① The net value of fund companies ‘”star-making” fell, and during the period of scale growth, fund managers’ performance suffered successive losses;

② When management capabilities fail to keep up with the rapidly expanding scale, fund companies that earn high management fees in the short term are also facing the dilemma of shrinking their scale.

Cailian News, March 7 (Reporter Zhou Xiaoya)There is also a fund manager who steps down from his post to manage products, especially because he has achieved tens of billions of glory.

On March 6, Guangfa Fund announced that due to work arrangements, Zhang Dongyi will retire from March 6 as the fund manager of five products including Guangfa Valuation Advantage, Guangfa Wisdom Two-Year Holding, Guangfa Juyou, Guangfa Shanghai-Hong Kong-Shenzhen Selection, and Guangfa Quality Return. Previously, the fund manager also stepped down from two products, including Guangfa Shanghai-Hong Kong-Shenzhen New Opportunities and Guangfa Shanghai-Hong Kong-Shenzhen Value Select, in February this year. Currently, she is no longer in charge of publicly offered products.

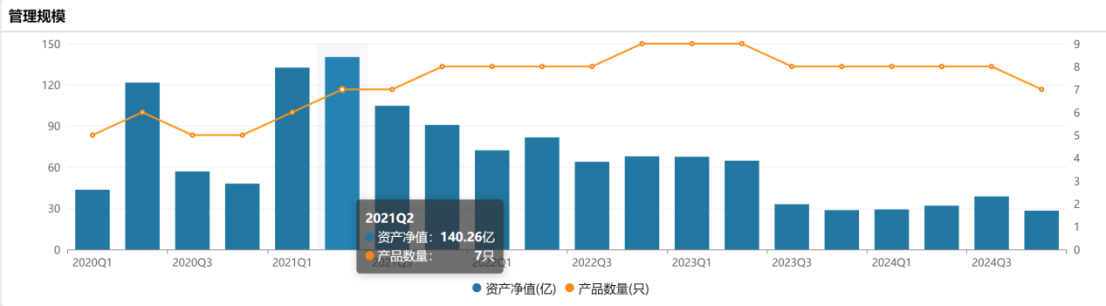

It is worth noting that the scale of Zhang Dongyi’s public offering under management once reached 14.026 billion yuan, but it has shrunk significantly in recent years, reaching only 2.823 billion yuan at the end of last year. The change in scale is due to both the company’s efforts and the successive redemption of funds. A similar plot has also been staged on many former tens of billions of fund managers.

As early as 2020 and 2021, the fund industry ushered in a trend of development under the strength of the stock market. Under the pursuit of short-term performance rankings, the trend of “grouping stocks” in the fund industry has become popular. Fund companies have “created stars” in batches, and tens of billions of fund managers have taken turns. Appealing; However, management capabilities have not kept up with the rapidly expanding scale. Even if they earn high management fees in the short term, fund companies are facing the dilemma of shrinking their scale. How to recover the former “lost ground” has become a long-term challenge for tens of billions of fund managers.

Another clearing-out resignation

Among the products left this time, Zhang Dongyi has been in charge of Guangfa Juyou, which has been the longest. As of the time of departure, his return on office was 80.58%, and the fund manager was changed to Li Yaozhu. In February this year, Zhang Dongyi stepped down from office, and Li Yaozhu also took over the new opportunities for Guangfa Shanghai-Hong Kong-Shenzhen value selection.

As a ten-billion fund manager, Li Yaozhu is currently the general manager of the International Business Department of Guangfa Fund. As of the end of last year, the public offering scale under management was 19.781 billion yuan. Previously, the scale under management reached 32.602 billion yuan at the end of the second quarter of 2021.

In terms of performance, he mostly manages QDII funds. Due to the advance of artificial intelligence tracks and the strong trend of overseas stock markets at that time, Guangfa Global Select, which he was managing, won the public fund performance championship that year in 2023.

Since the beginning of this year, market styles have changed and the performance of his products under management has diverged. The net value of the best-performing GDB Hong Kong Stock Connect Growth Select has increased by 17.59% during the year; but the above-mentioned GDB Global Select is still losing money so far this year.

When Zhang Dongyi left office, he was managing the largest Guangfa quality return (485 million yuan as of the end of last year), which was taken over by Wang Liyuan. As of the time of leaving office, Zhang Dongyi lost 25.14% during his tenure in the fund.

Wang Liyuan has experience as a seller and buyer. She joined Guangfa Fund on August 18, 2021 and is currently a fund manager of the International Business Department. In addition to Guangfa’s quality return, she currently has two products under management, including Guangfa’s Industrial Selection and Guangfa’s Ruifu Selection. Among them, Guangfa Industrial Selection is a new fund established during the year and is still in the period of establishing a position. The total return on the appointment of Guangfa Ruifu Selection is negative.

Among the remaining three products that have left office, Guangfa’s valuation advantage is taken over by Ye Shuai, and he is currently managing one product; Guangfa Shanghai-Hong Kong-Shenzhen Select is held by Guan Fuqin as the fund manager; Guangfa Zhizhi is held by Tian Wenzhou for two years. Take over.

Fund companies ‘”star-making” difficulties in defeating their net worth falls

Although he left the company in a liquidation manner, since the reason for leaving was work arrangements, whether Zhang Dongyi left from Guangfa Fund still needs to be tracked.

As a fund manager independently trained by GF Fund, Zhang Dong joined GF Fund in 2008 and began to manage public funds in July 2016. Changes in the past management scale show that as early as the end of the second quarter of 2020, she had entered the ranks of 10 billion fund managers. After a brief fall, her management scale returned to 10 billion at the end of the first quarter of 2021. At the end of the second quarter of the same year, it surged to 14.026 billion yuan.

The emergence of tens of billions of fund managers is inseparable from the new product layout of Guangfa Fund.

For example, in the second quarter of 2020, Guangfa Quality Return was established, with the establishment scale reaching 7.903 billion yuan at that time, and Zhang Dongyi was proposed to be appointed as a fund manager; in the first quarter of 2021, Guangfa Value Core was established, and the establishment scale reached 7.619 billion yuan at that time. Zhang Dongyi was also the first fund manager of the product; Zhang Dongyi was also the fund manager of Guangfa Shanghai-Hong Kong-Shenzhen Value Select established in the second quarter of 2021.

In addition to new products, Guangfa Fund also handed over the Guangfa Shanghai-Hong Kong-Shenzhen New Opportunities, which was approximately 3 billion yuan in the second quarter of 2021, to Zhang Xiaoyi for management, and ultimately “created” a tens of billions of fund managers.

However, the management capabilities of fund managers did not keep up with the growth of scale, and funds were eventually redeemed one after another.

Zhang Xiaoyi’s representative work Guangfa Juyou had a relatively good performance from 2018 to 2020. As of the end of 2020, the return since the product was established was as high as 268.25%. At that time, popular track stocks such as Kweichow Moutai, Luzhou Laojiao, Wuliangye, and Mindray Medical are all held in the fund.

When the market style changes in 2021, the “Ning Combination” will outperform the “Mao Index”. Guangfa Juyou will also transfer positions to the new energy and pharmaceutical industries in the first quarter of 2021, but its main positions are still concentrated in the liquor sector, and then continue to be adjusted in the pharmaceutical segment. The fund’s return will be negative in 2021.

The performance of the new products was also not satisfactory. Guangfa’s quality return, which was established in 2020, suffered a loss the following year. The new product, Guangfa’s value core, also suffered a loss of more than 20% in the same year. At that time, under the industry’s call to “cross Xiangjiang to compete for pricing power”, the two Shanghai-Hong Kong-Shenzhen themed funds managed also lost their net worth.

As a result, Zhang Xiaoyi’s management scale will quickly shrink to below 10 billion yuan by the end of 2021, reaching 9.078 billion yuan. In the following two years, the A-share market adjusted successively, and the overall public funds also ushered in a pullback, with active equity underperforming index funds. By the time he left office, Zhang Xiaoyi’s return on his tenure at Guangfa Juyou had dropped to 80.58%.

It is worth noting that in addition to Zhang Dongyi, Zhang Xiaotian, another fund manager under Guangfa Fund, also left office in February this year. At that time, he was the only fund manager who was leading the Guangfa Shanghai, Hong Kong and Shenzhen industry in managing products. In response, Guangfa Fund announced that it was due to job adjustment and was transferred to other positions in the company.

The “halo” of tens of billions of fund managers fades

In fact, under the aura of star fund managers in the early years, market funds were flocking to tens of billions of fund managers, and fund companies also took advantage of the opportunity to issue new products, and “Sunlight Base” appeared frequently.

When the investment boom subsided, the tens of billions of fund managers whose performance was unsustainable were also voted by the market with the redeemed funds.

Under the Guangfa Fund, Liu Gesong’s management scale was as high as 84.343 billion yuan, but by the end of last year, the scale had dropped back to 34.127 billion yuan, a contraction of nearly 60%; Fu Youxing is also another 10 billion fund manager of Guangfa Fund. His previous management scale was as high as 44.271 billion yuan, with only 16.598 billion yuan left at the end of last year; Zheng Chengran, Wu Xingwu and others were once 10 billion fund managers, but their management scale has also shrunk in recent years. Among them, Wu Xingwu’s scale has dropped below 10 billion as of the end of last year.

Behind the frequent shrinkage phenomenon is the mismatch between performance and management scale. For example, Liu Gesong’s management scale peaked at the end of 2020, and the scale was still 77.335 billion yuan at the end of 2021. However, Wind data shows that his performance in the past three years has suffered a loss of nearly 40%, and his management scale has also declined simultaneously.

This is not an exception in the industry. Many well-known fund managers such as Zhang Kun under E Fund, Ge Lan under China Europe Fund, and Liu Yanchun under Invesco Great Wall Fund have also seen their scale shrink in recent years. Behind this, in addition to the contradiction between performance and management scale and the reform of industry rates, it is also the result of the industry’s accelerated “de-starization” and the initiative of public fund managers to “slim down” tens of billions of fund managers and focus on team development.

In addition to the shrinking scale, the departure of tens of billions of fund managers has also become more frequent in recent years. In late February, Hongliu, the fund manager of Harvest Fund, left his post due to personal reasons. His management scale once exceeded 10 billion yuan. In recent years, there have been cases of continuous redemption of products under management. At the end of last year, Hongliu’s products under management appeared many times. Manager change.