① Morgan Stanley analysts predict Tesla’s share price will rise to $430 as Tesla diversified into AI and robotics.

② Jonas predicts that Tesla’s full-year deliveries in 2025 may decline year-on-year, but create an attractive entry point for investors and relist Tesla as the “preferred stock” in the U.S. auto industry.

Cailian News, March 4 (Editor Huang Junzhi)Morgan Stanley analyst Adam Jonas predicted on Monday that Tesla’s share price would rise to $430 as the company diversified into artificial intelligence (AI) and robotics.

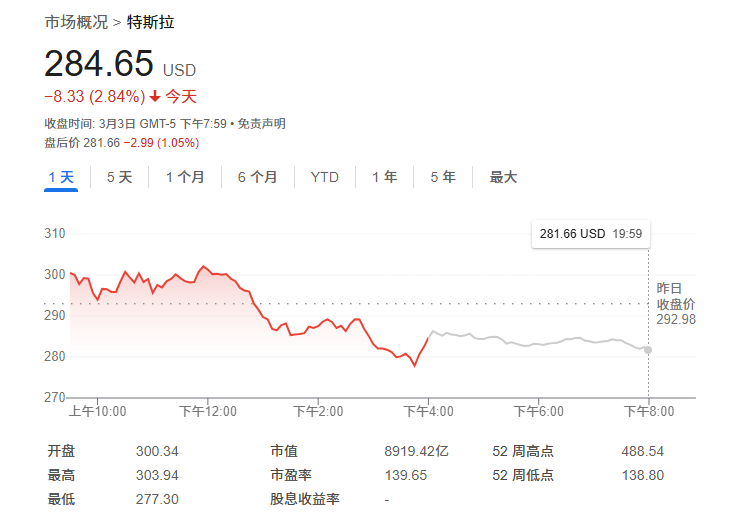

Tesla’s share price plunged nearly 28% in February as sales of electric vehicles fell, further exacerbating investors ‘concerns about CEO Musk’s involvement in politics.Data shows that in January this year, Tesla’s sales in Europe fell sharply by 45% year-on-year, while overall electric vehicle sales in Europe increased by 37% during the same period.

Tesla’s share price closed down more than 2.8% on Monday amid a general sell-off in technology stocks.Since hitting a closing high of $479.86 in mid-December last year, Tesla shares have almost given up 40% of their post-election gains.

Jonas predicts that Tesla’s full-year deliveries may fall year-on-year in 2025, but this “creates an attractive entry point” for investors. The analyst re-listed Tesla as the “preferred stock” in the U.S. auto industry, with a target price of US$430, which means there is more than 50% room to rise compared to the current share price.

“Tesla’s decline in car deliveries marks the company’s transformation from a ‘pure car company’ to a highly diversified artificial intelligence and robotics company.”He added.

Jonas also wrote in his latest report: “As we continue to analyze the overlap between artificial intelligence and robotics, we become increasingly aware that business opportunities in non-automotive areas of artificial intelligence may be greater than those in self-driving cars.”

The strategy of Tesla led by Musk seems to coincide with what Jonas described.Over the past year, Musk has gradually shifted Tesla’s strategic focus to robotic taxis and artificial intelligence,Although industry experts generally believe that the large-scale popularization of these products will take many years and face multiple challenges such as regulatory approval and technological maturity.

But as many analysts point out,Although new competition has eroded Tesla’s sales, public opinion surrounding Musk himself and his efforts to enter politics have also had an impact.

On Saturday (March 1) local time, demonstrators gathered outside Tesla car stores in many places in the United States to protest Musk’s push for cuts in federal spending at the request of U.S. President Trump.

In February, protests broke out in Tesla showrooms across the country, coupled with Musk-led General Electric’s firing of government workers, and many people raised fierce criticism of Tesla’s CEO and Republican lawmakers.

Musk’s critics want to stop people from buying Tesla cars and make buying Tesla a “stigmatized” behavior, thereby hurting Tesla sales. They pointed out that Musk’s actions blatantly violated Congress’s power to control the U.S. budget and that there were many ways in which he could enrich his own pockets.

But despite the many headwinds, Jonas is not the only bullish Tesla. Last month, well-known Wedbush analyst Dan Ives reiterated his “stronger-than-market” rating on Tesla and a price target of more than $500.