Despite the pressure on profits, Huaxi Biotech still has to make a big bet on the new raw materials revolution.

How much imagination does Huaxi Biota still have in search of new outlets?

Written by/Connected Insight Dou Wenxue

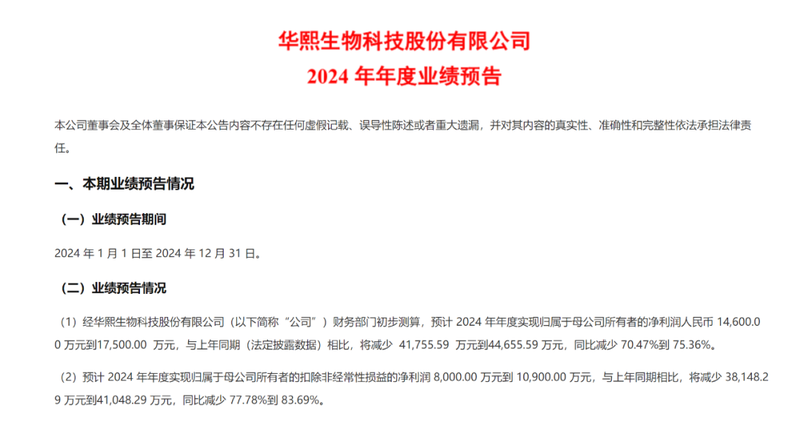

After a year of adjustments, Huaxi Biotech disclosed a 2024 annual results forecast.

The company expects to achieve net profit attributable to owners of the parent company of 146 million yuan to 175 million yuan in 2024, which will decrease by 70.47% to 75.36% year-on-year.

At the same time, net profit after deducting non-recurring gains and losses is expected to be 80 million yuan to 109 million yuan, a year-on-year decrease of 77.78% to 83.69%.

Huaxi Biotech’s 2024 annual results forecast, source by Choice

Regarding the changes in performance, Huaxi Biotech summarized six reasons in the forecast, including that businesses with a relatively high revenue account are still adjusting, the company’s management changes have led to increased costs, and the company is still maintaining forward-looking R & D investment.

In the past 2024, the reasons summarized in the above announcement seem to have traces to follow.

In 2023, Huaxi Biotech recorded a decline in full-year revenue and net profit. Entering 2024, Huaxi Biotech only recorded a growth in net revenue in the first quarter, and continued to record double declines in net revenue in the following second and third quarters.

At the same time, according to previously disclosed financial reports, Huaxi Biotech’s R & D investment has also remained high.

While summarizing the reasons, Huaxi Biotech also elaborated on the positive significance of the current layout to the company’s long-term development, but the capital seems to lack patience.

Huaxi Biotech’s share price has been declining since reaching a peak of 309.42 yuan on July 5, 2021. As of February 7, 2025, the company’s closing price was 49.08 yuan/share, with a corresponding market value of approximately 23.6 billion yuan.

Compared with the highest point, Huaxi Biotech’s market value has evaporated by about 125.4 billion yuan.

Behind the lack of confidence of capital in Huaxi Biotech is that there are many players entering the game in the hyaluronic acid field. After competition has become a red sea, Huaxi Biotech’s advantages are no longer obvious.

Huaxi Biotech is also looking for new outlets. It is working hard to develop new raw materials and find a second growth curve based on synthetic biotechnology.

For Huaxi Biotech, the company must bet on the new raw material revolution, and only succeed and not fail.

1. Significant changes in performance, and Huaxi Biotech continues to adjust

The decline in Huaxi Biotech’s overall performance is a continuation of previous quarters.

Before the annual report forecast was released, the company had disclosed financial reports of significant declines in revenue and net profit for two consecutive quarters.

Among them, Huaxi Biotech achieved revenue of 1.45 billion yuan in the second quarter of 2024, a year-on-year decrease of 18.09%; and achieved net profit of 98.4 million yuan, a year-on-year decrease of 56.1%.

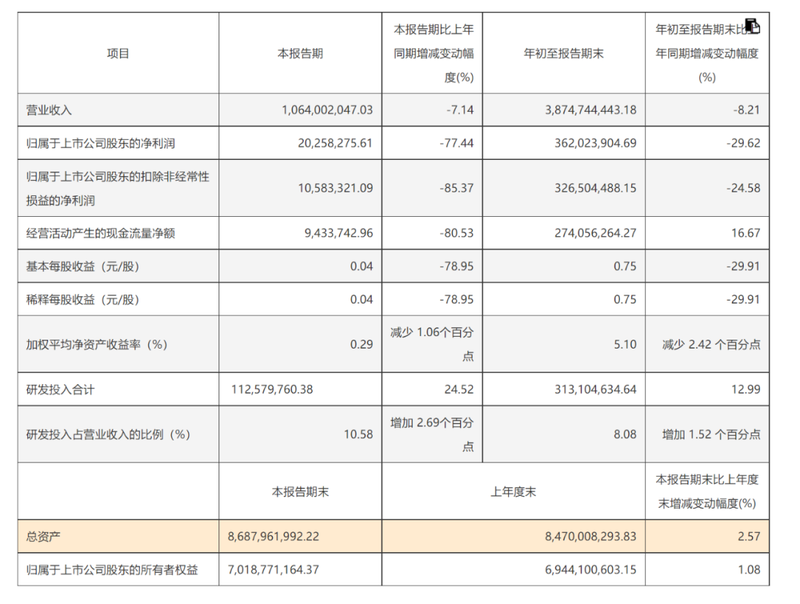

In the third quarter of 2024, Huaxi Biotech achieved operating income of 1.064 billion yuan, a year-on-year decrease of 7.14%; achieved net profit attributable to shareholders of listed companies of 20.2583 million yuan, a year-on-year decrease of 77.44%, and deducted non-net profit of 10.5833 million yuan, a year-on-year decrease of 85.37%.

Huaxi Biotech’s third quarter financial report of 2024, source Choice

Behind the decline in performance is that Huaxi Biotech’s main business functional skin care products have entered an adjustment cycle.

In the first half of 2024, Huaxi Biotech’s raw material business and medical terminal business both grew, achieving revenue of 630 million yuan and 743 million yuan respectively, a year-on-year increase of 11.02% and 51.92%.

The functional skin care products business, which accounted for 49.29% of revenue, achieved revenue of 1.381 billion yuan, a year-on-year decrease of 29.74%.

This situation also continued into the second half of the year and was reflected in the results for the whole year.

In its 2024 financial report forecast, Huaxi Biotech also listed the decline in functional skin care products business as the first reason for changes in performance.

The announcement stated that during the reporting period, the company’s raw materials business maintained steady growth and the medical terminal business maintained rapid growth. However, the functional skin care products business, which accounted for a relatively high revenue, was affected by various factors such as intensified market competition, industry cycle fluctuations and strategic adjustments. Still going on.

In addition to its main business entering a downward cycle, Huaxi Biotech has also implemented many management and business adjustments in 2024.

The company also stated in its performance forecast that the company is concerned about management changes, supply chain transformation, improving production efficiency and intelligence levels, increasing investment in forward-looking research and development, and increasing investment in innovative business areas.

In addition to business, Huaxi Biotech has also been frequently exposed to personnel changes in 2024.

In early April 2024, former core technician Ma Shouwei resigned; at the end of the same month, Huaxi Biotech announced that Liu Aihua, the company’s deputy general manager, and Luan Yihong, the former core technician, were no longer directly responsible for R & D related work, and core technician Wang Yongzhi resigned from the company for personal reasons.

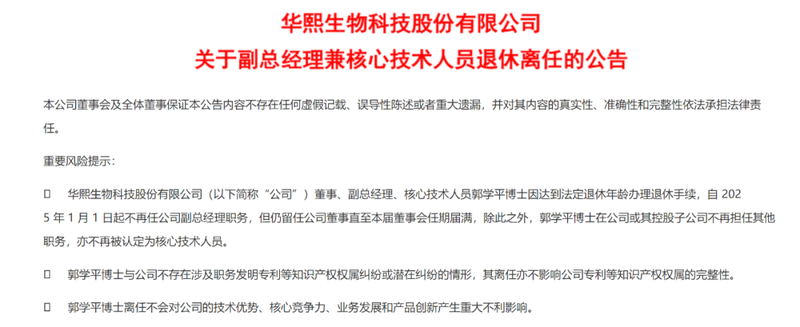

Entering 2025, a senior core technician of Huaxi Biotech will retire.

In January this year, the company issued an announcement stating that Dr. Guo Xueping, a core technician, will no longer serve as deputy general manager of the company from January 1, 2025 due to reaching the legal retirement age to go through retirement procedures, but will remain as a director of the company until the current board of directors. The term expires.

In addition, Dr. Guo Xueping no longer holds other positions in the company or its holding subsidiaries, and is no longer recognized as a core technical personnel.

Huaxi Biotech announced the retirement and departure of technical staff, Photo source Choice

These changes have all had an impact on the company’s performance.

The research report of Puyin International Securities also stated that throughout 2024, Huaxi Biotech’s multiple one-time expenses dragged down its performance. Among them, the management change of Huaxi Biotech caused the company to record multiple one-time expenses in 2024, exceeding RMB 70 million.

In addition, the company also recorded other one-time expenses, such as an accrual of RMB 210 million for assets such as accounts receivable, inventory and goodwill, as well as investment in innovative business and transformation and upgrading of production and supply chains.

Of course, these one-time expenses are incurred temporarily, and Huaxi Biotech still hopes to see the results of the adjustment in 2025.

2. Huaxi Biology, how much imagination does it have?

Once upon a time, Huaxi Biotech Station became the rapid development of hyaluronic acid, and once became the world’s number one hyaluronic acid supplier by using microbial fermentation to produce hyaluronic acid.

After winning half of the B-end market, Huaxi Biotech, which was unwilling to be just a supplier of hyaluronic acid, also successfully seized the opportunity in the C-end market.

In 2018, Huaxi Biotech launched China’s first hyaluronic acid secondary throwing liquid moisturizing Baiyan. Yang Jun, general manager of Runbaiyan brand, once revealed that in 2022, the sales of Runbaiyan brand will reach 1.5 billion yuan. Since moving to the C-end market in 2018, Runbaiyan’s average annual growth rate will reach 100%. rdquo;

2018-2022 In 2001, Huaxi Biotech’s revenue growth rates were 54.41%, 49.28%, 39.63%, 87.93% and 28.53%, respectively, and revenue jumped from 1.263 billion to 6.359 billion, almost using one ingredient, completing a myth of wealth creation.

Tuyuan Huaxi Biotech Official Weixin Official Accounts

The market was once very fond of this medical beauty. In July 2021, Huaxi Biotech’s share price climbed to 309.45 yuan/share, with a total market value of nearly 150 billion yuan.

However, the good times will not last long. As the hyaluronic acid market gradually matures, more and more companies are joining the battlefield, and the competition at the hyaluronic acid track is particularly fierce.

In the raw material market, Fufeng Group, Focus Freida, Anhua Biotech and other companies are all key export sources of hyaluronic acid raw materials; in the medical beauty terminal market, Aimei is rapidly emerging with star products such as Hiti, and Haohaishengke continues to launch new products and mergers and acquisitions to expand market share.

Behind the intensified competition, more and more players are seeing the potential of hyaluronic acid, or hyaluronic acid.

It is understood that hyaluronic acid, as an important filling material in the field of medical beauty, is widely used in the medical beauty and cosmetics industries. For example, it can be added to toners, essences, creams, masks and other products to moisturize and lock water., repair skin damage, enhance skin elasticity and other effects.

But at the same time, the application of hyaluronic acid is not only on the face, but its role on the human body has not yet been fully discovered.

Previously, hyaluronic acid could be used as a viscoelastic agent to temporarily support and protect eye tissue during ophthalmic surgery; in bone and joint surgery, it could also be used as a lubricant to relieve joint pain in patients.

Zhao Yan, chairman of Huaxi Biotech, once said in a speech that the total amount of information carried by glycan substances such as hyaluronic acid in people’s bodies exceeds the sum of nucleic acids and proteins. Many of these signaling mechanisms have not yet been understood by humans. The sugar science transformation roadmap was only proposed in 2012. With the 10-20-year research and development cycle of drugs, the golden age of research on such substances has just begun.

Amid fierce competition, Huaxi Biotech is still trying to tell a new story based on hyaluronic acid. Currently, Huaxi Biotech is expanding the application fields of hyaluronic acid and looking for breakthroughs in more product directions.

For example, Huaxi Biotech cooperated with Bausch and Lomb Company of the United States to dissolve small molecule hyaluronic acid in contact lens care solutions to improve the moisturizing, lubricating and antibacterial properties of the care solutions.

Huaxi Biotech has also made many new business attempts in hyaluronic acid food. It has launched products such as Shuijiquan hyaluronic acid drinking water, black zero hyaluronic acid food, and GABA night health drinks.

Huaxi Bio Shuijiquan Hyaluronic Acid Drinking Water, Tuyuan Huaxi Bio Official Weixin Official Accounts

However, or because consumers always have doubts about the efficacy of these hyaluronic acid foods, Huaxi Biotech’s functional food business has not developed smoothly. In the first half of 2024, the business achieved revenue of 29.22 million yuan, a year-on-year decrease of 11.23%.

For Huaxi Biotech, challenges still exist. The market does not pay for all the application stories of hyaluronic acid. Coupled with fierce market competition, it is understandable for investors to vote with their feet.

3. Looking for new outlets, Huaxi Biotech is still fighting hard in the technical field

In addition to hyaluronic acid, Huaxi Biotech will also face a new battle for technology research and development and a raw material revolution.

Over the years, Huaxi Biotech has been willing to spend money. From 2021 to 2023, its research and development expenses have increased from 284 million yuan to 446 million yuan, a year-on-year increase of 14.95%, setting a record high.

The 2024 semi-annual report shows that Huaxi Biotech’s R & D expenses are 200 million yuan, a year-on-year increase of 7.40%.

With high investment, Huaxi Biotech has also made some new progress in technological research and development.

Especially recently, the synthetic biotechnology that Huaxi Biotech has been deploying is showing signs of rising in popularity in 2024.

In the first half of 2024, there was a sharp increase in the synthetic biological index. According to Wind data, the synthetic biological index has been rising from February to April 2024. On February 29, the synthetic biological index was still 1,131.79 points, and by April 30, the index has risen to 1,280.36 points, and climbed to more than 1407 points in May.

Huaxi Biotech has a long history in the field of synthetic biotechnology. Using this technology, Huaxi Biotech can also gradually realize the iteration of production methods, improve raw material production efficiency and reduce costs.

Based on synthetic biotechnology, Huaxi Biotech can tap new performance raw materials and achieve a new raw material revolution.

At present, Huaxi Biotech has made breakthroughs in the research and development of multiple bioactive raw materials such as collagen, ergothioneine, and ecdoin.

In terms of collagen, Huaxi Biotech has been working hard on the track of recombinant collagen as early as 2022, and has now completed the layout of recombinant collagen at the raw material end + terminal end.

In 2024, Quadi, a functional skin care brand owned by Huaxi Biotech, will enter the bureau ‘s brand skin care track and launch new products such as recombinant type III humanized collagen repair paste, providing a full-cycle skin care solution after medical art.

Huaxi Biotech also responded to investors ‘inquiries at the semi-annual performance briefing and stated that in the past two years, the company has listed a variety of collagen products; at the medical terminal level, in the first half of 2024, the company obtained 5 second-class medical products in China. Device registration certificate covers a variety of medical device products related to recombinant collagen wounds.

In terms of the research and development of ergothioneine with good anti-aging effect, Huaxi Biotech was able to produce ultra-pure ergothioneine with a purity of more than 99%, and achieved an order of magnitude breakthrough in fermentation yield, from the original several hundred milligrams per liter. Increase to a few grams per liter greatly reduces production costs.

Judging from the market situation, the development prospects of collagen and ergothioneine are relatively broad.

According to data released by Heavy Capital Enterprise International Consulting, the market size of my country’s collagen products will reach 53.7 billion yuan in 2023, and the market size will reach 71.9 billion yuan in 2024.

According to statistics and forecasts from Hengzhou Bozhi, the scale of ergothioneine in China market in 2022 will be 22.37 million yuan, accounting for about 4.83% of the world’s total. It is expected to reach 185.80 million yuan in 2029, accounting for 20.80% by then.

In addition, Huaxi Biotech has also built the world’s largest pilot test achievement transformation platform, covering the entire process from fermentation, purification to refinement, which can provide efficient and reliable process support and comprehensive solutions for the transformation of technical achievements.

In addition to deep cultivation in the development of raw materials, Huaxi Biotech revealed to Wired Insight that the company is focusing on two major areas: glycobiology and cell biology.

In the field of glycobiology, Huaxi Biotech has relied on its research reserves and transformation capabilities in the field of hyaluronic acid to begin to explore areas such as heparin, chondroitin sulfate, breast milk oligosaccharides, sialic acid, etc., and successfully built a sugar bank.

In terms of cell biology, the company is exploring cell-level anti-aging and achieving the restoration of tissue functions through the regulation and optimization of cell types and functions.

If Huaxi Biotech’s technical attack can be successful, it will open up new growth space for the company.

On the one hand, the development and application of new bioactive raw materials will enrich the company’s product line and allow Huaxi Biotech to get rid of the single label of a hyaluronic acid expert and have more imagination.

On the other hand, when these new technologies and new raw materials are applied to businesses such as medical beauty terminals and functional skin care products, it is expected to develop more differentiated and competitive products and help Huaxi Biotech achieve new growth.

Of course, the challenge of technology is a long and difficult process, during which uncertainties such as technical problems and changes in regulations and policies may be encountered. The continuous increase in R & D investment will further increase the pressure on the company. Once the market acceptance of new products is not high, it will affect Huaxi Biotech’s performance and financial status.

For Huaxi Biotech, the road ahead is still long. The company’s long-term investment in technology and raw material research and development results determine the length of the adjustment cycle. However, before the end of the cycle, Huaxi Biotech must be ready.

(The header picture of this article comes from Huaxi Biotech’s official Weixin Official Accounts.)

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.