Real competitiveness is long-term doctrine.

Revelation of “Snow King” IPO: Behind the market value of 100 billion Hong Kong dollars, more than 20 years of hard work

author| Dingjiao One Chen Yi

The Hong Kong Stock Exchange ushered in a phenomenal IPO. On March 3, Mixue Ice City, the world’s largest existing beverage company, officially rang the bell for listing. On the day of listing, the company’s opening price was HK$262.00/share, an increase of 29.38% from the issue price, corresponding to a total market value of HK$98.790 billion. As of press time, Mixue once rose by 40%, with a market value of HK$105 billion.

Previously, Snow King’s new record set a new record for Hong Kong stocks.“” As of the morning of February 26, the public offering of Hong Kong stocks in Mixue Ice City (02097.HK) officially ended. The financing subscription multiple reached 5,258.21 times, and the subscription amount exceeded 1.82 trillion Hong Kong dollars, far exceeding the record of 1.28 trillion Hong Kong dollars set by Fast Hand in 2021, becoming the new champion of frozen capital in Hong Kong stocks.“”

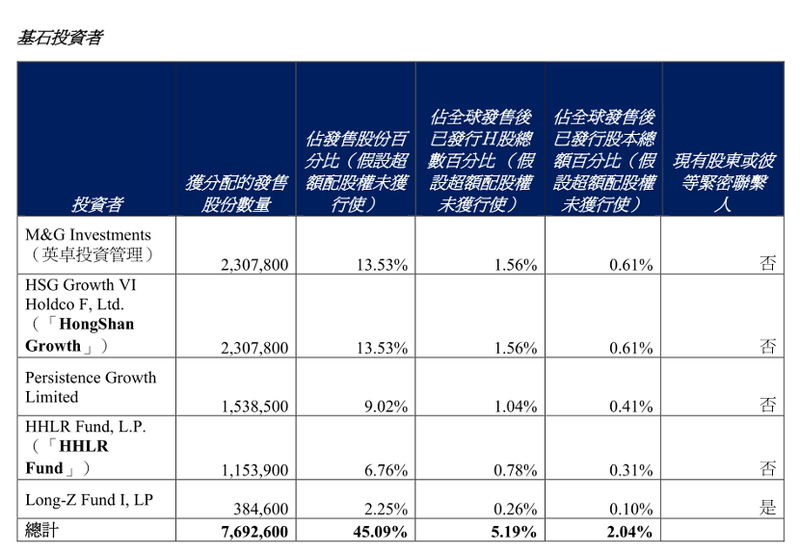

This is not simply emotion-driven, as can be seen from the cornerstone investors it introduces. Generally speaking, the stronger the cornerstone investor, the more enthusiastic the market is.

Mixue Ice City has gathered five top cornerstone investors M G, a European asset management giant; Sequoia China has invested in super cases such as Ali, Meituan, and Pinduo; Boyu Capital’s investment preferences include early market layout and continued attention to high-growth industries; Hillhouse has been accompanying Jingdong for 10 years and is the number one player of long-term doctrine; Meituan Longzhu is backed by local lifestyle giants and understands the logic of China’s sinking market.

Source/Announcement of Distribution Results of Mixue Ice City

The five cornerstone investors subscribed for a total of US$200 million in shares with a six-month lock-up period, which is equivalent to injecting a key to Mixue Ice City’s share price.

The collective support of top institutions shows the capital market’s recognition of their long-term value. An investment industry practitioner concluded that in the consumer track, Mixue Ice City’s store size, supply chain infrastructure and international layout can be called a triple moat.

It took Mixue Ice City 28 years to complete the transformation from a street shaved ice stall in Zhengzhou to a modern beverage empire with 46,000 stores around the world; it took more than ten years to realize the supply chain infrastructure from upstream raw material procurement to midstream production and processing, warehousing, logistics and transportation; and it took another seven years to replicate this system overseas, becoming the largest modern tea beverage brand in the Southeast Asian market.

Looking at the consumer sector in China, a company with these three capabilities at the same time can be regarded as an isolated example, and each capability is built in a decade. From this perspective, top institutions are not investing in the pure milk tea business, but are betting on a model: Mixue Ice City is polishing its mature single-store profit model and chain operation experience in the Chinese market, and through modular supply The chain is shifting to emerging markets, and the sword is to create Oriental Coca-Cola global consumer carrier that carries the efficiency and cultural symbols of China’s supply chain.

From 0 to 46,000, the Snow King spent 28 years

In many people’s perceptions, Mixue Ice City is a national ready-made beverage brand rooted in the streets. But if viewed from a more ambitious perspective, its similarities with Coca-Cola lie in that it uses decades of strategic determination to reconstruct the underlying logic of the consumer industry and uses time to build competitive barriers.

Coca-Cola’s shelves occupy the world’s supermarkets and vending machines. Behind it is the fact that it has built a network of bottling plants around the world in a century. Mixue Ice City’s density of 46,000 stores worldwide makes it a reality that the world is a huge Mixue Ice City.

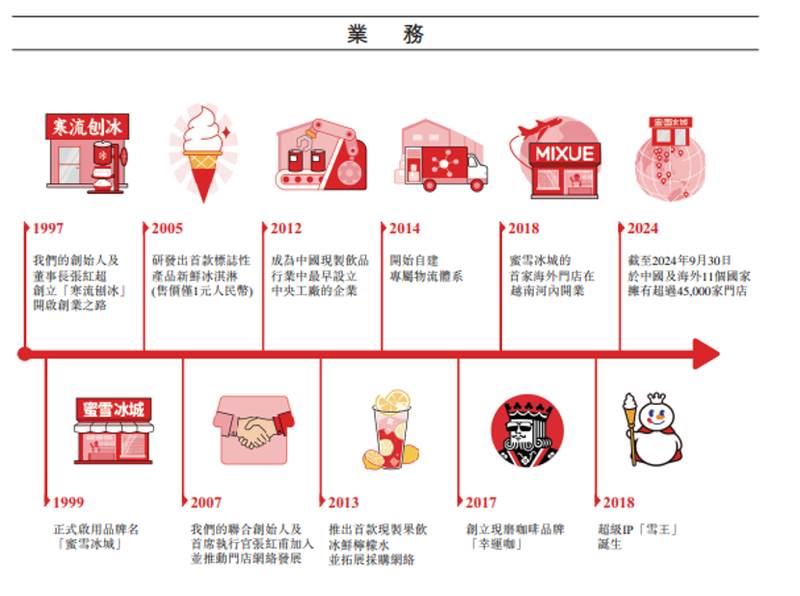

In 1997, Mixue Ice City started as a street shop selling shaved ice; in 1999, the Mixue Ice City brand name was born, focusing on high quality and low price. In 2006, 2 yuan ice cream was launched (after using coupons). In 2007, the first fresh ice cream shop officially opened, and the business was booming, attracting relatives and friends to join.

While its peers are chasing traffic from commercial centers, Mixue Ice City has quietly developed the survival skills of ant soldiers in urban villages, university towns, and industrial areas. Some practitioners have commented that Mixue Ice City’s survival wisdom accumulated through hard work in the low-price market is not something that can be achieved quickly by an Internet celebrity brand that has been promoted by capital.

The advantage of this long-term approach is that the development trajectory of the company is like bamboo slowly taking root five years before growth and growing 30 centimeters every day in the later period.

In 2018, once the image of Snow King was launched, it completely enriched the brand temperament. The snowman wearing a crown and holding an ice cream scepter in his hand, together with the brainwashing song “Honey Snow Ice City Sweet Honey”, quickly became popular all over the country.

By 2020, Mixue Ice City has opened tens of thousands of stores, completing the leap from a regional brand to a national brand, and becoming the first existing beverage brand with a scale of 10,000 stores in China.

Since then, Mixue Ice City has launched a rapid growth model. But unlike capital-catalyzed franchise expansion, its expansion strategy has always emphasized quality priority, and still maintains a franchise application approval rate of less than 5% per year, with the purpose of ensuring store survival and long-term competitiveness of the brand.

Just like Coca-Cola takes root in the capillaries of the global market through its distributor network, Mixue Ice City builds stores into nerve endings that reach consumers by sharing benefits with franchisees.

In 2022, Mixue Ice City will accelerate its journey to sea. Soon, it will establish its status as the largest producer of freshly made drinks in the sea with 4800 overseas stores and the number one store in Southeast Asia.

Looking back on Mixue Ice City’s 28-year growth path, we will find that when some brand pursuits broke out in the short term, Mixue Ice City chose a long-term path: focusing on the main channel and practicing hard basic skills.

Source/Mixue Ice City Global Release Announcement

14 years of hard core supply chain

Mixue Ice City’s supply chain infrastructure is not achieved overnight, but the result of more than ten years of hard work. From self-built factories to global procurement networks, every step embodies the ultimate pursuit of high quality and affordable prices.“”

In order to control the cost of a glass of lemonade, Mixue Ice City spent six years taking root in Anyue, Sichuan, to establish a lemon planting base and storage system. Its cold chain logistics network is a microcosm of hard work: from the cramped size of only 5 warehouses in 2020 to 27 warehouses covering the country now, Mixue Ice City uses a digital system to strictly control temperature and timeliness to ensure that every drink is fresh from raw materials to stores.

Through hard work, Mixue Ice City has finally built the deepest moat in the modern beverage industry with a huge size of 46,000 stores.

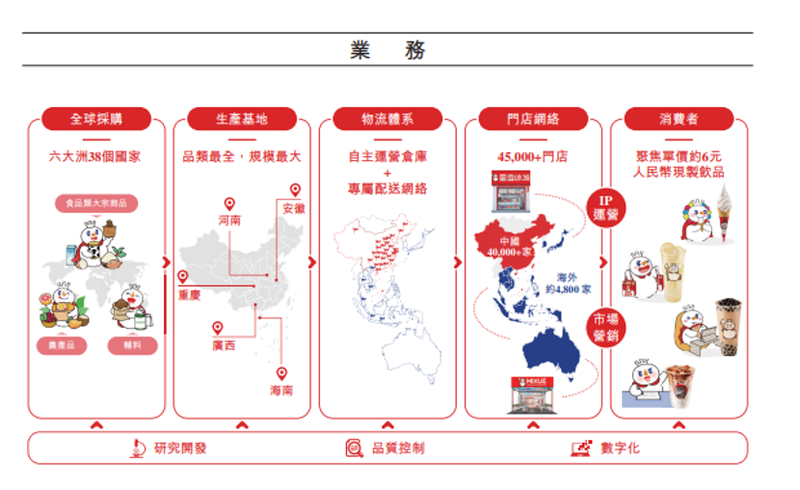

The prospectus mentions that currently, Mixue Ice City has built the largest and highly digital complete end-to-end supply chain system in China’s existing beverage industry, covering key links such as procurement, production, logistics, R & D and quality control.

Source/Mixue Ice City Global Release Announcement

In terms of procurement, Mixue Ice City’s procurement network has covered six continents and 38 countries around the world. In 2023, Mixue Ice City will purchase approximately 115,000 tons, 51,000 tons, 46,000 tons, 16,000 tons, and 16,000 tons of lemons, milk powder, oranges, tea, and green coffee beans respectively.

Under large-scale procurement, Mixue Ice City can purchase core raw materials at prices lower than the industry average. Taking milk powder and lemons of the same type and quality as examples, the procurement costs of Mixue Ice City in 2023 are about 10% and more than 20% lower than the average of the same industry respectively.

In terms of production, Mixue Ice City has five major production bases in Henan, Hainan, Guangxi, Chongqing and Anhui, covering a total area of about 790,000 square meters, and an annual comprehensive production capacity of about 1.65 million tons, covering sugar, milk, tea, coffee, There are seven categories of freshly made beverage ingredients: fruits, grains and ingredients.

Through a complete end-to-end supply chain, Mixue Ice City has formed a unique competitive advantage. This competitive advantage can bring at least three results: ① Where there are people and needs, Mixue Ice City can achieve store coverage, making complete national character possible;② It has a very broad source of raw materials and a high degree of flexibility. Own production lines and strong quality control allow the product to continue to have vitality;③ Through the overall cost smoothing ability, we always maintain a parity positioning and implement the ultimate cost performance to the end.

“Snow King ‘s growth code: supply chain + digitalization + brand IP

More than ten years of strategic determination have helped Mixue Ice City lock in its current victory and laid the foundation for future growth.

As the world’s leading player in freshly made drinks, Mixue Ice City still has a lot of core growth space.

As of September 2024, Mixue Ice City has 23,000 stores located in third-tier cities and below, forming a low-price barrier through the 6-yuan parity strategy. Despite intensified competition in the sinking market, there are still structural opportunities for Snow King.

Although Mixue Ice City has covered 4900 townships, 84% of townships have not yet entered, which means that nearly 30,000 township markets still have great development potential.

Globalization development is a blue ocean opportunity. Mixue Ice City has been fully rolled out in Southeast Asia. For every three milk tea shops opened, one is Mixue Ice City. Especially in Indonesia, its number of stores has reached 2600, even surpassing KFC.

From the perspective of consumption ecology, with Snow King IP as the traffic portal, Mixue Ice City is evolving from a single existing beverage brand to a multi-dimensional consumption platform covering tea, coffee, retail, and cultural creativity.

Lucky Coffee, a freshly ground coffee brand owned by Mixue Ice City, has entered the sinking market at a price of 5-10 yuan. In 2024, it has exceeded 4500 stores. Relying on Mixue Ice City’s existing supply chain and warehousing network, its expansion speed is expected to exceed the industry average level.

At the same time, as the only super IP in the existing beverage industry in China, Snow King IP has become a cultural symbol for young people through continuous content output (such as animation) and social media interaction, as well as omni-channel penetration of IP derivatives.

After Mixue Ice City went public, how to realize these growth stories? The answer lies in the fundraising use.

In Mixue Ice City’s fundraising plan, 66% of the funds will be used for the supply chain, 12% will be invested in digital full-link upgrades, and 12% will be used for the global development of brand IP. This shows that supply chain, digitalization and brand IP are the triple growth engines in its strategic layout.

In the growth process of Mixue Ice City, these three links are like gears: the supply chain ensures the cost performance and replicability of products, providing guarantee for the value proposition of high quality and low price; digitalization improves management efficiency, making it fast and precise. Lay out new stores and help franchisees improve quality and efficiency; Snow King IP serves as a global cultural symbol that transcends drinks, helping the brand enter the international market.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.