Wen| Light cone intelligence, author| Liu Junhong and Wei Linhua, Editor| Wang yisu

The capital market has finally looked forward to investment opportunities for Hangzhou’s Six Xiaolong Dragons.

On February 14, Manycore Tech Inc., the holding company of Hangzhou Qunhe Information Technology Co., Ltd.(hereinafter referred to as Qunhe Technology), officially submitted a listing application to the Hong Kong Stock Exchange. After DeepSeek stirred up the global technology industry and Yushu Robot appeared on the Spring Festival Gala, Hangzhou once again stood on the world’s technology stage with the attitude of China’s Silicon Valley.

With the submission of Group Nuclear Technology, the development path and background of China’s new generation of high-tech companies have also been unveiled.

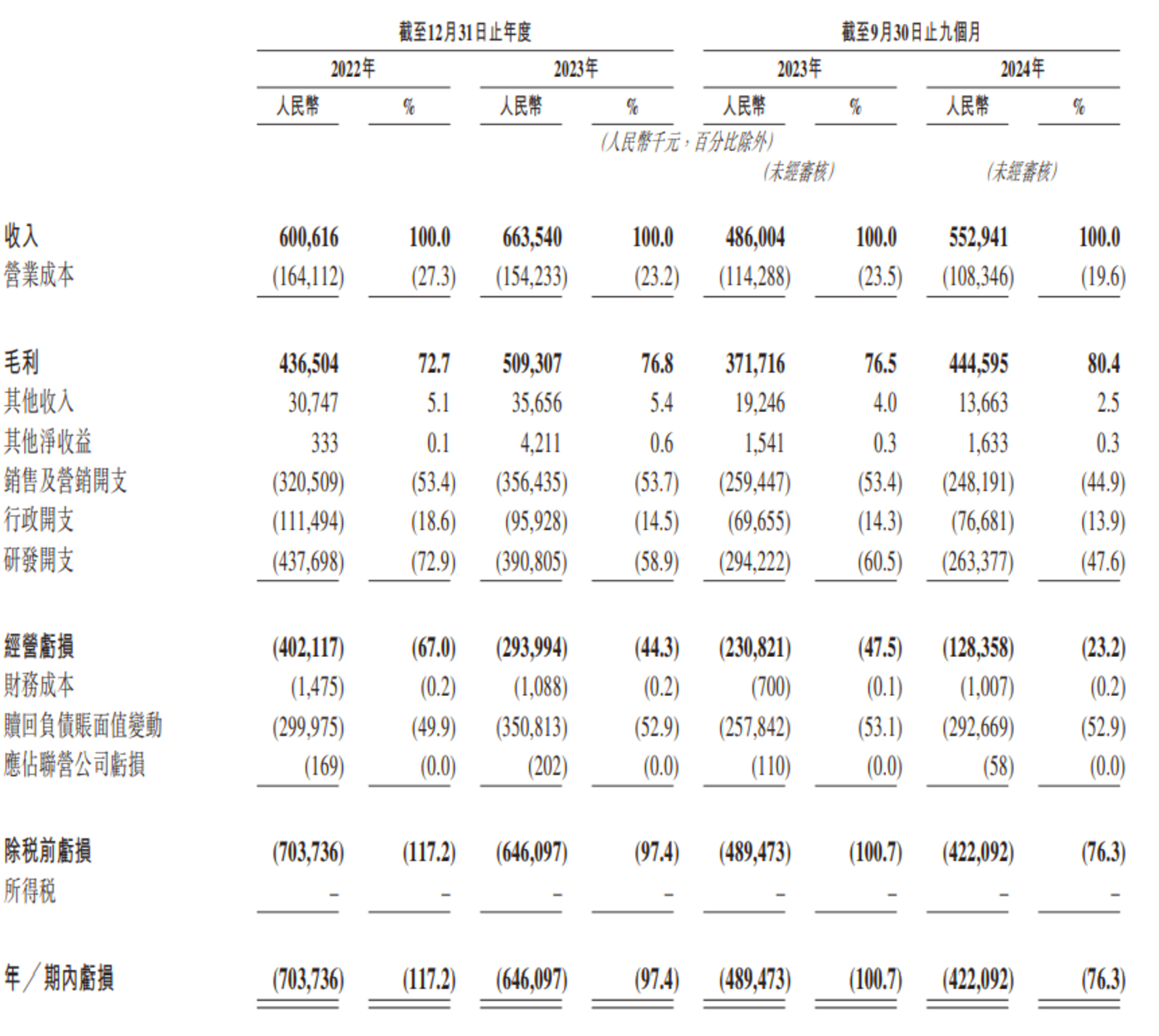

The prospectus shows that Qunnuclear Technology’s current main revenue model is subscription services for home design software (Kujiale). The basic financial situation shows that Qunnuclear Technology’s revenue in the first nine months of 2022, 2023 and 2024 will be 6.01 million yuan, 664 million yuan and 553 million yuan respectively. Based on revenue for the first nine months of 2024, the company’s corresponding revenue growth is 13.8%, which is not fast, but is growing steadily.

As a technology company, Qunnui Technology is still in the investment period. The company’s losses in 2022, 2023 and the first nine months of 2024 were 704, 646 and 422 million yuan respectively, showing a narrowing trend in losses overall. The most eye-catching data is gross profit margin. In 2022, 2023, and the first nine months of 2024, the company’s gross profit margins were 72.7%, 76.8% and 80.4% respectively, far exceeding the average gross profit margin of China’s SaaS industry (Shenwan third-level industry: horizontal general software, about 50%).

The ultra-high gross profit margin but low revenue growth rate exposes the business logic of Qunhong Technology.

From the perspective of software companies, the high gross profit margin that can be maintained for a long time means that Qunhe Technology has sufficient technical strength and is the result of the continuous dilution of operating costs as business develops. But from the perspective of technology companies, Qunhe Technology’s revenue growth rate of less than 20% is a bit low. This shows that the ceiling of the track, Qunnuclear Technology’s main home design software, may reach its peak.

“If you use home SaaS to describe cluster core technology, it is the biggest misunderstanding of cluster core technology.

Looking forward to the future of the company, Huang Xiaohuang, chairman of Qunnuclear Technology, believes that spatial design is not the company’s main development logic.

In 2011, Qunhe Technology was registered and established in Hangzhou. In the past few years of development, Qunhe Technology has achieved a leading position in space design software in China by relying on a set of software that can render design in indoor spaces and directly output data for production. Based on revenue in 2023, Qunhong Technology occupies the number one position as a spatial design software provider in China with a market share of 22.2%.

In this process, the equipment and experience accumulated by swarm core technology just met the opportunity of AI evolution.

In order to achieve high-efficiency rendering at low cost, since its establishment, Qunhong Technology has combined its GPU infrastructure with cloud infrastructure to further support its core business to complete complex large model training and improve rendering quality by optimizing computing power allocation.

In more than ten years of cooperation, Qunhong Technology has accumulated more than 360 million 3D model training data on its own platform through cooperation with B-terminals and C-terminals, and these data based on real home needs are in line with real world physics.

Judging from the three major elements of AI, computing power, data and algorithms, group core technology accounts for two core elements.

Group Nuclear Technology wants to be the first in spatial intelligence. Can its new positioning be the key to helping this company impact its IPO?

Software subscriptions are the main business,But Group Nuclear Technology wants to be an AI training platform

Space design and visualization are the most important businesses of Qunnui Technology. From a product perspective, Qunnui Technology’s revenue comes from the spatial design software Kujiale, the overseas version of Cohom, and a Qunnui Technology Space Intelligence Platform (SpatialVerse) for indoor environment AI development.

As the main product of Qunhe Technology, Kujiale is mainly used for interior space design and rendering. Currently, it is widely used in designing residential buildings, office buildings, retail chain stores and other commercial projects. Its software features that design drawings can be automatically converted into instructions for production. This means that Kujiale allows designers to directly connect with the decoration materials (or home furnishing) factory to complete the customization process from design to order.

Coohom is equivalent to an overseas version of Kujiale, with its main target markets being the United States, South Korea, Japan and Southeast Asia. For the nine months ended September 30, 2024, Qunhong Technology’s overseas revenue accounted for 7.4%. It can be seen that overseas markets are not the main markets in which Group Nuclear Technology currently operates.

The concept of a group-core spatial intelligent platform is a little abstract. The background of its birth was that Group Nuclear Technology collected a large number of real-life physical models in the process of operating space design software. In order to allow these physical models to be placed in virtual space like building blocks, Group Nuclear Technology provides a series of tool chains in the spatial intelligence platform, allowing users to directly call model data or use AIGC to generate virtual space environments.

In addition to being used for interior design, Qunhe Technology believes that spatial intelligence platforms can also be used to support spatial cognitive training in physical intelligence and AR/VR systems.The specific method is that Group Nuclear Technology connects OpenUSD (a 3D scene description technology, spatial three-dimensional modeling) with NVIDIA Isaac Sim (NVIDIA Robot Simulation Training Platform) based on high-fidelity RTX (ray tracing) rendering. This allows embodied intelligence to use model data for simulation training on the spatial intelligence platform, thereby reducing the training cost of embodied intelligence.

However, from the perspective of revenue model, the commercialization of the cluster core space intelligent platform is still at a quite early stage.

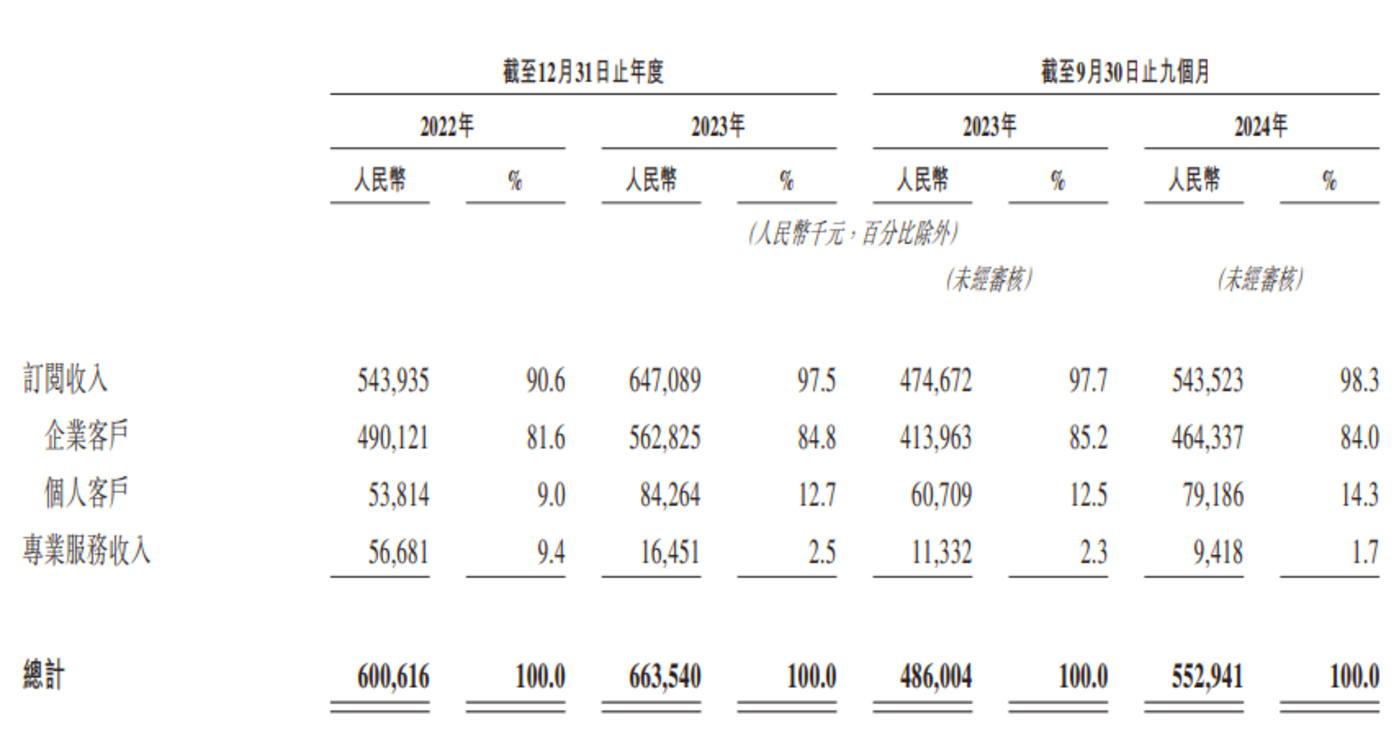

The prospectus mentions that Qunnuclear Technology’s revenue mainly comes from the provision of software subscription services. Among them, Kujiale and Coohom are divided into premium version and enterprise version, providing services to individual and corporate users respectively. The Group Core Space Intelligent Platform provides customized solutions that are billed based on the number of users, computing time, computing power and other conditions. Corresponding to the proportion of revenue model, as of September 30, 2024, the subscription model contributed 98.3% of revenue to Quni Technology, while special service revenue including model services, technical configuration services and customer training only accounted for total revenue. 1.7% of the total revenue.

As far as Qunhe Technology’s home design business is concerned, Qunhe Technology is developing quite well by reviewing the company’s financial data based on the standards of the SaaS industry.

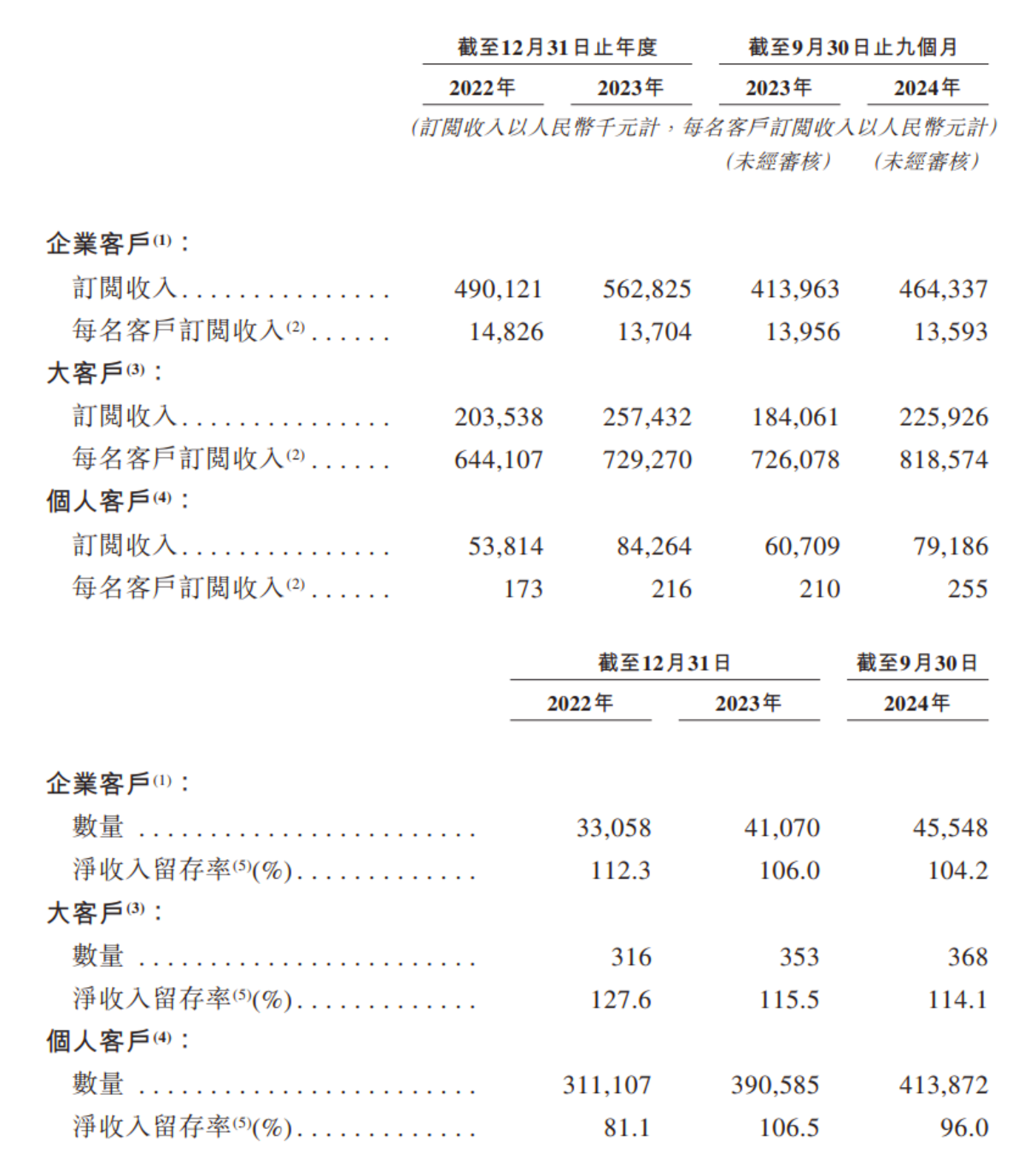

Generally speaking, human efficiency indicators can reflect the versatility of SaaS company software, and high efficiency means that the software does not rely on people to operate. The prospectus shows that as of September 30, 2024, Qunhong Technology has a team of 1388 people.Estimated based on the proportion of the same period in 2023, the ARR (customer subscription revenue for the year) of Group Nuclear Technology in 2024 will be approximately 740 million yuan, with a corresponding human efficiency of 534,000.

Take the office software track as a comparison. Before Flybook laid off its employees in 2024, it had a team of approximately 5000 people, an ARR of US$200 million, and a corresponding employee efficiency of approximately 290,000. Jinshan Office disclosed in its 2023 annual report that subscription revenue was 3.61 billion, with 4558 people, and the average subscriber efficiency was approximately 790,000. It is worth noting that considering that the market space for home design software is much lower than that for office software, the actual gold content of Qunhe Technology’s human effectiveness data may not be lower than that of Jinshan Office.

From the perspective of revenue sustainability, Qunhong Technology’s future revenue is also relatively optimistic.

In terms of the number of customers, as of September 30, 2024, Qunhe Technology had a total of 459,400 customers (enterprises + individuals), an increase of 27,800 customers in nine months. Since Group Nuclear Technology does not directly give the customer Retention rate, it only gives the net income Retention rate (calculation method: a fixed period of 12 months, the ratio of the total subscription revenue of customer categories). Combined with the changes in the number of customers and average customer subscription revenue, we can see that Qunhe Technology’s revenue is concentrated to the group of major customers (annual payments exceed 200,000 yuan). However, the concentrated customer base has not reduced the bargaining power of group-core technology. Compared with the data as of September 30, 2024, Qunhe Technology’s gross profit margin has increased from 76.5% to 80.4%, and Qunhe Technology’s business is making more and more money.

As a spatial design software company, why should Qunhe Technology emphasize the value of spatial intelligence platforms for specific intelligence training at a very smooth stage of development?

Perhaps it is because Group Nuclear Technology wants to open the income ceiling.

According to Frost Sullivan data, spatial design software has limited industry growth potential. It is estimated that by 2028, the CAGR5 (compound growth rate) of China’s spatial design software market will be 17.7%, corresponding to a market space of 6.8 billion yuan. In the global market, industry space is expected to increase from 18 billion yuan in 2023 to 36.9 billion yuan, corresponding to CAGR5 of 15.5%.

It is true that Qunnuclear Technology will achieve the first market share in the domestic industry in 2023. However, considering that the market CR3 has exceeded 60%, domestic spatial design software has shown an oligarchic competition pattern. As for overseas markets, Qunhong Technology’s overseas business revenue accounts for too low.

“Group core technology is the training ground for all these robots.

Just as Huang Xiaohuang spoke at the IF 2025 conference. On the basis of its main business, Qunhe Technology is thinking about a new way out for the company’s future development.

Embracing AIGC, Space Intelligence Revitalizes IPO?

With the title of Hangzhou’s Six Little Dragons, Qunhe Technology is the first of the six companies to launch an IPO.

As early as 2021, Qunnui Technology had submitted a prospectus to the US Securities and Exchange Commission, but it did not successfully go public. At that time, focusing on the spatial design business of the home furnishing industry and the environment of U.S. stocks, there was no way for Group Nuclear Technology to support its dream of going public.

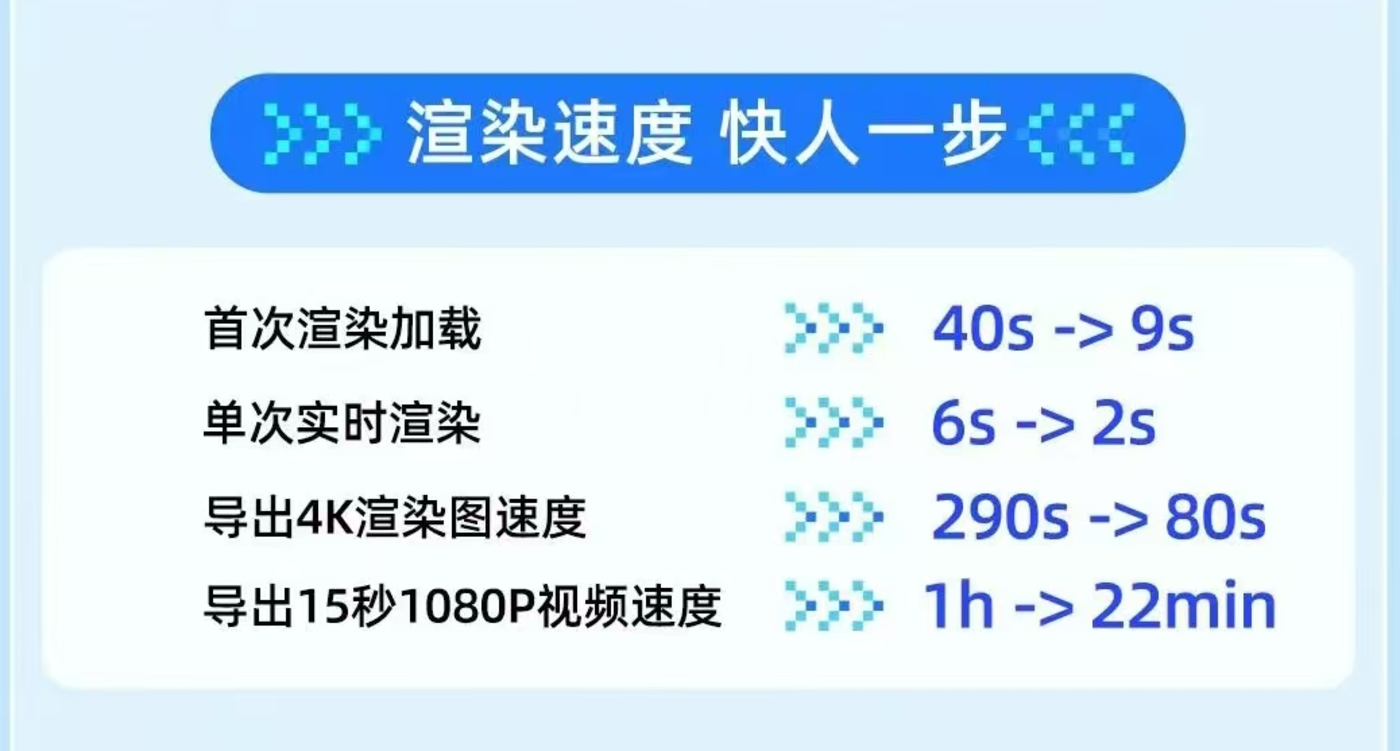

However, taking advantage of AIGC and upgrading its technical capabilities, Group Nuclear Technology has reached a new level, making substantial breakthroughs in image rendering speed, realism and other indicators.

Take the key image processing speed as an example. Two years ago, it took 53 seconds to process a typical 2K image. When the time came two years after AIGC’s rapid development, in 2024, Qunhong Technology will improve its processing speed. The speed has been increased to less than 1.2 seconds per piece, much faster than the industry average. Compared with the industry, it takes 10 seconds for Shang Tang to generate a picture with a resolution of 2K.

Qunnui Technology Revitalization Engine Improved rendering speed

In addition to the deep integration of AI capabilities into the spatial design business, Qunnuclear Technology has also found a new foundation through more than ten years of data and product capabilities accumulated in home SaaS.“The second curve uses a data set that conforms to the laws of the physical world to support the training of personal intelligence.

Just as Nvidia became a supplier of hard computing power currency with its GPUs in the AI era, Qunhong Technology has also found new development possibilities in this wave of AI.

Entering the fast lane to AGI, Qunan Technology has two key words to define itself:GPU computing power cluster + physical world simulator.

Why does a spatial design company have a lot of reserves on GPU infrastructure? This is closely related to the entrepreneurial story of Group Nuclear Technology. Huang Xiaohuang, one of its founders and chairman of Group Nuclear Technology, was once responsible for CUDA language development at Nvidia.

After leaving Nvidia, Huang Xiaohuang and two of his alumni founded Group Nuclear Technology and studied the issue of GPU high-performance computing. By applying the rapid rendering capabilities of cloud GPUs to the home industry, they developed their main business product, Kujiale.Therefore, optimizing computing power is indeed one of the advantages of this company.

“The physical world simulator is another card played by swarm nuclear technology. After many years of deep cultivation in home space design, Qunhong Technology has accumulated a large amount of large-scale high-quality synthetic data containing real physical laws, which gave Huang Xiaohuang the confidence to say with a smile that he could not find a second company.

In the training of embodied intelligence, the sources of data sets can be divided into two categories: simulation data and real data. The former can be applied to rapid learning in generalized scenarios, while the latter is more suitable for robots to learn in subdivided scenarios.

In the interview, Huang Xiaohuang once said thatSince training in a purely physical environment is expensive, robot companies must use synthetic data for training. The only difference lies in how much it uses.& less. ldquo; Some companies may have 99% synthetic data, and some companies may have 80%, 50%.” rdquo;

What Qunhong Technology provides is synthetic data that conforms to physical laws. Due to the higher requirements for physical laws in home design, based on customer data and platform engine construction over the past decade, Qunhong Technology can provide tailored intelligence with training. The synthetic data required.

Based on this, Group Nuclear Technology has launched the Group Nuclear Space Intelligence Platform (SpatialVerse), which uses a huge database of physically correct databases to support AI-generated content (AIGC) model training in virtual environments and cognitive improvement of intelligent robots and AR/VR systems.

However, in the customer cooperation story disclosed by Qunhui Technology, it has only been found that it has reached a cooperation with the intelligent robot. Currently, the training data of many physical intelligences on the market does come from synthetic data, but most of the sources of these data come from the company Self-training the corresponding large model through synthetic data, and then generates a steady stream of data based on the model.

Yushu Technology, one of the six dragons in Hangzhou, has also recently opened up a lot of training information, including training scene datasets.On the way to AGI with embodied intelligence, can the synthetic data provided by Group Nuclear Technology have such scarce market value?

In addition to doing a good job in the main business, how to seize the new opportunities arising from AI and turn it into a moat for the company’s business? This is the next question that swarm nuclear technology will answer.