There are no winners, but there is no endgame.

Written by: Deep Trend TechFlow

The president paints the door, celebrities issue coins, both long and short explosions, AI misfires… In the encryption market from the beginning of the year to the present, any single one in it can be enough for the majority of leeks to drink.

As a senior leek, it is also difficult not to drink these pots-weak points such as not getting enough information, listening to the wind, and having no discipline in trading are more likely to be amplified infinitely in the Scam Season and bear market, and losing money becomes a high probability event.

But it wasn’t just leeks that were injured.

When the market goes down, most people may not be the winner no matter how hard they work, including even KOLs.

KOL, who has always been regarded as standing on the same harvesting front as the project party, has also begun to lose money and complain endlessly in this round of bull-bear succession;

What makes them big leeks comes from the thing you never had a chance to touch, but now it has become a hot potato:

KOL wheel.

KOL round, from win-win tool to multi-lose trap

The bear market is often torn and coerced to defend rights, but I didn’t expect that KOL would also start to defend their own rights.

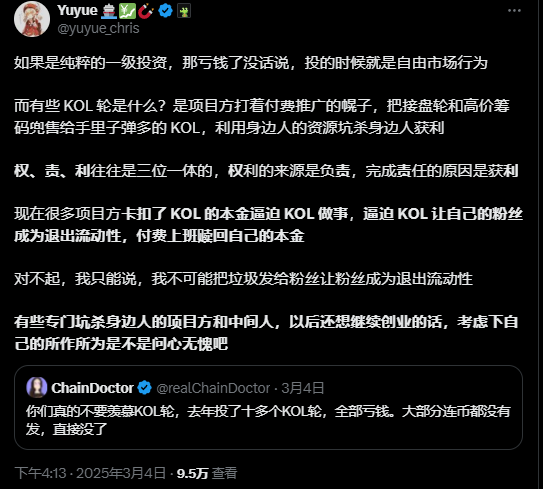

ChainDoctor sighed on March 4, 2025: Don’t envy the KOL round. Last year, he invested in more than a dozen KOL rounds and all lost money. Most of them didn’t even issue coins, and they were just gone.& rdquo;

Perhaps KOL’s loss acceptance ability is higher than leeks, but this does not change the fact that they are also losing money.

You can certainly regard it as a kind of performance and a miserable sale, but the fact that more KOL people don’t express their dissatisfaction proves in disguise that they have really been cheated.

After this post was posted, KOL bosses from all walks of life in the encrypted Chinese community began a collective criticism and complaint against the KOL round in the past few days. For example, the well-known KOL yuyue scolded very directly:

“Some KOL rounds are sold to KOL by the project party under the guise of paid promotion, and use the resources of people around them to profit from them.……”

You may also question the logic of KOL losing money, but in the entire token listing chain, KOL is actually at the ecological downstream.

The entire chain usually includes:

Seed rounds (early investors such as friends and family members participate), private equity rounds (for venture capitalists and strategic partners), KOL rounds (project parties sell them to KOL at a discount in exchange for promotion), public offering rounds (retail investment), and exchange listings (token trading).

The KOL round usually appears after the private placement round. Project parties sell tokens to KOL at low prices or discounted prices. KOL uses its influence on X and Telegram to promote the project and increase the project’s influence.

In a bull market, the KOL round may be a win-win weapon. The project party raises funds through the KOL round, and KOL makes money through the token cost price and the secondary price difference. Individual investors may also get a piece of the pie when the market is good.

But in a bear market, the situation is less optimistic.

Liquidity has dried up, secondary market trading volume has shrunk, and token prices have plummeted. Project parties often run away to cash out at the early stage, but KOL has been locked up. The usually 3 to 6-month lock-up period prevents KOL from selling in time, and the value of the token returns to zero.

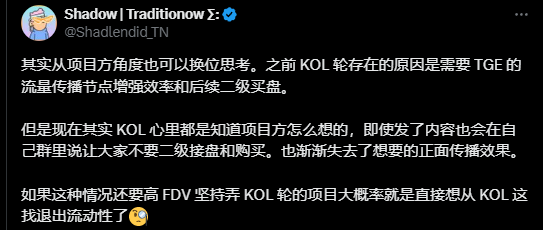

In the above posts, you can also see sharp comments:

"Nowadays, the kol wheel is a typical case of losing the wife and losing the soldiers. The project party couldn’t raise money and couldn’t cut it from the second level, so it started from kol who ate advertisements. Kol was equivalent to giving money and effort to give people.

This is no longer a passive stage when the market is bad and everyone understands each other. Instead, some project parties have even taken the initiative to take evil intentions and regard KOL as a part of exiting liquidity.

What is even worse is that KOLs are also facing a situation where they are attacked from both sides: the project party knows KOLs and is aware of the risks of this model, but still uses KOLs greed or survival pressure (traffic monetization need) to promote cooperation. KOL hopes to fight, but the results often backfire.

On the other end, retail investors ‘blind trust in KOL has decreased, and even a reverse indicator phenomenon has emerged (projects recommended by KOL are considered to fall). The promotion effect of KOL has declined, making it difficult for token prices to rise, further exacerbating the damage to his reputation.

If you leave without thinking about cutting a wave, who doesn’t want to cherish your feathers and lead everyone to earn it together?

From win-win tools to multi-lose traps, there may be no winners among most people standing downstream of the value chain in bear markets.

Agency, the professionalism of a broker

You may not know that there is another unknown role behind the KOL round in the crypto market: Agency.

Simply put, their responsibility is to undertake the promotion needs of the project party and help find suitable KOL on the market for promotion.

But the Agency’s responsibilities go far beyond matchmaking. They need to balance the interests of the project party and hope to attract the maximum traffic at the lowest cost, with the demands of KOL to obtain stable returns through promotion, protect capital and even make profits.

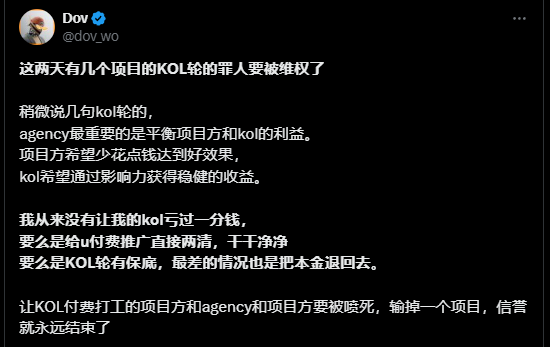

For example, Agency representative Dov posted:

"I have never let my KOL lose a penny. Either I paid for the promotion of U and paid for it directly, or I paid for KOL to have a guaranteed guarantee. The worst case scenario is to refund the principal.& rdquo;

From here you can see that the motivations and business capabilities of practitioners in any crypto ecosystem are actually mixed.

Excellent agencies will try their best to consider a minimum guarantee mechanism to ensure that KOL does not lose money, such as direct cash payment or KOL round principal refund. However, if the Agency lacks professional judgment and picks low-quality projects, KOL may face the risk of token depreciation, lock-up, and eventually lose money.

The fate of working people often depends on the professionalism of sending people.

In the chain of encryption marketing, perhaps only scammers want to do only one piece of business. Continuing to scam people in waves will make your business less and less, and the road will become narrower and narrower.

After all, no one is a fool. Lasting and win-win results is the way to make money.

But everyone may be a good broker in the downstream link, but it seems that they will inevitably become a victim in the upstream link.

There are no winners, but there is no endgame

The cruelty of the bear market is that it not only makes ordinary investors (leeks) feel the chill of the market, but also makes KOLs who once stood higher in the interest chain have to bow their heads and face reality.

In this cycle of alternating bulls and bears, project parties, KOLs, retail investors, and even agencies are all playing different roles, but in the end there is no winner.

KOL’s rights protection is actually a microcosm of the entire encryption ecosystem.

From a win-win tool in a bull market to a lose-lose trap in a bear market, the deterioration of the KOL round has exposed a deep-seated crisis of trust in the crypto market. The short-sighted behavior of the project party, KOL’s profit-seeking mentality, retail investors ‘blind follow-up, and even the Agency’s lack of professional capabilities are all amplified in this game.

When the market goes down, everyone is trying to protect themselves, but it is difficult to get rid of the fate of being harvested.

The cut-off of KOLs is not just a simple dispute of interest, but a reflection of the ecological imbalance of the crypto market in a bear market environment.When liquidity dries up and the capital chain breaks, all actors standing downstream of the value chain will become passive victims.

Looking back, the controversy over the KOL round was essentially a pain in the development of the industry.

When KOLs defend their rights, they are also speaking out for the entire ecology in disguise. Perhaps only after experiencing such a bear market can people truly understand that in a market without rules and trust, short-term winners will eventually become long-term losers.

But from a longer-term perspective, this may also be an opportunity to reshuffle the cards. Market lows are often the starting point for ecological optimization. Only by reflection and adjustment in pain can we usher in the next round of prosperity.

And will the next bull market come as scheduled? Perhaps it depends on whether every participant today can truly learn from the lessons of this bear market and find a new win-win balance.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern