Meituan survived Douyin and came to Jingdong.

Jingdong, why are you in a hurry to go to war?

author| Fixed focus One Su Qi

Jingdong, which seemed to have no intersection with Meituan, suddenly took out two cards: 5% commission, five insurances and one gold for the rider, and punched Meituan.

In fact, the two companies have already had a round of confrontation in 2024. Meituan’s instant retail business flash shopping will launch 3C digital and home appliances in 2024, which is Jingdong’s advantageous area; subsequently, Jingdong integrated and upgraded Jingdong Home and Jingdong Hour to Jingdong Second-Delivery, and launched the delivery of coffee and milk tea. The service is intended to gain a share of Meituan’s advantageous areas.

As the intersection deepens, Jingdong seems to be getting anxious.

In the first three quarters of 2024, although JD’s net profit maintained double-digit growth, its core businesses (3C digital and home appliances) revenue growth was weak and lacked eye-catching new businesses. It was even regarded by the capital market as a lack of imagination. Company.

Looking at Meituan, Meituan Flash Shopping, which is a business growth point, has leveled off its UE model by the second quarter of 2024, and some investors have begun to positively value this business. This also drove Meituan’s share price to rebound, reaching a high of HK$217 in the second half of 2024.

Business growth and stock price rise are both things Jingdong craves most at the moment. Jingdong must tell new stories to meet market expectations.

At the same time, opponents are also making frequent efforts. E-commerce rivals Ali and Pianduo have relied on AI and overseas markets to give sufficient market confidence. In addition to Meituan, in the instant retail industry, Hungry and Douyin are also increasing their numbers. They have announced that they will open 100,000 nearby stores within three years. The brand’s official flagship store is also a competition for small and medium-sized restaurants and super merchants with traffic.

However, instant retail, which is regarded as a battleground in 2025, is actually a hard job. Many industry insiders pointed out that this track not only needs to be transformed upstream in the retail industry, but also needs to continuously optimize supply and demand matching and capacity scheduling. The cycle is very long. Meituan took the lead, but Jingdong, which has transportation capacity and warehousing, is not completely unlicensed.

Jingdong needs a new story

Jingdong did make a lot of money in 2024.

After former CFO Xu Ran took over as CEO, he began to maintain profits. Net profit in the first three quarters maintained double-digit year-on-year growth (18.81%, 96.36%, and 56.11% respectively), but revenue, especially revenue from core categories, is about to rise.

Specifically, its revenue growth in the first three quarters of 2024 was 7%, 1.2%(the lowest since 2023) and 5.1% year-on-year respectively.

For reference, Pendoduo’s revenue growth rates during the same period were 130.66%, 85.65% and 44.33%, respectively. The trend declined but remained at double digits; Alibaba Taotian’s revenue growth rate almost stalled, at 4%,-1% and 1% respectively, but international business made up for it, with growth rates of 45%, 32% and 29% respectively, pulling back the game.

Although both are e-commerce companies, Pinduoduo and Alibaba are platforms, and they mainly earn commissions. Jingdong is mainly self-employed and earns price differences. It is expected that there will be a ceiling in revenue. However, it is worth noting that Jingdong’s core categories of electronic products and household appliances have encountered bottlenecks. The revenue growth rates in the first three quarters of 2024 (5.3%,-4.6% and 2.7% respectively) are not as good as that of daily necessities (8.6%, 8.7% and 8% respectively).

This is due to the stimulating effect of the national subsidy policy, which may not be reflected in the Q4 financial report until the Double 11 and the promotion discounts are released together. In contrast, daily necessities are purchased frequently, and most of the instant delivery business that Jingdong has launched in the past two years is in this category, which has promoted growth.

On the other hand, it is affected by the external competitive environment. Qing Song, a retail industry practitioner, said that firstly, categories such as 3C Digital, which are more emergency, gift-giving, and buy-and-enjoy scenarios, have had an increasing penetration rate on Meituan and Enimo in recent years, which has a squeezing effect on Jingdong. Secondly, the standardization of major appliances is high, the unit price is high, and there are many stores. Meituan and other channels are also actively competing for this group of merchants. Third, in 2024, all online and offline channels have launched national subsidies, spreading Jingdong’s market share.

Compared with the fact that its core categories are not rising, Jingdong’s longer-term worry is that its competitors have found new growth curves.

Ali’s big open source model Tongyi Qianwen released its latest model Qwen2.5-Max on the first day of the Chinese New Year. After the year, it won Apple’s big order. The market believes that its model performance and open source ecosystem have been far underestimated before.

Temu, an overseas e-commerce company, was recently announced by data platform Sensor Tower to become the world’s most downloaded shopping application in 2024, with downloads reaching 550 million, a year-on-year increase of 69%. At the same time, Pinduo recently reported that it has established an internal e-commerce recommendation model team.

Jingdong may be relatively conservative in investing in new business for the purpose of protecting profits. Its new businesses include Dada, Jingdong Industrial Development, Jingxi and overseas businesses. The overall volume is small and most of them are in a state of loss or scale reduction, which also reduces Jingdong’s motivation to continue to invest to a certain extent. In the first three quarters of 2024, Jingdong’s new business accounted for only 1.78%, with a total loss of 1.980 billion yuan.

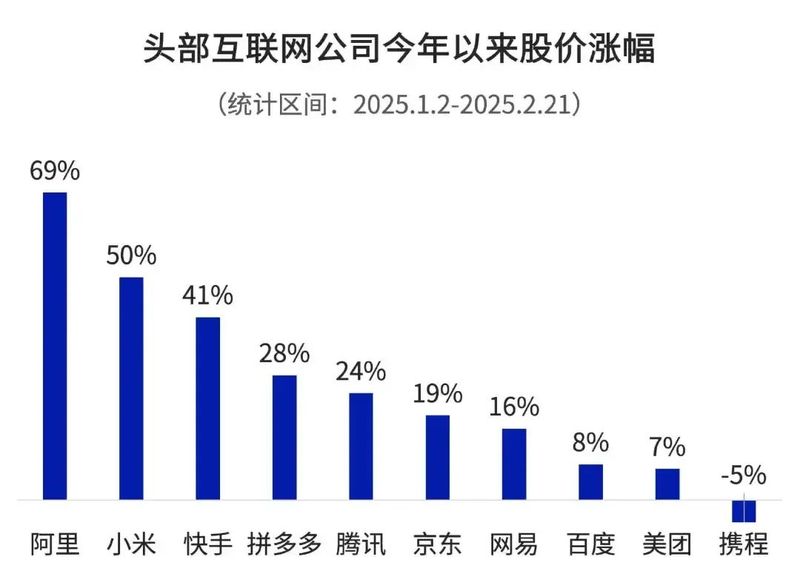

Without the support of new business, on the one hand, Jingdong’s profit scale will not increase, maintaining at around 10 billion yuan; on the other hand, it seems to lack momentum. Against the background of the general rise in China’s stocks this year, its share price has not increased as much as that of Alibaba and Pianduo, and its market value is not as good as that of its rivals.

As of the close of trading on February 27, Jingdong’s share price was HK$168.1, and its market value reached HK$484.7 billion. Alibaba’s share price has risen by more than 60% so far this year. The latest closing price is HK$136.9/share, and its market value reaches HK$2.6 trillion. Pinduoduo is US$119.77 (approximately HK$931)/share, with a market value of US$164.8 billion (approximately HK$1.28 trillion).

Whether it is to stabilize its core business or develop a second growth curve to drive up its share price, JD needs a new story.

How many cards does Jingdong have for making takeout?

This time, JD. com broke the situation with takeout stories, and successfully included Meituan, Enimo and Douyin into the opponent camp.

As early as 2022, Jingdong actually reported a pilot catering takeout business. At that time, JD. com was focusing on local life and planned to let takeout merchants launch on the JD Home-to-Home APP, with Dada responsible for delivery, but the takeout business was not launched in the end.

“In May 2024, Jingdong’s home-to-home service will be integrated and upgraded to Jingdong Seconds Delivery. The Seconds Delivery Zone will be launched on the homepage of Jingdong App (the fastest delivery time is 9 minutes), highlighting the coffee and milk tea category and can be said to be the predecessor of the takeout business.”“”“”“” Until this time, the quality takeout area was highlighted on the front page of the Jingdong App and it officially entered the takeout area.“”

The left is the page after Jingdong’s revision, and the right is the page before the revision

Jingdong has ready-made rider transportation capacity and brand resources, so it is not difficult to make takeout. Moreover, the take-out business can supplement Jingdong’s order delivery in seconds, and can also increase the opening rate and repurchase rate of the main station through the logic of high-frequency and low-frequency, ultimately driving the transformation and growth of other categories. This is a plausible story.

So how many cards does Jingdong have when making takeout? “Fixed Focus One” was measured.

In terms of merchant supply, JD. com takeout mainly promotes quality takeout, that is, the on-line catering brands with in-house food, which is different from some workshop-style small takeout shops. However, these catering brands are also online in Meituan and Eniao, and the supply side is less differentiated.

In terms of price, taking the same Drunken Noodles store as an example, Jingdong has the cheapest takeout price. On the one hand, the platform has subsidized stores that have low prices. Secondly, a 7-yuan coupon is issued every day during this period, but Jingdong’s delivery fee is higher than that of the other two companies. At the same time, Jingdong takeout merchants currently do not have any such operations as collecting and delivering small dishes.

From left to right, there are Jingdong takeout, Meituan and Hungry?

In terms of delivery timeliness, the delivery of Jingdong’s seconds (including takeout) is completed by Dada, and the delivery time of Jingdong’s takeout is within half an hour. However, Jingdong takeout cannot currently be placed in the takeout cabinet, causing trouble for both users and riders.

Qingsong pointed out that Jingdong Direct’s previous advantage was guaranteed authentic products + faster delivery, which may also become Jingdong’s advantage in takeout. For example, the takeout on Jingdong can see the kitchen situation and refuse pre-made dishes, etc., establishing user trust. Degree, but this requires Jingdong to get the right to speak on the merchant side.

In addition to the above-mentioned hard indicators that users care about, Jingdong attracted so much attention this time because it took the lead in paying social security to takeaways, reducing commissions to merchants, and providing subsidies to new users, attracting a wave of favorable feelings.

In terms of commissions, it was first reported that Jingdong takeout only received 5% commission, which was lower than Meituan. On February 8, Meituan responded to the media saying that the merchant commission rate of Meituan takeout merchants was 6%-8%. On February 11, JD. com announced that merchants who settled before May 1 would waive commissions for one year, but did not mention the specific commission ratio after one year.

It is worth noting that while the subsidy war is underway, Dada, which has not been profitable, may have further losses.

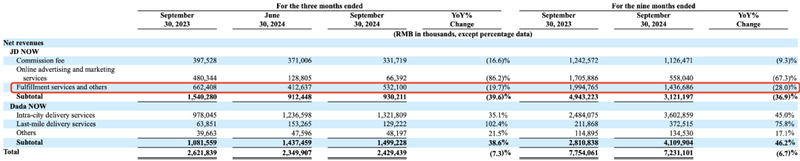

Dada’s financial report includes two revenue items, Jingdong Seconds Delivery and Dada Seconds Delivery (delivery to third-party merchants and individuals). Since February 2024, Jingdong Second-Delivery has launched a strategy of reducing and reducing delivery fees by over 29 yuan, which has sacrificed Dada’s delivery revenue. According to Dada’s financial report, in the first three quarters of 2024, revenue from Jingdong’s seconds delivery business fell by 36.9% year-on-year, of which performance services and other revenue fell by 28%. Jingdong takeout will continue to increase Dada’s burden.

An e-commerce person analyzed that Jingdong’s takeout seems to be a counterattack after its core business was robbed. No matter how much the odds of winning, it distracts its opponents first.” ldquo; Takeout has long been in an oligarchic situation. Once the winner takes all, the price will rise. The emergence of catfish will promote the industry to develop in a more benign direction.” rdquo; He believes that this is a long war.

Instant retail is a must-fight battle in 2025

Jingdong’s takeout is not only a counterattack against competitors, but also an important layout in the instant retail field.

This is a market with a scale of one trillion yuan and maintaining an average annual growth rate of more than 50%. It also has a high proportion of young users and strong purchasing power.

E-commerce companies with product supplies (Jingdong Second-Delivery, Panduo Local Life), takeout platforms with delivery systems (Meituan, Enamo), and live broadcast platforms with online traffic (Douyin takeout business has been merged into Henda Business), all want to find the next growth curve.

According to financial report data, it can be seen that compared with its competitors, Meituan is the largest in the instant retail industry. Meituan’s core local businesses are divided into in-store businesses (wine tourism, catering) and in-home businesses (takeout, flash shopping). The instant retail business represented by flash shopping is an important growth point.

Revenue scale: In the third quarter of 2024, Meituan’s distribution service revenue reached 27.784 billion yuan, Ali’s local life group (including Enliao and Gaode) revenue was 17.725 billion yuan, and Jingdong’s second delivery revenue was 930 million yuan.

Rider size: As of 2024, the number of riders in Meituan is 7.45 million, the number of active riders in Hunma exceeds 4 million, and the number of active riders in Jingdong Dada is about 1.3 million every year.

Order volume: In the first three quarters of 2024, Meituan’s real-time delivery transaction order volume reached 18.708 billion orders, and the total order volume of Dada (Jingdong Seconds Delivery + Dada Seconds Delivery) was 1.882 billion orders. The order volume of Hunma has not yet been announced.

Photo Source/Jingdong Second-Send Video Number

Instant retail simply means 30 minutes for everything to get home.

Chen Li, an investor familiar with Meituan, told “Dingfocus One” that in order to meet users ‘deterministic lifestyle, users need to first establish their order needs and stickiness on the platform, and then the platform can meet users through rich SKUs and performance timeliness. Demand, three elements are indispensable.

The dominant competitive point of this track is the distribution scheduling of riders and the number of platform users. In fact, many industry insiders pointed out that the difficulty of instant retail lies in the supply of goods, which relies heavily on local stores and warehousing. This is what Meituan has been promoting in the past two years. The lightning warehouse model. At present, Meituan’s self-operated Lightning Warehouse is a squirrel convenience and a crooked horse delivery of wine. The more well-known partners are Mingchuang Products.

Chen Li explained that the lightning warehouse is similar to the front warehouse in fresh food e-commerce, which can make delivery faster, but the SKUs are richer. Because these warehouses only do online business, they have low site selection requirements and lower rent and labor costs. After building a warehouse, Meituan gives a sales forecast through its self-built morning glory system, the merchants adjust and replenish the inventory. After running in the data, the single warehouse model will be able to run through. Before then, consider meeting user needs first.

Both Jingdong and Huneme know the importance of warehouses. After Meituan announced last year that it would open all 100,000 lightning warehouses by 2027, Hunger also announced that it would open all 100,000 NFC brand flagship stores by 2027. Jingdong is also working hard to open positions, but it is doing more heavily. It is more self-operated Yuncang, Jingdong Supermarket, Qixian Supermarket, etc., which has higher costs.

Chen Li pointed out that there are two major difficulties in real-time retail. One is how to differentially group the goods in the warehouse according to the population density and population needs in the covered area. The more accurate the data, the less redundant the SKUs can be and can be dynamically adjusted; Second, real-time retail is not a cost-effective logic. How to meet users ‘price comparison needs and how to persuade users to pay for the delivery experience takes time.

Based on the views of many industry insiders, the real-time retail track will have the following two major trends in 2025:1. Strive to sink the market, embrace dealers in the sink market, and further compete for and consolidate the mentality and consumption habits of users in the sink market (some are high-line urban returnees). 2. Expand the categories of commodities, from standard products to non-standard products, and from daily necessities to durable products.

From a retail perspective, Qingsong believes that the real-time retail track is a track that has to be laid out in 2025 for the platform. In the past, for many brands, whether it was stores, takeaways or e-commerce, they were actually channels for selling goods and providing traffic. However, in addition to being open 24 hours a day, instant retail can also reach younger users, explore users ‘consumption needs and scenarios, and use different product and gift combinations to increase sales and promote new products. This is an incremental value for brand owners.

However, instant retail is a business with a high moat. Like takeout, it relies on hard work to hone efficiency to make money. In this regard, both Meituan and Jingdong have this gene. In the past few years, Internet companies have been stuck with the question of whether to grow or make profits. In 2025, the answer to this question may be reversed. nbsp;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.