Original title: “LTC bucked the trend and rose 13%, ETF narrative is imminent, is the $130 Litecoin worth getting?”

Original author: Alvis, Mars Finance

Among the Top 20 cryptocurrency tokens, Litecoin is undoubtedly one of the most potential assets. The current price is about $130, and you may think it has not reached the eye-catching level, but this is an ideal time to enter. As a “lightweight alternative” to Bitcoin, Litecoin is bringing new expectations to the market with its years of technological accumulation and strong application prospects in the payment field.

In this article, we will conduct a systematic analysis of Litecoin and comprehensively discuss the future potential of Litecoin from factors such as technical foundation, market trends, macroeconomic background, to the upcoming spot ETF. Whether it is short-term price trend or long-term investment value, Litecoin shows investment opportunities that cannot be ignored in the price range of US$130.

The core logic of Litecoin being undervalued

1. Technological maturity and practicality are ignored

Litecoin’s technical architecture is based on Bitcoin, but through several important technological upgrades and innovations, it has gradually deviated from its positioning as a mere “Bitcoin substitute” and demonstrated unique technological advantages. Especially in the field of payment, Litecoin has formed a unique payment solution through optimization and innovation of the Bitcoin protocol.

Among the most significant technological advances include the integration of the MimbleWimble protocol and the deployment of Lightning Network. The MimbleWimble protocol (i.e., Privacy Enhancement Protocol) has greatly improved the transaction privacy of litecoin and resolved the contradiction between blockchain openness transparency and privacy protection. The integration of Lightning Network allows Litecoin to achieve near-instant transaction confirmations and significantly reduces transaction costs, allowing it to handle micropayments and high-frequency trading scenarios such as in-game purchases and streaming subscriptions.

Litecoin’s technological upgrade is providing strong support for its future development. The full deployment of the MimbleWimble protocol is expected to be completed in the second quarter of 2025, and this upgrade will significantly enhance Litecoin’s privacy protection features. As privacy needs increase, more and more users and institutions are interested in litecoin, especially in scenarios involving financial transactions, cross-border payments, and cryptographic asset management, where privacy protection has become a key factor.

In addition, the integration of Litecoin and Lightning Network will further enhance its transaction performance. The deployment of Lightning Network allows Litecoin to conduct higher-frequency transactions at a lower cost. This feature is particularly important in micropayment scenarios, especially in fields such as games, streaming media, and social platforms. The addition of Lightning Network will greatly expand the application ecosystem of Litecoin, thereby providing continuous support for its market demand.

2. ETF expectations and increased institutional attention

The current market bullish sentiment on Litecoin not only stems from its technical advantages, but also benefits from the market’s expectations for Litecoin spot ETFs. As a mature financial product, the approval and listing of ETFs (Transacted Open-ended Index Funds) usually mean that the asset will welcome a wider range of institutional investors, which will undoubtedly improve the liquidity and market awareness of the asset. and price level.

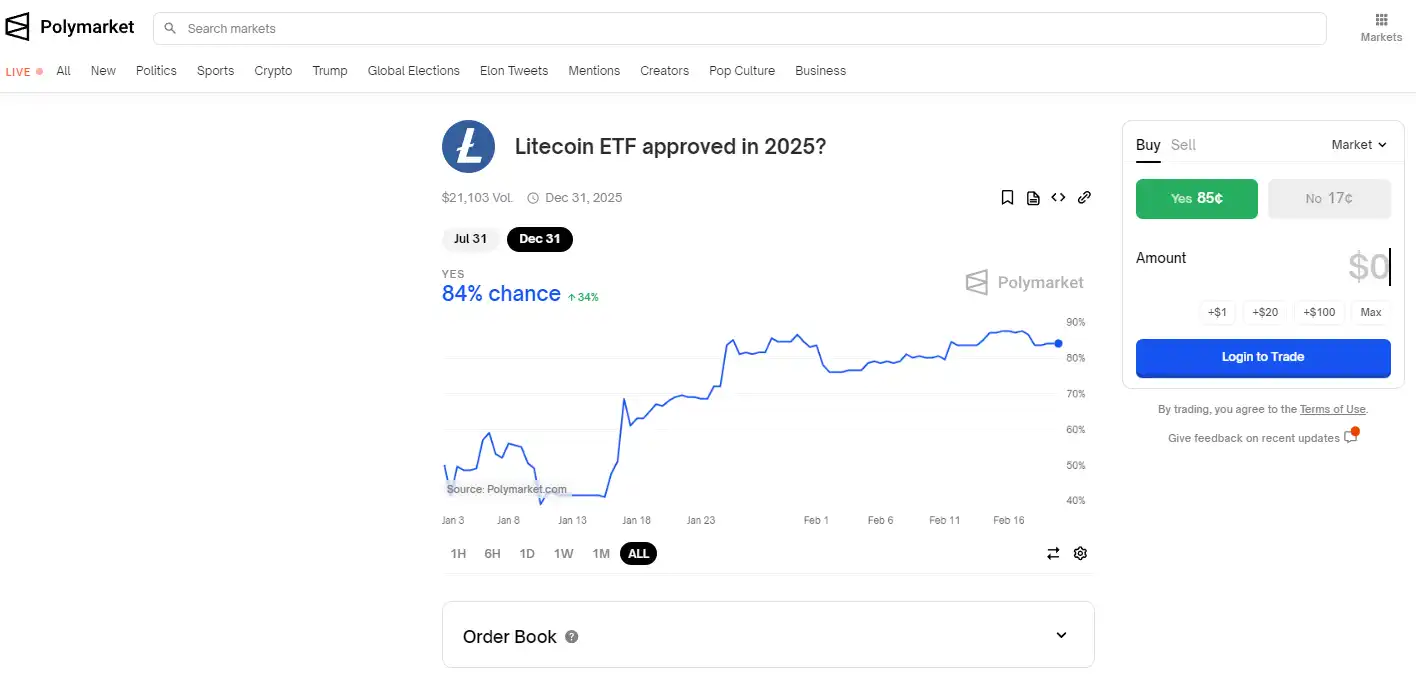

According to Bloomberg analysts, the probability of approval of the Litecoin Spot ETF is as high as 90%. The Polymarket data page shows that the Litecoin ETF has an 84% chance of passing in 2025, while the DOGE Dogecoin ETF has a 75% chance of passing.

Compared with DOGE, Litecoin has higher institutional attention and market maturity. Once the Litecoin Spot ETF is approved in the future, it may attract a large amount of traditional financial funds to flow into the Litecoin market, further promoting its price rise. In addition, the blockchain-based gambling platform Polymarket also showed that the Litecoin Spot ETF has an 84% chance of being approved, which further enhances the market’s confidence in Litecoin.

The successful launch of ETF will not only increase the number of Litecoin market participants, especially institutional investors, but may also attract more individual investors to enter the Litecoin market. The influx of institutional funds often causes the price of tokens to rise, a market effect that has been verified on multiple cryptocurrency assets in the past.

3. Scarcity and inflation hedging properties

As a cryptocurrency based on the PoW (Proof of Work) mechanism, the supply limit of Litecoin is set at 84 million pieces, which is a higher supply than Bitcoin’s 21 million pieces, but it is still scarce. As inflationary pressures increase and the uncertainty of the global economic environment, Litecoin has gradually demonstrated its safe-haven properties as “digital silver.”

In the current context of global economic instability, traditional investment markets are facing extreme inflationary pressure, and more and more investors are beginning to look for assets with the ability to hedge against inflation. The scarcity of Litecoin and the deflationary nature caused by its PoW mechanism make it an investment tool that can effectively fight inflation. In addition, Litecoin has relatively low transaction costs and fast transaction confirmation speed, which makes it have strong application potential in microfinance and cross-border settlement.

Litecoin price trend and market trend

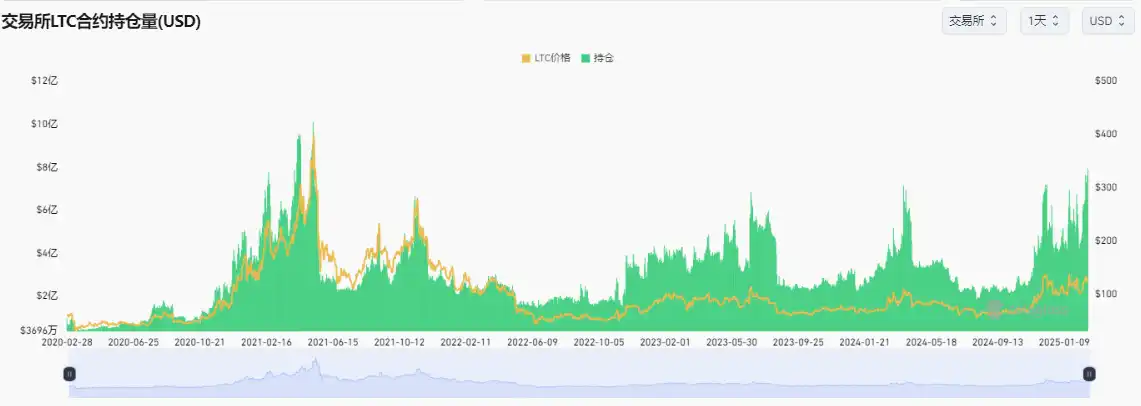

According to Coinglass data, Litecoin’s open interest has recently soared to US$840 million, setting a record high, approaching its peak in 2021, when LTC prices soared to US$400.

Current data suggests that market bullish sentiment against Litecoin is heating up.

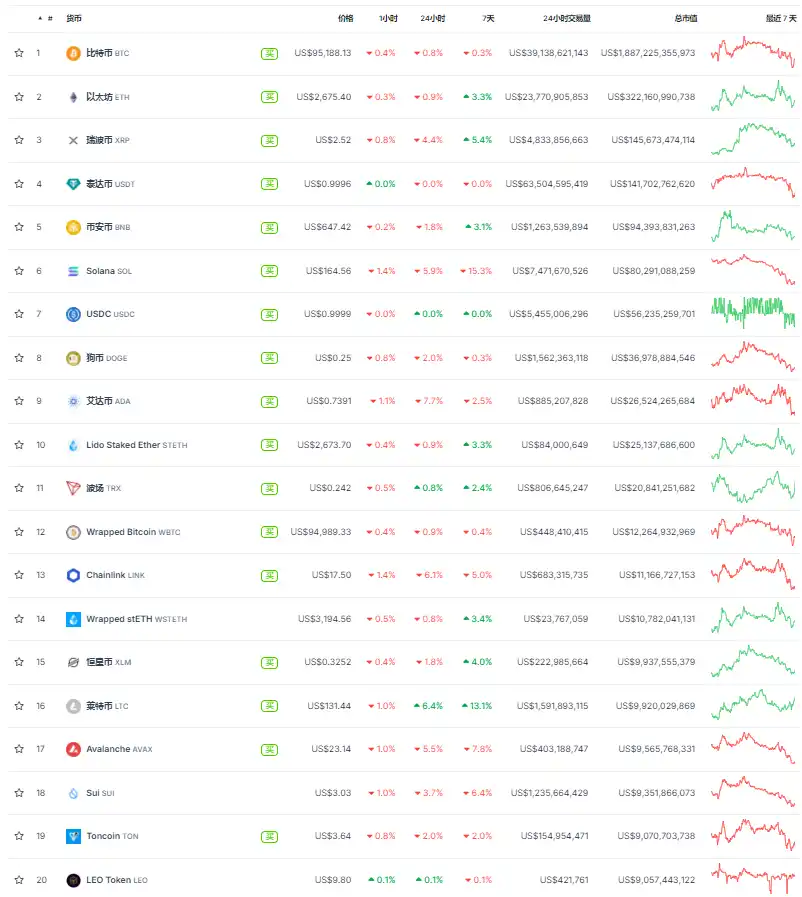

The current price of Litecoin exceeds US$130, making it the best performer among the top 20 cryptocurrencies in market value, and the only currency that has increased by as much as 13% in the past seven days.

According to historical data analyzed by crypto researcher Charting Guy, Litecoin and XRP (Ripple) have similar market performance. Over the past seven years, the price volatility trajectories of Litecoin and XRP have been almost exactly the same, with peaks and lows showing high correlations. If this trend continues, the price of Litecoin may experience a sharp increase like XRP, or even exceed the price of US$600.

In addition, Litecoin’s performance in macro trends is also similar to XRP. Especially driven by spot ETFs, Litecoin may gain the favor of more institutional investors. As the market continues to increase confidence in the future prospects of Litecoin, its price is expected to break through the current range and usher in a new rising cycle.

Analysis of market sentiment and price range

The current market performance of Litecoin shows strong range fluctuations.

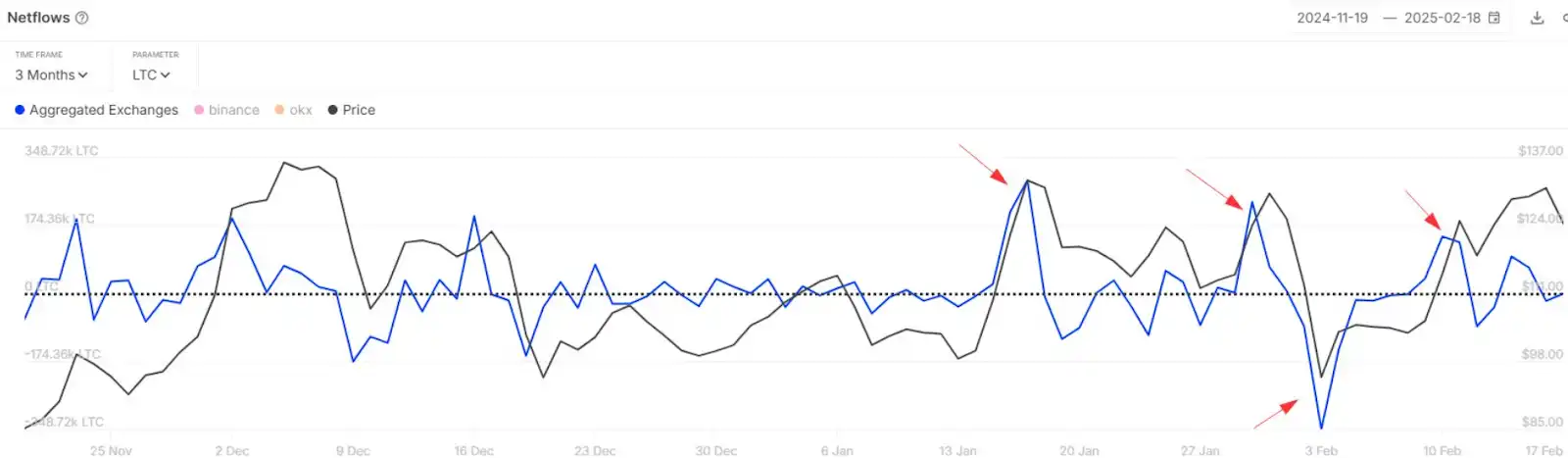

According to IntoTheBlock’s net exchange flow data, Litecoin traders carry out arbitrage operations during price fluctuations, usually withdrawing LTC from the exchange or hoarding coins when the price is low, and increasing deposits when the price rises. This trend suggests that the price of Litecoin may fluctuate between US$90 and US$130, with no significant upward or downward breakthrough.

However, as the probability of approval of the Litecoin Spot ETF continues to rise, market sentiment will turn further positive. It is expected that after the approval of the ETF, Litecoin will usher in a new wave of gains, breaking through the current range and entering a new price range. Especially when the price of Litecoin breaks through the key resistance level of $130, it may lay the foundation for the next round of gains.

Future price outlook for Litecoin

Litecoin is currently trading in parallel rising channels on the 4-hour chart, indicating that bull sentiment remains dominant. However, whether this bullish momentum can be maintained still depends on whether the Litecoin price can hold the support level of the downtrend line. If the price of Litecoin falls below the US$120 support level, it may make market sentiment more cautious and curb further price increases.

On the contrary, once the key resistance level of $130 is exceeded, the price of Litecoin may usher in a strong upward trend. This breakthrough will not only be a technical confirmation, but will also be driven by market sentiment and institutional capital inflows.

original link