Original title: “How much room does Robinhood have to grow, the new favorite of Gen Z encryption?”

Original source: RockFlow

mark the focal points

1. The rise of Robinhood’s encryption business stems from the three major advantages the company has accumulated over the years: the huge young user base established from the zero-commission model, the infrastructure foundation and technical strength behind product innovation, and the user investment habits cultivated during the Meme stock boom.

2. Recent quarterly financial reports have shown that Robinhood’s share price surge in 2024 is inseparable from the unexpected recovery of the crypto business. In particular, crypto revenue surged by 165% year-on-year to US$61 million in the third quarter of 2024, becoming the twin engines of the company’s revenue growth together with options trading.

3. Looking to the future, Robinhood’s layout in the EU and UK markets, coupled with its core user groups (Millennials and Gen Z) being the most active participants in cryptocurrencies, as well as the deregulation tendencies of Trump’s New Deal and the potential benefits of crypto, it will bring considerable room for growth for its crypto business.

Amid the 24-hour trading spree in the crypto market, one name is being mentioned by more and more investors-Robinhood. This financial technology platform founded by two Stanford students not only used a zero-commission model to leverage traditional Wall Street, but also created a new world in the field of encryption.

When Baiju Bhatt and Vlad Tenev still stuck to their dreams after 75 financing failures, they may not have imagined that Robinhood would eventually become a key bridge connecting traditional finance and digital assets.

RockFlow’s previous articles have introduced in detail the past development history of Robinhood, GME events and order-flow payment (PFOF)-Robinhood: There is no free lunch, only eternal leeks.

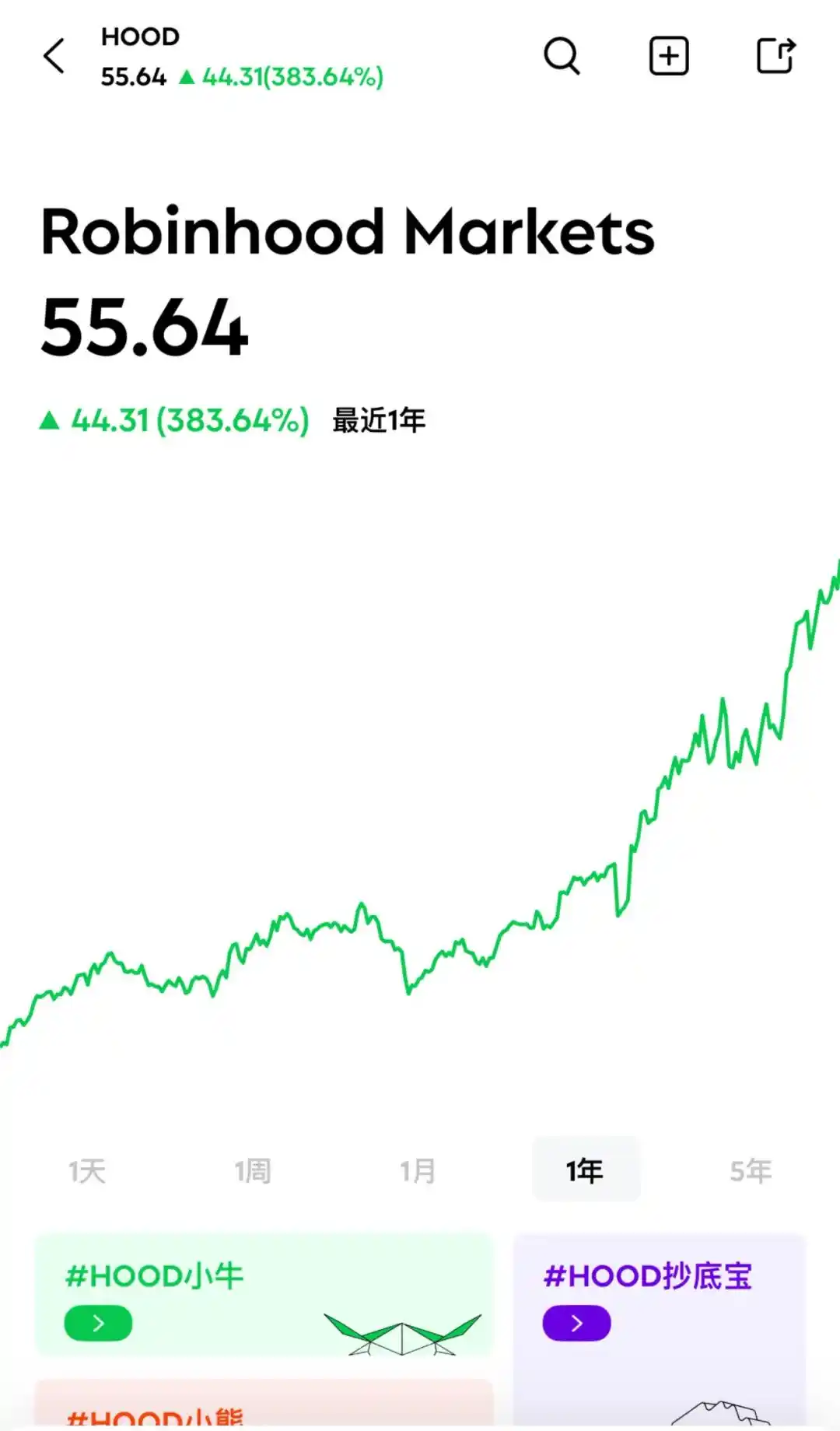

In this article, the RockFlow investment research team will go deep into the core of its crypto business, explore the reasons why its share price has soared 383% in the past year, and carefully analyze its current investment value and future bullish catalysts.

1. Three waves of growth have laid the foundation for the rise of encryption

It is no accident that Robinhood’s encryption business has exceeded expectations. The three revolutionary waves gradually built a strong user base and product innovation capabilities, laying a solid foundation for its subsequent take-off in the encryption business.

Robinhood initially entered the market with a zero-commission model, breaking the commission barrier of US$8 -10 for traditional brokers. By eliminating the minimum deposit requirement and supporting broken stock trading, it has successfully attracted a large number of young users and established users ‘initial trust in the platform. This has accumulated a valuable user base for expanding innovative services such as encryption in the future.

In the second wave of growth, Robinhood demonstrated excellent product innovation capabilities. By integrating gamified elements into the trading experience, creating a simple and intuitive interface design, and combining it with an attractive stock reward mechanism, the platform has achieved amazing growth. During this period, the trading volume was 9 times that of E-Trade, and the trading volume of options contracts was 88 times that of Schwab, proving its strong technical strength and product operation capabilities. These capabilities were later successfully applied to the development of crypto trading products.

In the third wave of growth, Robinhood played a central role in the Meme stock and cryptocurrency craze. The platform has become the main battlefield for trading popular stocks such as GameStop and AMC, as well as cryptocurrencies such as Dogcoin. In January 2021, it set a record that the number of new accounts opened in a single month exceeded the sum of all other securities firms. This period not only brought a large number of active users, but more importantly, cultivated users ‘investment habits in emerging asset classes.

Robinhood’s three revolutionary waves of user growth have not only changed the landscape of the brokerage industry, but also reshaped the entire investment culture. Under its influence, retail investors have risen, accounting for 20% of all trading volume. The younger generation has begun to view investment as part of their lifestyle, and this concept has transformed into creating an enabling environment for the popularization of innovative financial products such as cryptocurrencies.

These accumulated advantages-a huge user base, strong technical capabilities, mature operational experience and far-reaching impact on the investment culture-together constitute the cornerstone of Robinhood’s success in the encryption field.

2. Crypto revenue continues to surge, driving Robinhood’s share price to double

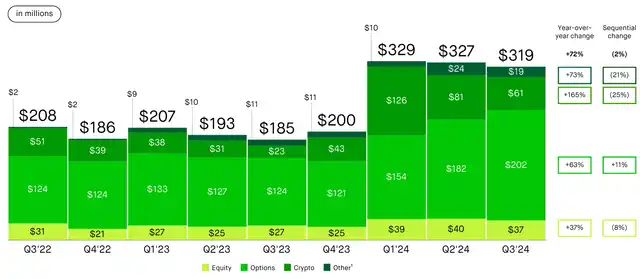

With the gradual recovery of the encryption market since 2023, Robinhood has also benefited. In its recent quarterly earnings reports, the proportion of encryption revenue has gradually increased. The following chart shows Robinhood’s revenue over the past nine quarters, with the growth in options revenue and crypto revenue being particularly eye-catching:

Taking the recently released third-quarter 2024 financial report as an example, crypto revenue surged 165% year-on-year to US$61 million, showing astonishing growth momentum. This achievement not only confirms the company’s strategic vision in the field of encryption, but also demonstrates its excellent execution in the process of business expansion.

Robinhood’s revenue mainly comes from three major sectors: trading income, net interest income and other income. Among them, transaction revenue increased by 72% year-on-year to US$319 million, while the encryption business became one of the most dazzling sectors with a year-on-year growth rate of 165%. This achievement, together with options trading revenue ($202 million), constitutes a dual engine for the company’s revenue growth.

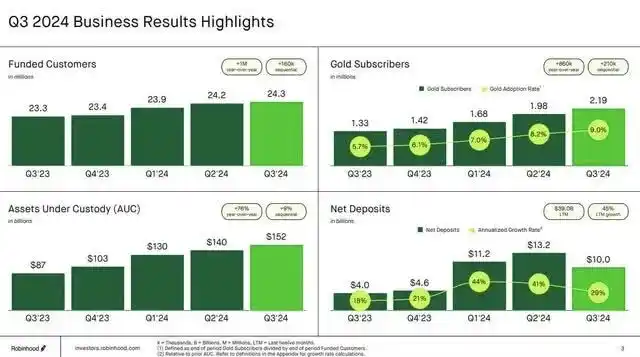

While developing rapidly, Robinhood has not ignored the robustness of its business. Net interest income increased 9% year-on-year to $274 million, providing the company with stable cash flow. Innovative services such as Gold subscriptions drove other revenue up 42% to US$44 million, and the 2.2 million premium user base attested to users ‘recognition of platform services.

In addition, the platform achieved net deposits of over US$10 billion for the third consecutive quarter, highlighting users ‘high trust in Robinhood. This trust not only supports the development of traditional businesses, but also provides a solid foundation for the expansion of innovative businesses such as cryptocurrency.

It is worth noting that while pursuing rapid growth, Robinhood still maintains prudent cost control and maintains its operating expenditure forecast for the full year of 2024 at US$1.85 – 1.95 billion. This strategy of balancing growth and efficiency provides a guarantee for the continued development of innovative businesses such as encryption.

It can be clearly seen from this financial report that Robinhood is gradually transforming from a traditional zero-commission trading platform to a comprehensive financial technology platform with cryptocurrency as an important growth pole. The outstanding performance of its encryption business not only brings considerable revenue growth to the company, but also indicates its broad prospects in the new era of encryption.

3. 2025, why is Robinhood still worth looking forward to?

Although Robinhood’s share price has increased by 383% in the past year, based on its unique market opportunities, the RockFlow investment research team is still optimistic about its performance in 2025. This confidence largely stems from its active deployment in the field of encryption.

Robinhood’s core user groups are mainly concentrated in millennials and Gen Z, which happens to be the most active participants in cryptocurrencies. As the wealth of the older generation shifts to the younger generation, these assets are likely to flow to platforms that better meet the investment needs of the new generation. As a bridge connecting traditional finance and crypto innovation, Robinhood will benefit significantly from this wave of wealth transfer.

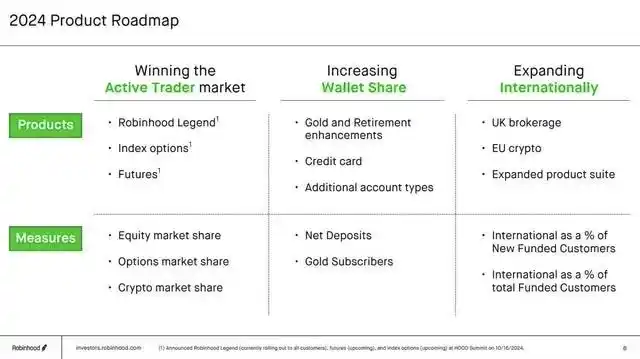

In addition, Robinhood’s international expansion strategy particularly emphasizes the importance of the encryption business: EU market: actively deploy EU encryption business as an important fulcrum for internationalization; UK market: develop business in the City of London to lay the foundation for the expansion of future encryption services.

Finally, Robinhood has strengthened the competitiveness of its crypto business through various measures: for example, the futures trading infrastructure it has developed can provide technical support for future crypto derivative trading;Gold membership services are expected to provide users with more cryptography-related privileges; Continuously optimized trading interfaces and services can also increase user participation in crypto trading.

Overall, Robinhood’s encryption business development reflects clear global thinking and innovation orientation. By integrating traditional financial and crypto services, the company is building a more inclusive financial ecosystem. Its layout in the European market, especially the expansion of its encryption business, demonstrates the company’s long-term development determination in the field of digital assets. As the global encryption market continues to mature, Robinhood is expected to occupy a more important position in this rapidly developing field.

In terms of policy, after Trump officially takes office, his impact on the U.S. stock market and the crypto industry will also become an important driving force in stimulating Robinhood’s share price to rise.

As we all know, the Trump administration has always advocated reducing financial supervision, which may further reduce compliance costs and simplify compliance processes. Financial technology companies such as Robinhood, which rely on flexible operations, may benefit from a more relaxed regulatory environment. If the crypto field continues to receive clear policy support (such as clarifying the regulatory framework or relaxing restrictions), Robinhood’s crypto business will continue to grow beyond expectations.

Second, although the new president has been in office for less than a month, the volatility he has brought to the market is increasing significantly. The market has already seen the implementation of tariff policies (and subsequent delays) cause U.S. stocks to fluctuate sharply. The increased volatility of the stock market has a significant impact on retail trading activity, and Robinhood’s trading volume and commission income (especially options) may increase significantly accordingly.

conclusion

The RockFlow investment research team believes that Robinhood is showing remarkable growth potential: its core user base (Millennials and Gen Z) is the most active participants in cryptocurrency and will benefit from the upcoming intergenerational wealth transfer; Coupled with the improvement of trading infrastructure and innovation in Gold membership services, as well as the deregulation tendencies of Trump’s New Deal and the potential benefits of encryption, these measures will jointly promote Robinhood to occupy a more important position in the global crypto market.

Although it may face regulatory pressures and market fluctuations in the short term, in the long run, Robinhood is expected to become an important bridge connecting the future of traditional finance and crypto, and its investment value deserves long-term attention.

original link