Young people don’t believe in diamonds.

The higher the price of gold rises, the more heartbroken those who buy Pandora

Wen| Source Sight Zhou Yi

When buying gold is no longer the exclusive consumption of middle-aged women, the meaning of diamonds and crystals will also disintegrate. In the wave of consumption downgrades, value preservation will become the measure of all items.

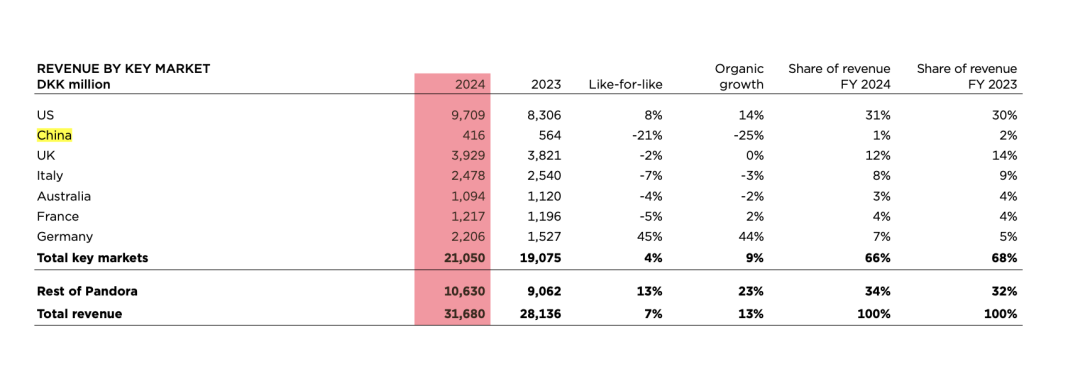

Light luxury jewelry brand Pandora recently released its 2024 financial report, showing that its same-store sales in China continue to decline, falling 21% this time. The proportion of revenue in the China market has dropped to 1%, and total revenue is DKr 416 million, the lowest in the world. Pandora believes that China is still in the process of recovering from the epidemic. Although the company will re-layout its brand around Shanghai from 2023, it still has no signs of vitality.

Compared with genuine gold ornaments such as Laopu Gold, Pandora, which uses silver and zircon as its main product materials, is in an increasingly difficult situation in the China market. There is another brand in the same boat, Swarovski. The trend caused by this pair of light luxury sister flowers

Luxury jewelry brands at the waist are experiencing a large-scale rise in gold prices and also experiencing an overall decline in luxury goods. Under the polarization, there is not much room left for them to struggle in the middle.

After five-year honeymoon, America saves Pandora

In five years, this is the honeymoon period for Pandora in the China market.

Pandora officially entered the China market in 2015 and was recorded in its financial report for the first time in 2017. At that time, its revenue reached 1.592 billion Danish kroner. In 2019, it reached 1.97 billion Danish kroner. At that time, China region contributed 9% of revenue.

In 2019, Pandora felt the weak performance of the China market, physical passenger flow continued to decline, and revenue had almost no growth compared with 2018. However, what Pandora didn’t expect at that time was that this was already the peak of the brand in China.

Then came the embarrassing period for this light luxury brand in China.

From 2020 to 2024, Pandora’s revenue in China has continued to decline. In 2024, its revenue will be only DKr 416 million, and its proportion of revenue has also dropped to 1%. The company said in its financial report that we are still committed to building a brand in China and are currently considering the next step. rdquo;

Screenshot comes from company announcement

Although Pandora mentions the situation of the China market in its financial report every year, as market contribution continues to decline, this emerging market that once had high hopes is no longer the focus of Pandora’s attention, especially in 2024. It decided not to purchase newly mined gold and silver for jewelry making, and then only use recycled precious metals. This setting is basically a bid farewell to the gold-crazed China market.

But because of similar environmental concepts, Pandora is still popular in Western markets.

In 2024, it will achieve growth of 14% and 45% in the United States and Germany respectively, while the U.S. market is far ahead with a 31% share. In addition to China, Pandora’s sales in Australia, Italy, France, and the United Kingdom are all falling. However, thanks to growth in the United States and Germany, its total revenue will reach 31.7 billion Danish kroner in 2024, an increase of 13% compared with 2023., it has achieved growth that exceeds market expectations and has experienced growth for four consecutive years.

For the China market, store closures are a very clear signal of reduction. In 2025, Pandora said it will optimize its store network and is expected to close at least 50 stores. Currently, the number of stores in Pandora is only 200, reaching more than 230 during the peak period.

From a marketing perspective alone, Pandora’s China strategy seems to be a failure. It first trampled on two spokespersons, Zhang Zhehan and Song Zuer, and then failed to achieve rejuvenation in its 2023 brand restart plan.

With an importance of 1%, Pandora’s investment in the China market should be nearing its end.

Swarovski’s 2024 results have not yet been announced, but judging from previous operating conditions, it has been in loss from 2019 to 2022, and its EBIT in 2023 has just corrected. Unlike Pandora’s overall revenue, which has been rising, Swarovski’s performance began to continue to decline after reaching its peak in 2017. In 2020, it also laid off 2000 people.

In 2013, Swarovski took the lead in entering international trade, similar to Pandora’s development. 2016 – 2019 was Swarovski’s peak period. Especially in 2016, China became Swarovski’s largest market in the world, but then As the company’s overall global revenue declined, the eclipse of the Chinese market was also visible to the naked eye.

Second-hand sold from China to the United States

A string of pure silver beaded bracelets and a crystal swan necklace, Pandora and Swarovski entered the China market with these two flagship products, becoming the first attempt for young consumers to get started with luxury brands.

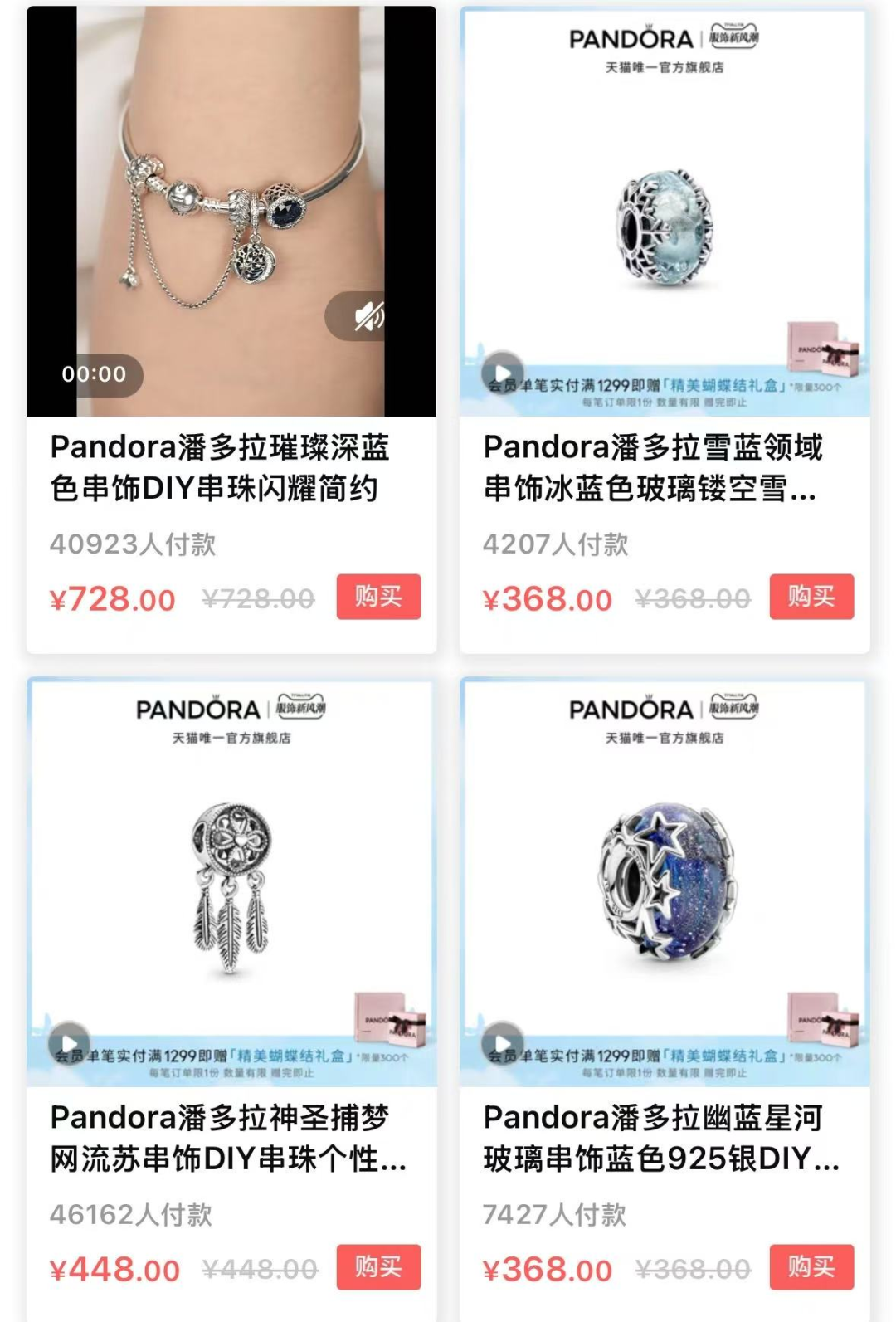

Pandora’s main product is beaded bracelets. Selling beads individually is also a major feature of the brand. Although the bracelet is less than 1,000 yuan from the unit price, a single bead costs 300-700 yuan. It is impossible to have only one or two beads on a bracelet. Over time, some bead farmers ‘full-level bracelets will eventually cost five to six thousand yuan.

But when it is put on the second-hand market, the situation is very different. On a second-hand website, there is a price of 29.9 yuan marked Pandora Beads that can be verified at the counter. There is also a post with a 30%-50% discount on internal purchasing. In the Little Red Book, there are also many people who have worked so hard to raise beads that only cost two to three hundred.

The screenshot comes from Salted Fish APP

If there is no one-tenth of the hedging rate, then Pandora’s collapse in the second-hand market is inevitable. A blogger who posted a post on Xiaohongshu to collect beads told Source Sight that he only accepts single beads of good quality. If he has never brought them, there will be 100 cases, usually thirty to forty. The bracelet is worthless at all”

Due to the common problem of silver jewelry, the silver edge of Pandora beads is easily oxidized and turned black. The bracelets many people exposed under the posts are really tears of the times.

However, it is worth noting that due to the popularity of overseas markets, the blogger mentioned that many of his second-hand customers are overseas students. Young people abroad rarely wear gold and still prefer personalized jewelry. Pandora’s single-bead design feels very good. If the aesthetics are enough, the bracelet you finally raise will be very beautiful and will be very popular in the social circle. rdquo;

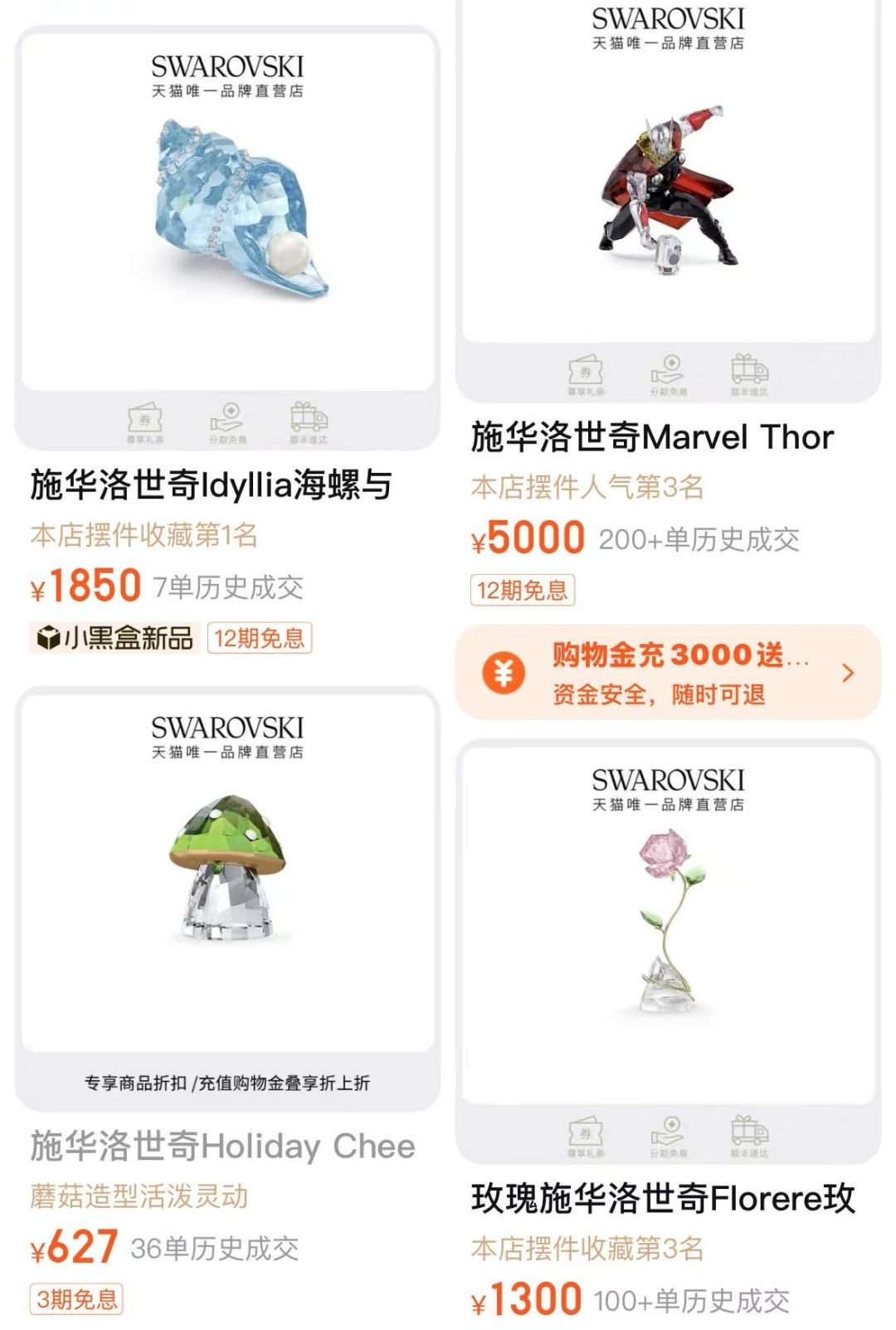

Compared with Pandora’s products, which are mainly zircon and silver and basically only have the uniqueness of jewelry, Swarovski’s products are more abundant. In addition to jewelry, they also include home ornaments and watches, and mainly focus on artificially cultivated diamonds and imitation crystals.

However, judging from the sales volume of e-commerce channels, even if it is co-branded with various brands, the sales volume of Swarovski’s crystal products is not outstanding. From the perspective of materials, although Pandora and Swarovski have difficulty maintaining their value, the crystal business has a deeper channel in China, and the emotional value contained therein cannot be shaken even by luxury goods.

“Metaphysical crystals have changed from an accessory to a track. Many bloggers have found a bowl of rice on the Internet based on their taboo analysis of various types of jewelry. Even the more advanced Van Cleef and Arpels need the help of Metaphysical guides to help sell goods.

Obviously, Swarovski’s meaning of crystal is outdated.

Can’t touch the golden edge of the old shop

From the perspective of the entire hard luxury market, jewelry and watches will encounter a cold winter in 2024. Even Rolex has frequently plunged in the second-hand market. In Gaozhuzhong, Cartier, Van Cleef and Arpels, and Bucelati are the top luxury brands. The products are still strong. Lifeng Group’s financial report for the first half of fiscal year 2025 mentioned that sales of the jewelry division dominated by the above three brands increased by 2%, and the overall revenue contribution has reached 70%.

The “2024 Mid-Year Update of Global Luxury Market Research” released by Bain & Company mentioned that consumers ‘purchasing decisions for jewelry, the best-performing category in the luxury market, often have investment purposes.

Similar to the dilemma faced by luxury goods, the deeper it sinks, the more difficult it becomes. The crisis faced by middle-waist jewelry brands not only comes from the crushing of their own kind, but also the fatal blow from the fierce gold to value preservation.

Although Chow Sang and Chow Tai Fook are facing performance pressure, they still have wedding gold ornaments as a basis. Waist luxury goods, mainly Pandora and Swarovski, can only rely on brand premiums. However, because they are unfavorable in China and cannot expand investment, the two brands ‘popularity and recognition in China continue to decline.

When Pandora and Swarovski became a kind of entry accessory for college students, essays about their boyfriends sending Swarovski to break up continued to undermine brand value, and marketing methods were expected to turn things around, and the road ahead was even less bright.

When the price of gold approached 900 yuan, Laopu Gold began to raise prices with a luxurious momentum and engaged in hunger marketing. Pandora’s diamond business was facing a full-scale collapse.

Relevant data shows that the price of natural diamonds will drop by 24% in 2024, from about US$4300/carat in December 2023 to the current US$3500/carat. De Beers, the world’s largest diamond supplier, cannot hold back the price cut. At the same time, artificially cultivated diamonds have begun to become popular. Swarovski launched the Galaxy boutique jewelry series made of cultivated diamonds in 2023, trying its best to follow the development of the times.

Van Cleef and Arpels Four-Leaf Clover Series

At present, only Van Cleef and Arpels has achieved growth in the four-leaf clover lift and has competed head-on with the gold market. For Pandora and Swarovski, Swan and Single Pearl are both waiting for a newer story.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.