Original title: Mindshare is Everything: The Rise of InfoFi

Original author: ManoppoMarco, partner at primitive

Original compilation: ChatGPT

Editor’s note:InfoFi financializes information, narratives, and market sentiment, relying on trusted prophets (such as Chainlink, Pyth) to securely link offline data. At present, oracle machines face challenges such as data manipulation and subjectivity in emotional analysis, and need to be optimized in combination with AI and incentive mechanisms in the future. InfoFi’s development directions include narrative ETFs, Internet celebrity financial products, MemeCoin derivatives, etc. The core is to capture and trade attention. It may become an independent market rather than a subset of DeFi. The key lies in whether it can create highly liquid, scalable financial instruments that make digital mind shares truly tradable.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Mind share is everything, and if you think I’m going to start with an obvious sentence like a typical VC, you’re absolutely right-but please be patient and read on.

Attention has always been the most important “currency” because this is how goods are sold. Before the advent of the Internet, printing and advertising ushered in a golden age. Cigarette companies attract attention by tying themselves to socially controversial topics and movements-in other words, to sell more.

Simply put, attention → mind occupancy → channel distribution.

Then, the brand era arrived. Brands such as Nike, Lucky Charms, and Nutella have mastered the art of emotion-driven marketing, which has increased mental share and ultimately led to higher profit margins. Consumers are willing to pay a 30% premium for the same product simply because of different brand perceptions. I myself was a “victim” of this trend-a shameful period when I was madly collecting Supreme Box logos in college.

I almost spent $1000 on these junk when I should have bought ETH.

Fast forward to the 2020s, and everything revolves around digital mind occupancy.

This trend accelerated during and after the epidemic, but its roots can be traced back to the rise of YouTuber over the past 15 – 20 years. Early content creators such as Ryan Higa and Smosh initially made “funny little videos” out of interest. However, social media has changed everything. Platforms such as Facebook, Twitter and Instagram have accelerated the viral spread, giving YouTuber and independent creators the influence of most second-tier stars.

For example, Casey Neistat started his daily watch vlog in 2015-just a decade ago. At the time, YouTuber was rarely able to turn traffic into commercial success. Companies try to take advantage of this trend (like BuzzFeed), but we all see how they end up.

Fast forward to today, creators like MrBeast have built multimillion-dollar business empires entirely based on their own distribution channels. Rhett & Link is also a typical example, acquiring and expanding the Mythical Entertainment Network through its YouTube audience.

Clearly, all companies are competing for mental share these days.

Mind share means a premium, and in modern capital market environments, it directly affects stock prices (or token prices). If Elon Musk hadn’t been creating topics online 24 hours a day, Tesla’s market value wouldn’t be where it is now. I believe this trend will continue to grow over the next five years and will be further financialized-this is the era we can call InfoFi today.

What is InfoFi?

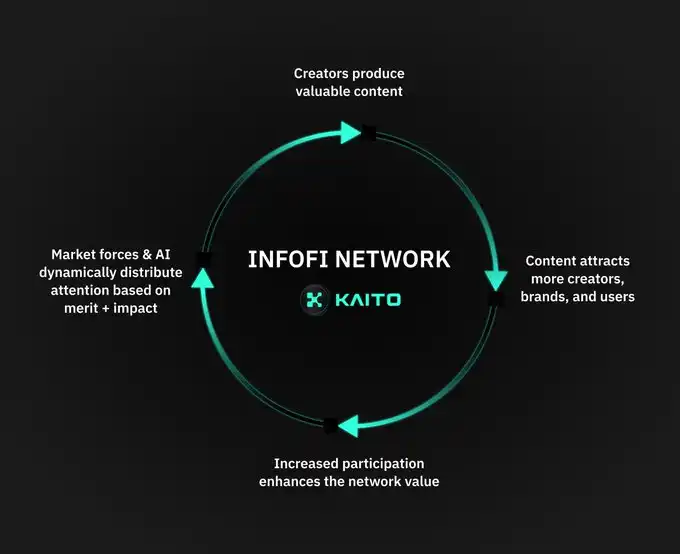

The term InfoFi was promoted by Kaito, but I think it goes far beyond the original definition. According to Grok (quoting Kaito), InfoFi is: “An emerging concept that combines financial incentives with the generation, verification and distribution of information, often based on decentralized systems.”

The goal is to use market forces to solve problems in today’s information economy, such as unreliable data, algorithmic bias and unfair distribution of value, to ensure that information is more accurate, credible, and efficiently organized and disseminated.”

While this definition is reasonable, I think InfoFi represents something deeper. In essence, InfoFi is tokenization of the information supply chain itself.

Its core philosophy is that information is not just free-it is a resource that can be priced, traded and optimized through financial mechanisms. For decades, the way to realize attention has been to first create an independent product and then direct attention to that product. This model works well, for example:

·Food blogger → restaurant/condiments (Uncle Roger, David Chang)

·Fashion bloggers → personal clothing brands (Alexa Chung, Kardashians)

·Fitness blogger → Protein powder/energy drink (Christian Guzman)

·Investors & Financial Institutions → Financial Products (ARK Invest, VC Funds for LP/HNWIs)

·Fake financial mentor → trading signal group (understand everything you understand)

·Toxic masculinity blogger → pyramid scheme scams (everyone understands)

But now, we are standing at the threshold of direct trading of “mind possession”.

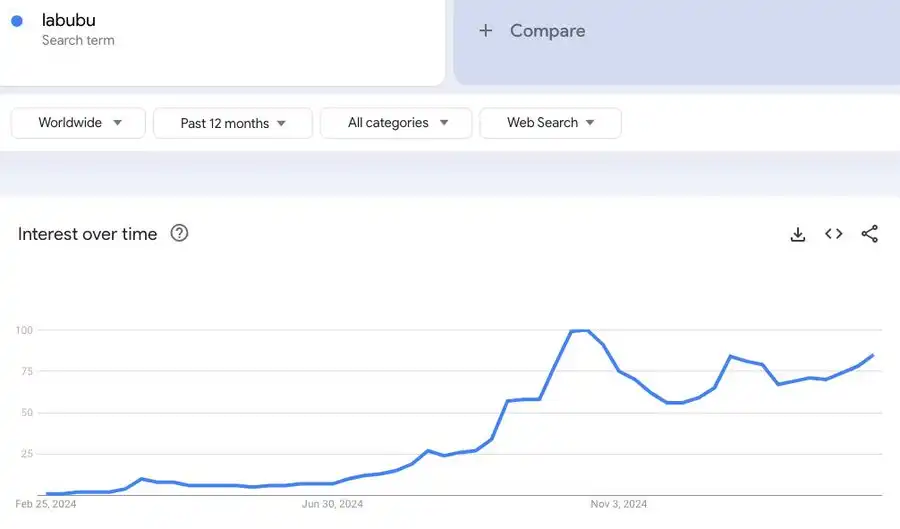

Imagine a world where people no longer need to create derivative businesses, but can directly invest and trade cultural trends, narratives, or attention cycles. For example, when Labubu exploded, there was no effective way in the market to bet on its continued popularity. Although there is a brief appearance of memecoin (LABUBU), its price movement has little to do with actual trends-it is more influenced by the overall sentiment of the crypto market than by pure mental share.

InfoFi offers a new option: a more direct and liquid mechanism that allows people to directly speculate on attention itself.

Key to InfoFi’s growth: The role of trusted oracles

For InfoFi to truly become a reliable market, there must be a trusted oracle data source to ensure that off-chain information is safely and untampered with. Since the nature of InfoFi transactions revolves around narratives, trends and market sentiment, real-time data streaming becomes crucial.

Currently, oracle solutions such as UMA, Chainlink, Pyth, and API3 have played an important role in the DeFi market. These oracles provide off-chain data services to apps, allowing them to settle bets, verify market trends, and aggregate price data from multiple sources.

Current Oracle Infrastructure Challenges

Despite the progress made in decentralizing Oracle, there are still several challenges that hinder InfoFi’s development:

1. Lack of real-time sentiment analysis: While existing prophets focus mainly on price data or structured event outcomes, InfoFi needs to be able to track and quantify social sentiment, interaction trends, and viral data in real time.

2. Verificability and subjectivity issues: Unlike price data, sentiment analysis involves subjective judgment. How to ensure that data is objective, fair and not manipulated?

3. Scalability of data flow: While current oracles rely on limited verification data sources, InfoFi requires large-scale data aggregation, including news, social media, predictive markets, forums, etc., to provide accurate insights.

4. Risk of data source manipulation: InfoFi relies on speculative narratives, so malicious manipulation (such as robot farms, false interactions) may affect market trends, and the oracle must have the ability to detect and filter these abnormal data.

5. Financial incentives for data providers: Who will verify whether the data provided by the oracle is reliable? Designs such as mortgage mechanisms, penalty mechanisms, reputation scores, etc. must be strong enough to ensure that data providers report honestly.

The next generation of InfoFi Oracle will rely on AI data aggregation, incentive-aligned reputation mechanisms, and real-time trend verification to ensure that narrate-based financial products are secure, scalable and anti-manipulation.

InfoFi’s market expansion: From predictive markets to digital mental trading

Forecasting markets have long been the prototype of InfoFi, allowing speculators to bet on real-world events based on information advantages.

Platforms such as Polymarket, Kalshi, and Augur have demonstrated this potential, but the overall adoption is still niche.

Data markets are a similar attempt. As early as the ICO boom in 2017, some people tried to commoditize and trade data, but due to unclear value propositions and inefficient Token economic models, they could not be truly implemented.

InfoFi is a more mature, extensible version of these concepts. It’s not just betting or trading data, but turning “mind share” into a tradable asset class.

Possible InfoFi markets include:

·Narrative ETF: A tokenized basket that tracks hot trends (such as the “AI Hotspot Index” and “Metaverse Concern Index”)

·Internet celebrity financial tools: Tokenization of content creators ‘share of revenue, allowing fans to speculate on their future influence

·MemeCoin derivatives: a more sophisticated way of cultural speculation that is no longer limited to the traditional crypto token model

·Token-based media channels: The ownership of the content platform is fragmented and tradeable, making profits based on the subscription model

Summary of core views

InfoFi subverts the concept that information is free: it advocates that attention, narrative and data are inherently valuable assets that can be traded, speculated and financialized through structured financial instruments.

InfoFi is an inevitable evolution of the attention economy: as mind occupancy increasingly determines financial outcomes, markets will develop ways to directly capture and monetize attention cycles.

·InfoFi opens up new financial markets: It is no longer turning attention into commercial products, but directly speculates on cultural hotspots, Internet celebrity growth and trend changes.

·The key to InfoFi’s success lies in product-to-market fit (PMF): To become a true financial paradigm, rather than just another DeFi gimmick, InfoFi needs to create a highly liquid, scalable, and sufficiently attractive trading mechanism.

future prospects

InfoFi is still in its early stages, but the financialization of attention has become an inevitable trend. Whether it is through predicting markets, Internet celebrity financial products, or tokenized trend trading, the core of the next wave of financial innovation will be how to effectively measure and trade digital mental share.

“Original link”