Apple’s destocking products, but it has strategic significance.

Saving sales, iPhone 16e is still too expensive

author| Dingjiao One Jin Yu Fan

Apple has been very busy recently. While cooperating with Alibaba and Baidu to develop AI, it has launched a new mobile phone.

On February 20, Beijing time, the official debut of a new member of the Apple family was not the fourth generation of iPhone SE as previously speculated by the outside world, but the new series of iPhone 16e.

Although the previous S is missing from the name, it is regarded as the successor of the SE series and a typical destocking product:

The iPhone 14 ‘s body shell, 6.1-inch OLED full-scale screen, and Liu Haiping; the iPhone 16 ‘s equivalent Action Button and USB-C interface; the A18 chip that uses a 3nm process but cuts off a GPU core; The body is only black and white, of course, you can change various protective shells.

However, don’t ignore what this model means to Apple:

First, the iPhone 16e launches Apple C1 baseband. This shows that Apple’s self-developed baseband has finally been implemented, and there is no need to plug in Qualcomm and Intel’s baseband to achieve communication functions. Not surprisingly, this year’s iPhone 17 series will also be fully cut to C1.

Second, low-profile 16e all support Apple Intelligence (Apple AI software), indicating that AI has become a higher priority in the Apple ecosystem. The Chinese AI function still needs to wait for its cooperation with Alibaba to be implemented.

The iPhone 16e will be available for pre-order on February 21 and will be officially released on February 28, but the price is not as fragrant as expected. At least it has increased a lot compared to the iPhone SE series, and the price difference between storage rooms is also relatively high:

The 128G version is 4499 yuan, and the price in the China market will be reduced to 3999 yuan after participating in the national subsidy; the 256G version will be 5499 yuan, which will be reduced to 4999 yuan after the national subsidy; and the 512G version will be 7499 yuan. Shipments mainly rely on the first two models.

Many netizens said that instead of buying the iPhone 16e, they might as well add some money to buy the iPhone 16e. The price of the iPhone 16 after enjoying the national subsidy starts at 4699 yuan, which is the lowest price in the world.

The price of the 16e in the U.S. market is even more attractive: the iPhone 16e starts at $599, which is $200 cheaper than the iPhone 16 (which starts at $799). Some practitioners said that this is a model that cooperates with operator subsidies.

Apple’s market value growth has always relied on the capital market’s view of its hard-soft ecosystem. In the second half of 2024, Apple’s share price reversed in a V-shaped manner and peaked (US$260) in December 2024, mainly due to AI functions (Apple Intelligence was launched in some English-supported regions, driving iPhone 16 sales), services The capital narrative of (high-profit) and emerging markets (mainly Indian) has driven market value expansion.

But since the beginning of this year, weak hardware sales in Greater China, the third largest market, and lagging AI implementation have exposed Apple’s growth bottleneck. From January to mid-February 2025, Apple’s share price fell 5%.

After the iPhone 16e was released on its official website, Apple’s share price fell slightly by 0.3%. As of press time, its share price was US$244.8, and its market value was US$3.68 trillion.

The cheapest iPhone, the price is not competitive

Apple did not hold a press conference specifically for the new iPhone 16e, but chose to release it directly on its official website and released a product introduction video by Apple CEO Cook and several people in charge.

Although the name is series 16, the benchmark is still SE. The default comparison target for all upgrades on Apple’s official website is still the iPhone 11 released six years ago, especially in terms of battery life and chip performance. Apple also provides comparison options for iPhone SE 2 and 3.

Photo source/Apple official website

The iPhone 16e follows the SE series as a whole, and its performance in all aspects is a collection of past models:

The body and screen are aligned with the iPhone 14: the same body shell, a 6.1-inch OLED full-scale screen, and a Liu Haiping screen. There is no Smart Island, and an Action Button.

Although the screen size is not very SE, it is a single-camera design like the iPhone SE. The camera is the main camera of the iPhone 16 and has 48 megapixels behind the rear. There are basic algorithms for taking pictures, but it is impossible to take macro, space photos, space videos, and movie effects.

Performance benchmarking iPhone 16: As an entry model for iPhone, the 16e rarely uses a 3-nm A18 chip, but it only has a 4-core GPU, while the iPhone 16 has a 5-core.

Communication capabilities are benchmarked with iPhone 14-16: 4G, 5G, and satellite communications. The first C1 baseband developed by Apple is its low energy consumption, claiming a 30% improvement in energy efficiency and a video battery life of 26 hours, but the 5G peak rate (4Gbps) lags behind the Android flagship model, and the actual signal stability still needs to be verified by the real machine.

Photo source/Apple official website

Battery life compared to iPhone 14: The battery capacity is the same, but with improved energy consumption, the battery life should be longer. However, the charging ability is a bit awkward. The USB-C interface only supports USB 2.0, and the wireless charging limit is 7.5W. The iPhone 16 standard version has 15W, and the 16e does not support MagSafe magnetic charging.

Equipped with the A18 chip, the iPhone 16e naturally uses Apple Intelligence.

However, Chinese AI functions need to wait for cooperation with Alibaba to be implemented. Prior to this, the iPhone’s AI functions focused on basic optimizations, such as photo cleaning. Compared with domestic models with deep integration of AI assistants, there was obviously insufficient localized innovation.

Another difference between the Bank of China version is the price:

The 128G version is 4499 yuan, and the price is reduced to 3999 yuan after the national subsidy; the 256G version is 5499 yuan, which is reduced to 4999 yuan after the national subsidy; the 512G version is 7499 yuan, which is not within the scope of the national subsidy. The 128GB version that is mainly shipped has precise card blocking in the price range of 3000 yuan to 4000 yuan, competing with Huawei nova 12 (Kirin chip) and Xiaomi 14 Youth Edition.

In contrast, the price in the North American market is more fragrant: the iPhone 16e starts at $599, which is 200 bucks cheaper than the iPhone’s starting at $16,799.

Overall, the iPhone 16e is the cheapest model Apple currently sells in the global market and can run Apple Intelligence at full capacity. Although the A18 processor is castrated, its performance surpasses the Android manufacturer’s Snapdragon 7 Series and 8 Series, and this is the first time that Apple has integrated baseband C1 in its mobile SoC.

But the price is really not competitive in the China market. A digital enthusiast said that there are no bad mobile phones, only bad prices. If you want to buy, you can wait until the price drops in subsequent times. He believes that the appropriate starting price for the iPhone 16e is less than 70% of the current price after the national subsidy.

Apple’s four strategic intentions

Regarding the current pricing of the iPhone 16e, many netizens said that it is a model that cannot be saved even by national subsidies, but don’t ignore the significance of this model to Apple.

Based on the views of multiple interviewees, Apple’s four strategic intentions are behind the current launch of the iPhone 16e.

From the perspective of the North American market, this is a model that cooperates with operator subsidies and steals the entrance of young people.

An practitioner familiar with the North American market said that the iPhone 16e starts at $599, which seems to be a price set in line with subsidies from U.S. carriers.

After the US$599 model is subsidized by the operator, the user promises to bind to a high-traffic plan (e.g., more than US$60 per month) for a long time (e.g., 36 months). The actual monthly equipment supply paid is as low as US$1.99 (the total payment is approximately US$71.64), and the remaining US$527.36 will be borne by the operator.

The iPhone has high brand loyalty among American teenagers, with a figure of 87% in 2024. However, the consumption power of the youth group is limited. Apple has lowered the purchase threshold through the carrier contract machine model, which not only conforms to the positioning of home backup machines, but also uses long-term contracts to bind users, especially the youth group, to directly cultivate the usage habits of the first generation of users.

From a global market perspective, Apple is targeting price-sensitive but cost-effective users in emerging markets (such as India and Southeast Asia), competing for mid-end market growth to alleviate the pressure of stagnant growth in the high-end market.

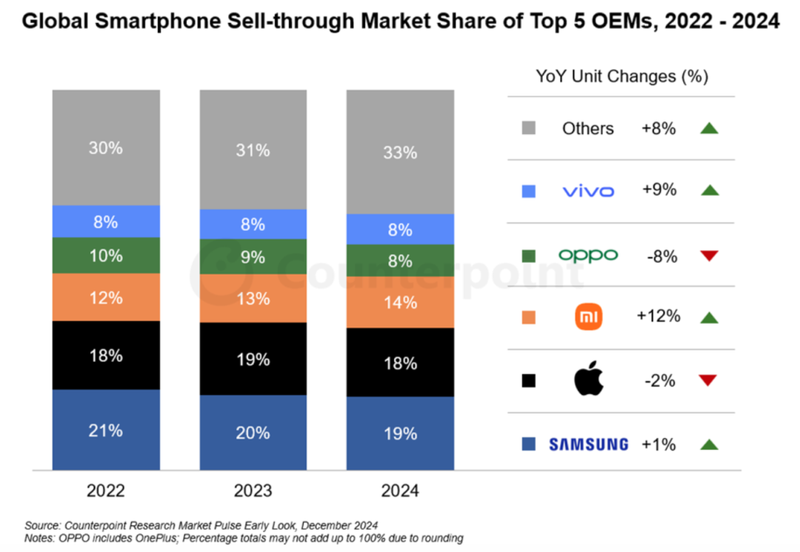

Counterpoint data shows that models under $600 account for 65% of the global market. Although Apple ranks second in 2024 with a market share of 18%, iPhone shipments will drop by 2%.

At the same time, Samsung’s Galaxy A series is already competing for the mid-end market with AI functions and cost performance. Apple is trying to intercept the flow of Android users through its more powerful AI series chips.

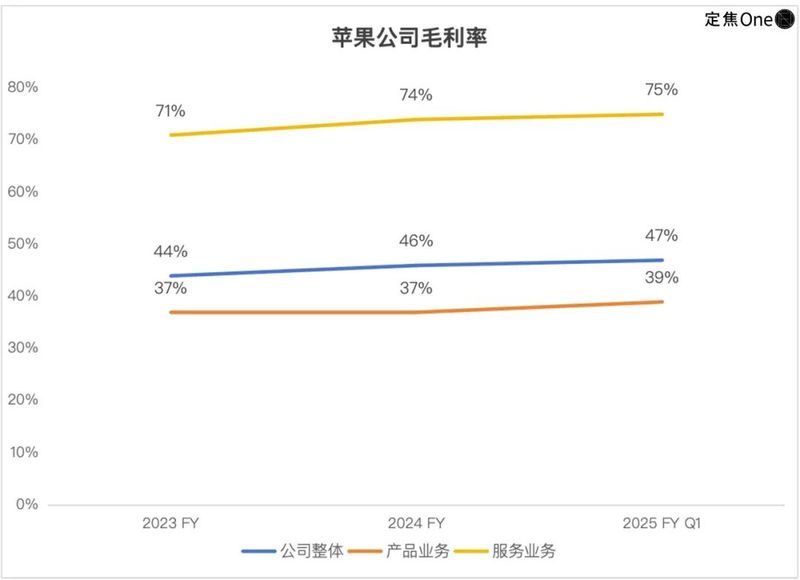

From an ecological perspective, Apple is increasing the underlying user pool for service businesses with higher gross margins (iCloud+, Apple Music, etc.), forming a closed loop of hardware diversion + service profitability.

“Fixed Focus One” mapping

Apple’s services business revenue for the first quarter of fiscal year 2025 (in response to Q4 2024) was US$26.3 billion, a year-on-year increase of 14%. This part of revenue relies on the hardware user base. Currently, Apple’s service subscriptions have exceeded 1 billion.

Now, Apple has decentralized iPhone 16e technology to share core experiences with high-end models, which can lower the threshold for users to enter the iOS ecosystem and strengthen the ecological moat.

From a technical perspective, Apple is strengthening its supply chain autonomy and getting rid of Qualcomm’s dependence, while training for the folding screen era and the AI era.

The implementation of Apple’s self-developed C1 baseband chip can not only reduce dependence on Qualcomm, but also optimize 5G power consumption and signal stability in the long term, paving the way for future folding screen iPhone and AI functions. According to foreign media reports, Apple’s first foldable screen iPhone may be available as early as the end of 2026 or early 2027.

The success or failure of baseband chips directly affects Apple’s voice in the global supply chain, determining its full closed-loop control from chips to ecology and its technical moat.

iPhone 16e’s mission in China: saving sales and buying time for AI

The above four strategic intentions can be summarized as defensive as offensive: consolidating fundamentals through technology decentralization and price sinking, while at the same time buying time for future innovation.

Both ecology and technology need long-term results, but right now, Apple’s mobile phone is facing the most urgent dilemma in the China market.

Apple’s first-quarter fiscal year 2025 results were the best in history: revenue of US$124.3 billion, a year-on-year increase of 4%. However, Greater China has been dragging its feet, with revenue of US$18.51 billion, down 11.1% year-on-year. It is the only market where Apple’s revenue has declined.

The biggest variable lies in Huawei’s comprehensive counterattack in the China market.

After Huawei launched the Mate 60 series equipped with Kirin 5G chips, it will return to first place with an 18% share in Q1 in 2024; the Mate 70 series will be priced at a lower price compared with the iPhone 16, and its production capacity will be fully released; its domestic alternative narrative further stimulates local market support.

Apple’s ranking in China once fell to sixth place (Q2 2024), resulting in the situation that domestic mobile phone manufacturers occupied the top five seats in the China market. This is the first time in history.

Although in Q4 of 2024, shipments of the iPhone 16 series returned to the first place in the quarter due to significant improvements in performance and Apple’s price cuts and sales volume, it did not change the situation for the whole year of 2024: Apple shipments fell by 17% against the trend, The biggest decline among the top five manufacturers. Huawei rushed from outside the list to second place, with a market share (16%) surpassing Apple.

The competition between Huawei and Apple is essentially a competition between technological autonomy and ecological control.

Li Da, a person in the mobile phone supply chain, told Focus One that after Huawei officially returned, it diverted some Apple business users, especially re-attracted some government and enterprise users.

At the same time, Huawei and manufacturers such as Xiaomi, vivo, OPPO, and vivo have directly impacted innovation areas that Apple has not yet set foot in through technical differences such as folding screens (high-end folding pricing overlaps with the iPhone Pro series) and betting on AI functions, further shaking Apple’s only high-end option.

As Apple’s third largest market, Greater China has completely exposed two major bottlenecks in Apple’s growth: weak hardware sales and lagging AI implementation.

In order to save the market, Apple has rarely cut prices many times in 2024 (the highest discount is 2250 yuan), but the price strategy is not as flexible as domestic manufacturers. Wang Xin, a practitioner in the mobile phone industry, gave an example that many flagship phones of domestic manufacturers accurately latch on iPhones, directly intercepting potential Apple users.

In 2025, Apple cannot simply rely on price cuts, otherwise it will inevitably weaken brand loyalty and high-end personality. Some practitioners have analyzed that the iPhone 16e is Apple’s model in response to defensive price cuts in the China market. It can be regarded as Apple’s direct counterattack against Huawei’s mid-range models (nova series) using the national subsidy policy.

However, the logic behind the national subsidy is to support the domestic industrial chain. In essence, domestic manufacturers have a home-court advantage, and Huawei, Xiaomi and other manufacturers benefit more obviously.

Another task for the iPhone 16e is to buy time for AI to be implemented.

In the second half of last year, after cooperating with OpenAI, Apple launched Apple Intelligence in multiple markets, and temporarily faced data compliance and localization adaptation problems in the China market.

Recently, there has finally been clear progress. While Apple has confirmed its cooperation with Ali, it has also maintained cooperation with Baidu. The intention of building an AI cooperation network is to improve the AI competitiveness of Apple products in the China market while reducing potential risks.

According to media reports, Ali will provide an AI model for the China market for the Apple Intelligence platform (scheduled to be launched in May 2025), while Baidu will be responsible for the development of functions such as visual intelligence.

To sum up, Apple’s high-end image in the China market still exists, but it has lost its previous absolute monopoly position. Domestic manufacturers including Huawei are rewriting market rules. Judging from the current pricing of the iPhone 16e, the task of saving sales in China is too arduous, but if the price drops in the future, it may buy some time for AI to be implemented.

An investor who follows Apple told “Fixed Focus One” that unless Apple makes substantial breakthroughs in the AI field or launches disruptive hardware (such as folding-screen phones), its market value may remain high. In the long run, China The market is the key to whether Apple can turn the situation around.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.