Estee Lauder’s huge losses and layoffs are not only a microcosm of the cyclical adjustment of the high-end beauty market, but also expose the structural risks of its over-reliance on China’s single market.

Estee Lauder is in deep transformation pain: another US$580 million in the second quarter, making the China market a double-edged sword

Photo source: Visual China

Blue Whale News, February 6 (Reporter Wang Hanyi)Recently, Estee Lauder Group announced its second quarter financial year 2025 (September 30 to December 31, 2024) results report.

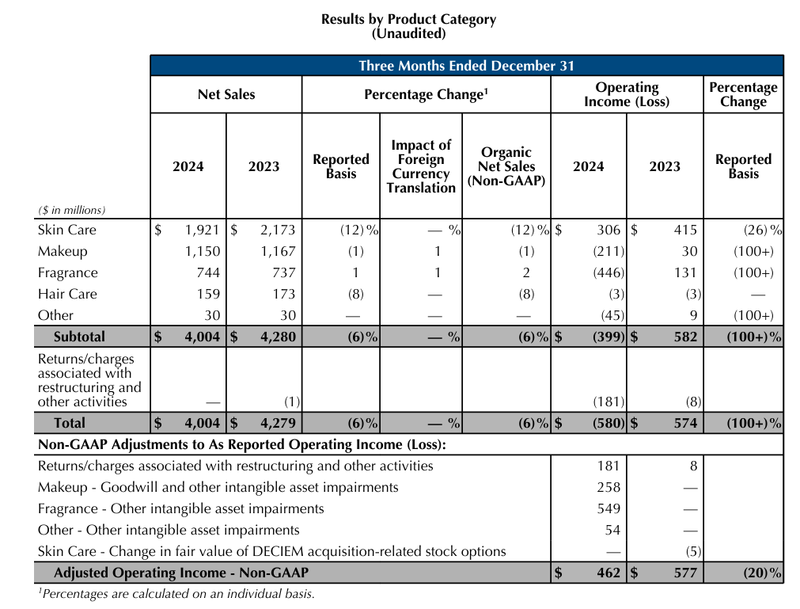

During the reporting period, Estee Lauder Group’s net sales fell 6% to US$4.004 billion (approximately RMB 29.034 billion), with a net profit loss of US$580 million (approximately RMB 4.2 billion), compared with a net profit of US$574 million (approximately RMB 4.162 billion) in the same period last year.

In the first quarter of fiscal year 2025, Estee Lauder had a net loss of US$156 million (approximately RMB 1.11 billion), which has recorded huge losses for two consecutive quarters.

This performance was far below market expectations. The stock price plummeted 16.07% on the day of the earnings report, and the market value shrank to US$24.9 billion.

Commenting on this performance, St phane de La Faverie, the new president and CEO of Estee Lauder Group, said: The sluggish consumer sentiment in China has put tremendous pressure on the high-end beauty industry and the group’s business. rdquo;

“At the same time, our agility in the market has also declined, and we have gradually fallen behind the trend in terms of channels, media, etc. So in the third quarter of fiscal 2025, we launched the bold strategic vision of Beauty Reimagined, with the goal of restoring sustainable sales growth and maintaining double-digit operating margins in the next few years. rdquo;

Specifically, Estee Lauder’s core business is under pressure across the board. As the pillar of revenue, sales of skin care category plunged 12% year-on-year, mainly due to setbacks in Asia-Pacific markets such as Estee Lauder and Sea Migne; cosmetics category dropped slightly by 1%, and only Clinique achieved double-digit growth with its online channels and medical beauty series., offsetting the decline of brands such as MAC and TOM FORD; the perfume category bucked the trend by 1%, and the high-end brand Le Labo performed well, but the decline in shipments of holiday suits of Estee Lauder’s main brand dragged down the overall situation; Scalp care was dragged down by Aveda, with sales falling by 8%, and salon channels in North America and Europe were weak.

Photo source: Excerpts from Estee Lauder Group’s financial report

In response to the crisis, Estee Lauder announced the launch of the largest restructuring plan in history, laying off 5800 to 7000 people, accounting for approximately 7%-8% of the total global workforce. It is expected to bear US$1.2 billion to US$1.6 billion in restructuring costs, with a goal of saving US$800 million to US$1 billion per year. The scale of this round of layoffs far exceeds the 2024 ceiling of 3000 people, reflecting management’s urgency for change.

At the beginning of 2024, Estee Lauder Group announced that it would lay off 3% to 5% of the total global workforce as part of its PRGP (Profit Recovery and Growth Plan). Based on the employee base as of June 30, 2023, it would lay off a maximum of 3100 people.

However, in the latest report for the second quarter of fiscal year 2025, the group stated that it will significantly expand the restructuring part of PRGP, and it is expected that the net reduction in positions, including approved positions, will reach 5800 to 7000. At the same time, some work aspects will be completed through outsourcing, and the specific measures of the restructuring plan are expected to be completed by the end of fiscal year 2026.

It is reported that the announced layoff plan is the largest for Estee Lauder Group in nearly 10 years. It aims to accelerate the advancement of PRGP, including measures such as restructuring and process simplification, with a view to reviving sales growth under the leadership of the new CEO.

Blue Whale reporter asked about the impact of Estee Lauder’s layoffs on the China team. Estee Lauder said that although the group is advancing large-scale restructuring and layoffs, the leadership structure of the China team remains stable. Fan Jiayu, President and CEO of Estee Lauder Group China, will continue to lead business in the mainland of China and join the newly formed management team to report directly to Group President and CEO St phane de La Faverie.

In addition, Estee Lauder Group emphasized that the China market occupies an important position in its global strategy. The group is strengthening its business layout in China through a series of measures, including launching innovative products for the China market, such as Clinique’s“ CX| Theater lines specialize in” series and introduce new brands and product lines, such as“ The Ordinary”. These measures demonstrate that despite the ongoing restructuring around the world, the China team will remain an important part of the group’s future development.

In fact, in the China market, there is a tug of war between weak high-end consumption and localized breakthroughs.

Estee Lauder repeatedly mentioned in her earnings report that the China market had a disproportionate impact on her performance. Sales in the Asia-Pacific region fell 11% year-on-year, making it the worst region in the world. China’s high-end beauty market continues to be sluggish, and consumers are turning to cost-effective domestic brands. Coupled with the weak economic recovery, the two trump cards of Estee Lauder and Sea Blue Mystery have suffered cold weather.

It is worth mentioning that Estee Lauder’s dilemma is not isolated. Shiseido’s profit in 2024 will fall by 61% year-on-year, and its perfume business will become a few growth points.

In contrast, L’Oréal relies on its diversified brand matrix and emerging market layout, its revenue will increase by 4.8% in 2024, and high-end lines such as Lancome and Sulico will perform steadily. With more flexible product iteration and full price band coverage, it continues to seize market share, which has indeed put a lot of pressure on Estee Lauder.

Coupled with the rise of domestic products, brands such as Pelaiya and Hanshu will achieve explosive growth on the Double 11 in 2024. Pelaiya Tmall sales will increase by 600% year-on-year, and Douyin will increase by 90%. The advantages of cost performance and social media marketing will be prominent, which will make it even worse for traditional high-end beauty.

Can Estee Lauder’s strategic reconstruction and beauty reshaping turn the tide? In the long run, if the beauty reshaping strategy can find a balance between organizational efficiency, product innovation and cost control, it may rely on the recovery of online channels in China and the growth of the perfume business to gradually regain its blood.

However, the technological upgrades and price offensives of domestic brands will still pose challenges to their high-end positioning. Estee Lauder expects retail sales in China to improve in the third quarter of fiscal year 2025, but tourism retail sales in Asia will be weak or continue.

Estee Lauder’s huge losses and layoffs are not only a microcosm of the cyclical adjustment of the high-end beauty market, but also expose the structural risks of its over-reliance on China’s single market.

When brand premium encounters rational consumption, how to adhere to high-end tonality while embracing localized innovation will become the key to the success or failure of its transformation.