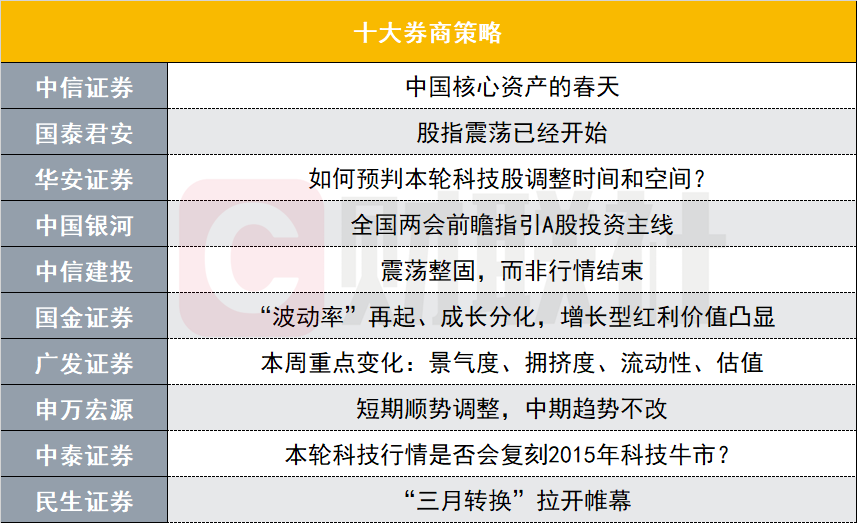

Technology stocks have pulled back. Can this round of market continue? As the National Two Sessions approach, what opportunities will the market face? Has the spring of China’s core assets arrived?

Financial Union, March 2, technology stocks that had performed strongly before suffered setbacks on Friday. Can the original market continue? Or is new investment lines already sprouting? The National Two Sessions are approaching. In this suddenly warm and cold weather, what opinions do securities firms give on the market trend?

CITIC Securities: Spring for China’s core assets

Looking forward to spring, as policies advance and exert efforts in three major areas, confidence restoration will gradually spread from the scientific and technological field to the economic field. The strengthening of U.S. restrictions on China may be the biggest challenge for the market in the spring, but it is also a touchstone for comprehensive confidence restoration; China’s new tracks are sprouting, new core assets with a market value potential of hundreds of billions of US dollars are being expanded, and about 30% of the companies leading traditional tracks are gradually experiencing operating turning points; The market for Hong Kong stocks is still in its early stages, and the core assets of A-shares that were relatively stagflation in the early stage are accelerating their clearing. In the future, the GARP strategy or the relay extreme flexibility strategy,China’s core assets are expected to usher in spring.

Therefore, following the three perspectives of scientific and technological innovation promoting industrial value reconstruction, supply-side reform guiding industry supply and demand clearing, and institutional optimization releasing consumption potential, we selected the “new core asset 30” combination from the technology, industry and consumption sectors as spring. The focus of allocation, we believe that after confidence is fully restored,The differentiation between “good companies” and “ordinary companies” will far exceed the differentiation between “good industries” and “ordinary industries”.

The science and technology sector places more emphasis on extreme innovation to generate new demands, focusing onDomestic computing power, end-side AI, high energy density energy carrierandinnovative drugsFour directions; supply-side efforts are to accelerate the elimination of low-quality production capacity through five major policy measures, promote the return of profits and reshaping of valuations of high-quality production capacity, with a focus onAluminum, steel, panels,while paying close attention toMeasures to optimize production capacity in the new energy sectorThe implementation process of consumption; consumption makes up for shortcomings is to release potential through countercyclical adjustment and structural reform measures, focusing on both offensive and defensive.consumer internet, operations are expected to take the lead in stabilizingdairy productsandmass cateringand other sectors, and at the same time choose opportunities to allocate those with obvious pro-cyclical characteristicsCatering supply chain, hoteland other industries. We select bottom-up based on recommendations from industry analysts“New Core Assets 30”Stock pool, including 14 new technology track companies and 16 traditional core assets.

Guotai Junan: Stock index shock has begun

General trend judgment: Uncertainty factors have increased, and the stock market turmoil has begun.Since Guotai Junan’s strategic judgment on January 5 that “the stock market is expected to stabilize before the Lunar New Year” and “technology is important to expand Hong Kong stocks”, we updated the judgment on February 16 that “after the rebound, the stock index is expected to fluctuate sideways.” Judging from recent market performance, the turmoil has already begun. We still need to be clear about the future outlook: 1) Since we have seen the determination of the decision-makers to reverse the economic situation and support the capital market, the stock market will no longer be a bear market in 2025, entering a structural bull market, and adjusting positions without short positions;2) The biggest driving force for the stock market in 2025 comes from the increase in funds entering the market after the risk-free interest rate falls. After the long-term bond interest rate “broke 2”, we saw that residents ‘interest in fixed income is declining, while their interest in stocks and equity is changing. This is an important change not seen in the past three years;3) In terms of the current international situation and economic situation, investors still have doubts. It will take time to establish and improve expectations, so the stock index operation will have an N-shaped rhythm rather than a “mad cow” without a correction.As far as the current market is concerned, the recent stock market turmoil cannot be simply understood as a decrease in “price/performance”. It is difficult to ignore that after the market’s previous gains have been factored into more optimistic expectations and overheated transactions, uncertainties in the next stage (Sino-US friction, performance growth, etc.) have increased. It is difficult to adjust quickly in the short term, and investors ‘willingness to take risks will decline. We judge that the stock index turmoil will continue.

Subjective investment in China’s stock market will begin to return in 2025, but to distinguish the main battlefield, we expect that the technology index will not adjust to a new low and will look at a new high throughout the year. First,After three years of decline and adjustment, some China assets (Hang Seng Technology, GEM, etc.) have achieved pessimistic expectations and double clearing of transaction structures. The adjustment in the past three years is equivalent to Japan’s biggest decline in 89-03;Second,DeepSeek reasoning and the rapid cost reduction of robots mark the emergence of business opportunities and industrial trends, the beginning of social capital, and the emergence of people’s risk-taking spirit. The coupling of these three marks the clear focus of the main investment battlefield in 2025 and the establishment of the main line of science and technology;Third,Corporate capital expenditures are accelerating, industry expectations are established, and investors ‘inner expectations can begin to lengthen, rather than focusing on current EPS like in the past three years. Therefore, the idea of industrial chain analysis has begun to return, and subjective investment is based on value discovery. The investment method will work again.Despite this, we should still make two points clear: First,It is expected that the direction of establishment will be science and technology, so the main battlefield of investment is structural and not yet overall;Second,The stock market fluctuates and technology will also adjust. The technology index is expected to not reach a new low and will look at a new high throughout the year.

Industry comparison: The main battlefield throughout the year is technological growth, but short-term shocks suggest “cutting high and low”. Risk appetite will move downward in the next stage, so we suggest:1) Technology will be divided in the short term, and more attention should be paid to sectors and individual stocks with higher valuation margins of safety and higher performance certainty: RecommendationElectronics/New Energy/Computing Power, Hong Kong Stock Internet;2) As the international environment and economic situation remain complex, there will be repair opportunities for low cyclical assets and high dividends:Banks/railways and roads/chemicals/coking coal, etc.;3) The performance verification period is approaching, focusing on high-certainty performance sectors that benefit from equipment updates and trade-in policies:Consumer electronics/home appliances/mechanical equipment, etc.。

Theme recommendations: 1. Mergers and acquisitions:Shanghai proposes to build a global M & A center, accelerate the asset integration of central state-owned enterprises, and is optimistic about the reorganization and integration of hard technology fields such as military industry/semiconductor.2. Solid state batteries:The pace of all-solid-state mass production is accelerating, adapting to new robot/low-altitude scenarios, and optimistic about solid electrolytes/positive and negative electrode materials/key equipment.3. Domestic computing power:Domestic government and enterprise computing power spending is accelerating, and we are optimistic about server/power supply/liquid cooling and Huawei and other computing power chip industry chains.4. Specific intelligence:Beijing has released a personalized intelligent action plan to promote the implementation of scenes, and is optimistic about dexterous hands/screws/sensors.

Risk warning:Overseas economic recession exceeds expectations and global geopolitical uncertainty.

Hua ‘an Securities: How to predict the adjustment time and space for this round of technology stocks?

The risk of additional tariffs imposed by the United States has repeatedly caused short-term disturbances to the global capital market. The market’s policy expectations for the “Two Sessions” have returned to reality. The overall set tone of the government work report is expected to be difficult to exceed expectations, and the market has entered a periodic high and volatile market. In terms of configuration, March returned to rotation, and technology entered an adjustment period. In March, we focused on seasonal infrastructure advantages with high winning rates (before mid-month), pharmaceuticals, automobiles, and home appliances with policy catalysis, as well as banks and insurance with short-term cost-effectiveness and medium-and long-term strategic allocation value.

Market view: The market has entered a stage of high and volatile market conditions

External risks have been disturbed and internal expectations have returned, and the market has entered a periodic high and volatile market.Externally, the risks of imposing tariffs by the United States have been repeated. Recently, Trump has frequently expressed his views on tariff issues and may impose a 25% tariff on the EU. After the previous suspension of tariffs on Canada and Mexico, it may also be formally imposed, and imposed on China. A further 10% will cause certain disturbance to the market in the short term. The internal “Two Sessions” will be held soon, and the market’s policy expectations for the “Two Sessions” will return to reality. It is expected that the overall tone of the government work report will be in line with market expectations.

Market Hotspot 1: How to view the policy expectations of the “Two Sessions” and the February PMI?The “Two Sessions” are just around the corner, and market expectations for policies are returning to reality. It is expected that the overall tone of the government work report will basically meet market expectations and the probability of exceeding expectations will be small. The accelerated resumption of work after the holiday and the recovery of supply and demand pushed the PMI back above the boom-bust line in February, but it was still at a relatively low level. The current effective demand still needs to be boosted, and it remains to be seen whether PMI can recover further.

Market Hotspot 2: How to view the risk of the United States imposing tariffs again in the near future?In the early stage, Trump signed a presidential memorandum to initiate “reciprocal tariffs”, and core members of his cabinet are expected to take effect on April 2. However, recently, Trump has frequently expressed his views on tariff issues and may impose a 25% tariff on the EU. In the early stage, he has imposed tariffs on Canada and Mexico. After the suspension of tariffs on tariffs, tariffs may also be formally imposed, and another 10% will be imposed on China exports. The repeated risk of the United States imposing additional tariffs may cause certain disturbances to global capital markets in the short term.

Industry configuration: Return to rotation and focus on underestimating the types of stagflation superimposed catalysts

In the last week of February, the market fluctuated violently. DeepSeek and robot-related sectors, which were strong in the previous period, adjusted significantly, while some infrastructure, consumption and dividends ushered in a round of incentives, leading the overall performance. This is in line with our March monthly report “Still Water Flowing Deep”. The judgment is consistent. Looking forward to the market outlook, we still adhere to the view that the market is volatile at a high level and the industry is returning to rotation. Regarding specific industry opportunities, we suggest focusing on three main lines that are expected to rotate:1) Before mid-March, advantageous varieties of infrastructure construction with strong seasonal effects. Focus on engineering consulting services, environmental protection equipment, professional engineering, environmental governance, non-metallic materials, cement, general equipment, and new metallic materials. 2) Areas with policy catalysis, focusing on medicines, automobiles, and home appliances. 3) Banks and insurance that have short-term allocation cost performance and medium-and long-term strategic allocation value under market shocks.

Configuration Hotspot 1: How to expect the time and space for phased adjustment of growth technology?This round of pan-TMT growth technology’s phased theme market is coming to an end, and this week the pan-TMT sector has also seen a significant correction. Since chatgpt, AI phased theme markets have experienced many times, and after a round of phased theme market interpretation, it will enter a period of adjustment and digestion. Judging from the past few adjustments and re-offers: 1-3 months in the time dimension, there is no stable time rule, but usually a round of adjustment needs to wait for the emergence of a new powerful catalyst; in the spatial dimension, computers and media led the increase but also experienced a large decline, while communications and electronics increased less, so the adjustment range is also smaller. Specifically, the adjustment range for computers and media is 30-35%, the adjustment range for communications is 20-25%, and the adjustment range for electronics is 15-30%.

Configuration Hotspot 2: Where has the market reached this spring?The end of the spring market for A-shares cannot be separated from the necessary trigger factor of the phased decline of U.S. stocks. The resumption of trading in the past seven years shows that the internal factors at the end of the A-share spring market are different, including weakening economic fundamentals or expectations, weakening liquidity or expectations, and the impact of other events. However, external factors have all appeared to have a phased decline in U.S. stocks. Opportunities, and usually within one week before and after the phased decline in U.S. stocks, the A-share spring market rally ends. At present, this shocking external factor has emerged. U.S. stocks have continued to adjust in the past week or so. The biggest declines in the Nasdaq index, the S & P 500, and the Dow have fallen by 7.54%, 4.6%, and 3.11% respectively. Moreover, as the two sessions are approaching, the market’s macro policy expectations are returning to reality, so the overall judgment that this year’s turbulent spring rally has basically ended.

Risk Warning

Social finance credit or economic data in February significantly fell short of or exceeded expectations; macro policies of the “Two Sessions” significantly fell short of or exceeded expectations; and U.S. policies towards China exceeded expectations and was severe.

China Galaxy: The National Two Sessions Forward-looking Guidelines on the Main Line of A-share Investment

Outlook for the National Two Sessions:The 2025 National Two Sessions will be held soon. According to the overall tone of the Central Economic Work Conference, as well as the statements made by the local two sessions and recent high-level meetings, we mainly focus on the impact of the following policy levels on the capital market: (1) Continue the tone set by the Central Economic Work Conference, and macro policies are expected to be more proactive. (2) Expanding domestic demand is the top priority of economic work in 2025. Among them, boosting consumption is the key focus in expanding domestic demand, and investment is another starting point. (3) The construction of new productive forces is the key direction. (4) Continue to pay attention to adhering to the two “unwavering” principles. (5) Risk prevention is still expected to become an important issue in 2025. (6) The long-term healthy development of the capital market deserves further attention.

Future investment outlook:The convening of the National Two Sessions is expected to provide further guidance on the investment structure of the A-share market. Against the background of the domestic economy switching between old and new momentum, especially boosted by the accelerated development of new productivity and a series of policies, the A-share market is facing opportunities for structural valuation reshaping. The current valuation of the all-A index P/E ratio is at the historical median level, but it is still at a low level compared to overseas markets. As medium-and long-term funds accelerate into the market, investor confidence will be further enhanced. In the follow-up, we need to pay attention to the disturbance in Trump’s China policy and the pace of repairing domestic economic fundamentals. Overall, the A-share market is expected to show a volatile upward trend. In terms of configuration, the focus will be on: (1) Scientific and technological innovation themes based on independent controllable logic and the requirements for developing new productive forces. (2) The “dual” and “two new” themes guided by expanding domestic demand. (3) Continue to be optimistic about the dividend sector with a higher margin of safety, focusing on central state-owned enterprises.

Risk warning:Risk that the strength and effectiveness of domestic policies fall short of expectations; geopolitical factors moderate the risk: Risk of unstable market sentiment.

CITIC Construction Investment: Shock consolidation, not the end of the market

How to understand recent market changes?

The recent market adjustment is caused by both internal and external factors, including the impact of external policies and the overheating of the internal trading structure of the market. In the external environment, Trump expects to impose additional tariffs on China, leading to the spread of risk aversion. Due to internal factors, the market is excessively concentrated in the technology sector, and funds are highly poured into major sectors related to DeepSeek and humanoid robots.

How to judge subsequent market trends?

Looking forward to the future outlook, the market will remain volatile and consolidated in the short term. With the two sessions next week and the earnings disclosure period at the end of March, attention to policies and corporate financial reports will increase. In the medium term, the medium-term environment such as profit improvements and capital inflows brought about by stabilizing demand and shrinking supply have not changed, and the dividends of capital market reform will continue. Under the consensus of industrial trends, the technological growth sector will remain the main line. From the perspective of global comparison and choice, the medium-term trend of revaluation of asset confidence in China is expected to continue.

How to choose the subsequent configuration direction?

In addition to technology, marginal data such as credit, steel, housing and consumer sectors are showing signs of improvement, and the directions of some related areas are worthy of attention. In the medium term,”AI+” is still the main line. The current “artificial intelligence +” has entered the boom verification stage and has shown strong growth potential and investment value. After shocks, consolidation and stabilization, the direction that can verify the progress of the real industry boom is still worth paying attention to.

Risk warnings: Domestic demand supports low expectations for policy effects, stock market selling pressure exceeds expectations, geopolitical risks, U.S. stock market fluctuations exceed expectations, etc.

Guojin Securities: “Volatility” resurfaces, growth is differentiated, and the value of growth dividends is prominent

Strategy: Be alert to the risk of rising market “volatility”

Looking back at the performance of the A-share market in February,After the year, the A-share market started a clear upward trend, and the market for AI-robot-related technology tracks continued to be hot. Our key recommendations: the directions of electronics, computers and robots have been verified. Among them, the “higher AI content” market for Hong Kong stocks has become more extreme.Until the end of February, the market style suddenly changed, and technology stocks fell sharply for two consecutive days. Data shows that among the major broad-base indexes of A-shares as of February 28, small and medium-sized technology indexes such as Beijing Securities 50, Science and Technology Innovation 50, and Science and Technology Innovation 100 have increased significantly, recording monthly month-on-month increases of +23.53%/+12.95%/ +11.95% respectively; However, the Shanghai and Shenzhen 300, Shanghai Stock Exchange 50, and Shanghai Stock Exchange Index have weak gains, with monthly month-on-month records of +1.91/+2.14%/+2.16% respectively. On the structural level, the industries with the highest growth rates among the primary industries include computers, machinery and equipment, automobiles, electronics, etc., with monthly month-on-month records of +16.31%,+10.71%,+9.18%, and +8.31% respectively; Coal, petroleum and petrochemical, banking, public utilities and other industries led the decline, recording month-on-month records of-7.58%,-1.06%,-0.99%,-0.94% and-0.81% respectively. From a structural perspective, the popular appearance of the DeepSeek model and the connection of major platforms to DeepSeek have promoted the AI model and related applications to continue to attract market attention. The appearance of robots on the Spring Festival Gala and the innovation and progress of related technologies have also become hot spots in market transactions.

The balance sheets of residents and enterprises have been repaired weakly, and domestic fundamentals may also “weaken”.Since last year’s “9.24”, we have promptly increased the number and proposed that the “market bottom” has emerged, and technological growth will blow the clarion call of “counterattack”; at that time, we have simultaneously constructed this round of “restful market” and the technological growth style when there will be a “ebb tide” framework.That is to say, the salaries and profits of residents and enterprises have not changed significantly, and the “willingness to spend money” is still relatively weak. Therefore,M1 has a high probability that it will fall back at some point in the future. Policies based on history only act on the “debt side” of the economy. The M1 and market repair cycle is generally four months. By then, domestic fundamentals will “weaken” and M1 will fall back. The liquidity-driven technological growth style will also “ebb”.In January, M1 under both new and old calibers slowed down year-on-year,In particular, M1 fell by 5.7% under the old standard, of which unit demand deposits actually fell by 15.2%, setting a record low; even if the Spring Festival effect is excluded, the cumulative M1 increase from January to February may still fall by 1 to 2 trillion yuan, corresponding to year-on-year growth. The best state is still down by 3%–It just confirms the four-month repair cycle mentioned above, and M1 may experience a “phased” decline again.

In fact, the February PMI data improved marginally month-on-month due to the “Spring Festival effect”, but the momentum is still weak.(1) The PMI structure of large, medium and small enterprises deviates significantly, with the PMI of small and medium-sized enterprises known as the “thermometer” of economic prosperity still weak.During the period, although the PMI of large enterprises rose significantly to 52.5% month-on-month, returning to above the “boom-and-bust line”, the PMI of small and medium-sized enterprises continued to fall month-on-month, dropping to 49.2% and 46.3% respectively.(2) Compared with the years of domestic economic recovery since 2020, the month-on-month growth momentum is significantly weak.Considering that the PMI month-on-month base has a large impact, when removing the “Spring Festival effect”, we compare “2021, 2023 and 2024 and find: Compared with the “Spring Festival month”, the PMI in February only increased by 1.1pct month-on-month, which was lower than the sample’s average month-on-month increase of 1.8pct in the same period. Among them, important indicators such as new orders, new export orders and production in February increased by 1.9pct\2.2pct\2.7pct respectively, which were much lower than the sample’s average month-on-month increase of 3.1pct\4.6pct\3.8pct in the same period.

The risk of “stagflation” in the United States continues to heat up, and it may also bring a new round of impact on the domestic balance sheet through “exports”.The U.S. inflation data in January far exceeded expectations. The core CPI month-on-month +0.45%(expected +0.3%) hit a new high since the beginning of 2023. In particular, the inflation stickiness of super core services other than housing was stronger (+0.64% hit a new high since the beginning of 2022); At the same time, the latest released January retail sales data was-0.9% month-on-month, far lower than the market expectation of-0.2%, the largest decline since March 2023.The narrative of “weak economy, strong inflation” seems to be playing out,The possibility of “stagflation” in the United States will increase significantly in 2025. The obstruction of its “broad monetary” policy will accelerate the pace of “recession” in the U.S. economy, especially increasing the vulnerability of interest-sensitive government departments and low-and middle-income groups.We judge that the global Jugla superimposed inventory downward cycle will likely lead to a decline in U.S. capacity utilization and job vacancies. Under the influence of the flattening of the “Beveridge Curve”, it is expected that the U.S. unemployment rate will continue to show a trend and accelerate in the future. rise.

Market “volatility” may pick up again, growth style or overall “ebb”, and some structural technological directions are still expected to “cross”.At the end of February, technology stocks suffered a sharp correction for two consecutive days. On the one hand, as we have repeatedly warned that AI and robot-related tracks have been very crowded in recent transactions and funds; on the other hand, as domestic fundamentals “decline”, if overseas risks are superimposed, both liquidity and sentiment are facing a significant trend decline, causing the “volatility” of the broad-based index to rise again. By then, overall, the growth style of small and medium-sized caps will “switch” to large-market value defense; considering that the “market bottom” of A-shares has emerged +AI industry logic catalysis, it is expected that technological growth will still have some structural opportunities.

Industry configuration in March: Growth is significantly differentiated, and value gradually dominates

Suggestions: (1) Reduce holdings: “penetration rate below 10%” relies on liquidity and emotion-driven AI end-side;(2) Increase allocations: Structural technological growth directions that contribute or potentially produce results, including:(1) Optical chips, smart cockpits and new display technologies;(2) The construction of the Deep seek model and related infrastructure will benefit from the expansion of industrial Capex and domestic fiscal expansion support. (3) Overallocation: “growth dividend” assets such as the three major operators, infrastructure and consumption.

Risk warning: The confirmation of a “hard landing” for the U.S. economy is accelerating, exceeding market expectations; domestic exports are slowing more than expected.

Guangfa Securities: Key changes this week: prosperity, congestion, liquidity, valuation

Mid-term prosperity: The direction of improvement in prosperity this week is mainly in the fields of building materials, consumer electronics, semiconductors, automobiles, etc. The obvious clues for price increases are: upstream building materials, consumer electronics and semiconductors in the field of technology TMT, and downstream consumer fields. Cars, etc.Specifically, according to Wind data statistics, among upstream resource products, COMEX gold futures prices fell month-on-month, COMEX silver futures prices fell month-on-month, copper prices fell month-on-month, rare earth metal praseodymium neodymium oxide prices rose month-on-month, and terbium oxide prices rose month-on-month. The spot price of West Texas Intermediate Light crude oil in the United States rose month-on-week, and the spot price of Brent crude oil in the United Kingdom rose month-on-week. In the field of technology TMT, the average sales price of mobile phones and tablets rose year-on-year in January, while the average sales price of smart devices and notebooks rose year-on-year. In the downstream consumption sector, sales of new energy vehicles and passenger cars increased year-on-year in January, and output of power batteries and energy storage batteries increased year-on-year. In terms of financial real estate, the total transaction volume in the Shanghai and Shenzhen markets fell month-on-month. The overall demand in the real estate industry is still weak. However, last week, the weekly transaction area of commercial housing in 30 large and medium-sized cities increased significantly year-on-year.It is recommended to pay attention to pro-cyclical resource products, large consumption, and large financial sectors; at the same time, it is recommended to pay attention to the direction of reversal of difficulties among boom growth assets.

Industry congestion: tmt sentiment fell slightly.

Valuation:(1) According to wind data, looking at the overall market, the overall A-shares and the financial valuation of A-shares shrank this week. Among them, the GEM shrank the most. (2) From an industry perspective, the industries with the largest expansion in PE (TTM) quantile this week are machinery and equipment, computers, and media. The industries with the smallest expansion in the PE (TTM) quantile are food and beverage, real estate, and banking. (3) According to wind data, the equity risk premium was raised this week from 2.34% last week to 2.4% this week, and the stock market yield was raised from 4.06% last week to 4.16% this week.

Liquidity: This week, the average daily change of hands is stable and volatile, and the monthly inflow of funds to the south is high.In terms of the primary market, the IPO size this week was 0 billion yuan, and the IPO size the previous week was 0 billion yuan. In the secondary market, the net inflow of funds to the south as of Thursday was 59 billion yuan, the net inflow last week was 47.9 billion yuan, and transaction costs were 20.3 billion yuan. In terms of investor sentiment, the average daily turnover rate this week was 2.03%, compared with 1.99% in the previous week; the net outflow of institutional funds was 87.5 billion yuan, compared with 35.1 billion yuan in the previous week. This week, the ban on restricted shares was lifted by 16.7 billion yuan. The ban on restricted shares was lifted by 466.1 billion yuan the previous week. It is expected that the ban on restricted shares is lifted by 29.7 billion yuan next week.

Risk warning:Global geopolitical risks; in the context of global tightening, the global economic downturn exceeds expectations; overseas policies and the pace of interest rate hikes are uncertain, and the timing and form of the introduction of China’s monetary and fiscal policies are uncertain; historical laws may have deviations.

Shen Wan Hongyuan: Adjust the trend in the short term, but remain unchanged in the medium term

1. Adjust the trend in the short term and focus on resolving various problems: the US tariff threat to China has increased, and the main contradiction has temporarily switched back to overseas disturbances. Early March and early April are verification windows. The domestic two sessions are coming soon, and after the meeting is a period for policy implementation and effect observation. The issue of short-term low cost performance in the technology industry trend has been widely discussed. It is healthy to adjust with the trend and wait for the industry to catalyze it before starting.

Before the Spring Festival, uncertainty in the macro environment was the main contradiction for A-shares. After the Spring Festival, macro expectations have not changed significantly. DeepSeek has made a breakthrough, and changes in industrial trends have become the main contradiction leading the rebound of A-shares. In the short term, investors are worried about the short-term cost-effectiveness of the market. At the same time, domestic policies and U.S. tariffs on China are approaching critical verification periods. This week, Trump increased the threat of tariffs on China. The main contradiction temporarily switched back to macro changes, and the market adjusted accordingly.

Short-term adjustments, concentrated digestion of various problems: 1. Early March and early April are the verification windows for the specific implementation of U.S. tariffs on China. The game between China and the United States is bound to have multiple rounds of games with repeated disturbances. Uncertainty in short-term verification exists objectively and asset prices can only be digested. U.S. tariffs have increased, recession transactions have intensified, and major markets around the world have generally undergone adjustments. 2. The “Two Sessions” will be held soon, and we observe possible clues from the current policy layout. On the one hand, historically, the two sessions have continued the tone set by the Central Economic Work Conference last year and further refined specific measures. From the perspective of the 2024 Central Economic Work Conference, stimulating domestic demand, two new things, and service consumption are important starting points. The two sessions may continue; On the other hand, the 2024 Central Economic Work Conference mentioned “carrying out artificial intelligence + actions” and the holding of a private enterprise symposium on February 17, 2025, and the importance of the field of science and technology has increased. We can pay attention to whether private economic promotion and artificial intelligence industry policies have further layout. After the meeting, there is a period of policy implementation and effect observation. More optimistic expectations for fundamental improvement require further data verification. 3. The issue of low cost performance trends in the technology industry has been widely discussed. It is healthy to adjust with the trend and wait for the industry to catalyze it before starting. The big model is still improving, domestic application exploration has been fully rolled out, domestic computing power has just begun to release performance, and subsequent industry new catalytic cashing is a high probability.

2. The judgment that the 25H1 technology industry trend is dominant remains unchanged: 1. AI hardware and applications both have industry depth, and there is still clear room for improvement in the “AI content” of A-shares in the medium and long term. 2. The medium-term high of the industrial trend market has a high probability that it will appear in a position with low cost performance in the medium term. The adjustments triggered by low cost performance in the short term are often not large-level adjustments, but signals that lead the switch in the direction of the growth segments. 3. The environment in which the 25H1 small-cap growth style dominates remains unchanged, expectations of continued economic improvement are still difficult to form, and trading funds are still marginal pricing funds.

After short-term adjustments, we continue to be optimistic about the trend of the 25H1 technology industry and discuss three medium-term judgments:

1. AI hardware and applications both have industry depth. The focus of overseas AI computing power demand has shifted from training chips to inference chips, and domestic AI computing power demand has just entered an accelerating period. Overseas 23 years have gone through the process of AI application explosion to cooling down, and domestic To C-end application explosion is still in the pipeline. These all constitute follow-up clues to the A-share AI market. We have developed the A-share “AI content” indicator. Referring to the historical experience of “Internet content” in 2015,”new energy content” in 2021, and the peak of the industrial trend market, the market value of related concept stocks may be as high as 35-40%, but now the AI content is only 14%, which directly points to the AI industry trend still has depth, the AI securitization rate has increased, and there is still room for expansion of the market value of existing stocks.

2. The medium-term high of the industrial trend market has a high probability that it will appear in a position with low cost performance in the medium term (the absolute high level of the public offering allocation coefficient implies a historical low level of ERP), and adjustments triggered by simply short-term low cost performance are often just adjustments to the market. At the same time, before and after the adjustment, there may be a switch in the direction of the leading segment. Therefore, the short-term focus is not to switch styles, but to find a new leading direction in the trend direction of the technology industry.

3. The environment in which the 25H1 small-cap growth style dominates remains unchanged: expectations of continued economic improvement are still difficult to form, and the “high to low” market lacks flexibility and sustainability. Trading funds are still marginal trading funds, and the trend of the technology industry is the direction of strengthening consensus among various types of funds.

3. The adjustment window is more optimistic about the value sectors with short-term catalysis: international engineering contracting, real estate, and securities firms. The core consumption expectation will stimulate domestic demand, and focus on the investment opportunities of the first quarterly report window that will break the company’s market value management for a long time. In the medium term, continuing to be optimistic about the trend of the technology industry is the main line of the structure, focusing on: domestic AI computing power and applications, humanoid robots and low-altitude economy.

Short-term adjustments, the value and high dividend sectors have relative returns. We note that in the value sector, stock prices are still inelastic, depending on the direction of continued improvement in the overall economy. We are more optimistic about the sectors that have short-term catalysis: international engineering contracting (Russia-Uzbekistan reconstruction), real estate (sales improvement expected from March to April), and securities firms. Core consumption benefits from the expectations of domestic demand stimulation during the two sessions, and can “buy expectations and sell them to cash in.” In addition, pay attention to the quarterly report window and long-term investment opportunities for companies to disclose market value management plans.

In the medium term, we will continue to be optimistic about the trend of the technology industry as the main line of the structure. We will continue to recommend: domestic AI computing power and applications, humanoid robots, and low-altitude economy.

Risk warning:Overseas economic recession exceeds expectations, and domestic economic recovery falls short of expectations

Zhongtai Securities: Will this round of technology market repeat the 2015 technology bull market?

1. Will this round of technology market repeat the 2015 technology bull market?

This week, A-shares and Hong Kong stocks showed a volatile correction trend, with a large decline on Friday. Among them, the small micro-disk sector, which performed relatively well after the year, performed poorly overall, with a large correction on Friday. From a sector perspective, this Friday’s market correction was mainly caused by the withdrawal of funds from the technology sector. AI downstream industry chains such as computers, electronics, communications, and media fell significantly on Friday, with the computer sector falling more than 5%. In addition, the Hang Seng Technology sector also fell significantly on Friday, driving the Hang Seng Index and the Hang Seng China Enterprise Index to fall. The Hang Seng Technology Index fell 5.32% on Friday, with BYD, Ideal Automobile and Xiaopeng Automobile falling significantly.

Since the Spring Festival, the technology stock market has continued to interpret, and the market is concerned about whether this round of technology stock market can replicate the 2014-2015 bull market in technology stocks. At the same time, in terms of geography and policy, situations such as the imposition of tariffs by the United States have also caused greater disturbance to the U.S. stock market and the A-share market.

In terms of market sentiment, we believe that the current market is more similar to early 2021 than 2014-2015. The overall macro environment of the market this year is a significant increase in risk appetite. However, the current profits of my country’s enterprises will still face greater pressure. Geographically, Trump imposed tariffs faster than market expectations. Domestically, my country’s current policy framework is still dominated by high-quality development, and the intensity of the monetary and fiscal policies of the two sessions may be lower than market expectations. In addition, the collapse of the international trade order will also make the international geopolitical situation more severe, and entrepot trade may become more difficult.

Therefore, from an index perspective, we believe that market volatility this year may be significantly stronger than market expectations. In the short term, the market’s rise after the Spring Festival is mainly driven by the increase in valuations brought about by technological breakthroughs. However, with the implementation of this year’s policy tone after the two sessions, and the release of April’s financial reports and various economic data, the market may enter a “reality and redemption period.” If the aggregate policy falls short of expectations and corporate profits have not improved, the pressure on index adjustment may be greater than market expectations. Therefore, for investors currently holding defensive assets (dividends, bonds) and safety assets (gold, nonferrous metals, power equipment, military, nuclear power, etc.), we believe that there is no need to be “forced short” to chase high-tech stocks, especially those who turn to overvalued small and medium-sized market capitalization and science and technology innovation among A-shares.

From an industrial perspective, despite the current high market volatility, the new energy and GEM in 2021 is an industrial main line that runs through the year. We believe that the trend of Hang Seng Technology targets such as Internet leaders and computing power in 2025 or the new energy market similar to 2021 will become the main line of local structural opportunities:

1) In terms of policy logic, this round of policy changes under the private enterprise symposium is only targeted at local Internet leaders and leading technology companies. In terms of actual results, the valuation increase in this round of technology market may be limited to the above-mentioned local companies, making it difficult to drive the overall market.

2) From the perspective of industrial logic, the fundamental logic of AI lies in AGI (Universal Artificial Intelligence)-a winner-take-all model in which one model solves all problems, rather than the Internet-era model in which each industry creates its own applications. After the launch of DeepSeek, most large domestic model companies have now been fully connected, and the industrial chain may radiate more narrowly in the future.

3) From the perspective of valuation and profit, the current P/E ratio of the Science and Technology Innovation 50 Index is 113 times, and the profit is negative. In terms of Hong Kong stocks, Hang Seng Technology is valued at 23.62 times, and its 24Q3 profit growth rate is 23%. This means that if Hong Kong stocks adjust under the influence of subsequent Trump tariffs, long-term capital such as insurance capital can still be allocated.

4) In terms of capital dimensions, this round of technology stock market may still be dominated by “large stock funds”, while the participation of long-term allocation funds is more cautious. Due to the absolute return attribute of long-term funds and compliance requirements, it is difficult to participate in this round of market driven by the rise in the valuation of technology stocks.

2. Investment advice

In the short term, driven by market risk appetite before the two sessions, technology stocks will not rule out continued strength. But at this point in time, we are still firmly optimisticDefensive assets (dividends, bond markets)withSafety assets (gold, nonferrous metals, power equipment)。On the other hand, the current high-level science and technology innovation board and small and medium-sized market capitalization need to pay attention to certain risks of overvaluation. Wait for “real shocks” such as Trump tariffs, or the next layout point for major industrial varieties such as Hang Seng Technology.

Risk warning:Global liquidity has tightened more than expected, market games have become more complex than expected, and the rhythm of policy changes has become more complex than expected.

Minsheng Securities: “March conversion” kicks off

After the AI market has reached its peak, the market has switched between high and low this week. However, China’s assets not only have low-level defensive attributes, but the continuous improvement of PMI and the further efforts of the future “double and two new” policies are all accumulating to repair the AH premium and the power to gap between the Shanghai and Shenzhen 300 and Hang Seng Technology.

January and March shift from expectation to reality.

This week (20250224-20250228), the market structure has not only seen a “high and low switch” in price increases, fluctuations and valuations, but also the characteristics of switching from the AI-led technology sector to the traditional domestic demand field. The reasons behind this have been discussed in detail in the weekly report of the previous month, mainly three points: First, the trading popularity and volatility between various A-share sectors have become extremely differentiated and need to be converged; second, the market for technology stocks depends on the continuous emergence of new catalysts. Even if new catalysts emerge, referring to the experience of the fourth quarter of last year, the market’s response to the catalysis itself may gradually be inactivated; Third, the momentum for endogenous economic repair is gradually emerging, and the artificial intelligence + robot industry logically presents marginal challenges.

2. When the story of the “American exception” is broken.

The macro narrative of AI driving U.S. economic growth has been challenged. The initial US S & P service industry PMI for February released last week recorded 49.7, a 25-month low. The number of initial jobless claims in the week of February 22 exceeded that of the past three years. At the same period of the same period in the past three years, as an economy dominated by the service industry,The cooling of the service industry may indicate that the U.S. economy has not escaped its original cycle because of AI.In addition, personal consumption expenditure fell in January month-on-month for the first time in 22 months, and the index of pre-owned housing contracts fell to a historical low. This at least indicates that a large part of the U.S. economy is still constrained by high interest rates. Against the backdrop of weakening economic data and Trump’s continuous waving of the “tariff stick”, the Atlanta Fed predicts that the U.S. economy will shrink by 1.5% in Q1 of 2025, and this will be the first negative growth since the first quarter of 2022.When the economy weakens, the capital expenditures of the giants cannot be excluded. Currently, the proportion of capital expenditures of the top seven U.S. companies in their net operating cash flow is close to a record high, and recession expectations may drag down capital expenditures.

3. There are headwinds in the overseas economy and inflation, and China’s technology stocks are also undergoing division.

On the premise that the U.S. domestic economy is weakening and inflation levels are still manageable, the Trump administration has further raised the priority of the “tariff card”, but its efforts to reduce inflation on the supply side have made little progress recently.The current U.S. inflation in line with expectations seems to be more caused by the decline in the demand side, while the uncertainty at the supply level has increased because tariffs have not been lowered, ultimately pointing to either pushing the weakening of the demand side or a rebound in inflation.In addition to the United States, central banks in Europe and Japan have expressed caution about inflation, and marginal tightening of overseas liquidity seems to be the more likely direction.Can China’s technology stocks be “alone” and become a safe haven for funds investing in technology?On the one hand, from the perspective of overseas mapping, Nvidia’s valuation was digested to 41.8 times PE after the release of this results, highlighting the “anchoring effect”; on the other hand, judging from the industry experience of typical industrial cycles rushing in history, A-share investors often rush the industrial cycle for no more than a year. Compared with the realization of the performance elasticity of the rushing portfolio in the past two years, it is a bit “delayed”.Looking back, the performance of China’s technology stocks may bring about market differentiation.

4. China’s assets are not only low-level defense, but the proliferation market has just begun.

Since the beginning of this year, Hang Seng Technology’s performance has significantly surpassed the Shanghai and Shenzhen 300 (this indicator has historically been related to the relative strength of Sino-US manufacturing industries). The decline in China’s manufacturing activity in the early period has led the market to choose Hang Seng Technology, which is related to the more prosperous AI industry chain, and abandon the Shanghai and Shenzhen 300, which is more related to China’s economic market. However, China’s manufacturing PMI began to repair in February and surpassed the seasonality of 2024 and 2019, which may reverse the above logic. On the other hand, the A-H premium has also reached a low level in nearly three years. Judging from past experience, Hang Seng Technology fell this week due to the corresponding market, which may be an opportunity to repair the premium of A-shares relative to H-shares. At present, the inventory level of domestic industrial enterprises has dropped below the center level in the past five years, and the operating rate has increased. The implementation of the “two new and two heavy” policies after the “Two Sessions” will bring greater marginal improvement in the pro-cyclical domestic demand sector. We recommend: First, downstream consumption that is more related to the stabilization of “quantity”(Brand clothing, food, beverages, white electricity, tourism, etc.)+ The midstream supply pattern is better or has positive changes(Construction machinery, steel, chemicals, lithium batteries, etc.)+ Colored(Copper, Aluminum); Second, under inflation risks, commodities are revalued: the launch of gold, crude oil, and gold stocks may depend on the confirmation that the gold price center moves upwards after gold’s growth slows down; third, low valuations + dividends, which also combines the decline in macro risks in China:Banking, insurance.

Risk warning: 1) Domestic economic growth fell short of expectations. 2) The overseas economy has declined significantly. 3) Calculation error.