Recently, Meme has shown obvious signs of “ebbing”, coupled with the approaching ultra-large unlocking, which can be said to be a double whammy. Solana’s pressure has doubled. Has its “good luck” really been used up?

author| Mumu

produced| Vernacular blockchain

Due to Solana’s outstanding performance in this round of market trends, many people believe that this bull market is Solana’s bull market. Looking at Solana’s development history in the past few years, whether it was taking advantage of DeFi Summer’s entry into Wall Street, or seizing the Meme craze as a life-saving straw, the “Return of the King” after FTX went bankrupt, these are all People feel that Solana’s fortune is too good.

However, giants like FTX can fall overnight, and Meme also has its own ebb and flow. Recently, Meme has obvious signs of “ebb”. Coupled with the approaching ultra-large unlocking, it can be said that it is a double whammy. Solana’s pressure has doubled. Has its “good luck” really been used up?

01. Meme tide decline

Recently, online data shows that Solana’s online transaction volume has dropped rapidly since February, and the number of launches on related platforms such as Meme Launch has dropped sharply. Popular projects in the Solana ecosystem have dropped sharply, and various FUD voices have begun to appear on social platforms.

At the beginning, Meme rose amid the calls of “anti-VC”,”no offer” and “fair launch”. However, after the rise of the Meme craze, various institutions took advantage of the trend and quickly occupied a favorable ecological niche. The encryption community quickly discovered that without continuous injection of funds, Meme relying on fair launch was like a flash in the pan. As a result, most people fell into the arms of various institutions and took over their offer.

Immediately afterwards, the presidential coin, which represents the top celebrity, was born. The Trump family Token first quickly sucked up the liquidity in the market, and then the Milay Token came on to give another heavy blow. Afterwards, people gradually discovered that there was a management team behind these celebrity projects, and some were even related to each other. Behind each hot project, there was an invisible hand controlling it. The encryption community suddenly felt that it was being pressed to the ground. Friction repeatedly. Some KOL bluntly said that our encryption community just wants to circle, not let celebrities outside the circle come in and make money…

In the final analysis, the Meme craze and the bursting of the bubble have ultimately exposed the “evil” of human nature. Excessive speculation by greedy retail investors has always been unable to escape the fate of “takeovers”. This has caused a huge blow to the Meme market and has benefited from the Meme craze. For the Solana ecosystem, which has gained rapid growth momentum, it is like a blow. The powerful relationship is self-evident.

02. Huge unlocking at an extremely inappropriate time

While still immersed in the sadness of Meme’s ebb tide, another desperate news came,”On March 1, 11.2 million SOLs will be unlocked.” At first, people mistakenly thought this was an unlocking planned in the Token economic model. Usually, such unlocking is a planned small-scale unlocking and has little impact on market conditions. However, this large-scale unlocking is the second wave of blows after FTX’s bankruptcy. Simply put, these 11.2 million SOLs are part of the Tokens sold during FTX’s liquidation process. These tokens have a certain Vetting Schedule set during trading, usually 1-3 years, and will expire in March 2025, so they enter the circulation market.

After FTX went bankrupt in November 2022, the huge amount of SOL held by its affiliated company Alameda Research became part of the liquidation assets. It is estimated that FTX/Alameda initially held approximately 58 million SOL units, accounting for 10%-15% of Solana’s total supply at the time. The bankruptcy custodian (led by John J. Ray III) then sold the Tokens to institutional investors at a discounted price. It is reported that those who bought these tokens at the time included Pantera Capital, Galaxy Digital, Figure Markets and other institutions. Based on information on X and on-chain data (such as Lookonchain tracking), the market estimates that the selling price of these Tokens will be approximately US$60 -80 per piece (30-40% of the current market price).

Due to the fact that the 11.2 million SOL units that are about to be unlocked are purchased at a discount and at a low cost, the market expects that if no one takes over the offer and quickly absorbs it, it is likely to bring huge selling pressure to SOL after unlocking. The current pressure has already been put on the current market price and Solana Ecological Community.

03. Has Solana run out of luck?

So has Solana’s luck really run out? It doesn’t seem that whether it is the Solana spot ETF expected to be passed this year or Trump’s series of crypto-friendly policies, it can be regarded as a continuation of Solana’s good luck.

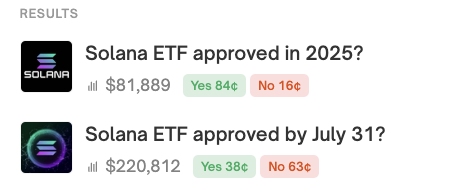

High hopes are placed on the Solana spot ETF, which may pass as soon as June this year. Currently, on well-known forecasting platforms, the probability of the Solana ETF passing in 2025 is 84%, while the probability of passing before June 31 is 38%. Judging from the previously approved performance of Bitcoin and Ethereum spot ETFs, the current position value of the Bitcoin spot ETF is more than US$110 billion, while the position value of the Ethereum spot ETF is more than US$10 billion. Judging from Solana’s institutional support rate, it will at least There will be billions of dollars flowing in, so it can naturally easily cover the unlockable benefit of 11.2 million. However, the problem is that the unlocking is close at hand, and the ETF is still approved for at least a few months.

Trump’s series of friendly policies are actually being gradually implemented. This is a friendly regulatory environment for the entire encryption industry. Thanks to the accelerated catalysis of the Meme craze, the Solana ecosystem has also become remarkable. At the beginning of 2025, the DEX transaction volume on the Solana chain once exceeded that of Ethereum. It is considered to have successfully passed the stress test, and both the number of users and the activity are strong momentum.

In addition, Solana’s developer community is also growing at a rapid rate. Coupled with the iterative upgrades of Solana’s future roadmap plan, the existing deficiencies in technical solutions, its ecosystem continues to attract more and more attention, such as Paypal, Franklin Templeton and other top institutions have also joined in.

04. Summary

Whether the Meme craze is cooling down or large-scale unlocks, these are actually short-term “pains” that are common in the encryption field. It cannot be concluded that Solana has fallen, let alone when its ecological development momentum is good. The east wind of friendly encryption supervision is even more beneficial as the number one public chain founded in the United States. As for the longer-term future, waiting for time will bring more tests.