The chairman of Wanchen Group was investigated.

Wang Jiankun, chairman of Wanchen Group, was detained and opened for investigation, and his sister Wang Liqing acted on her behalf

Photo source: Visual China

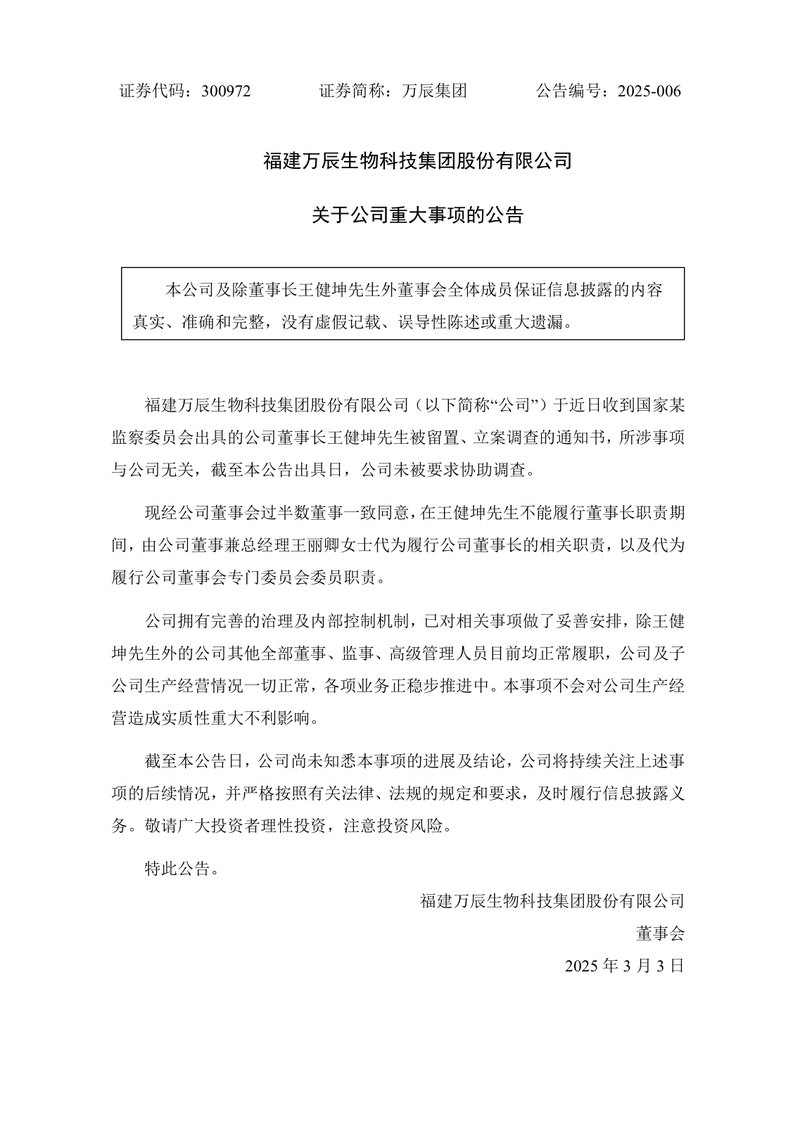

Blue Whale News, March 4 (Reporter Zhang Jinglun)On the evening of March 3, Wanchen Group (300972.SZ), a leader in the mass snack industry, issued an announcement stating that the company had recently received a notice from a national supervisory committee that Wang Jiankun, the company’s chairman, had been detained and filed an investigation. The matters involved had nothing to do with the company. As of the date of issuance of this announcement, the company had not been required to assist in the investigation.

At the same time, Wanchen Group stated that while Wang Jiankun was unable to perform his duties as chairman, Wang Liqing, director and general manager, would perform the relevant duties of the company’s chairman on his behalf. All other directors, supervisors, and senior management personnel of the company are currently performing their duties normally, and the production and operation of the company and its subsidiaries are all normal.

Picture source: Company announcement

Affected by this news, on March 4, Wanchen Group’s share price closed at 88.43 yuan/share, down 7.74%, triggering market concerns about the stability of its family business management.

The reason why Wang Jiankun was detained is still unknown. Wang Jiankun’s last public appearance before being filed was in February 2025.

According to the prospectus previously submitted by Wanchen Group, Wang Jiankun and his wife Lin Gichun are the founders of Wanchen Group, and Wang Liqing is Wang Jiankun’s sister.

However, according to Tianyan APP, although Wang Jiankun is the legal representative of Wanchen Group, he does not hold shares in the company. The actual controllers of Wanchen Group are Wang Zening, Wang Liqing, and Chen Wenzhu. The three of them acted in concert, of which Wang Zening is Wang Jiankun’s son.

In the prospectus, Wanchen Group once revealed that Wang Jiankun hardly participated in the company’s general manager’s office meetings to study and resolve important issues in the company’s administration and operation management. Wang Jiankun continues to serve as chairman of the company and participates in decision-making on major issues of the company, mainly to ensure the smooth transition of the family industry in the process of intergenerational inheritance.

When Wanchen Group entered the capital market, it was once the first stock of edible fungi. During Wang Jiankun’s tenure, Wanchen Group began to transform from edible fungus planting to the mass snack industry. Since 2022, Wanchen Group has continued to expand its snack sales segment by incubating its own brand Lu Xiaochan and successively integrating regional snack brands such as Haoxian, Laiyoupin, and Yadi Yadi. According to the 2024 semi-annual report, Wanchen Group has a total of 6638 mass snack stores. In the snack wholesale industry, it ranks second in the industry after Mingming Busy Group, which has 15,000 stores.

Benefiting from the rapid development of the mass snack industry in the past two years, Wanchen Group’s performance has also taken off. The company’s revenue increased from 549 million yuan in 2022 to 9.294 billion yuan in 2023. Among them, the company’s mass snack business achieved operating income of 8.759 billion yuan, accounting for more than 90%. It is worth noting that after integration, Wanchen Group will not make a profit in 2023, with a net profit attributable to the parent company of 82.9265 million yuan.

Judging from the performance forecast released by Wanchen Group not long ago, last year was a year for the company to rise rapidly. In 2024, Wanchen Group expects its parent net profit to be 240 million yuan to 300 million yuan, achieving a turnaround. Among them, the mass snack business is expected to achieve operating income of 30 billion yuan to 33 billion yuan, a year-on-year increase of 242.5%-276.75%.

On the fiercely competitive track of selling snacks in bulk, Wanchen Group and Mingming Busy Group, as two leading companies, have been competing fiercely in store development, with each side focusing on areas. Data shows that among the 6638 stores of Wanchen Group as of the first half of 2024, 4093 are located in East China, and the number of stores in South China and Northwest China does not exceed 200. However, Mingming is very busy and is more deeply involved in southern and central provinces such as Hunan and Jiangxi. In 2024, as the two sides expand into each other’s hinterland, the competition will become more intense. In addition to the two giants, brands such as Snacks Youming, Tangchao Snacks, and Snack Choice are also expanding.