the current valuation is at a high level (approximately 26.7 times forward earnings), the technology industry has high profit quality and moat. In the long run, trends such as digital transformation and artificial intelligence will continue to drive the growth of the sector. Lowering high-quality technology leaders during the pullback may become a source of long-term benefits.

◆ The performance of the defense sector of the health care sector has stabilized. The health care industry’s fourth-quarter earnings returned to double-digit growth, with 82% of companies ‘revenue exceeding expectations. Big pharmaceutical and medical device companies benefited from improved profits as demand rebounded and the weakening dollar. Although the sector’s net interest rate (7.7%) is still lower than historical levels, the rigid medical demand makes its profits relatively stable and has strong ability to withstand the economic cycle. In times of market volatility, health care can provide solid returns as a defensive allocation and is worth retaining a certain weight in the long-term portfolio.

◆ Consumption upgrades in the consumer optional sector are a long-term trend with high profit elasticity. Profits in the optional consumer industry increased by 27% year-on-year in the fourth quarter, a strong rebound for several consecutive quarters. The rebound in consumer spending in tourism, entertainment, luxury goods, etc. has driven cruise lines, casino resorts and branded retailers to exceed expectations (for example, profit surprises such as Norway Cruises and Wynn Resorts all exceeded 80%). Although the forward-looking P/E of this sector is more than 26 times, as long as the economic environment is stable and employment and income trends are positive, high growth is expected to partially absorb the high valuation.

High-quality optional consumer stocks still have the potential to obtain excess returns in the long run, but need to closely track consumer confidence and the macro environment. Like technology stocks, despite the recent correction, they are optimistic in the long run. Considering that if the Federal Reserve starts to cut interest rates in the second half of 2025, bulk consumption such as automobiles and home improvement may rebound.

However, it is important to be warned that whether the high growth of optional consumption can continue depends on consumers ‘financial health: at present, excess savings of American consumers have fallen sharply, and factors such as the resumption of student loan repayments and soaring credit card interest rates may weaken some consumer demand in 2025. Therefore, we should also pay close attention to signs of weak consumption and appropriately reserve the allocation of essential consumer goods to hedge potential risks.

◆ The industrial and materials sector cycle industry shows resilience. The industrial sector originally expected a decline in earnings in the fourth quarter, but actually achieved a small positive growth (+2.7%, expected to be-3.3%), indicating that the economy has exceeded expectations. Cost control and improved demand for some industrial companies (such as aviation and manufacturing) have brought profit surprises. In the materials industry, the year-on-year increase in profit margins (10.2%, higher than 8.3% in the previous year) also indicates that the pressure on the manufacturing chain has eased. If the economy makes a soft landing in the future and tariffs do not escalate, these cyclical stocks may have room for both valuations and performance to rise. The current valuation of the industrial and materials sectors is not high (about 18 times forward P/E), providing potential value restoration opportunities.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern