① Since the beginning of the new year, two “city commercial banks” have publicly issued warnings about the liquidation risks of their initiated FOFs, and four initiated FOFs have issued liquidation reports;

②60 initiated FOF will face a three-year scale test this year. Among them, 7 products have a scale exceeding 200 million yuan at the end of last year, and 6 products are pension FOF;

③6 Only initiated FOF may face liquidation risks in the next March.

Cailian News, February 22 (Reporter Feng Qijuan)Since the beginning of the new year, 4 initiated FOFs have issued liquidation reports, and another 2 initiated FOFs have warned of liquidation risks.

Since February, one FOF of each of the two “city commercial banks”, Yongying Fund and Shangyin Fund, has issued announcements reminding that the termination of fund contracts may be triggered and subscriptions and regular fixed investment businesses will be suspended. These two FOFs were both established in 2022 and are both initiated funds. At the end of last year, their sizes were both below the scale target of 200 million yuan.

Since the beginning of the year, Morgan Stanley, Tianhong Fund, Changjiang Securities Asset Management, and Chuangjin Hexin have each completed liquidation. These four FOFs are also initiated funds and have not passed the three-year scale test.

Under the three-year scale test, many initiated FOF faced liquidation due to substandard scale, and their performance was uneven. According to Choice statistics, a total of 60 initiated FOFs established in 2022 will usher in a three-year scale test this year, including 38 elderly FOFs. As of the end of last year, only 7 initiated FOFs exceeded 200 million yuan. Invesco Great Wall Pension 2035 Three-Year (FOF) A and Yinhua Zunyi Steady Pension One Year (FOF) A have successfully passed the exam, but the latter’s scale is significantly reduced compared with the initial period of its establishment. Overall, a total of six initiated FOFs established in March 2022 had a scale of less than 200 million yuan at the end of last year and may face liquidation risks in March.

Two public offerings remind their FOF liquidation risks

On February 21, the Bank of China’s Stable Preferred 12-Month (FOF) also issued a reminder announcement that may trigger the termination of fund contracts, a suspension of subscriptions, and an announcement on regular fixed investment business.

According to the announcement, starting from February 24, Shanghai Bank of China’s prudent preferred 12-month launch (FOF) will suspend subscription, conversion and regular fixed investment business.

Bank of Shanghai Steady Preferred 12-Month (FOF) was established on March 3, 2022 and is an initiated fund. According to the fund contract, if the fund has been established for three years, if the fund size is less than 200 million yuan, the termination situation will be triggered, the fund contract will be automatically terminated, and liquidation should be carried out in accordance with the agreed procedures, and the fund contract period cannot be extended by convening a holders ‘meeting. As of the end of the fourth quarter of last year, the total A/C share of this product was 20 million yuan.

In terms of performance, Shanghai Bank’s Steady Preferred 12-Month (FOF) yields ranked first in the past year. According to Tiantian Fund. com, as of February 19, the product’s yield in the past year was 8.20%, ranking 68th among 362 similar products.

On February 19, the Yongying Pension Target Date of 2040 (FOF) also issued a reminder announcement that may trigger the termination of fund contracts, an announcement to suspend subscriptions, and an announcement to regular fixed investment business.

It is also an initiated fund, and the Yongying Pension Target Date 2040 Three Year (FOF) was established on February 24, 2022. As of the end of the fourth quarter of last year, the product size was also 10 million yuan. By February 24 this year, it is also facing liquidation risks.

According to Tiantian Fund. com, as of February 19, the product’s yield in the past year was 9.72%, ranking 179th among 273 similar products.

Four initiated FOFs have completed liquidation since the beginning of the year

Since the beginning of the new year, one initiated FOF from Morgan Stanley Fund, Tianhong Fund, Changjiang Securities Asset Management, and Chuangjin Hexin each has issued a liquidation report.

Morgan Stanley’s pension target date of 2040 Three Years (FOF) has entered the liquidation period since December 16 last year. There is no need to convene a fund unit holders ‘meeting. The liquidation report was disclosed on January 15 this year. After the disposal of assets and the settlement of liabilities, the remaining assets of the fund on January 13 this year were 12.6037 million yuan, which will be distributed according to the proportion of the fund shares held by the holders.

This product was established on December 15, 2021, with an initial scale of 11 million yuan. As of January 13 this year, the scale of this product was 13 million yuan.

According to Tiantian Fund. com, Morgan Stanley’s pension target date of 2040 three-year (FOF) has a yield of 1.92% in the past two years, ranking 22nd among 202 similar products.

Since December 22 last year, Tianhong Flagship Select has entered the liquidation period for 3 months (FOF). Since December 12 last year, the product has issued three suggestive announcements that may trigger the termination of fund contracts; on January 13 this year, fund contract termination announcements and liquidation reports have been issued. As of the end of 2024, all trading financial assets held on the last operating day of this product have been realized, with a realized amount of 8.9894 million yuan.

Tianhong Flagship Select 3 Months (FOF) was established on December 21, 2021. The total scale at the beginning of its establishment was 12 million yuan. As of the end of last year, the product scale was 09 million yuan. According to Tiantian Fund Network, in the past two years, this product has suffered a loss of 10.76%, ranking 112th among 134 similar products.

Since December 23 last year, Changjiang Xinxuan entered the fund liquidation period in three months (FOF). According to the liquidation report, after asset disposal and debt settlement, the remaining property of this product was 18.5942 million yuan.

Changjiang Xinxuan 3 Months (FOF) was established on December 22, 2021. The total scale at the beginning of its establishment was 337 million yuan. As of December 26 last year, the scale was only 19 million yuan. According to Tiantian Fund Network, in the past three years since its establishment, the product’s yield has been 1.11%, ranking 26th among 113 similar products.

Chuangjin Hexin’s 3-Month Prosperity Industry (FOF) has also entered the liquidation period since December 23 last year. The market value of stocks and fund investments held on the last operating day of this product totaled 7.6925 million yuan, which has been fully realized. As of December 27 last year, the total scale of this product was only 08 million yuan.

Three-year FOF scale test

Choice data shows that a total of 60 initiated FOFs were established in 2022, including the Bank of China’s Stable Preference 12-Month (FOF) and the Ever-Win Pension Target Date of 2040, and they are facing the three-year scale test this year.

The above 60 products come from 32 public offering institutions. Chuangjin Hexin, China Asset Management Fund, Yinhua Fund, and BOC Fund each have 4 products, and Caitong Asset Management, CCB Fund, Invesco Great Wall Fund, and BOC Securities each have 3 products. After investigation, all four products of Huaxia Fund are pension FOFs, three of the four products of Yinhua Fund are pension FOFs, and the three products of CCB Fund and Invesco Great Wall Fund are also pension FOFs.

According to statistics, among the 60 initiated FOFs, there are 38 elderly care themed products. Yongying Fund, Dongfanghong Asset Management, Fuguo Fund, Guangfa Fund, Guolian Fund, China Life Security, SDIC UBS, Southern Fund, Shenwan Lingxin, Tianhong Fund, Yingda Fund, China-Canada Fund, the only initiated FOF established in 2022 are pension themes.

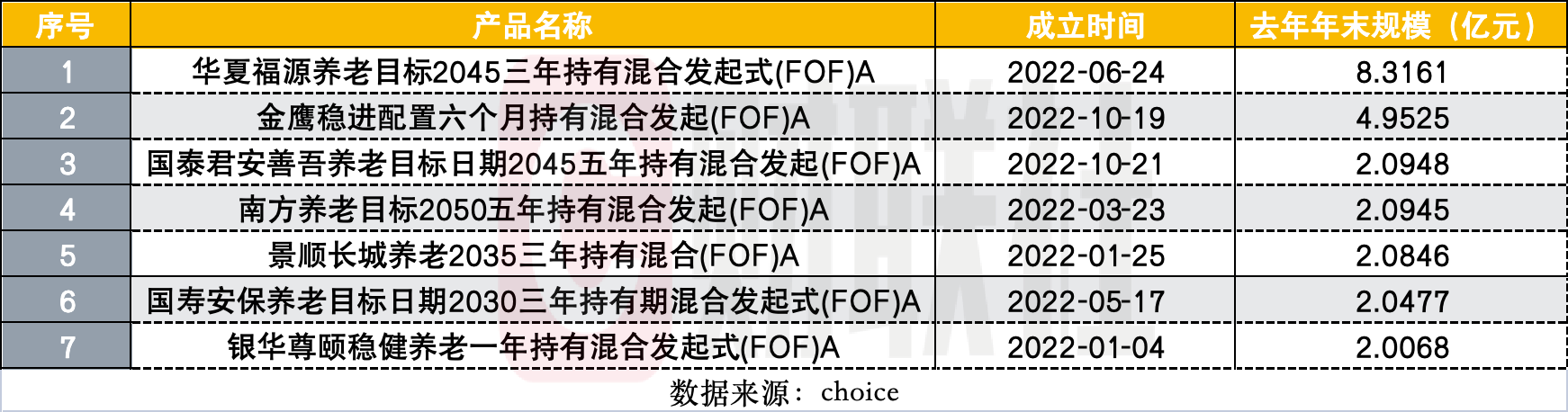

As of the end of last year, among the launched FOFs established in 2022, 7 products have a scale of more than 200 million yuan, of which 6 products are pension FOFs.

Overall, Invesco Great Wall Pension 2035 Three-Year (FOF) A and Yinhua Zunyi Steady Pension One Year (FOF) A, which were established in January 2022, successfully passed the three-year test. As of the end of last year, the scale of these two products was 208 million yuan and 201 million yuan respectively, and no liquidation warning announcement has been issued since the beginning of the year.

It is worth noting that Yinhua Zunyi’s One-Year Pension (FOF) A had a scale of 660 million yuan at the beginning of its establishment, which was 459 million yuan smaller than the initial scale of its establishment. According to Tiantian Fund Network, in the past three years, the loss has been 2.31%, ranking 92nd among 120 similar products.

Compared with the early days of its establishment, the scale of China Fuyuan Pension Goal 2045 Three-Year (FOF) A has been reduced. The scale was 832 million yuan at the end of last year. The scale of this product when it was established in June 2022 was 1.04 billion yuan. According to Tiantian Fund, in the past two years, this product has lost 15.72%, ranking 202nd among 211 similar products.

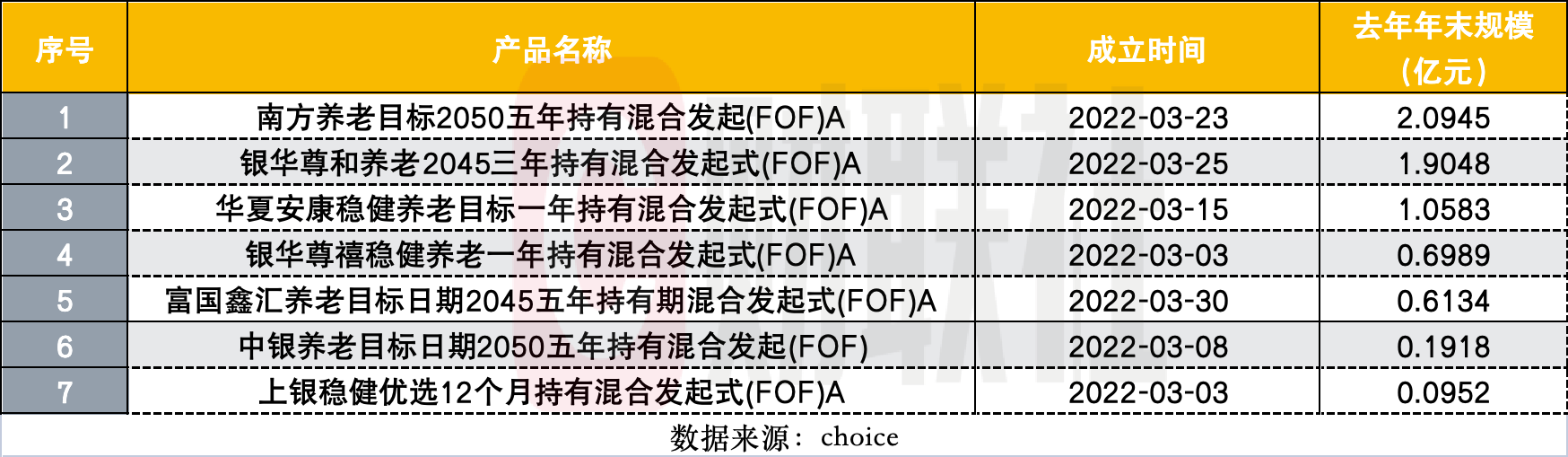

According to Choice statistics, in addition to Shanghai Bank’s stable preferred 12-month (FOF), there are also 5 initiated pension FOFs, namely Yinhua Zunhe Pension 2045 three-year (FOF) A, Huaxia Ankang Stable Pension Target One Year (FOF) A, Yinhua Zunxi Stable Pension One Year Holding (FOF) A, Fuguo Xinhui Pension Target Date 2045 Five-year (FOF) A, and BOC Pension Target Date 2050 Five-year (FOF) were established in March 2022, and the scale was less than 200 million yuan at the end of last year.

This means that the above five pension FOFs may face the risk of liquidation in the next March.