With HK$23.3 billion, the IPO of new tea drinks is here for the first year.

Ancient tea is on the market, but new tea drinks are changed?

Wen| Fixed focus One Su Qi

Ancient tea, the third stock in the new tea and beverage industry, has finally been listed. Although it was the third strand, it attracted no less attention than the first two.

When it is launched in 2025, Guming is given the expectation of a turning point in the industry. The two new tea and beverage companies that entered Hong Kong stocks before it did not perform well.

As of the close of February 11, the first share of new tea drinks, Naixue’s tea, closed at HK$1.25/share, down 93.68% from the issue price of HK$19.8. Its market value was once close to HK$30 billion, but now only HK$2.1 billion is left; Another tea baidao closed at HK$9.60/share, which was 45.14% lower than the issue price of HK$17.5/share, and the total market value was approximately HK$14.2 billion.

The market is waiting to see whether Guming can successfully reverse the curse of the first batch of Naixue tea and the second batch of tea breaking immediately after being listed on the market, and rewrite the capital market’s negative judgment on new tea drinks. At the same time, can we get a good start for Mixue Ice City and Shangshang aunts who are still queuing, as well as the Overlord Tea Lady and Tea Yan Yuese who have heard the news of plans to go public in the United States?

Guming’s listing performance did not disappoint. On February 12, Gu Ming was listed on the Hong Kong Stock Exchange with an issue price of HK$9.94/share. As of the afternoon market close, the share price was HK$9.98/share, with a market value of approximately HK$23.3 billion.

Although it has not entered first-tier and second-tier cities, in the three southern provinces of Zhejiang, Fujian and Jiangxi, the headquarters of Guming, there are nearly 10,000 stores (9778 stores) in prefecture-level cities in these areas, and the density is higher than that of Mixue Ice City.

More stores have higher revenue. In 2023, Guming’s revenue will be 7.676 billion yuan and its net profit will be 1.096 billion yuan. This year, it sold nearly 1.2 billion cups of milk tea, equivalent to a net profit of about 1 yuan per cup of tea sold. By the first three quarters of 2024, Guming’s revenue and profit will continue to grow double, stabilizing its leading position in the 10-20 yuan price band.

However, listing is not a panacea. Before listing, Chabaidao also had good performance and profits for three consecutive years. As a result, its first financial report after listing changed its face, and revenue and net profit both fell in the first half of 2024. Guming, which is in the same price band as Chabaidao and relies on franchisees to make money, also needs to prove its stability and growth after listing.

How did the third share of the new tea drink perform?

Ancient tea is already the third share of new tea drinks, but given the performance of Naixue’s tea and Baidao, many investors lament that how hot Naixue’s tea was back then, how cold the entire new tea drinks industry is now.

In 2021, Naixue’s tea was launched when the market sentiment was high. At that time, Naixue’s tea was still a representative of high-end new tea drinks (high-end materials, high-end stores, and high-end prices). It received 432 times oversubscription during the IPO. As a result, it broke on the first day of listing, down 13.54% from the issue price.

After this battle, Hong Kong stocks ‘enthusiasm for new tea brands gradually cooled, and almost no one dared to hand in their watches for the next three years. It will not be until 2024 that Mixue Ice City, Chabaidao, Guming and Shanghai Aunt will restart their listing path.

Unlike Naixue’s tea listing at a loss, Chabaidao has maintained its net profit at around 1 billion yuan for three consecutive years (2020 – 2022) when it IPO in 2024. However, because the amount raised was too large, and the impact of the performance and stock performance of the first share was still there, Chabaidao’s public offering only received 0.5 times subscription, which was insufficient. It also broke on the first day of listing, and the intraday share price fell more than 37%.

Jason, an investor who has long been concerned about the new tea and beverage industry, explained that in addition to the poor record of the first and second stocks, the franchise model of new tea and beverage companies has difficulty in compliance and quality control (food safety issues), and the fierce competition in the market has also brought about problems such as price wars, which will affect the attitude of the capital market towards the new tea and beverage industry.

Tuyuan/Guming official website

Will Guming continue to be affected by the downturn, or will it restore hope in the tea drinking market?

Judging from the results of Guming’s IPO, the situation has changed.

Contrary to market expectations, Guming finally chose top pricing. Gu Ming’s final IPO price is set at the upper limit of the offering range of HK$9.94. At the same time, the issuance volume will increase by 23.79 million shares based on the 159 million shares. Finally, approximately HK$1.82 billion was raised through this offering. However, this issue price is still lower than Chabaidao’s HK$17.5.

Top pricing indicates that the market has a high degree of recognition of the company’s prospects, and the public subscription portion has responded relatively enthusiastically. Therefore, Gu Ming adjusted the placement ratio and increased the proportion of retail investors. Of the IPO shares, 90% were originally reserved for institutional investors, but the proportion has dropped to 56.5%, and retail investors have increased from 10% to 43.5%.

However, consumer industry investor Chen Lin said that top pricing needs to bear the risk of breaking after market sentiment reverses, and also relies more on subsequent performance to maintain market confidence.

Perhaps in order to give investors and the capital market more confidence, compared with Chabaidao’s non-cornerstone streaking, Guming introduced five cornerstone investors, including Tencent, Meituan Longzhu, and Zhengxin Valley Capital (investment cases include Netease Cloud Music, Station B and Bubble Mart), Duckling Fund and Yuansheng Capital, with a total subscription of approximately US$71 million (approximately HK$553 million).

At the same time, although Guming’s IPO valuation is slightly lower than that of Chabaidao, it is relatively reasonable. At that time, the IPO price of Chabaidao was HK$17.5 per share, with a total share capital of 1.478 billion shares, and a valuation of HK$25.9 billion, which was 22.5 times PE of net profit in 2023. The offering price of Guming is HK$9.94/share, with a total share capital of approximately 2.355 billion shares, and a valuation of approximately HK$23.4 billion, which is 20 times PE of the net profit for the first three quarters of 2024. If compared according to the full-year data, the valuation will be more reasonable.

In addition, Gu Ming promised in the prospectus to pay dividends of 1.74 billion yuan to old shareholders (to be paid within 2 years), and also promised to distribute special dividends of no less than 2 billion yuan to new and old shareholders after listing to reduce selling pressure and cushion the risk of breakdowns. ldquo; This is equivalent to giving the market a reassurance. Some investors explained to “Focus One”.

Judging from its performance on the first day alone, Guming did not disappoint. Its issue price was HK$9.94/share. As of the afternoon market close, its share price was HK$9.98/share, and its market value was approximately HK$23.3 billion.

Chen Lin observed that Hong Kong stocks themselves are relatively active this year. Gu Ming’s IPO results and listing performance will have a positive pulling effect on the subsequent listings of Mixue Ice City and Shangshang Aunt in Hong Kong.

The achievements and troubles of the second and third children

At present, among the top three stocks in the new tea and beverage industry, Naixue’s teas are basically directly sold and have a higher price band. They are all in the same price band of 10 – 20 yuan. They are all franchisor-based teas and will compete with the ancient tea that will be listed later. It is inevitable that the two are often compared together.

Chabaidao and Guming are typical franchising models. If you break down the income situation, you will find that the majority of their income is selling consumables and raw materials to franchisees, working as middlemen to earn a difference, and providing soft services such as training and management to supplement income.

The franchise model can quickly start production, allowing Chabaidao and Guming to quickly rank among the top three in the industry in terms of scale. According to data from Narrow Gate Dining Eye, as of press time, the TOP3 of the number of existing tea beverage stores in China are Mixue Ice City, Guming and Chabaidao, with the corresponding number of stores being 33,300, 9735 and 8301 respectively.

Picture Source/Narrow Gate Dining Eye

Nearly 10,000 franchisees have supported the main revenue and profits of Chabaidao and Guming. However, with the fierce competition in the milk tea industry and the start of price wars, Chabaidao’s performance will show a downward trend in 2024.

The prospectus for Chabaidao’s listing is very beautiful. From 2021 to 2023, revenue increased from 3.644 billion yuan to 5.704 billion yuan, while the total net profit for three years is approximately 2.9 billion yuan. However, its first financial report after listing showed that Chabaidao’s revenue in the first half of 2024 fell by 9.96% year-on-year, and its net profit fell by 59.9% year-on-year. The change in performance has exacerbated investors ‘concerns about the sustainability of its growth.

Jason explained that the decline in Chabaidao’s profits was affected by the deduction of take-out order platforms and the loss of fresh fruits and fresh milk distribution. ldquo; Especially for franchisees, fresh fruits account for about 30% of the total cost. The loss of fresh fruits directly affects the profitability of franchisees and increases the processing costs of store personnel. rdquo;

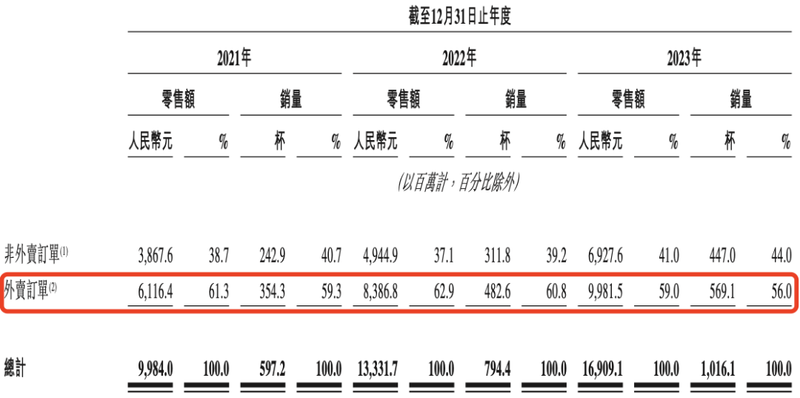

2021-2023 In 2008, the GMV and sales of tea hundreds of takeout orders accounted for about 60%

Gu Ming’s performance was relatively stable, maintaining a double-digit growth rate. From 2021 to 2023, Guming’s revenue increased from 4.384 billion yuan to 7.676 billion yuan, and net profit increased from 24 million yuan to 1.096 billion yuan; in the first three quarters of 2024, Guming’s revenue was 6.442 billion yuan, a year-on-year increase of 15.6%, and net profit was 1.120 billion yuan, a year-on-year increase of 11.78%.

Guming has more stores, and its income will naturally be higher. At the same time, due to its regional encryption strategy, it has built a cold chain logistics and warehousing advantage in the sinking market, and achieved cost in the storage and distribution of fruits and fresh milk with short shelf life. Lower than peers.

The prospectus shows that as of September 30, 2024, Guming can provide cold chain distribution services every two days to approximately 97% of stores, while other existing tea and beverage shop brands usually provide cold chain distribution every four days and do not provide cold chain distribution. At the same time, during the performance period, the average delivery cost of Gu Ming warehouses to stores accounted for less than 1% of GMV, far below the industry average of 2%.

However, the biggest common anxiety of Chabaidao and Guming, which rely on franchisees, is how to attract more franchisees and rely on franchisees to continue to make money.

Obviously, judging from the single-store indicators that franchisees are most concerned about, Guming’s old store operating data has declined, new entrants have difficulty making money, there are fewer and fewer good spots, and the turnover rate of franchisees has become higher.

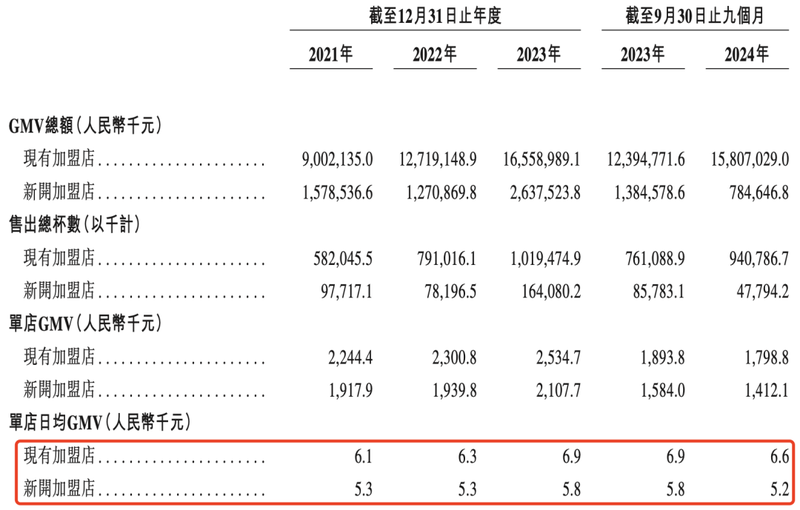

Operating data in the prospectus shows that in the first three quarters of 2024, the average daily GMV of existing franchisees (including old stores) fell by 4.4%; the average daily GMV of newly opened franchisees fell by 10.3%. In 2021, 2022, 2023 and the first three quarters of 2024, Guming’s franchisee turnover rates were 6.2%, 6.7%, 8.3% and 11.7% respectively.

Operating data of Guming franchise stores

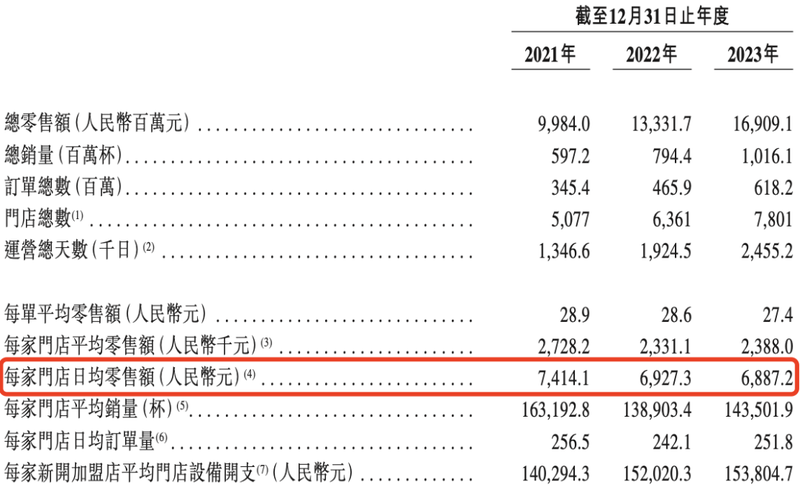

Chabaidao is also facing the same situation. In 2021, 2022, 2023 and the first half of 2024, the franchisee turnover rates of Chabaidao are 0.17%, 1.14%, 10.69% and 8.19% respectively. At the same time, the average daily GMV of a single store in Chabaidao also showed a downward trend, from 7414 yuan in 2021 to 6887 yuan in 2023.

Operating data of Chabaidao franchise stores

In addition, they also face the problem of stock competition after regional encryption, the problem of opening up new markets, and the problem of new rhythm and SKU richness on their products.

The expansion logic of the two companies is actually different. Chabaodao belongs to shop first and then encrypt. Although the number of stores is not as large as that of Guming, it covers more provinces and cities than Guming. What needs to be replenished is the warehouse allocation capacity.

Chabaidao is good at shop map sources/narrow door dining eyes

Guming is a key scale first and then expanding north. It has absolute advantages in the three major provinces of Zhejiang, Fujian and Guangdong. However, one of the negative effects of Guming’s regional encryption strategy is the same-store GMV of old stores (GMV of stores that have been open for more than a certain period of time) has declined. In order to prevent new and old franchisees from nibbling each other, Guming needs to expand north, which is the touchstone market for milk tea. When opponents occupy an advantageous position, it will be difficult to break through.

In terms of categories, the styles of the two are also different. In 2023, the sales volume of Chabaidao Yangzhi Ganlu was approximately 92.4 million cups, and the single product was sold nearly 1.8 billion yuan; in the same year, approximately 68.7 million cups of signature taro round milk tea and 111 million cups of jasmine milk green were sold; Gu Ming focuses on rapid new products. In 2023, Gu Ming launched 130 new products, equivalent to one new product every 2.8 days.

“Low-order products require high repurchase to ensure revenue. Hot purchases and new purchases are both means to stimulate repurchase, but they also have limitations. rdquo; Jason explained that hot products have traffic, which reminds people from time to time, but they need to face the crisis of a cliff-like decline in traffic after the vitality cycle declines; rapid new products can revitalize users, but they test the matching of the supply chain and the team’s research and development capabilities.

According to the financial report, Guming’s average quarterly repurchase rate in 2023 will reach 53%, and Chabaidao’s member repurchase rate in Q4 2023 will reach 35%, both higher than the industry average.

In 2025, four major trends in the milk tea industry

After Guming went public, Mixue Ice City reported that it would start a public offering before the end of February, planning to raise about US$500 million. Currently, there are also Aunt Shanghai, Bawang Tea Girl and Cha Yan Yuese who are still in line. News of going public in the United States.

In fact, listing is not the only way for the development of these new tea drinks companies. The size and operating logic of some new tea drinks brands are actually not necessary to go public. Chen Lin analyzed, but due to the exit needs of the investors behind the brands, the need to launch the brand and the need to have an additional financing channel, they have launched listings one after another, just to take money to continue rolling. In addition, whether it is a price war or the expansion of thousands of stores, it requires the help of franchisees. Companies are rushing to go public in order to give franchisees confidence.

China’s new tea and beverage industry is too big, as can be seen from Guming’s prospectus.

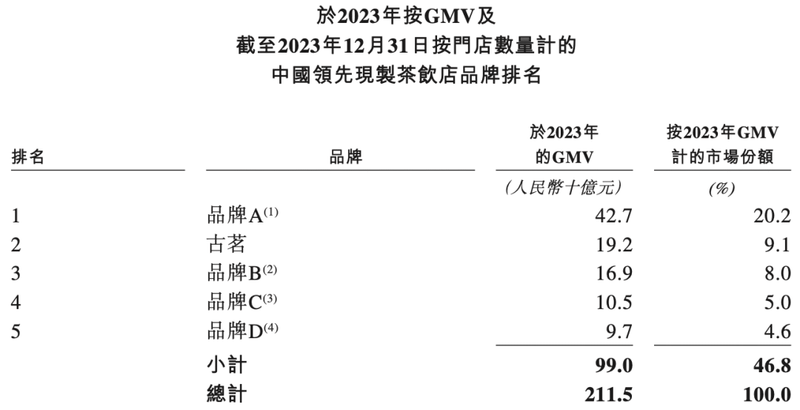

It ranks the market structure of existing tea and beverage shops in China according to GMV. According to calculations, the top five in 2023 are Mixue Ice City, Guming, Chabaidao, Bawang Tea Ji and Aunt Shanghai.

However, many people only pay attention to the rankings. They don’t pay attention to the top five market share, which only accounts for 46.8% in total, leaving half of the market share to new and old players to continue to gain.

The price range from 10 yuan to 20 yuan is the Red Sea Market. Almost all the top ten brands in the number of stores are in this price range, including Chabaidao, Ancient Ming, Diandian and Bawang Tea Ji. Under fierce competition, what changes will happen to the new tea and beverage industry in 2025?

One of the major trends is to continue to recruit franchisees, but suspend extensive franchising and shift to high-quality store stores.

In the past, new tea drinks wanted to compete in thousands of stores because consumer brand loyalty in the tea industry was low, especially in the price band of 10 yuan to 20 yuan, so the scale was approximately equal to the brand influence to some extent. But now the logic of the new tea and beverage industry has changed, and scale is no longer the only winning point. Some fight for supply chains, some fight for marketing, and some fight for new categories. Industry players each have their own tricks.

At this time, excessive pursuit of the goal of 10,000 stores resulted in a surplus of stores. The story that the more franchisees, the more money it makes is no longer true. Some franchisees said that when the store protection distance is changed from 1 kilometer to 50 meters, it is a lose-lose for both franchisees and brands.

Instead of stacking quantity, a group of brands have already responded to this: On February 10, Xicha released an internal email to all employees, rejecting meaningless store size submissions and suspending acceptance of business partnership applications. It will launch in November 2022 The business partnership business has come to an end. In August last year, Naixue’s tea chairman also said at the performance meeting that the company would be very rational and cautious, and slowly develop franchise stores and direct stores. rdquo;

In order to stabilize the operating data of existing franchisees, Gu Ming also began to control the growth rate of new franchisees. In the first three quarters of this year, the average monthly net increase was 86.33, much lower than last year’s monthly average of 194.33.

Second, the price war will come to an end. If it continues, everyone’s profits will be lost.

At the beginning of 2025, more and more coffee and tea brands have stopped fighting price wars. The prices of some drinks and desserts in Mixue Ice City have increased by 1 yuan, and the prices of some products in Ruixing have increased by 3 yuan. Xicha and Starbucks have shouted to give up the price war. slogan.

Third, the new tea drinking market is a typical type of flavor and one god. In the era of pearl milk tea, there was a little bit of harmony and CoCo. In the era of fresh fruit tea, there were Xi tea and Naixue tea, and then there were Chabaidao and Ancient Ming tea. Original leaf fresh milk tea has tea Yanyue color and Overlord tea, and lemon tea has lemon season and forest.

By 2025, some practitioners told “Fixed Focus One” that the new tea industry may have more functional products, such as clearing heat and sleeping aids (low-caffeine). When the direction of product research and development changes, the supply chain will also change accordingly.& ldquo; Whenever new flavors and categories emerge, new industry overlords will be born.

At the same time, the coffee and new tea industry will have a battle in 2025.

In the past 2024, whether it is tea brands making coffee, such as Guming Coffee Drink SKUs accounting for 12%; or coffee brands making tea, such as Lucky launched a new Light Milk Tea series and continuously increased SKUs, the purpose is to encourage users to repurchase and fill store operating efficiency based on the support of the original supply chain.

However, Jason pointed out that Lucky, which is making efforts to sink the market in 2025, will face siege from milk tea brands at a price band of around 12 yuan. At the same time, new tea brands such as Bawang Tea Ji have the same high-content tea polyphenols as caffeine. It is addictive and can further replace coffee and snatch space for migrant workers.

In 2025, the battle between the coffee and new tea industries will become even more intense, leaving players with little time to go public.

* The caption comes from the official Weibo of Guming Tea Drink. At the request of interviewees, Jason and Chen Lin were used as aliases in the article.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.