When there are too many factors in the outside world that make a company’s development uncertain, the quality of the product may be the one with the strongest certainty.

Sam and Netflix share a success

author| Slightly larger reference small distance

On the scale of consumption, there are often more people on the price side. This is a more straightforward and logically simpler choice.

Especially now. Price wars are on the rise in various industries, but it is hard to say who the real winner is. Needless to say, some players who have fallen may just be forcing a smile on their faces.

Sam and Netflix experienced another success. Wal-Mart’s recently released fourth-quarter financial report for the fiscal year 2025 shows that Sam has become Wal-Mart’s growth engine this quarter. Its sales growth reached 6.8%, the fastest among the three divisions. In 2024, Netflix’s net profit increased by 99.25% year-on-year in the fourth quarter, and operating profit exceeded US$10 billion for the first time.

What the two have in common is that they have not entered the price war, sacrificing profits for growth. Instead, they all increased their prices in their own way. But it is not difficult to find out how to review them: this is probably a difficult assignment to copy.

01 Growth against the trend

On February 20, Wal-Mart released its financial report for the fourth quarter of fiscal year 2025. Combined with the financial reports for the first three quarters, it can be seen that in this fiscal year, Sam’s Club Store’s fuel-free sales increased by 5.05% year-on-year.

Since fiscal year 2020, Sam’s fuel-free sales have increased year-on-year for six consecutive years, with growth rates of more than 5% in four years.

In particular, the China market has become an important source of growth for Sam in the past two years. According to data from the China Chain Store and Franchise Association, Sam’s sales in China will exceed 80 billion yuan in 2023, and Sam’s sales of US$86.179 billion in fiscal year 2024 (February 1, 2023 to January 31, 2024) accounted for approximately 15%.

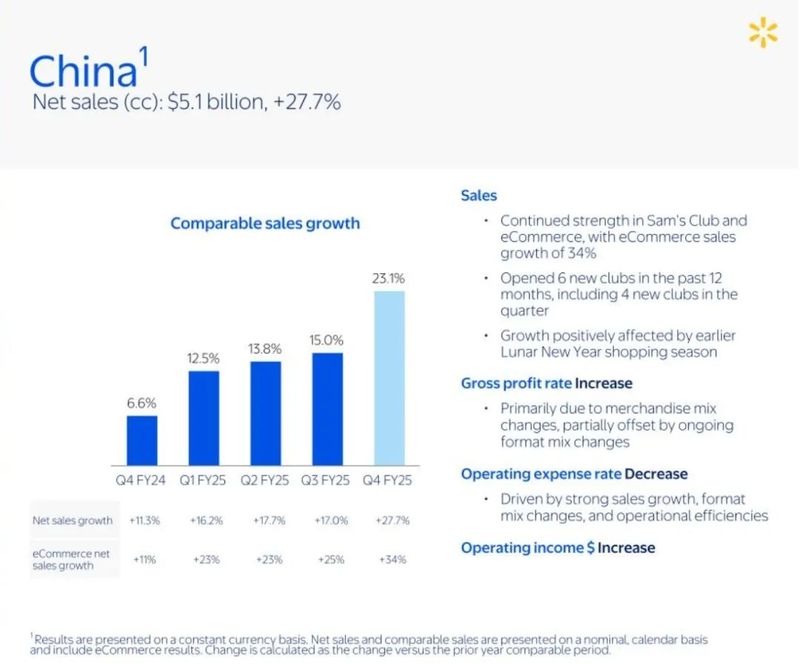

The financial report also mentioned that in the fourth quarter of 2025, driven by Sam and its e-commerce business, Wal-Mart’s sales in China increased by 27.7% year-on-year to US$5.1 billion. John David Rainey, executive vice president and chief financial officer of Wal-Mart, said in a telephone conference that Sam’s membership fee revenue in the China market has increased by more than 35%, and the number of members has continued to increase. rdquo; For comparison, Sam’s membership fee income in the United States grew by 13% during the quarter.

From 2020 to 2024, in China, consumers have not cultivated a market where they can obtain the habit of paying a membership fee first. Sam’s membership number has increased by more than 1.5 million per year on average. At the New Consumer Forum series of summits held in 2021, Zhu Xiaojing, President and CEO of Walmart China, once revealed that the time it took for Sam’s members to increase by 1 million has been shortened from the initial 21 years to a few months.

In December 2024, Chris Nicholas, President and CEO of Sam, said in an exclusive interview with Yahoo Finance that in the past year, Sam’s membership number and renewal rate have reached record highs.

The prerequisite for obtaining this result is that starting in October 2022, Sam will make the first membership fee adjustment in the United States since 1999, increasing the annual fees of ordinary members and premium members by $5 and $10 respectively.

A few months ago, its American fellow Netflix also adjusted the price of its products. Starting from January 2022, Netflix’s basic, standard, and premium membership packages will increase by 1 to 2 US dollars per month in North America and Europe.

Like Sam, after adjusting the membership fee, Netflix not only did not lose users, but achieved better results.

Netflix has adjusted the price of membership packages many times. This time in 2022 is the sixth increase in the price of the standard version package since 2011. It can also be regarded as the most serious consequence of the price adjustment for Netflix. In the first two quarters, Netflix’s paying users experienced negative growth for the first time in 15 years, losing a total of 1.17 million people, and its market value once evaporated by US$180 billion.

Although the gap was quickly filled in the next two quarters, Netflix’s users still showed an increasing trend due to the launch of new packages and the release of new series, adding a total of 8.9 million new members throughout the year. However, Netflix’s revenue and net profit were still affected. The former’s growth rate slowed down from 18.8% in the previous year to 6.46%, while the latter was the first year-on-year decline since 2015, and the rate exceeded 10%.

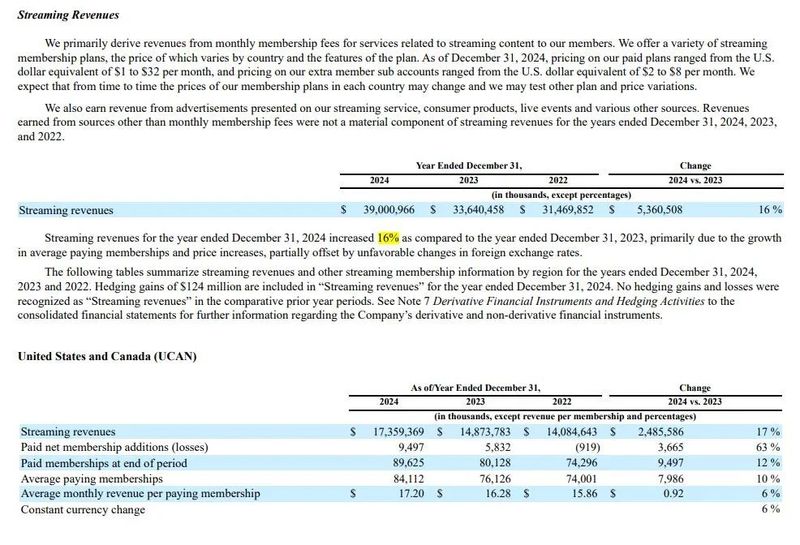

Netflix’s membership package prices have not dropped because of this, but have instead been raised again: in October 2023, the prices of some Netflix packages in Europe and the United States will be raised by US$2 to US$3. However, this has not stopped Netflix’s user growth trend. Benefiting from the launch of hits such as the final season of “Crown” and “Squid Games 2”, and the continuous crackdown on superimposed account sharing, Netflix added a net 13.12 million and 41 million users in the fourth quarter of 2023 and the whole year of 2024 respectively., of which the growth of users in the United States, Canada and Europe is leading the way.

It is also starting from 2023 that Netflix has gradually emerged from the haze: in the next two years, the company’s revenue and net profit will continue to grow, and the growth rate of many indicators exceeds expectations. Indicators such as operating profit and net new users will be in 2024 The fiscal year hit a new high.

After announcing its good results in 2024 a month ago, Netflix once again reported the price increase: Netflix once again announced that it will increase the price of most packages in the United States, Canada, Portugal, Argentina and other countries.

It is not that Sam and Netflix have no opponents. On the contrary, the competition they face is not easy.

Sam’s biggest competitor, Costco, is very strong. Even though the overall situation of the physical retail industry is unclear due to the impact of e-commerce, sales have been growing since 2009. Similarly, in 2024, it raised its membership fee for the first time in seven years, with the same range of $5 and $10, and the number of members also showed an increasing trend. The difference is that there are more cash back incentives for members of opening customers, and the market strategy highlights the low gross profit margin of commodities.

Netflix has more competitors in the streaming media industry, and many of them have advantages in IP, users, funds and other resources, such as Amazon’s Prime Video, Disney’s Disney +, Warner’s HBO Max and Apple’s Apple TV+. Their overall membership package prices and price increases are lower than those of Netflix.

Among them, according to JustWatch, a streaming media aggregation search platform, as of the fourth quarter of 2024, Prime Video’s market share in the United States reached 22%, ranking first. Netflix’s market share is 21%, ranking second.

Although price increases are taken into account objective factors such as rising prices, when competition is very fierce, not choosing price to compete for users can also reflect that a company has sufficient confidence in its own competitiveness.

02 Quality is king

Where does Sam and Netflix’s growth and confidence come from?

The simplest and most essential product quality.

After achieving record user growth in the fourth quarter of 2024, Netflix attributed the reasons to regular seasonal factors, broad strength in content and improved product/market fit in all regions.

The content released by Netflix did perform well this quarter: “Squid Game 2″ broke the platform record in views for its premiere,”Carry-On” made the list of the top ten movies in Netflix’s history, and Jack Paul and Tyson’s boxing match and the two NFL games on Christmas Day became the most-watched live sports events and NFL games in history respectively.

Of course, not just this quarter, Netflix’s content has always been the biggest factor in attracting users. After the broadcast of popular Korean dramas such as “Squid Games” and “Dark Glory”, users in the Asia-Pacific region grew rapidly, making it surpass Latin America in the second quarter of 2024 and become the third largest user group after North America and Western Europe.

Sam’s core competitiveness also lies in his products.

Take the Swiss Volume, one of its most successful products in the China market in recent years, as an example. After its launch in 2019, this product quickly became a hit item. Annual sales once exceeded 1 billion yuan, and social media browsed and discussed hundreds of millions of times.

The high popularity and low difficulty in production have led many supermarkets to try to replicate successfully by launching the same item. However, the difference in cost performance, especially quality, makes it possible that even though there is a social hot topic about how to divide the eight Swiss rolls, none of these products has surpassed Sam’s sales and recognition.

In an interview in 2022, Wen Ande, then president of Sam’s Club Store China, said that when China counterparts rushed to imitate Sam’s Swiss rolls, Sam’s Swiss roll sales did not decline and even increased.

The difficulty in copying product quality comes from the advantages brought by long-term and large investment.

Zhang Qing, chief purchasing officer of Sam’s China, once revealed that the research and development cycle of one of Sam’s products may be three times that of competitors, and he also built a cold chain specifically to ensure the quality of beef.

However, Netflix’s investment in content has rapidly increased since it shifted its development focus to streaming media in 2011, reaching a peak of US$14.61 billion in 2019. In the five years since 2020, content investment has exceeded US$15 billion in three years. Correspondingly, as of the fourth quarter of 2024, Netflix had content assets of US$32.5 billion.

Such investment brings about the accumulation of Sam and Netflix in the supply chain, which can mobilize global resources.

Needless to say, Sam has relied on more than 30 years of global supply chain construction by his parent company Wal-Mart, and has accumulated sufficient supplier, retailers and logistics resources in various countries around the world, allowing each market to obtain worldwide raw materials and goods.

After entering overseas markets in 2016, Netflix established cooperative relationships with film and television production teams and streaming media operators from various countries.

On the one hand, like other platforms, both adopt the method of cooperating with suppliers to purchase ready-made goods to provide users with high-quality choices.

For example, Netflix maintains cooperation with content producers such as television stations and video platforms from various countries all year round to obtain content. In the the mainland of China market that failed to enter, Netflix acquired works such as “The Night Hunt” and “The Later Us”, and obtained the rights to broadcast works such as “The Wandering Earth”, allowing users in other regions to watch high-quality Chinese dramas.

On the other hand, the two come out personally, making the options they offer more and more unique.

In 2011, Netflix entered the development of original content, but the early progress was not fast. By the first quarter of 2018, Netflix’s home-made content accounted for just over 20%.

After that, it started acceleration. Changes in the outside world have brought new pressures. Many partners turned into competitors: In 2017, Disney announced that it would terminate its licensing to Netflix in 2019 and establish its own streaming platform. In 2018, Warner also withdrew the copyright of national series such as “Friends”. In order to reduce the impact on itself and get rid of its dependence on the outside world, homemade content has become a must-make choice for Netflix.

By the second quarter of 2021, Netflix has more than half of its home-made content. Starting with the Emmy Award for “House of Cards” and the Oscar nomination for “Rome”, Netflix broke into the mainstream of the film and television industry, and later defeated traditional media giants such as HBO many times, becoming the most Emmy nominated king of TV.

Sam launched its own brand Member’s Mark in 1998. In 2014, the brand’s sales accounted for 6% of Sam’s overall sales. Ten years later, this figure has exceeded one-third.

Among them, the localization strategy, especially giving local teams sufficient autonomy, allowing them to create products according to local conditions, has become a secret to success in various markets.

Sam’s teams in various regions operate independently and hire local talents to create products based on the characteristics of the local market. For example, the fresh meat mooncakes launched by the China team after adjusting the ratio of fat to lean through research were popular after their launch and became an Internet celebrity product; Netflix has also adopted a model in which it is only responsible for investment and quality control, and the production is carried out by a local team. One month after the launch of the TV series “Kingdom” produced by a South Korean team, Netflix’s visits in South Korea have tripled that of the same period last year. Screenwriter Kim Eun-sook said:“ Netflix never expresses any opinions and only gives money. rdquo;

When there are too many factors in the outside world that make a company’s development uncertain, the quality of the product may be the one with the strongest certainty.

03 Has not stopped

Although they have achieved certain results in products, Sam and Netflix have not stopped in their current comfort zone.

Facing the future, their choices are still very similar. Learn from successful cross-border competitors and develop omni-channel businesses.

The logic behind it is still to ensure the user experience by providing more comprehensive services. On the one hand, new growth points can be found based on existing users and the business model can be more complete. On the other hand, complete products and services can also In turn attract users.

Texas and Pennsylvania in the United States will welcome two Netflix Houses in 2025, namely Netflix offline theme parks. The parks will provide Netflix’s popular IP-related themes such as “Stranger Things”,”Bridgetown” and “Squid Games”. Thematic activities, catering and surrounding products.

Although these two parks are the first to be implemented in the Netflix House project, Netflix has carried out similar services before then. In 2024, Blood City, the annual autumn celebration of Everland in South Korea, collaborated with Netflix to integrate the park into the thriller elements of dramas such as “Zombie Campus” and “Stranger Things”.

Previously, Netflix has also cashed out its IP through online shopping malls, offline flash stores and flash events many times.

The IP business, especially offline parks, sounds more like Disney’s hinterland. However, rather than interpreting this behavior as a counterattack, it is better to say that this is another time when Netflix is learning from its opponents.

Hastings, founder of Netflix, said in 2018 that commercial businesses such as theme parks would not be considered in the next five to ten years. rdquo; Just as he rejected advertising for years and finally admitted that he was wrong despite the success of his competitors, Netflix will launch advertising services in 2022.

But learning is not the same as copying, and Netflix is deliberately making a difference: Netflix House is opened in a shopping mall with a smaller area and better infrastructure, which requires fewer assets, lower maintenance costs, and fewer themed projects., Updates are faster, allowing tourists to have shorter stays but more visits.

Although Netflix did not disclose the specific revenue of its consumer goods business, with the closure of another business, DVD rental and distribution, at the end of 2023, it is hoped that it will shoulder the responsibility of filling the gap in financial reports, especially revenue sources, in the future.

On the other hand, Sam has achieved results–the transformation comes earlier and is progressing faster.

After being hit by e-commerce companies such as Amazon, Sam began a series of attempts to transform into digital. The most representative one was its Scan Go APP launched in 2016, which can make online payments while shopping. This application has been retained to this day. Sam not only improved operational efficiency in this way, but also collected a large amount of customer data.

More important is the e-commerce business that can bring practical benefits. In many markets such as the United States, China, India, and Mexico, Sam has provided online services through self-employment or cooperation.

In 2016, the new retail concept became popular in China’s retail industry. After learning from his counterparts in China, Sam created the cloud warehouse model in China in 2017, which means establishing pre-warehouse warehouses in the community, matching them with a variety of delivery services to achieve hourly delivery, and learning from and promoting them in other regions.

Facts have proved that the e-commerce business has brought new growth points to Sam. Since fiscal year 2019, sales of Sam’s e-commerce business accounted for 11.49% of overall sales. Under the influence of factors such as the epidemic lockdown, the growth rate once reached 47.22%.

China’s online business is particularly good. According to telephone conference information in the 2024 fiscal year, Sam China’s online sales accounted for approximately 48%, much higher than Sam International’s 10% and 20%. The financial report shows that in the four quarters of fiscal year 2025, Wal-Mart’s e-commerce business sales growth rate in China was more than 20%.

Up to now, Sam and Netflix have similar faces and share the same success. When reviewing their key actions, it is not difficult to find that while the two companies adjusted their operating strategies, they did not deviate from the original direction.

Wal-Mart founder Sam Walton said he has followed one guiding principle throughout his retail career: The secret to success in retail is meeting customer needs. The beginning of the story of Netflix was founder Hastings ‘insight into user needs through his own and others. Since then, the user experience has occupied a high priority in Netflix and has not changed.

This may seem simple, but it may be the most difficult homework to copy.

Boeing is a negative example. After acquiring McDonnell Douglas in 1996, it gradually shifted from an engineer culture that focused on product research and development and innovation to an accountant culture that advocated profit. In recent years, product safety problems have gradually been exposed, damaging the root causes. On domestic e-commerce tracks, some people have also gone through the detour of following suit and forgetting their roots and paid the price of declining performance.

This also makes Sam and Netflix’s current success even more rare. nbsp;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.