Article source: Alphabet List

Image source: Generated by AI

Image source: Generated by AI

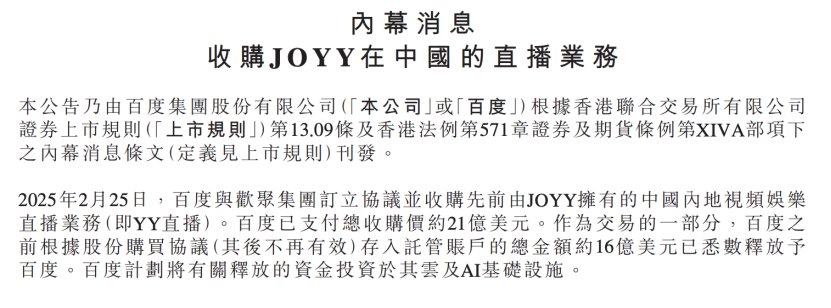

A transaction sent two major chips to Baidu.

On the evening of February 25, the Hong Kong Stock Exchange announced that Baidu and Huanju Group had reached an acquisition agreement. Baidu acquired Huanju Group’s domestic video entertainment live broadcast business YY Live for US$2.1 billion. After the new agreement was reached, the US$1.6 billion (more than 11 billion yuan) previously deposited in the co-custody account has been fully returned to Baidu, which will invest the money in cloud and AI infrastructure construction.

As the dust settled on the acquisition of YY, Baidu not only completely ended this more than four years of see-saw transaction, but also gained another 10 billion yuan in investment chips in the current fierce competition for big models.

Considering the objective reality that YY Live Broadcast is still making money, for Robin Li and Baidu, this is like finding a new cash cow for the company in addition to the original Baidu mobile ecosystem.Jointly shoulder the important responsibility of Baidu’s blood transfusion in the new competition of AIGC.

The greater strategic significance brought by ending the YY acquisition is to allow the outside world to reassess Baidu’s determination and perseverance to bet on AI. Previously, among the major technology companies that were struggling with whether to connect to DeepSeek, Tencent took the lead, followed closely by Baidu. But now it seems that in terms of AI development strategy, Baidu is showing more freedom than Tencent: not only has it chosen to embrace DeepSeek and open its high-end large model capabilities to all users for free, but it has also further chosen to open source its future new generation flagship model. -Wenxin 4.5 series, and after completing the acquisition of YY, it has chosen to invest more than 11 billion yuan in AI.

At the beginning of 2025, the explosion of DeepSeek R1 has achieved a re-education of large models across the industry and further enhanced the public’s awareness and enthusiasm for experience of basic models.

More importantly, DeepSeek has given early signs of the explosion of large-scale models. David Luan, former vice president of OpenAI and now head of Amazon’s AGI laboratory, recently explained that the misunderstanding of DeepSeek is that DeepSeek only verified that more intelligence can be achieved at a lower cost, but “It doesn’t mean you will stop pursuing intelligence.” On the contrary, you will use more intelligence.”

The AI technology narrative that has not been changed by DeepSeek is still being staged in a number of major technology companies at home and abroad.OpenAI officials announced the upcoming release of GPT-5, and Baidu also announced plans to launch Wenxin 5.0 soon.

The pursuit of computing power demand by big model players is still in progress: After the release of the new quarter’s earnings report, Google disclosed a capital expenditure plan of up to US$75 billion for the fiscal year 2025 to continue to expand its AI strategy; Microsoft announced that it will Invest US$80 billion to build AI data centers;Meta will also spend US$60 billion to build AI infrastructure and significantly expand its AI team.

Domestic Alibaba has also recently announced a new AI plan, which will invest more than 380 billion yuan in the next three years to build cloud and AI hardware infrastructure.

Behind the high AI spending is the objective reality that AI is becoming a new engine driving the business development of major technology companies.This is also clearly reflected in Baidu. In the latest financial report for the fourth quarter of fiscal year 2024, Baidu’s smart cloud business revenue reached 7.1 billion yuan, a year-on-year increase of 26%, ranking first among Baidu’s businesses in growth.

From the new generation of AIGC launched by ChatGPT, Baidu launched a domestic 100-model war, and then to the current application wave accelerated by DeepSeek, the major technology companies with cloud services have once again entered a new round of infrastructure investment. No one wants to miss AI. Express.

a

The connection between Baidu and YY is all due to an acquisition more than four years ago. In November 2020, Baidu and Huanju Group reached an agreement to acquire YY Live Broadcast for US$3.6 billion.

Although the transaction was delayed for four years, Baidu had already paid $3.6 billion in advance for the acquisition. According to the prospectus documents submitted by Baidu for its secondary listing in Hong Kong in March 2021, after considering a working capital adjustment of US$100 million at that time, Baidu paid a total of US$1.9 billion to Huanju and its designated co-custody accounts, and deposited a total of US$1.6 billion to multiple co-custody accounts.

The joint custody account is jointly supervised by both parties. Once the pre-established delivery conditions are triggered, the corresponding amount will be automatically transferred to the buyer or seller.Today, as the price of YY’s acquisition has dropped from US$3.6 billion to US$2.1 billion, the US$1.6 billion in the co-managed account has been returned to Baidu’s hands.

In addition to withdrawing 10 billion yuan for AI investment, Baidu, which has completely acquired YY, is expected to continue to make profits from YY.

Despite the decline in acquisition prices, YY Live Broadcast is still a continuing profitable business and is expected to become a new cash cow under Baidu. Previous data showed that YY’s revenue in 2018, 2019 and 2020 was 10.1 billion yuan, 10.7 billion yuan and 9.7 billion yuan respectively, and its single annual profits were all more than 3 billion yuan. Although specific revenue data has not been disclosed in recent years, according to people familiar with the matter, YY’s annual revenue is still more than 10 billion yuan, and it has maintained a good profitability.

Also,With more than 40 million monthly active users, it can also become a new channel for Baidu to launch short dramas.

At the beginning of 2024, Baidu APP opened a special secondary entrance for short dramas, and the company began to restart the short drama project internally. According to Photon Planet, in the fourth quarter of last year, the daily activity of Baidu’s short drama users exceeded 40 million, and the quarterly GMV increased by 51.2% month-on-month.

Nowadays, with the addition of YY, whether it is channel distribution or content ecosystem construction, Baidu short dramas have greater room for operation.

More importantly,As a live broadcast application, YY can also provide Baidu with richer AI technology application scenarios.

After ChatGPT detonated the AIGC wave, Baidu executives mentioned at an earnings conference that using artificial intelligence to generate Short Video content is a typical application of AIGC. This can not only attract new users for the platform, increase user time spending and user stickiness. Create opportunities, and is expected to help Baidu increase online marketing revenue and promote cloud revenue growth.

While Baidu’s search is fully connected to DeepSeek, YY recently announced its connection to DeepSeek and launched YYDS almost simultaneously. Earlier, YY also officially released the AI companion digital person “Ling ‘er”, becoming the first live broadcast service-based digital person it launched. Official data shows that the digital person “Linger” currently covers more than 6000 live broadcast rooms, serving an average of more than 1 million users per day.

second

Faced with the large model track that is entering a new round of investment, Baidu currently needs more funds to ensure the smooth development of AI infrastructure.The tens of billions of yuan released from YY’s acquisition has undoubtedly served as a icing on the cake.

The current access to the open source model DeepSeek has gradually evolved into a resource competition among major technology companies. DeepSeek’s official service often prompts that it is busy, but fully connected to DeepSeek’s full-blood version of Baidu search has basically achieved a smooth experience on the user side. Behind this, Baidu is investing more money to mobilize capital expenditures for more computing power clusters.

Beyond DeepSeek,On February 13, Baidu also announced to the public that it would soon open Wenxinyiyan to all users for free and that it would add new in-depth search functions to Wenxinyiyan.

With the free use cycle opening on April 1, Baidu is bound to attract a wave of peak user traffic. To ensure a good interactive experience between new users and Wenxinyiyan, this also requires Baidu to invest more money to expand its computing power service cluster.

In addition to meeting the needs of more C-end users, Baidu Cloud is also increasing its services to the B-end developer community.“We continue to enhance the MaaS platform to improve the model and application development experience for customers and partners. Our platform uses the Wenxin series of models and provides access to a range of high-quality models around the world, and DeepSeek is one of our newest members.” Baidu executives said at the new quarter earnings conference.

In addition to deploying DeepSeek on the cloud platform, Baidu has also taken up the idea of open source, announcing that the Wenxin Model 4.5 series launched in the next few months will be officially open source starting from June 30.

“One thing we learned from DeepSeek is that open source the best models can greatly promote user adoption and acceptance of the model.” Yanhong Li said when explaining Wenxin 4.5 ‘s open source strategy.

By then, on the Baidu YunQianfan Model Service Platform, B-end users can not only call third-party models such as DeepSeek, but also directly reproduce the training secrets of Wenxin Model. In order to meet the needs of more users for calling different models, Baidu will need to further increase capital investment to expand its AI infrastructure.

Especially while consolidating the existing mobile ecosystem advantages, one of Baidu’s current top priorities also includes further improving the user experience and improving product functions. This tests Baidu’s ability to continue research and development iteration on large models.

To provide users with an amazing experience comparable to DeepSeek, early funding preparation and investment are even more indispensable.

three

In the long run, Baidu’s investment in AI will far exceed 10 billion yuan.

In the past ten years, Baidu’s cumulative R & D investment has exceeded 180 billion yuan, and the R & D investment has accounted for more than 20% of revenue for many years. Coupled with YY’s withdrawal of funds, it is estimated thatIn the next three years, Baidu will invest a total of more than 100 billion yuan in AI research and development.

With pressure R & D investment, Baidu has achieved certain results in AI technology and applications. Last year’s fourth quarter and full-year financial reports showed that Baidu Intelligent Cloud grew strongly in the fourth quarter, with revenue increasing by 26% year-on-year. In 2024, intelligent cloud AI-related revenue increased nearly threefold year-on-year. At the same time, as of December 2024, the monthly active users of Baidu Library’s AI function have reached 94 million, a nearly double month-on-month increase. The number of paid users ranks first in China and second in the world, second only to Microsoft Copilot. Baidu Library has thus become the only China AI application that has achieved commercial scale effects.

The R & D investment of over 100 billion has also brought Baidu’s full-stack layout in the artificial intelligence chip layer, framework layer, model layer and application layer, and promoted Baidu to become one of the few artificial intelligence companies in the world with full-stack layout.

Recently, Baidu Intelligent Cloud successfully lit up the Kunlun Core third-generation Wanka cluster, which is also the first self-developed Wanka cluster to be officially lit in China.In the future, Baidu Smart Cloud will also light up the 30,000 card cluster.

“From hardware to software, the technical challenges are comprehensive in the construction of the domestic Kunlun Core 10,000 card cluster and the future 30,000 card cluster.” According to Baidu insiders, Baidu Baige AI Heterogeneous Computing Platform 4.0, which was upgraded in September 2024, has played a vital role in the construction of the Wanka cluster, andAt present, it has mature 100,000 card cluster deployment and management capabilities.

The completion of self-developed chips and Wanka clusters not only brought strong computing power support to Baidu’s AI battle, but also effectively improved the overall utilization of resources for Baidu and its service customers, and produced a series of chemical reactions in reducing the cost of training large models.

Among the current cloud platforms deploying DeepSeek, the above technical achievements have also become Baidu Cloud’s core advantages in attracting users. “Thanks to our full-stack AI capabilities and end-to-end optimization, we can ensure the best performance and stability for any model hosted on the platform while remaining highly competitive.” Baidu insiders introduced.

Changes in the average daily API call volume intuitively illustrate the growth of customers choosing Baidu AI services. Over the past year,The average daily API calls processed by Baidu Wenxin series models soared from 50 million to 1.65 billion, an increase of 33 times.

As the cost of calling large models decreases, the above-mentioned average daily API calls are expected to explode further.

“Today, innovation is much faster than ever before. In Moore’s Law, performance doubles and prices halved every 18 months; today, reasoning costs for large models can be reduced by more than 90% per year.” In a recent external interview, Li Yanhong said that looking back on the past few hundred years, the essence of innovation is cost reduction and productivity improvement. In AI, IT and even more fields, most innovations are related to cost reduction, such as reducing costs by a certain percentage. Productivity can also be increased in the same proportion.

The investment of hundreds of billions of yuan and the cost reduction results brought about by the investment will jointly constitute Baidu’s confidence and confidence in pursuing AGI.