① Today, the total transaction volume of A-shares was 2.23 trillion yuan, setting a new high in nearly three months. It also exceeded the 2 trillion transaction mark again in two months.

② The artificial intelligence (TMT) and robot (mechanical equipment) sectors accounted for more than half of the market’s volume and energy today, with a turnover ratio of 54.6%.

③ At present, the market financing balance has hit a new high in nearly three months since the end of December last year, and the computer and electronics sectors are the key directions for increasing holdings during the month.

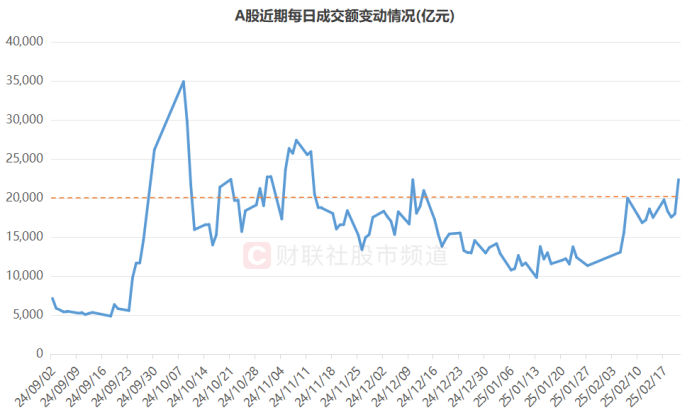

Financial Union, February 21 (Editor Zi Long),Today (February 21), market trading activity has increased significantly. As of the close, the total transaction volume in Shanghai, Shenzhen and Beijing reached 2.23 trillion yuan, nearly 440 billion yuan higher than yesterday. At the same time, today’s transaction volume hit a new high in nearly three months since November 12 last year, and it also broke through the 2 trillion transaction mark again in two months.

Note: Recent changes in daily turnover of A shares (as of the close of February 21)

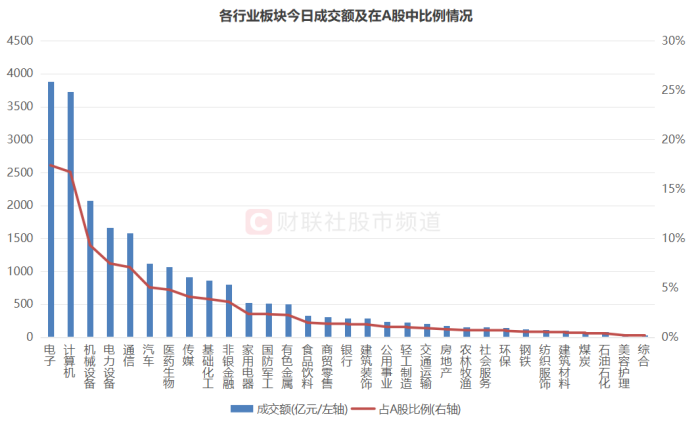

The two hot spots continue to ferment, and the proportion of transactions continues to be high

In terms of industries, market funds are mainly concentrated in the five major sectors of electronics, computers, mechanical equipment, power equipment, and communications today. Among them, the turnover of the electronics and computer sectors accounted for nearly 17.4% and 16.7% of A-shares respectively. Based on statistics from TMT shares (electronics, computer, communications, media) volume exceeds 1 trillion yuan, accounting for 45.3% of the total A shares. If the machinery and equipment sector is also included, its five industries (the current two hot spots) account for more than half of the market volume and energy, and the turnover ratio reaches 54.6%.

Note: Today’s turnover and proportion in A shares of each industry sector (as of the close of February 21)

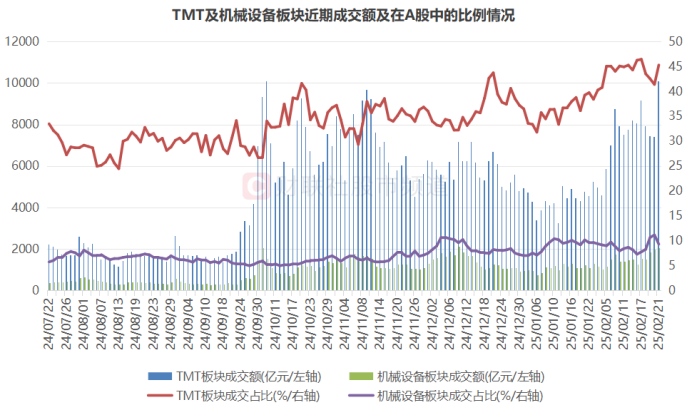

At present, artificial intelligence (TMT sector) and robots (mechanical equipment sector) continue to attract the attention of investors, and active funds in the market continue to enter. Judging from recent data, the turnover of the TMT sector and its proportion in A shares have increased significantly since the beginning of this year. Among them, in the 15 trading days since January 24, the TMT sector accounted for more than 40%. At the same time, the recent quantitative and energy data and proportion of the mechanical equipment sector have also shown a slight upward pulse, which is also slightly higher than last year.

Note: Recent turnover of the TMT and machinery equipment sectors and their proportion in A shares (as of the close of February 21)

In terms of specific individual stocks, after screening TMT and machinery and equipment stocks, as of today’s close, a total of 8 target stocks have a turnover of more than 10 billion yuan. Among them, ZTE, Tuowei Information, Inspur Information, Donghua Software, and SMIC ranked among the top five in terms of volume and energy, with turnover reaching 16.26 billion yuan, 15.39 billion yuan, 13.00 billion yuan, 12.84 billion yuan, and 12.72 billion yuan respectively. Among these high-volume stocks, Cambrian and Aofei data both recorded a 20cm daily limit, and many stocks such as Tuowei Information, China Unicom, and Ziguang also gained daily limit.

Note: TMT and machinery and equipment stocks with the top turnover today (as of the close of February 21)

32 shares traded in a huge volume today, and financiers have continued to increase positions in the near future.

Boosted by the high level of overall trading activity in the market today, in addition to the two current hot spots in the market-artificial intelligence and robots, many stocks also recorded a large number of transactions today. According to specific data, as of February 21, excluding new shares during the year, a total of 32 shares traded today, setting a new high since listing. Among them, there are 24 shares in the TMT and machinery and equipment sectors, accounting for nearly three-quarters of the overall share. Another 8 stocks also recorded a record volume of transactions. Among them, there are relatively many basic chemical stocks, and some of the targets are also related to the two hot spots at present.

Note: Excluding TMT and machinery and equipment stocks, today’s turnover hit a new high since listing (as of the close of February 21)

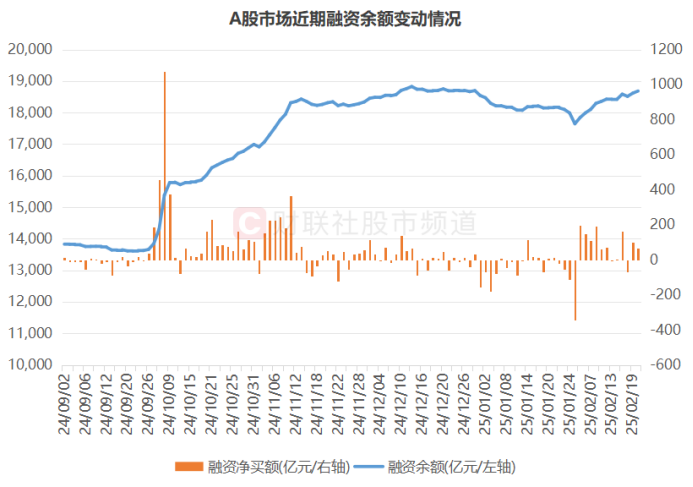

In addition, from a funding perspective, as the market continues to be active in the near future, financiers have also increased their positions in A shares. As of February 20, the current financing balance of Shanghai, Shenzhen and Beijing stock markets has reached 1.8683 billion yuan, a record high in nearly three months since the end of December last year. At present, A shares have been increased by nearly 14.2 billion yuan by financing customers during the year. Among them, financing customers significantly reduced their holdings in January, but significantly increased their positions in February, with a net financing purchase reaching 103.8 billion yuan. At the same time, during February, a total of 6 trading days had a single-day net purchase amount of more than 10 billion yuan.

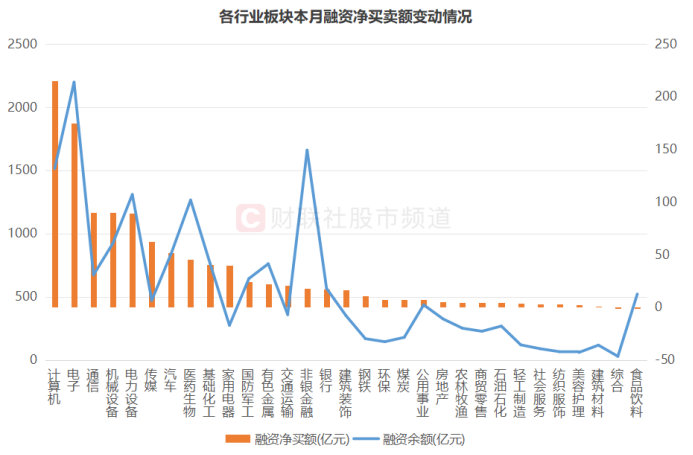

Note: Recent changes in financing balance in the A-share market (data as of February 20)

In terms of the specific direction of increase in holdings, only statistics are made on this month’s market. As of February 20, among the 31 Shenwan-level industry sectors, only the comprehensive and food and beverage sectors have been slightly reduced, and the remaining more than 90% of the sectors have received financing. Customers add positions. Among them, the computer and electronics sectors are the key directions for increasing holdings, with net financing purchases reaching 21.5 billion yuan and 17.5 billion yuan respectively during the month. The communications, machinery and equipment, power equipment, media, and automobile sectors also attracted the focus of financiers. The net financing purchases since this month have also exceeded 5 billion yuan.