Original title: “B3 tokens are pulled four times in 3 days: A carnival of leeks, or a new leek land for capital?”

Original author: Alvis, MarsBit

Opening comment: The magical reality of B3 tokens

The B3 token we are going to talk about today can be called the most magical script in the crypto circle in 2025-a “magic coin” operated by a former Coinbase employee and known as the “Tesla in the Games Industry”, whose price has soared by 249% in three days after launch. Now it is harvesting global leeks as the “Base Chain Leader”.

Let’s start with a few digital games:

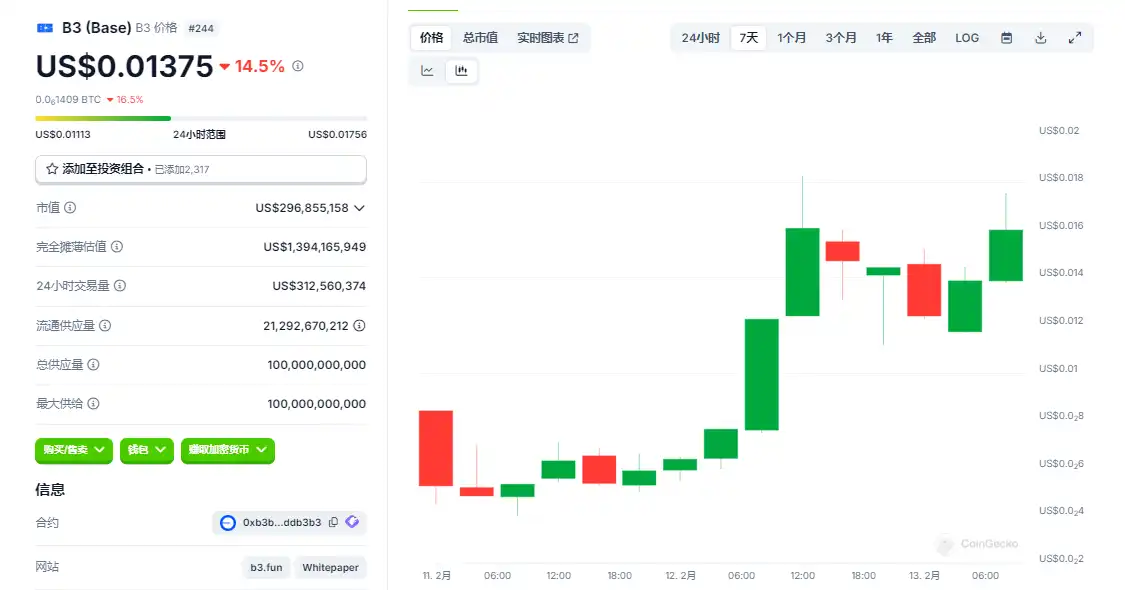

– The current price of B3 is US$0.014, which has soared from a low of US$0.04 when it went online on February 10 to a peak of 0.02 yuan on February 12. It has increased by 400% faster in three days, which is faster than the price increase of pancakes and fruits downstairs in your house. Faster;

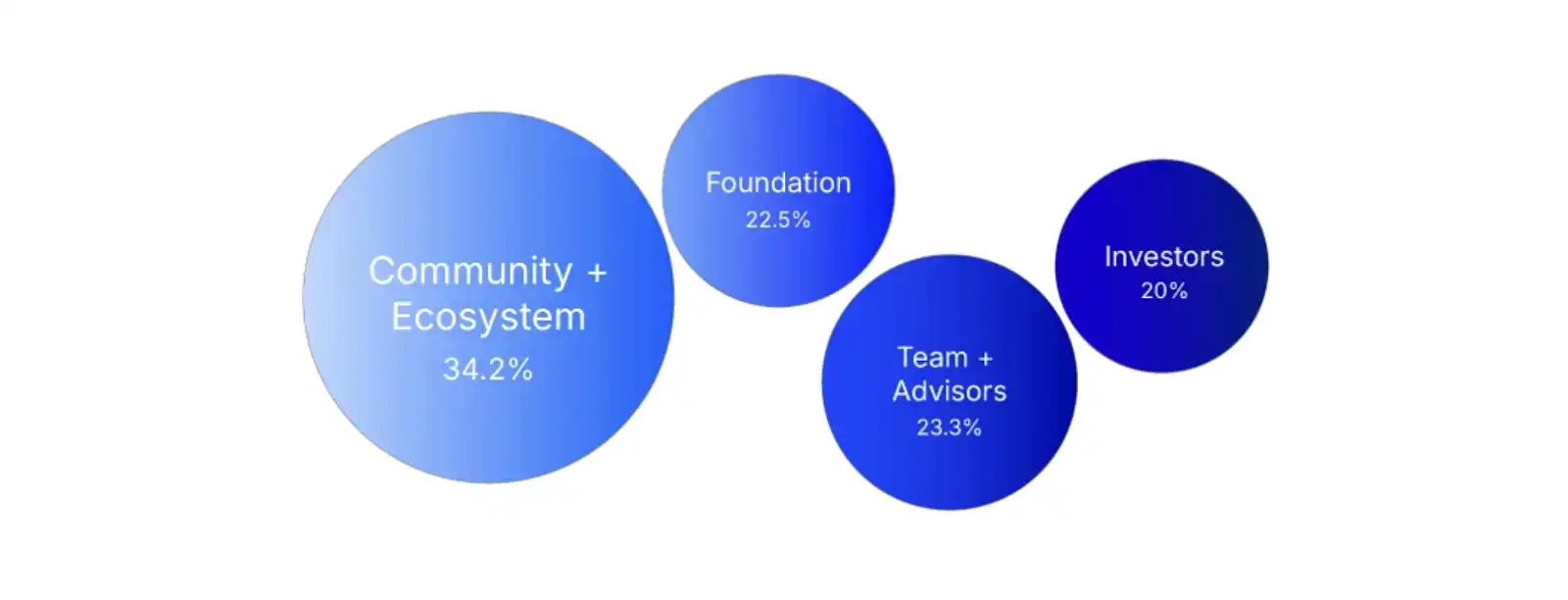

– The total supply was 100 billion pieces, and the team + investors directly took 43.3%, which is equivalent to every 10 coins issued, and 4 pieces went into the banker’s pockets;

– On the first day of launch, 900 million pieces were airdropped, and the dealer’s control of the market was comparable to the behind-the-scenes BOSS in “Squid Game”.

This kind of magical plot, even the screenwriter of “The Wolf of Wall Street” has to call him an expert after watching it. Today, Marsbit will take you to use a “physical plug-in” to disassemble the valuation logic of B3 to see if this thing is a “new infrastructure for the game revolution” or a “leek meat grinder 3.0.”

B3 ‘s “triple personality design”-the quantum entanglement of technology, capital and leeks

Technical design: “game highway” on the Base chain

B3 officially claims to be a “dedicated chain for Layer3 games on Base.” To put it in plain Chinese, it is building another floor on the Base Chain (Layer2), Coinbase’s son, to provide “private room services” for game developers. This thing has two technical advantages:

– Gas fees are ridiculously low: each transaction costs $0.001, which is cheaper than going to a convenience store to buy a bottle of water;

– TPS is terrifyingly high: the theoretical peak is 9000+, but it actually runs faster than Solana.

But there is a dark humor here: the underlying technology of B3 is backed by the Base chain, and the Base chain is backed by the security of Ethereum.

In other words, B3 is like a “third landlord”-Ethereum is the landlord, Base Chain is the second landlord, and B3 is the third landlord who converted the basement into a capsule hotel. Once Ethereum is stuck in traffic (such as during the NFT boom period), B3’s speed advantage immediately becomes turtle speed.

Capital design: Former Coinbase Tiantuan’s “Re-employment Plan”

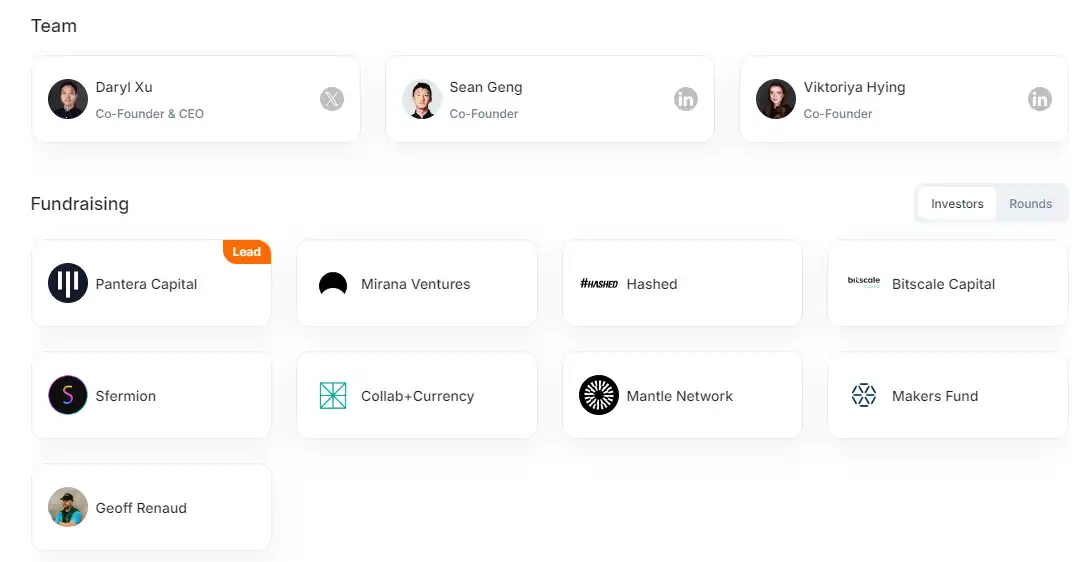

B3 ‘s core team is all former Coinbase employees:CEO Daryl Xu has been in business development for 4 years. CTO Sean Geng is an engineer at Coinbase, and even financing is the personal platform of Coinbase Ecological Fund. This kind of background is like writing “former Alibaba P9” on your resume-investors immediately climax and directly smashed the US$21 million seed round.

But here’s the question: If these people are really awesome, why don’t they continue to promote and raise wages on Coinbase, but instead come out to start a game chain? The answer may be hidden in the token allocation-team + consultant gets 23.3%, investors get 20%, adding up to 43.3%,Based on current prices, the market value after unlocking will be at least US$400 million. This is not entrepreneurship, it is clearly a “Guide to Cash Out for Employees of Former Big Factory Employees”。

Leek Character Design: Airdrop + Game “Double Screw Harvester”

B3 ‘s most exciting operation is “Airdrop Economics”:

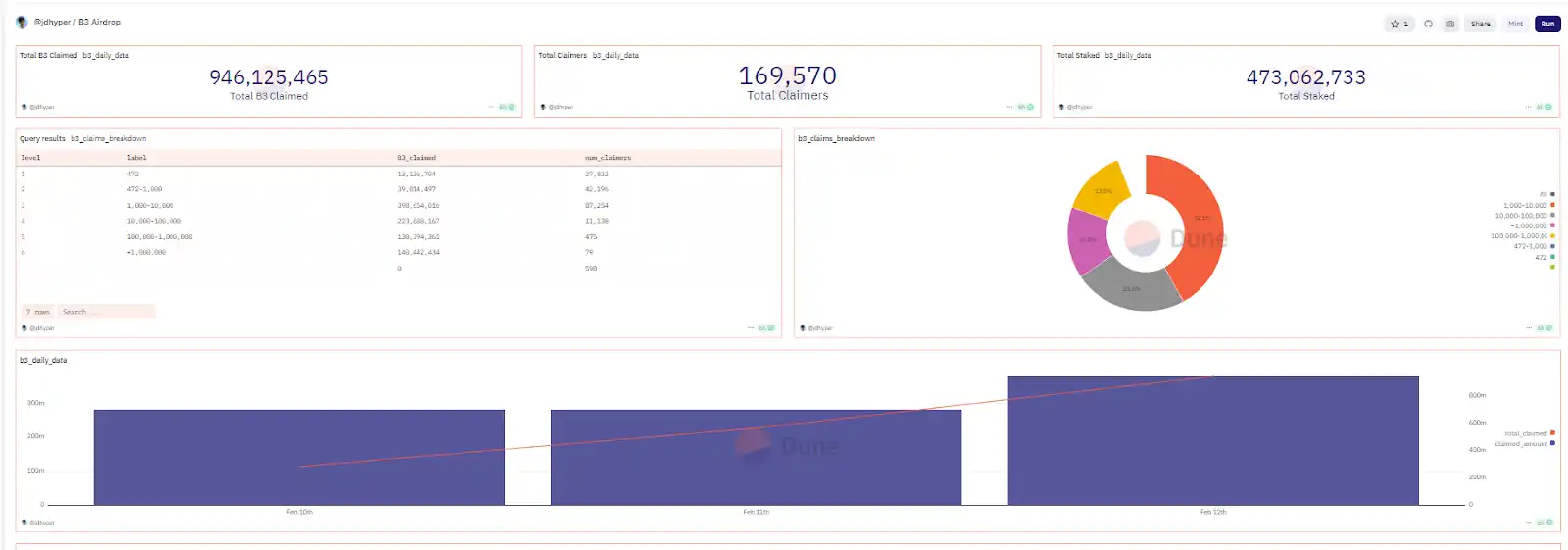

– The first wave of airdrops: According to Dune data, 9.9 billion airdrops have been issued currently, and players exchange for them by “playing games to earn points”. As a result, the point rules are as complex as college entrance examination math problems;

– The second wave of airdrops: Promise that there will be “championships” and “gamified mining” in the future, but the specific rules? I’m sorry, the banker has the final say.

The essence of this routine is “exchanging token subsidies for user data”-you think you are collecting wool, but in fact it is sold to game developers as a data package. What’s more, B3 also launched a “pledge mining” exercise. The annualized income of 35% may seem tempting, but if you calculate carefully: if the currency price falls by 35%, the principal will be directly cut in half. This is not financial management, it is simply “Russian roulette”.

1. Relative valuation method: How much is B3 worth against Axie and Sandbox?

Let’s first look at our peers:

– Axie Infinity (AXS): At its peak, it has a market value of US$28 billion, with 2.7 million daily active users and a single user valuation of US$10,000;

– The Sandbox (SAND): Peak market value of US$20 billion, daily activity of 500,000, and single user valuation of US$40,000;

– B3: Daily activity claims to be 6 million yuan (it is actually possible to inject water). Based on a single user valuation of US$10,000, the market value should be 60 billion yuan? But the reality is that the circulating market value of B3 is only US$260 million, and the FDV is US$1.4 billion, not even a fraction.

There is a shocking loophole here: of B3 ‘s 6 million users, 90% are wool parties who come for airdrops, and there may be fewer than 600,000 real players. Based on this data, the reasonable valuation of B3 should be 600,000 users × 10,000 US dollars = 6 billion US dollars, 30 times higher than the current market value. But the problem is–Once these users receive the airdrop, they immediately withdraw their coins and run away, leaving you with a bunch of zombie accounts.

2. DCF Model: Future Cash Flow? No, the ability to draw cakes in the future!

A serious valuation depends on cash flow, but where is the cash flow of B3? The official white paper lists a bunch of scenarios:

– In-game transaction commission: 0.5% is charged for each transaction, but now 80% of games are free to play. Is it a drain?

– Pledge income: 35% annualized, but this is using the money from new leeks to pay interest to old leeks, a typical Ponzi structure;

– Advertising revenue: The unit price of chain-game advertising is less than 1/10 of that of Web2, and the money earned is not enough to pay the server electricity bill.

So the true valuation model of B3 should be:

Market value = team background × airdrop popularity × leek FOMO coefficient ÷ regulatory risk

The translation is: former Coinbase team + crazy airdrop + leek take-up-SEC raid = current price.

3. On-chain data metaphysics: The love triangle between giant whales, retail investors and dog farms

Take a look at B3 ‘s online data:

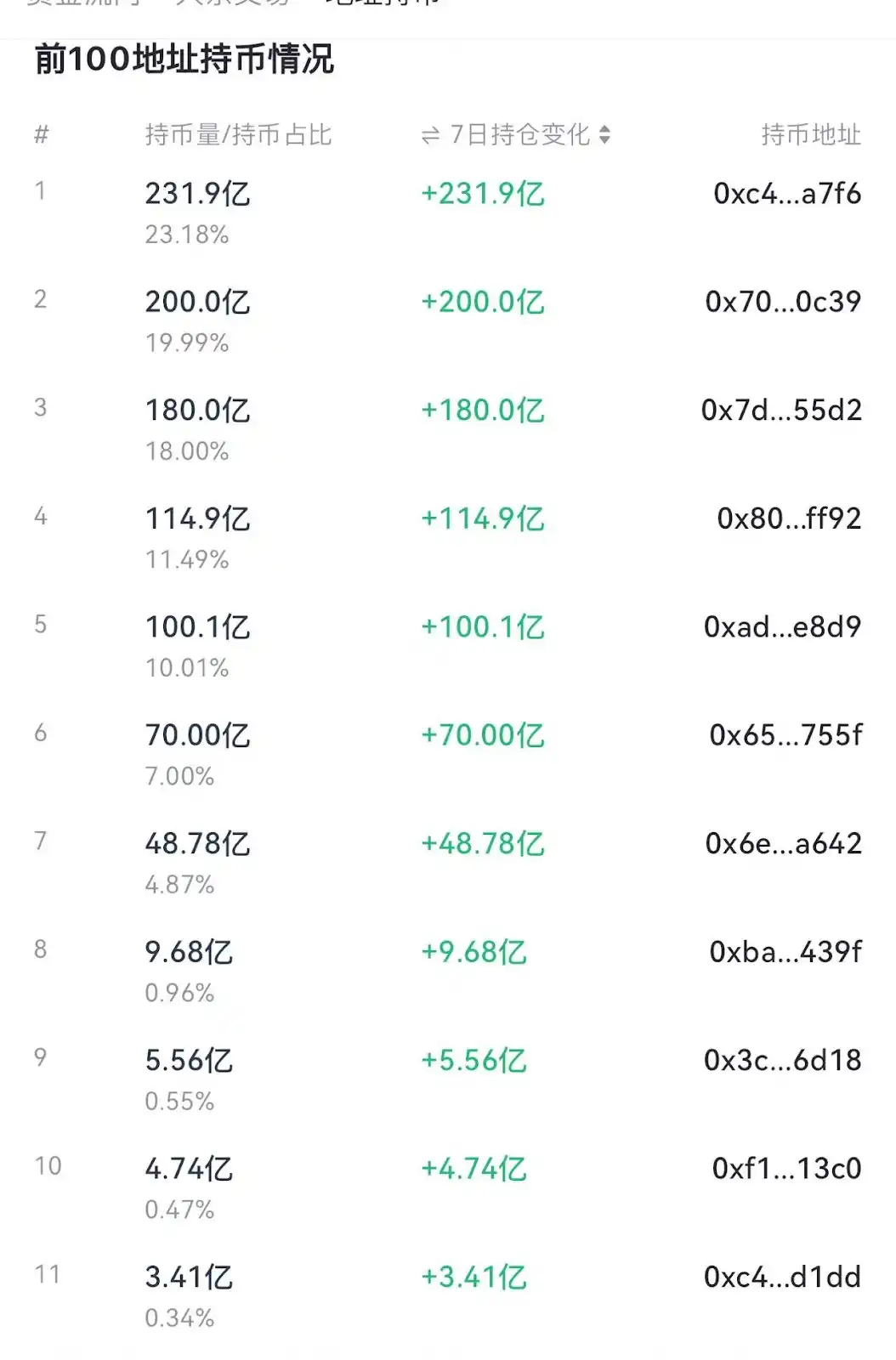

– The top 10 addresses deduct the tokens held by the exchange, totaling 72%: properly controlled by the banker, the price rise and fall depends on the mood of the boss;

– The net inflow of the exchange was 12,000 pieces: when the price rose, some people were still trying hard to recharge, either retail investors were chasing after the price, or bankers were fishing;

– Contract capital rate-0.12%: Shorts are betting on a sharp fall, but the price is forcibly pulled up, which is obviously a short position from Gouzhuang.

In this data environment, technical analysis is not as reliable as rolling dice.

Risks and pitfalls-secrets that bookmakers won’t tell you

1. Token Unlock: Sword of Damocles hanging overhead

The biggest problem with the B3 token is that “the team and investors lock up 25% of their positions in the first year, and then unlock them in 48 months.” What is this concept? Assuming the current price is 0.1 yuan, if it drops to 0.01 yuan when unlocking one year later, the dealer will still make 10 times (after all, the cost may be less than 0.001 yuan). Individual investors are fighting hard in the secondary market, and dealers are cramping while counting money at home.

2. Regulatory nuclear bomb: SEC’s “securities recognition” sniper rifle

The B3 team is all from the United States, and the tokens have been added to the Base chain of Coinbase’s own son, which is simply a living target for the SEC. Once designated as a security:

– Exchanges are collectively removed: refer to the XRP case, the price is directly cut;

– The team faces a class-action lawsuit: fines could reach hundreds of millions of dollars.

3. Ecological bubble: 80 games, 80 thunder?

B3 claims to have 80 games online, but take a closer look:

– 70% are skin-changing Mini games: such as “Tetris on Chain” and “Blockchain Minesweeping”;

– 20% are AI hotspots: for example, the Zerebro AI game, the actual experience is even more mentally retarded than Siri;

– The remaining 10% has not yet been developed: all screenshots on the official website are from PS.

This ecology is like the “food street” at your doorstep-looking at the dazzling array of signs, you can enter Lanzhou ramen and Sha County snacks.

The ultimate soul torture-can I buy it now?

1. Short-term gamblers:

– Strategy: Take out a position of no more than 5%, set a stop-loss line (such as cutting the meat below 0.08 yuan), and bet that the dealer pulls the offer to 0.2 yuan;

2. Long-term believers:

– Strategy: Make monthly bets, ignore fluctuations, and bet that B3 will become the “Chain Games version of Steam”;

– Risk: There is a high probability that when the token is unlocked, the principal will shrink by 90%.

3. Rational investors:

– Strategy: Watch and eat melons, wait until the token unlocking period expires before bargain-hunting;

– Risk: You may miss out on short-term surges, but keep the principal safe.

Conclusion: The survival rules of the encrypted world

The story of the B3 token is essentially a trio of “technological vision + capital operation + human greed.” Its price surge is neither a miracle nor a scam, but a manifestation of the inherent laws of the crypto market: before consensus is formed, all values are bubbles; after consensus is shattered, all bubbles are tears.

Finally, I will give you an encrypted motto: “In a bull market, everyone is a stock god, and in a bear market, everyone is a philosopher.” Cherish life and speculate rationally.

original link