Token issuance is like a big gamble. Although it can occasionally bring in a 10-fold return, this is just an exception.

Author:Stacy Muur

Compiled by: Shenchao TechFlow

We are in the midst of a wave of token issuance and TGE (Token Generation Event), but not all offerings are worth participating in. So how to determine whether a project is worthy of attention? Let me use @KintoXYZ as an example to share my analysis framework.

Looking back at history, the 2016 token issuance provided huge investment opportunities. By 2017, the ICO boom reached the peak of market expectations, similar to the explosion of AI agents in December last year.

Nowadays, token issuance is more like a big gamble. Although it can occasionally bring a return of 10 times, this is only an exception. According to Cryptorank data, only 30% of token offerings achieved positive returns in January this year. Among these 30%, there are indeed some hidden value items.

So, how do you determine whether a token issuance is worthy of your attention? In this article, I will use Kinto as an example to illustrate my analysis method.

Step 1: Analyze the product

Simply put, when analyzing token issuance, you need to break down the protocol into multiple components and evaluate it from three dimensions: maturity, demand, and innovation.

For product analysis, I mainly focus on the following aspects:

-

Concept (Narrative)

-

product status

-

Data indicators and market performance

-

competitive advantage

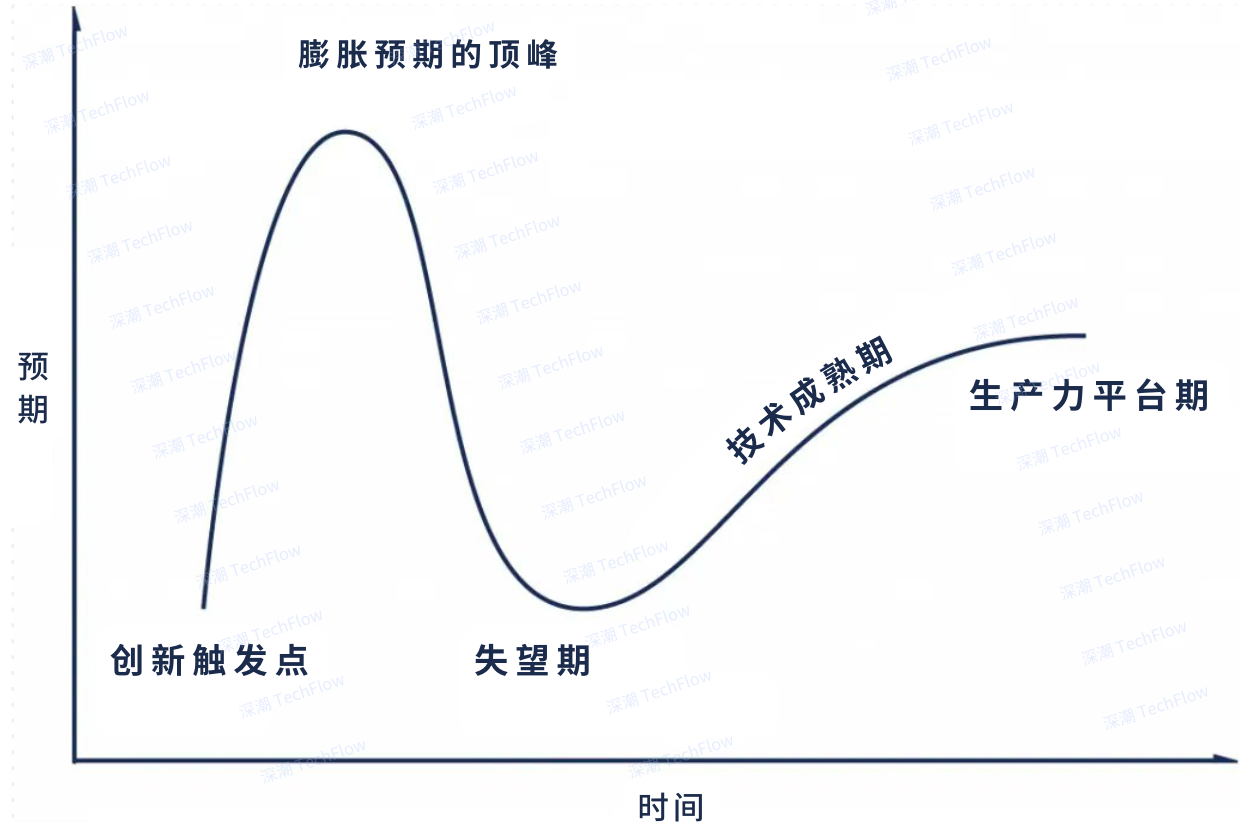

When analyzing concepts, you can refer to Gartner’s Hype Cycle:

(Original picture comes from Stacy Muur, compiled by Shenzhen TechFlow)

If the agreement is in the following stages:

-

Near innovation triggers:5 points (for example, this week’s BNB meme)

-

Near the peak of inflation expectations:0 points (for example, new AI agents or AI agents on a new chain launch platform)

-

The disappointment period is approaching:1 point (for example, many current DePIN/GameFi protocols)

-

Technology maturity period:3 points (for example, many RWA agreements are now at this stage)

-

Productivity platform period:1 point (for example, most DeFi protocols are currently located here)

Why is the agreement between the disappointment period and the productivity plateau only 1 point? Because when a concept enters a period of disappointment, it is either forgotten or revived in a new form (such as ERC404). In the productivity plateau stage, the concept tends to be neutral and its contribution to the communication of the agreement is limited.

Similarly, we scored the following parameters (0.5 points):

-

Is the agreement already the leader ranked by TVL in its category? 5 points.

-

Is it still in the testnet stage? 2 points.

-

Are there many competitors and some clear and well-known leaders? 1 point.

You can ask more questions as needed, but make sure you record all questions and answers so that the average score can be calculated later.

Case study of Kinto

As mentioned earlier, I will use Kinto as an example to illustrate how to analyze the process of a token issuance.

Here is a quick overview of the product to help you understand its core features.

Kinto is an level modular exchange thatPositioned at the middle level between traditional bank accounts and Web3 wallets,Focus on providing users with safe on-chain financial services.

Kinto is an level modular exchange thatLocated between traditional bank accounts and Web3 wallets, is committed to providing secure online financial access.

Simply put, Kinto connects the traditional financial and blockchain worlds, and its characteristics include:

-

Implement KYC, AML and fraud monitoring at the blockchain level;

-

KYC is more private and secure than a centralized exchange (CEX) because no user data is stored and users can freely choose a KYC provider;

-

Transactions can only be executed by verified participants, thereby achieving Sybil protection;

-

Each user is equipped with a smart contract wallet driven by Account Abstraction, and users are almost unaware of its existence;

-

Misubi chain abstraction layer:

-

Kinto is the first protocol to launch chain abstract redemption, chain abstract lending, and chain abstract perpetual contracts, implemented via @HyperliquidX;

-

-

As a 100% KYC Ethereum Layer 2 protocol with built-in insurance, Kinto greatly reduces regulatory and financial risks.

It should be noted that although Kinto implements KYC, it is still a decentralized, user-owned and unmanaged protocol.

Simply put, Kinto is a product that combines on-chain wallet and exchange functions, with built-in KYC, AML and traditional financial asset support.

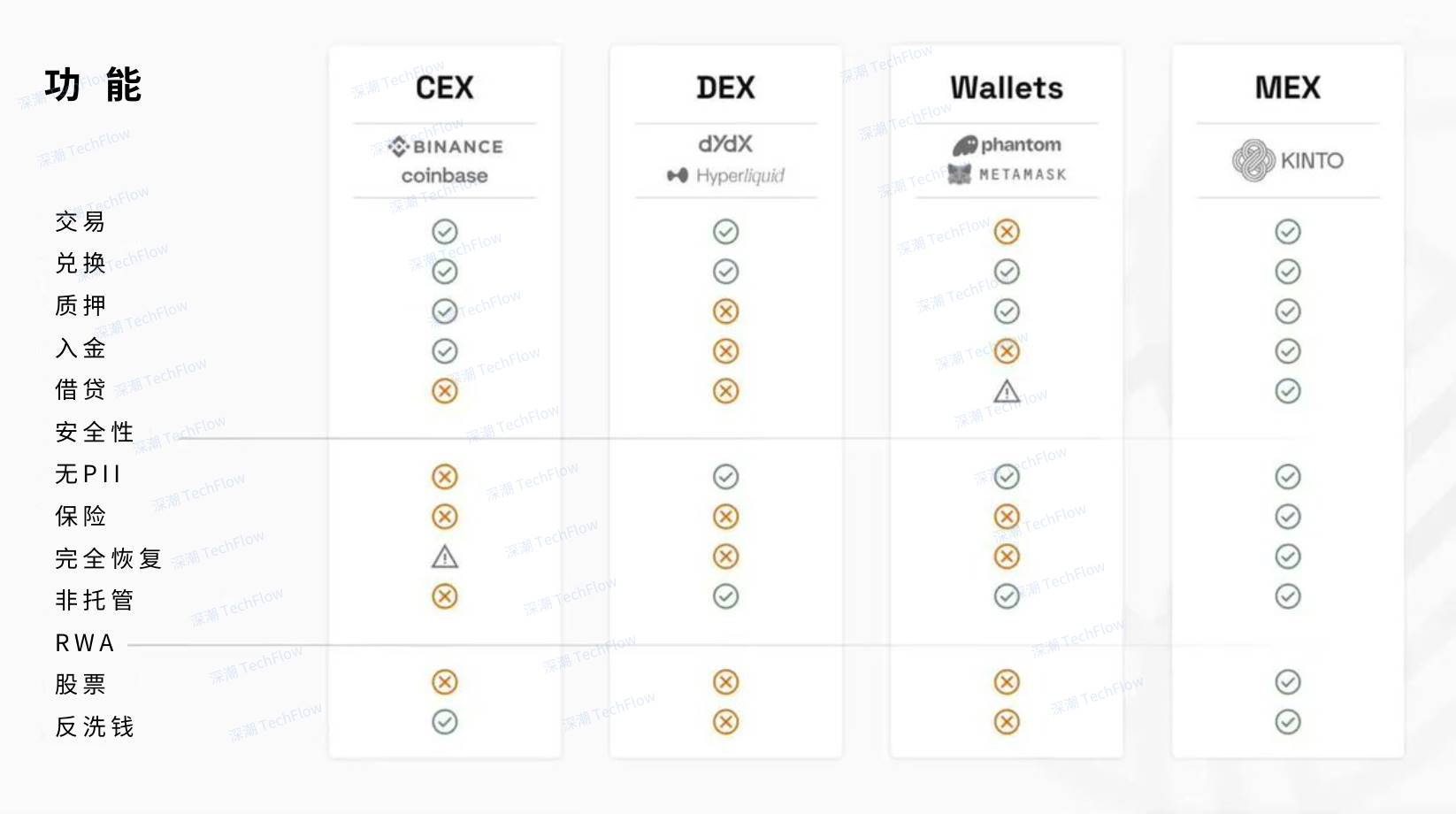

You might think Kinto is a competitor to Hyperliquid, but that’s not the case. Instead, Kinto provides users with direct access to Hyperliquid, supports cross-chain lending on Aave, and allows users to exchange assets on any AMM on chains such as Ethereum, Arbitrum, Base, etc. Its positioning is to exist as an abstraction layer for DeFi.

For end users, Kinto’s functions are similar to a wallet with centralized exchange (CEX) functions, such as supporting the fiat gold deposit channel. At the same time, it runs completely on-chain, decentralized, permission-free, and gas-free. All of these features are currently online.

(Original picture comes from Stacy Muur, compiled by Shenzhen TechFlow)

Now let’s use an analytical framework to answer a few key questions:

-

What is Kinto’s positioning?

Kinto is located at the intersection of infrastructure and transactions, and its core concepts include institutional orientation, financial ecosystem, chain abstraction and aggregator. This positioning is indeed innovative; currently, apart from Kinto, I personally have not seen any other product trying to build a DeFi chain with KYC. However, what are the needs for this solution compared to centralized rivals? In the field of chain abstraction, can it compete with Particle’s Universal Accounts, which is also growing rapidly? These issues will take time to verify. Therefore, I will give Kinto a 3 point, which may increase as the amount of activity increases in the future.

-

What is the development stage of Kinto?

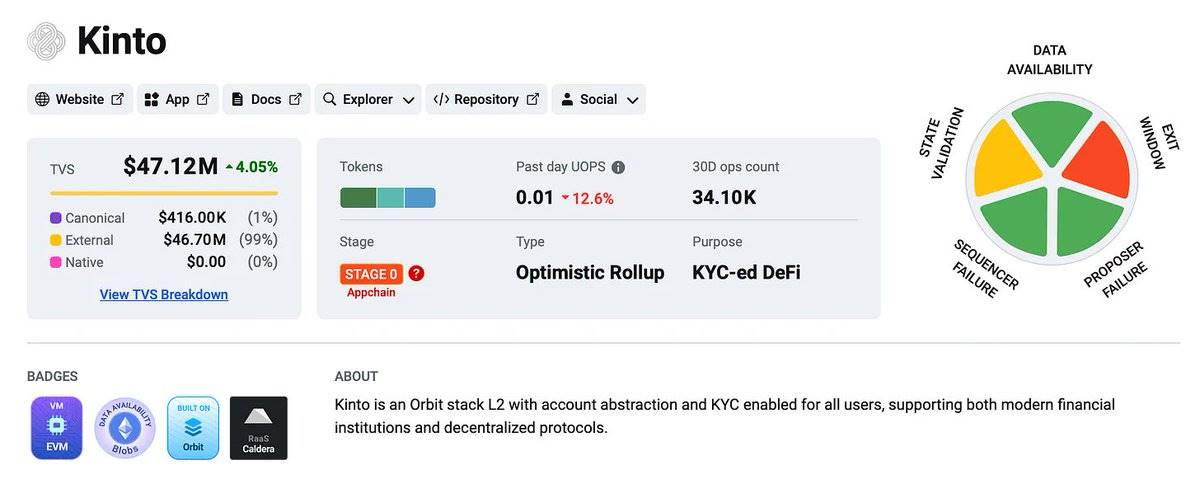

Kinto has been running for some time since it was launched on the main network in March 2024. According to L2Beat, its TVS (total lock-in value) is US$47 million. However, the number of operations in the past 30 days is not high, only 34K, and the total wallet number is 147K. In this regard, I would give Kinto a 4.

-

How does Kinto’s trading function perform?

In addition to traditional Web3 assets, Kinto also provides support for a wide range of popular traditional financial assets. This feature distinguishes it from centralized exchanges (CEX) and decentralized exchanges (DEX), and supports assets such as Nvidia, Meta, Uber and SP500. This diversity can appeal to specific types of users, so I gave Kinto a high score of 5 in this category.

The more specific the questions are asked, the more accurate the final product score will be. It is important to note that the weights of each question are similar, otherwise the final scoring may lose accuracy.

In Kinto’s case, my final product score was 3.6.

Step 2: Assess professional capabilities

When assessing professional capabilities, I consider all factors that may affect product success from the perspective of human resources, technical strength and business development (BD). Key areas to focus on include:

-

Team:Assess team members ‘past experience, transparency, social media activity, and developer engagement.

-

Venture Capital (VC):Venture capital is not only an important way to raise money, but also a key to connecting with other projects and industry opinion leaders.

-

Financing amount:Adequate funding is crucial for team recruitment and product development.

-

partners: An extensive network of partners can significantly improve user entry efficiency.

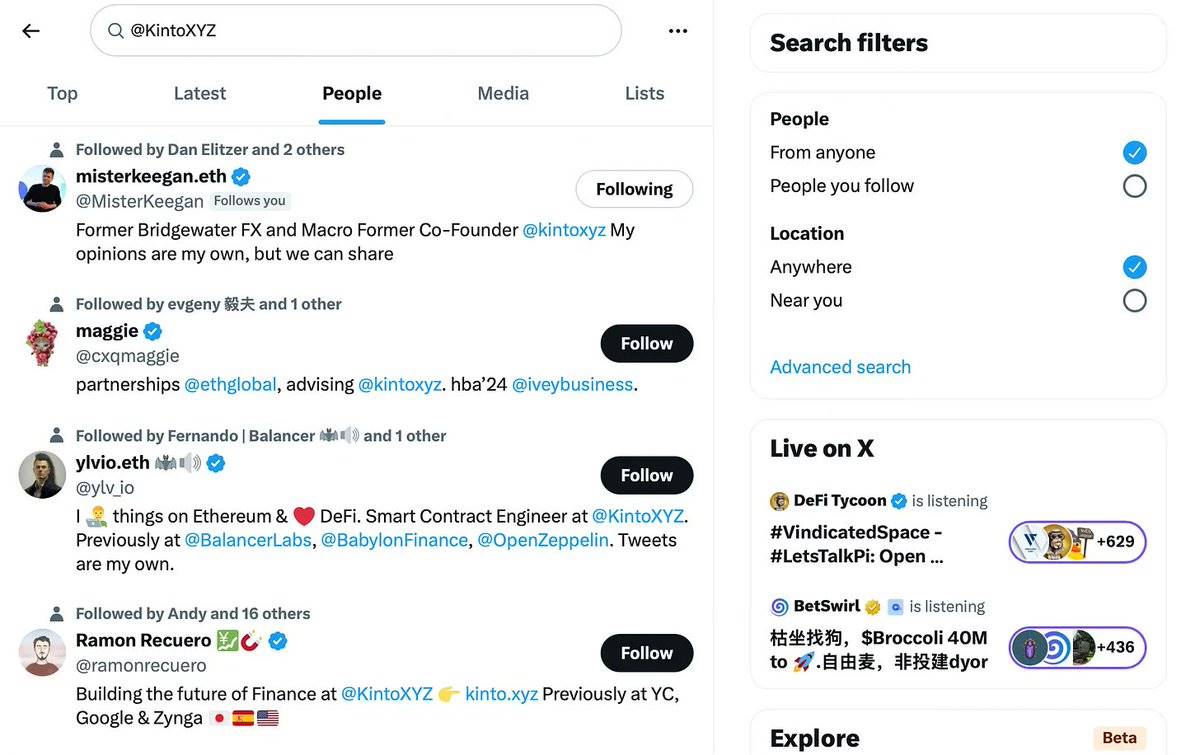

Taking Kinto as an example, I want to illustrate a few important evaluation points. Many people have difficulty finding team information, but the method is actually simple. Simply search for brand names on X (Twitter) and LinkedIn and you can browse team members ‘profiles to assess their professional abilities.

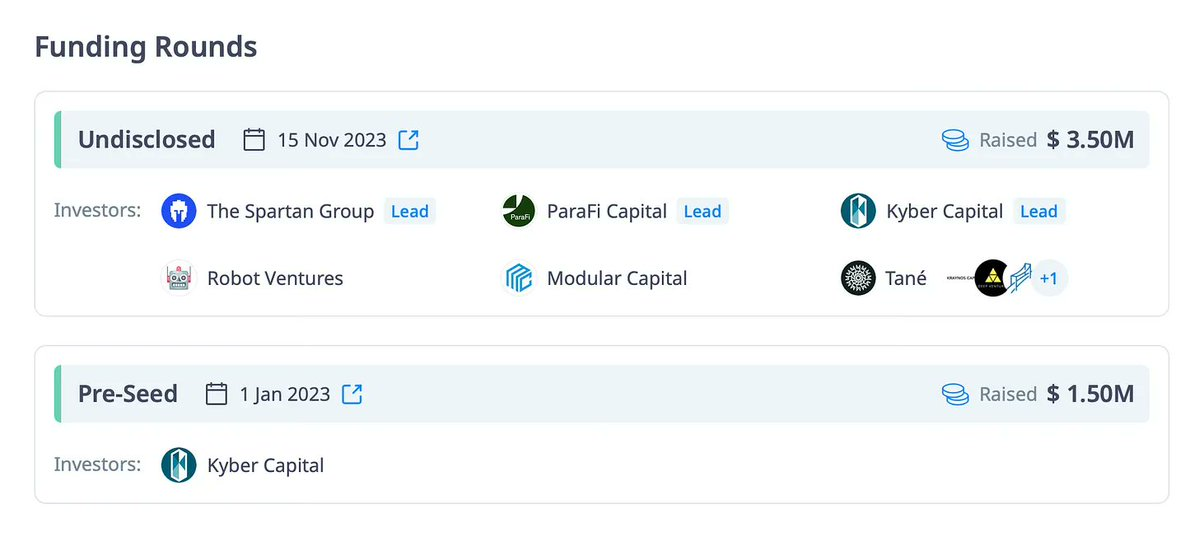

When evaluating financing rounds, there are several key points worth noting:

-

Whether leading venture capital firms (Lead VC) continue to participate in subsequent financing rounds (such as Kyber Capital) is a positive sign for investor confidence.

-

On the Cryptorank platform, venture capital companies are classified into different levels based on their activities. You can also check the performance of other portfolio projects of these investment companies for reference.

The more projects you analyze in this way, the more efficient your research will be, allowing you to quickly identify potential risks and opportunities.

Among Kinto’s partners are some noteworthy protocols, such as Caldera, Socket and Arbitrum.

My rating of Kinto is as follows:

-

Team: 5 points

-

Venture Capital: 4 points

-

Financing: 4 points

-

Partner: 4 points

Average score: 4.25

Step 3: Tokenomics

Token economics is one of the most challenging parts of analyzing projects, especially after many disappointing launches of low liquidity and high fully diluted valuation (FDV) projects.

In this link, we need to focus on the following aspects:

-

Whether the FDV of TGE (token generation event) is reasonable (previous analysis of the product and team is important in assessing the rationality of the FDV).

-

The supply of circulating tokens.

-

Token allocation model.

-

Design of lockup period and release period.

-

Supply and demand utility.

-

Short-term and medium term inflation.

-

Design plan for token issuance.

-

Does the project start with an FDV that supports short-term growth?

-

Are there factors that could trigger selling pressure after the token goes online (such as airdrops, public or whitelist pre-sales, consultant or ambassador tokens, etc.)?

-

Does it make sense to hold coins in the medium term considering their actual use?

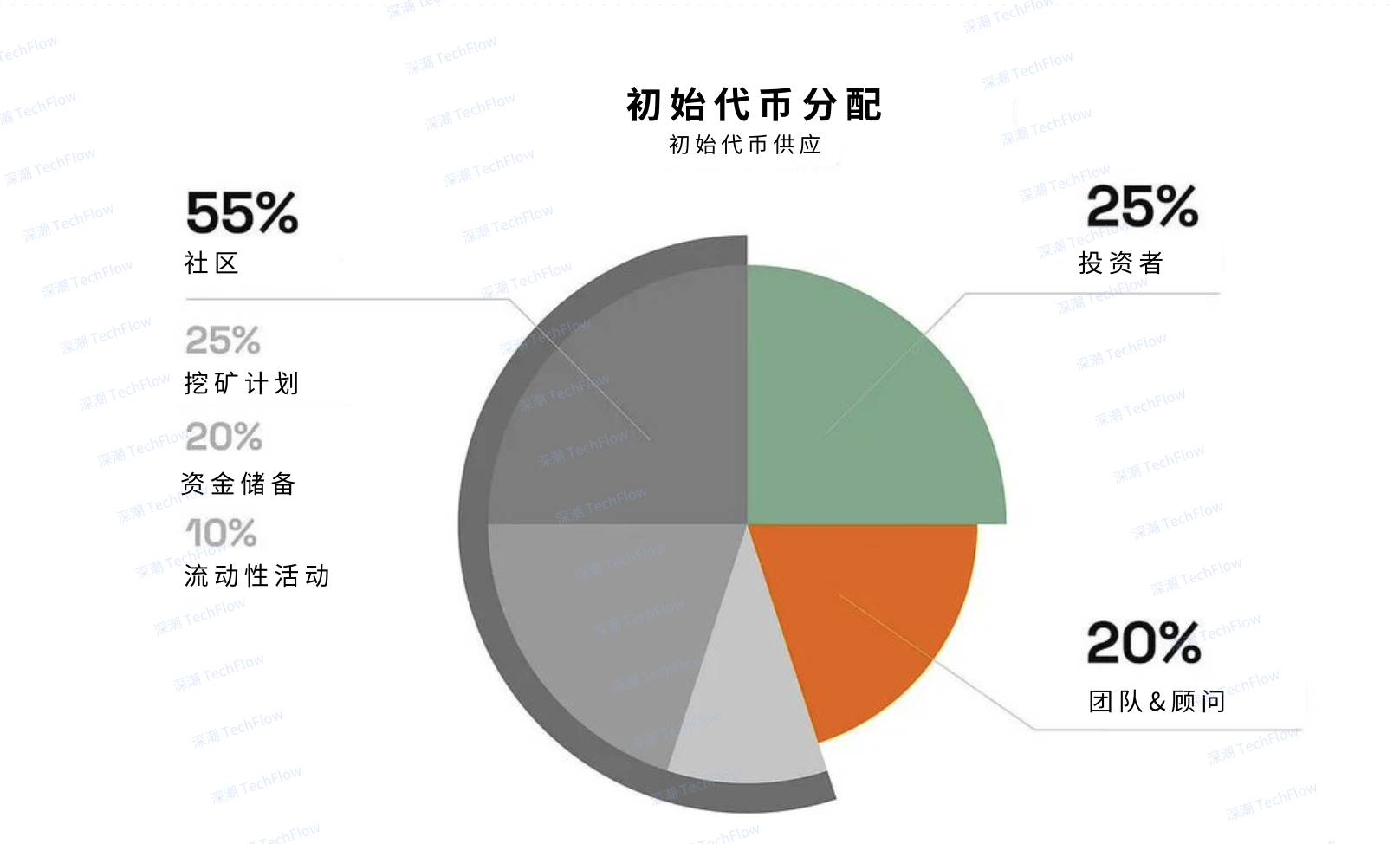

The following are the results of Kinto’s token economics analysis, which I divide into two parts.

(Original picture comes from Stacy Muur, compiled by Shenzhen TechFlow)

-

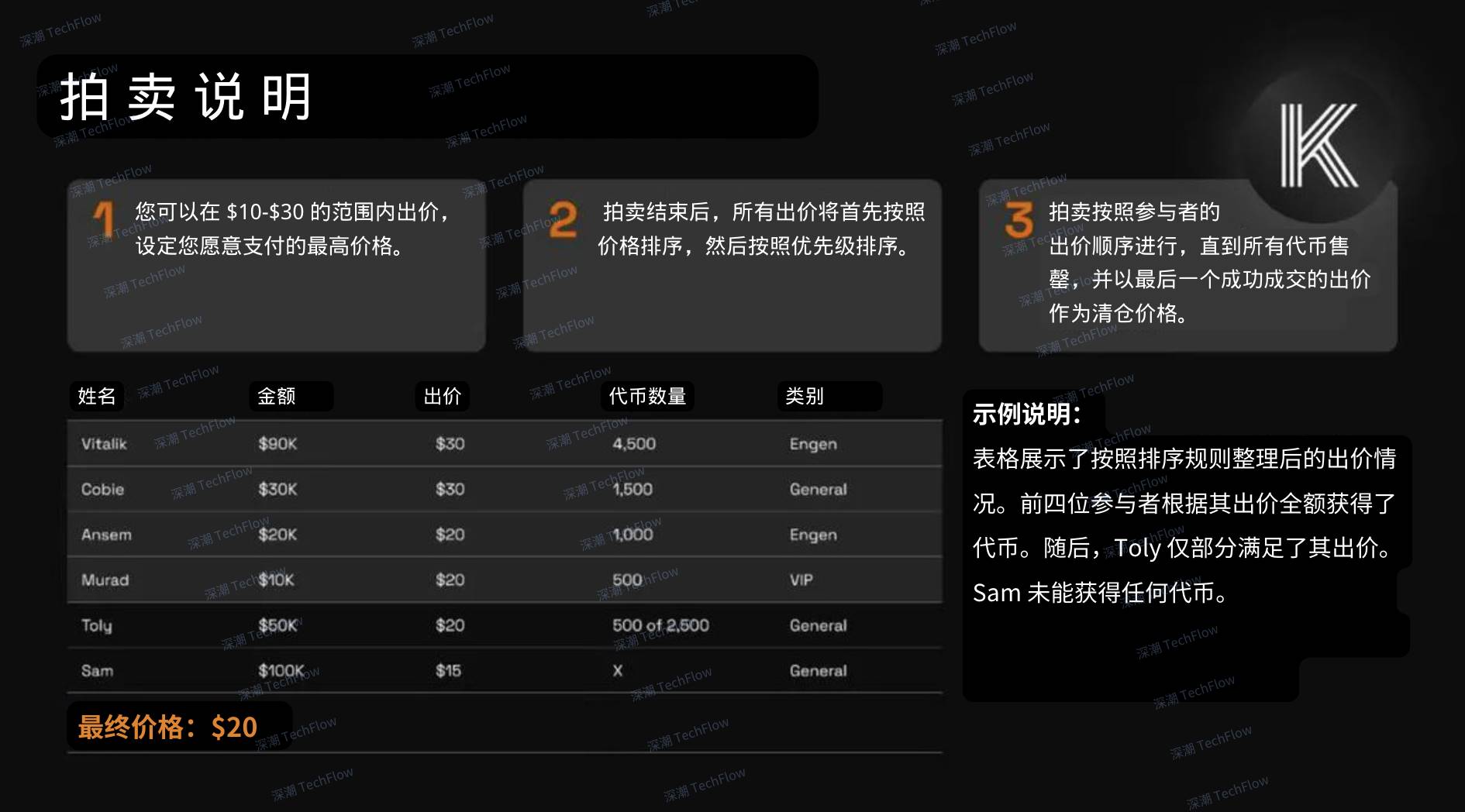

The auction mechanism is designed to allow users to set a preferred purchase price and facilitate fairer FDV discovery.

-

70% of the total token amount will be allocated to the community, indicating the importance the project places on decentralization.

-

The team’s token release period was set at 3 to 4 years, reducing short-term selling pressure.

-

There is no lockup period for token issuing participants, which improves the liquidity of the token.

-

Transparency in venture capital rounds is high: Kinto’s most recent round of financing had a token price of $10 (corresponding to $100M FDV).

-

According to market expectations, the auction price may be between $20 and $30, which will bring Kinto’s FDV to $300M, which is relatively reasonable.

-

The $K token is not just a governance token, its functions include being used to pay account restoration fees and extended wallet insurance. In addition, all revenue from the agreement will go to the treasury, and token holders can manage these funds through on-chain governance.

Question:

-

The auction price mechanism may limit the room for growth in the price of TGE’s descendants.

-

Airdrops may increase selling pressure.

-

Tokens will not be immediately transferable; to be transferable before March 31, at least two of the following three conditions must be met:

-

At least 20% of tokens in circulation: To avoid projects starting with low circulation and high FDV, at least 20% of tokens need to be fully unlocked and distributed to participants.

-

Governance enters the second phase: the first Nios election has been held and the first phase has been reached in Roll-up (this phase is about to be completed and is expected to be achieved before March 31).

-

TVL reaches $100 million: The total lock-in value (TVL) of the network must exceed $100 million and last for more than four weeks.

-

(Original picture comes from Stacy Muur, compiled by Shenzhen TechFlow)

My rating on Kinto Tokenology: 3.25 points.

Step 4: Community

When studying token issuance, the last aspect that needs to be analyzed is the activity, loyalty and size of the agreement community. A loyal and active community, coupled with successful products, can deliver extraordinary results, and Hyperliquid is a good example. Therefore, this aspect deserves our focus.

We need to examine the following aspects:

-

Number of high-quality users: The number of users in the community who truly have influence and contribution capabilities.

-

Community activities: Interaction, discussion and participation among community members.

-

Product activities: Evaluate user Retention rate and token demand after TGE by analyzing users ‘actual use of the product.

-

Demand related to token issuance platforms: Some token issuance platforms such as Coinlist have very active investor communities, which may have a direct impact on token demand.

How to track this information?

-

Analyze the authenticity of participation data: For example, if a tweet has a high number of retweets but almost the same number of likes, this may be fake data or caused by activity similar to the Galxe task. Normally, the ratio of retweets to likes will not exceed 1:5.

-

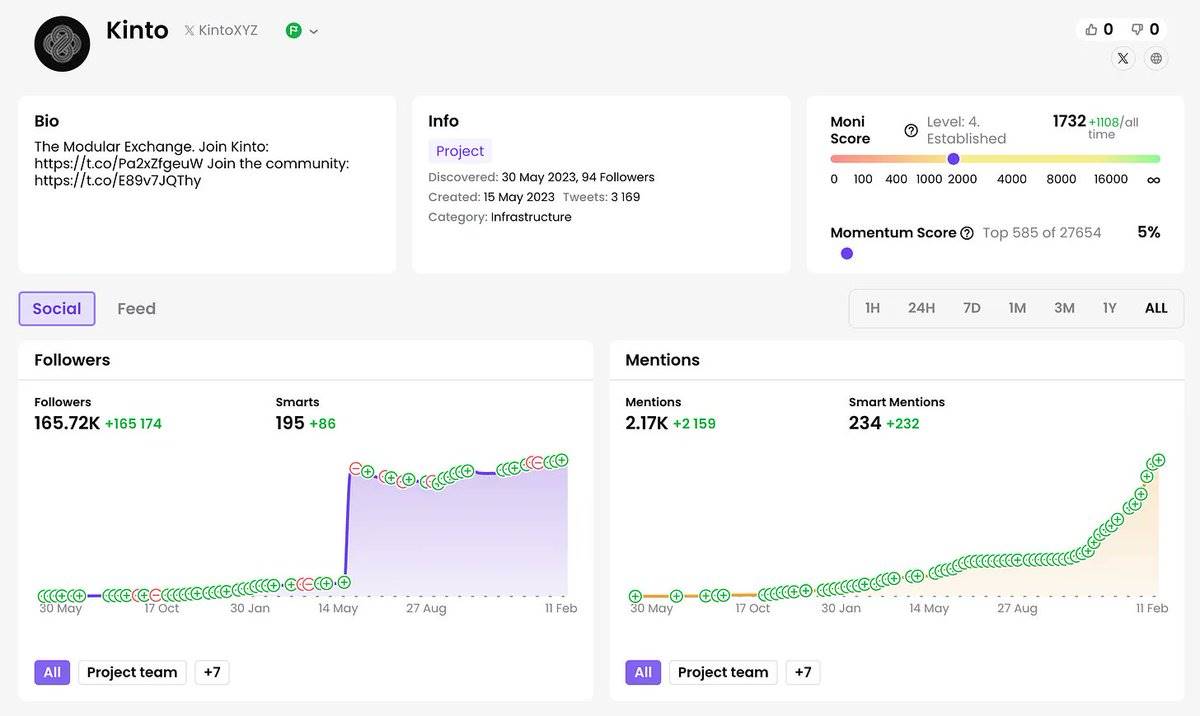

Use analytics tools: Tools such as Moni Discover, TweetScout, or Kaito can be used to track community attention and the number of high-quality users. These tools can help you more efficiently understand the actual activity and potential of a community.

On the Moni platform, Kinto’s followers have increased significantly. This phenomenon is usually related to the following two situations:

-

False followers (zombie fans)

-

Galxe or Zealy style event or giveaway promotion

Therefore, we can speculate that Kinto’s real and active followers on the X platform are approximately 35,000. This figure is reasonable compared with other indicators.

Judging from the high-quality mentions (Smarwww.gushiio.comntions) chart, the performance is good.“”As a result, my final rating for the Kinto community section is 3.75.

What should I do next?

The analytical work so far has been critical to assess the rationality of starting the project’s FDV, analyze growth potential, and determine whether the project deserves attention.

Next, you need to calculate the final score for the protocol being analyzed and make a decision based on the score results.Here are the scoring criteria I usually use:

-

Below 2.5 points: Skip directly and participation is not recommended.

-

2.5 3 points: Consider participating only if the project has significant advantages (such as innovation triggers or high Kaito platform attention and active community).

-

3 3.5 points: If you decide to participate, it is only recommended to invest a small amount of money because of the higher risk.

-

3.5 4 points: This type of project may belong to a third-line agreement; if there are multiple favorable factors, it may be a good opportunity, but it is not recommended to invest too much money.

-

4 4.5 points: It is a high-quality product and is worth participating in the token issuance.

-

4.5 5 points: This is a rare high-quality project and is very worthy of attention.

My average rating for Kinto is 3.71.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern