The rise of community fundraising marks a major shift from the traditional venture-led model to a community-driven model.

Author:Francesco

Compiled by: Shenchao TechFlow

Community-led token issuance is re-emerging, a trend that challenges traditional institutional investor-led models.

To analyze this change, we will explore recent trends, including the cases of Hyperliquid and Echo, while also assessing community sentiment and market performance of different token distribution methods.

Community-led token issuance: The rise of new trends

Community-driven fundraising has picked up significantly in recent months.

There seem to be several key factors behind this trend.

1. Positive sentiment in the market towards community fundraising

In the past token issuance model dominated by venture capital (VC), tokens often performed poorly after issuance.

Low circulation, uneven token allocation and strict token unlocking program, often causing prices to continue to fall. Over time, market sentiment gradually tilted towards a community-led distribution model.

This shift in trend is largely influenced by Hyperliquid. The case of Hyperliquid shows that if a mature product can be combined with a carefully cultivated community, it can not only reduce reliance on VC funds, but also effectively avoid the common problem of a drop in the value of tokens after issuance.

In addition, as more and more new tokens enter the market, projects need to find ways to stand out from the competition, and community participation is becoming a key differentiating factor. Therefore, the fair distribution model has returned to people’s attention.

This trend has also created new opportunities for retail investors to participate in investments that were previously limited to institutional investors. In some cases, community-led models even allow retail investors to obtain tokens at a better price than traditional investors.

2. The dilemma of venture capital support

Today, users are increasingly skeptical of projects that allocate most of their tokens to venture capitalists and other institutional investors. This put the project team in a dilemma:How to maintain fairness in token allocation while ensuring necessary funds.

Although many founders value democratic community participation, they often face a more practical problem: how to raise enough money to complete product development.

While a community-driven distribution model provides a fairer distribution mechanism, it also brings uncertainty about financial stability and strategic investor support.

Even so, this model still has unique advantages:

-

Help the project build a loyal user base

-

Promote iterative product development and testing

-

Make the project more focused on long-term value creation rather than short-term investor interests.

If the token allocation structure relies too much on institutional investors, it will often lead to a mismatch between short-term price fluctuations and the long-term strategic goals of the project. This problem is usually manifested through a strict token unlocking mechanism, further affecting the healthy development of token economics.

In addition, excessive control by institutional investors can also weaken retail investors ‘voice in project governance and long-term development. This lack of participation can lead to a decrease in community activity and ultimately loss of investor interest and attention.

Common pain points

-

Privilege issues:Early investors and advisers often receive better token terms and preferential access than ordinary community members, creating significant unfairness.

-

Insufficient governance impact:Although many projects claim to be community-led, retail token holders often have limited influence in actual decision-making.

-

Contradiction between strategy and market sentiment:Project teams usually focus on long-term development, but token prices are often dominated by short-term trading sentiment.

Community preferences: What do users care about most?

Discussions on social media and the rise of platforms like Echo suggest that cryptocurrency users are increasingly dissatisfied with the special treatment that venture capitalists and institutional investors enjoy.

Community calls for a fairer investment environment are growing.

Key expectations of the community

-

Equal investment opportunities:The community wants investment conditions similar to those of venture capitalists, including fair token pricing and a simpler participation process.

-

A clear token economy model:Clear token allocation rules are the key to building investor trust.

-

Inclusive participation mechanisms:Investment opportunities should not be limited to whales (high net worth individuals), but should be open to all investors fairly.

-

Diversified avenues of participation:Whether it is by providing liquidity, participating in platform construction, or directly purchasing tokens, users should join the project in multiple ways.

Structural considerations

-

Clear token unlocking mechanism:A clear unlocking plan can effectively mitigate market fluctuations and prevent insiders from suddenly selling tokens.

-

Balanced governance structure:Although holders of large tokens have greater influence, the participation rights of small investors can be enhanced through proxy voting or governance models based on holding time.

-

Clear reward allocation mechanism:Projects should develop a transparent reward framework, such as through pledge rewards, token repurchase or revenue sharing, to create value for token holders.

-

Community-centered development:Regular interaction with the community, transparent governance processes, and financial support for community-driven projects are key to maintaining long-term engagement.

Trends: Impact on the market

As more and more projects adopt community-centered strategies, some key trends are emerging:

Innovative token issuance mechanism

-

The community truly holds power:Projects are moving from symbolic governance to substantive empowerment, allowing token holders to directly participate in agreement changes, fund allocations, and strategic decisions. This includes adopting a weighted voting system and giving communities direct management of funds.

-

Diversified participation reward mechanisms:Many projects are beginning to experiment with innovative reward methods, such as dynamic pledge proceeds, contribution-based token distribution, and reputation systems that reward long-term active participation, rather than allocating rewards based solely on token holdings.

-

Token economy model for long-term development:The project focuses more on designing a sustainable token system with built-in mechanisms to maintain token value, such as flexible supply adjustments, a usage-triggered repurchase system, and incentives linked to agreement growth.

-

Reduce your reliance on venture capital funding:The project is exploring more diversified financing methods, such as community fundraising, agreed-to-own liquidity (liquidity funds directly held and managed by the agreement), and a growth model based on revenue sharing, thereby reducing its reliance on large upfront investments by venture capital investors.

Key challenges faced by the project

-

Balancing funding and control: Teams need to raise enough funding to support project development while ensuring that the community maintains sufficient ownership and decision-making power. To this end, a hybrid financing model may be needed to balance funding needs with community control.

-

Promote long-term community growth: Sustainable community development requires going beyond short-term incentives to attract and retain community members through education, shared goals, and real value creation. This can be achieved through ambassador programs, developer funding, and community-led marketing campaigns.

-

Transparency has become the new normal: Projects must regularly update progress, engage in open governance discussions, and maintain clear communication. These transparency measures have become basic expectations of the community rather than options.

-

Build a sustainable revenue model: Projects need to develop mechanisms that can generate stable revenue for agreement and token holders, such as through service charges, platform fees, or other value-creating activities to support the long-term development of the project.

Case study: Hyperliquid’s non-venture model

The successful performance of Hyperliquid’s tokens after distribution provides a reference for rejecting traditional venture capital financing:

-

Not allocated to VCs:Tokens are fully distributed to platform users, not venture capital institutions.

-

Stable market performance:The price of the tokens remained stable after distribution without drastic fluctuations.

-

Organic community development:The growth of the project relies entirely on the participation of real users rather than through artificial incentives.

-

Contribution based allocation mechanism:Token allocation is based on users ‘activities and actual contributions on the platform, rather than simply purchasing behavior.

However, Hyperliquid’s user community has some unique characteristics,Makes it different from other projects that attempt a similar community-driven approach and may not be suitable as a common reference case:

-

Professional traders are mainly:The core users of the platform are not ordinary retail investors, but professional traders who often conduct large-value transactions.

-

Ability to hold for a long time:These users have sufficient funds and do not need to sell tokens quickly to achieve returns, thereby reducing selling pressure in the market and promoting long-term holding behavior.

-

Naturally consistent with the interests of the platform:Since these users have already made considerable profits through transactions on the platform, their interests are closely linked to the development of the platform, and tokens are just additional rewards.

-

Lower selling pressure:When users are already profitable on transactions, they are not eager to make short-term gains by selling tokens.

-

No need to rely on token financing:Unlike many projects that rely on token sales to raise development funds, Hyperliquid does not require token sales to fill the funding gap.

-

Pure use reward mechanism:Tokens are distributed only to users who actually use the platform, not to investors who purchase tokens in hopes of future earnings.

-

Different holding mentality:Users who earn tokens through the use of the platform will have completely different psychological tendencies in the decisions to hold and sell tokens than investors who purchase tokens directly.

While Hyperliquid’s approach has been significantly successful, other projects need to realize that their communities can be vastly different from Hyperliquid’s. Strategies that are suitable for a platform with many wealthy and experienced traders may not be suitable for projects aimed at ordinary retail users.

This also raises a question worth pondering:Is community fundraising really more sustainable, or does it just shift selling pressure away from venture capital to retail investors who are more eager for quick returns? Venture capital usually adopts well-thought-out exit strategies, while retail investors in community fundraising lack the ability to invest in the long term due to limited funds, which may lead to more instability and emotional fluctuations in the market.

In addition, it’s worth noting that although Hyperliquid distributes more than 31% of its tokens, they remain focused on building a quality product that users truly want to use.

This provides important inspiration for other projects:The community itself cannot ensure the success of a project; projects must be built on a solid foundation, such as providing a superior product experience.

Key differences between different methods

Although the crypto community enthusiastically embraces the transition from a venture-led fundraising model to a community-driven model, one fact that cannot be ignored is that the short-term profit-seeking tendency in human nature has not changed.

The key differences between these allocation methods are reflected in the following aspects:

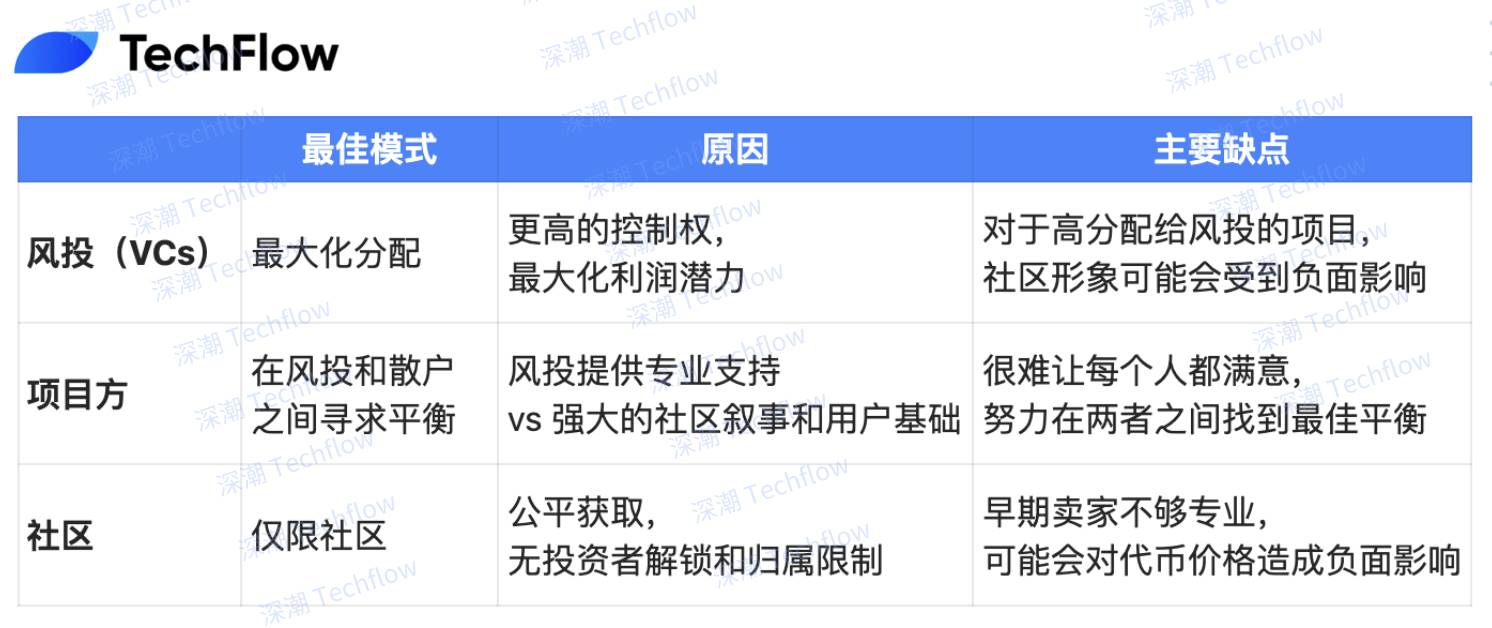

(The original table comes from Francesco and compiled by Shenzhen TechFlow)

Make investment opportunities more democratic

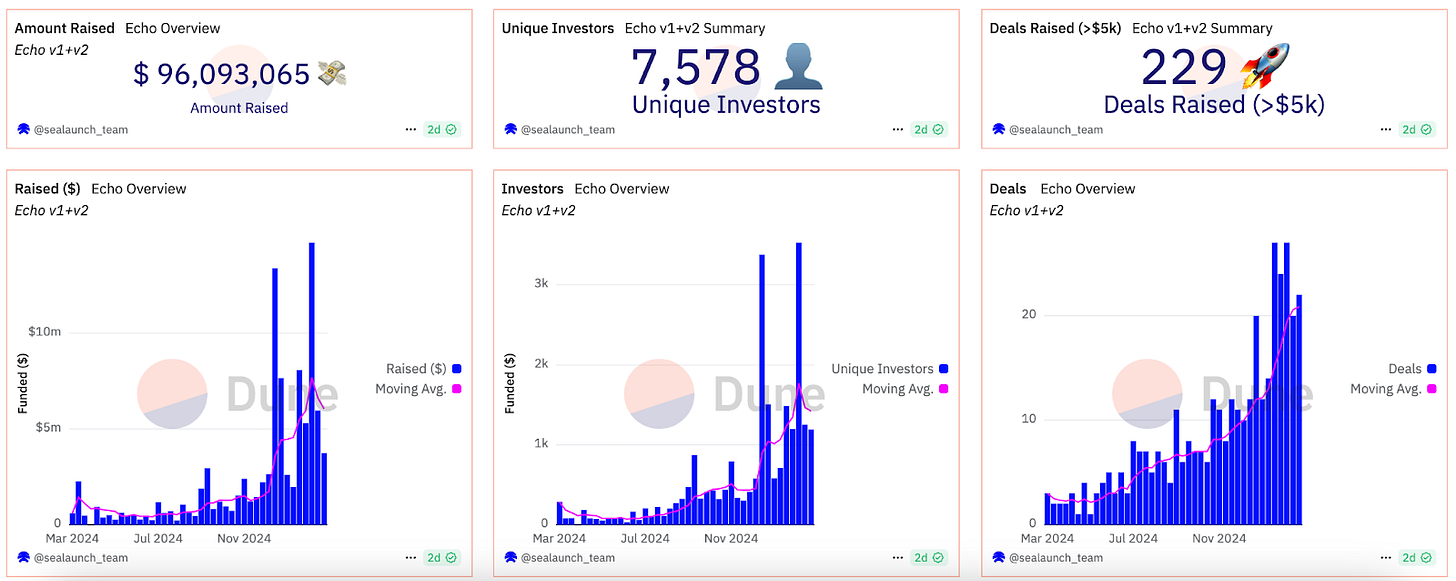

The rise of platforms such as Echo and Legion has further promoted opening up investment opportunities that have traditionally been limited to venture capital and institutional investors to a wider range of ordinary investors.

In addition, these platforms provide a simplified operating interface for protocols to conduct investment rounds, making it easier for protocols to optimize their strategies when allocating tokens.

Current trends are changing, and these new developments have begun to affect how new projects redesign their token allocation methods. It is worth noting that more and more projects are choosing to sell tokens on these platforms, and the recent MegaETH is one of them.

This change has resulted in a more balanced stakeholder relationship and capital structure table, while the allocation of community funds continues to increase.

Echo and Legion’s approach:

-

Focus on a community-driven development model

-

A transparent token economy

-

Balanced stakeholder relationships

-

Innovative token allocation mechanism

There is no so-called universal formula for token allocation and investment strategies.

However, the project can refer to the following new factors based on current industry development trends.

Suggestions for future projects

For future projects that want to innovate the token allocation model, the following points can be considered:

-

allocation strategy

-

Implement a fair and transparent community sales mechanism

-

Ensure that token holders ‘interests are closely linked to project success

-

Develop innovative project financing methods

-

Ensure broad distribution of governance rights and enhance community participation

-

community participation

-

Establish open and transparent communication channels

-

Reach community consensus around the distribution mechanism

-

Maintain long-term community activity

-

Provide practical use for token holders and increase the added value of the token

-

Give the community influence on the long-term direction of the project

Who are the winners and losers in the different token models?

(The original table comes from Francesco and compiled by Shenzhen TechFlow)

Interesting part:mixture modelthe reality of

When venture capital (VCs) are integrated with the community:

-

VC harvest: Smaller share, but better public image

-

Harvest of the project: More supporters, but more complex management

-

Community gains: Higher stability, but less token allocation

There is no absolute standard for the merits and disadvantages of a token model, whether it is more investor-oriented or the community.This always depends on the perspectives of different entities, especially the needs of the market.

Conclusion and Thinking

The rise of community fundraising marks a major shift from the traditional venture-led model to a community-driven model. More and more projects are realizing the importance of being aligned with community interests rather than simply catering to large institutional investors. In this evolving environment, the key to success may be designing allocation mechanisms that both prioritize community ownership and ensure long-term sustainability of projects.

Although there is no one-size-fits-all formula, some emerging elements must be carefully considered for projects that want to start successfully.

Currently, we are in the transition phase between the two models, with many projects trying to replicate the Hyperliquid model, but with mixed results. On the one hand, they strive to show a willingness to allocate a higher proportion of tokens to the community; on the other hand, they are limited by their relationships with existing investors, which limits their autonomy in token allocation.

However,Community participation is not enough to ensure long-term success of the project or consistency of incentives.

Retail investors tend to focus more on short-term gains when handling the tokens they receive, and may even be more inclined to cash out quickly than traditional investors. In addition, retail investors lack mature exit strategies, which may have a greater impact on market price fluctuations.

Still, achieving a balance is not impossible as long as these factors are fully considered from the early stages of the project. Just as blockchain technology continues to evolve over time, so does the project’s token allocation model. Although the current pace of progress may not be as rapid as expected, we can still see a revival of community-led models, which brings new hope.

The next few months will be a critical period to observe and evaluate this trend:Can the community truly gain fair investment opportunities, or do these changes just stay at the marketing level and make few substantial improvements to traditional models?

This time, can we truly achieve a breakthrough?

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern