① Data from the National Bureau of Statistics showed that PPI fell by 2.3% year-on-year in January;

②7 The new torch network of connected boards reminds us of risks, and the IT operation and maintenance agent business has not yet generated revenue;

③ Trump said he would announce a 25% tariff on steel and aluminum imports from all countries on Monday.

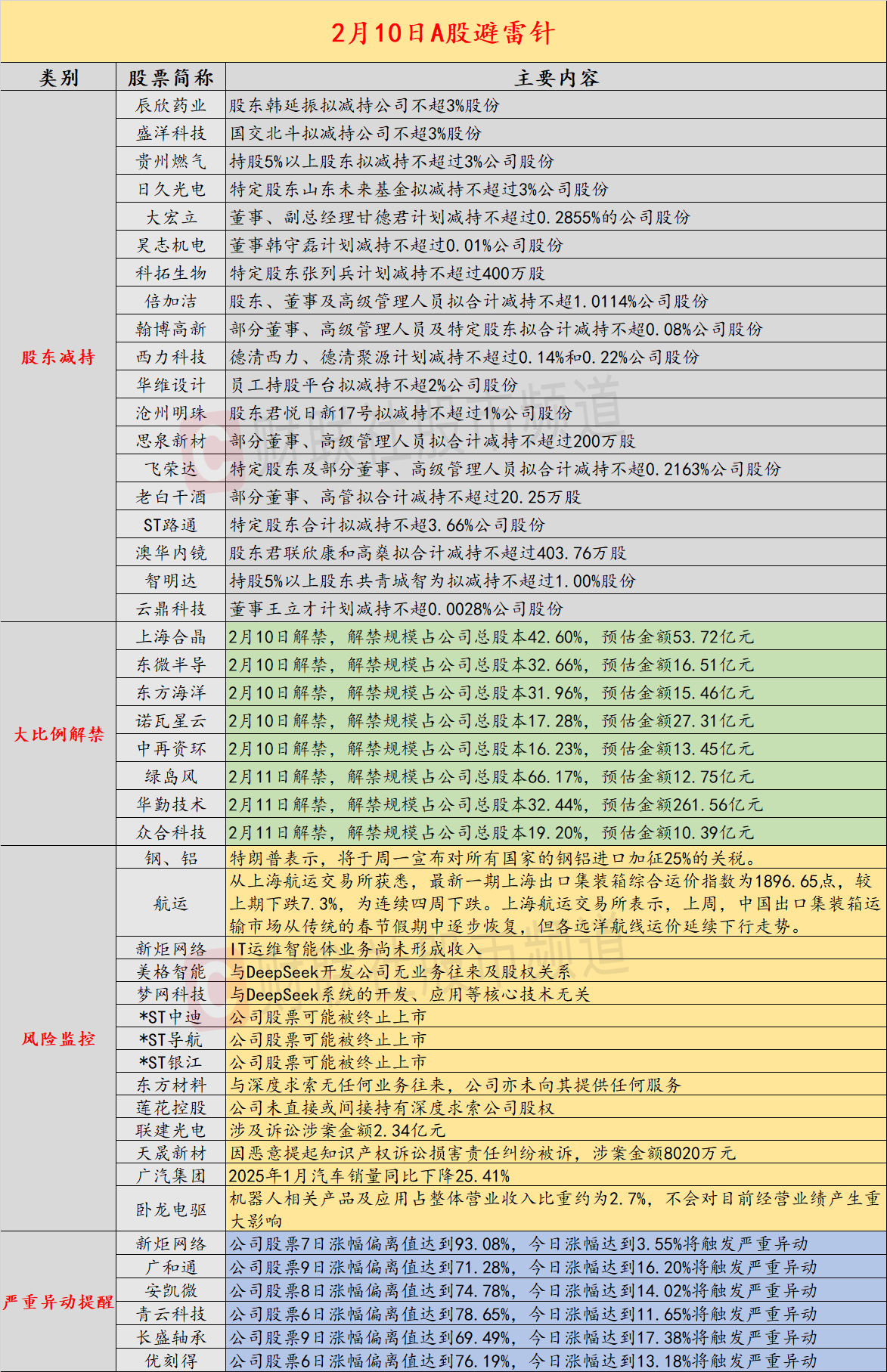

Introduction:Cailian invested in the lightning rod on February 10. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) Data from the National Bureau of Statistics showed that the PPI fell by 2.3% year-on-year in January;2) Shanghai’s export container freight index fell for four consecutive weeks, and market demand was flat; the company’s key concerns include: 1) The 7-board Xinju Network warns of risks, and the IT operation and maintenance agent business has not yet generated revenue;2) 5-board Meige Intelligent announced that it has no business dealings or equity relationship with DeepSeek Development Company; key concerns in overseas markets include: 1) Trump said he would announce a 25% tariff on steel and aluminum imports from all countries on Monday;2) Last Friday, the three major U.S. stock indexes closed down collectively, with Amazon recording its largest one-day decline since December 18 last year.

economic information

1. Data released by the National Bureau of Statistics shows that in January 2025, the ex-factory prices and purchase prices of industrial producers across the country both fell by 2.3% year-on-year, with the same declines as the previous month; both fell by 0.2% month-on-month. In January, among the ex-factory prices of industrial producers, the price of means of production fell by 2.6%, affecting the overall level of ex-factory prices of industrial producers by about 1.95 percentage points. Among them, the price of the extractive industry fell by 4.9%, the price of the raw material industry fell by 1.9%, and the price of the processing industry fell by 2.7%. The price of means of living fell by 1.2%, affecting the overall level of ex-factory prices of industrial producers by about 0.31 percentage points. Among them, food prices fell by 1.4%, clothing prices fell by 0.1%, general daily necessities prices rose by 0.5%, and consumer durables prices fell by 2.6%.

2. It was learned from the Shanghai Shipping Exchange that the latest issue of the Shanghai Export Container Composite Freight Index was 1,896.65 points, a decrease of 7.3% from the previous period and a four-week decline. The Shanghai Shipping Exchange said that last week, China’s export container transportation market gradually recovered from the traditional Spring Festival holiday, but freight rates on various ocean routes continued to decline.

3. According to the “Civil Affairs Statistics for the Fourth Quarter of 2024” released by the official website of the Ministry of Civil Affairs, the number of marriage registrations nationwide in 2024 was 6.106 million, and the number of divorce registrations was 2.621 million. In 2023, 7.68 million couples will be registered for marriage and 2.593 million couples will be registered for divorce nationwide. In comparison, the number of marriage registrations nationwide decreased by 1.574 million pairs, a decrease of about 20.5%; the number of divorce registrations increased by 28,000 pairs, an increase of about 1.1%. This also means that the number of marriage registrations nationwide will drop again after a rebound in 2023. (The Paper News)

Company warning

1. 7 Connected board new torch network: IT operation and maintenance agent business has not yet generated revenue.

2. 5 Connected board Meg Intelligence: No business dealings or equity relationship with DeepSeek Development Company.

3.3 DreamNet Technology: It has nothing to do with core technologies such as the development and application of the DeepSeek system.

4. Chenxin Pharmaceutical: Shareholder Han Yanzhen plans to reduce his shareholding in the company by no more than 3%.

5. Shengyang Technology: Beidou plans to reduce its shareholding in the company by no more than 3%.

6. Guizhou Gas: Shareholders holding more than 5% of the shares plan to reduce their shares in the company by no more than 3%.

7. Rijiu Optoelectronics: Specific shareholder Shandong Future Fund plans to reduce its shareholding by no more than 3% of the company’s shares.

8. Da Hongli: Director and deputy general manager Gan Dejun plans to reduce his shareholding in the company by no more than 0.2855%.

9. Haozhi Electromechanical: Director Han Shoulei plans to reduce the company’s shares by no more than 0.01%.

10. Ketuo Biotech: Specific shareholder Zhang Liebing plans to reduce his holdings by no more than 4 million shares.

11. Peppernix: Shareholders, directors and senior management plan to reduce their shares in the company by no more than 1.0114%.

12. Hanbo High-tech: Some directors, senior managers and specific shareholders plan to reduce their shares in the company by no more than 0.08%.

13. Xili Technology: Deqing Xili and Deqing Juyuan plan to reduce their shares of the company by no more than 0.14% and 0.22%.

14. Huawei Design: The employee stock ownership platform plans to reduce its shareholding by no more than 2% of the company’s shares.

15. Cangzhou Pearl: Shareholder Junyue Rixin No. 17 plans to reduce its shares in the company by no more than 1%.

16. Siquan Xincai: Some directors and senior managers plan to reduce their holdings by no more than 2 million shares in total.

17. Fei Rongda: Specific shareholders and some directors and senior management personnel plan to reduce their shares in the company by no more than 0.2163%.

18. Laobaigan Liquor: Some directors and senior executives plan to reduce their holdings by no more than 202,500 shares in total.

19. ST Lutong: Specific shareholders plan to reduce their shares in the company by no more than 3.66% in total.

20. Aohua Endoscopy: Shareholders Junlian Xinkang and Gao Shen plan to reduce their holdings by no more than 4.0376 million shares in total.

21. Zhimingda: Gongqingcheng Zhiwei, a shareholder holding more than 5% of the shares, plans to reduce its shares by no more than 1.00%.

22. Yunding Technology: Director Wang Licai plans to reduce his shareholding in the company by no more than 0.0028%.

23. *ST Zhongdi: The company’s shares may be terminated from listing.

24. *ST Navigation: The company’s shares may be terminated from listing.

25. *ST Yinjiang: The company’s shares may be terminated from listing.

26. Oriental Materials: There is no business relationship with Deep Search, and the company has not provided any services to it.

27. 2 Lianban Lotus Holdings: The company does not directly or indirectly hold equity in Deep Seeking Company.

28. Lianjian Optoelectronics: The amount involved in litigation was 234 million yuan.

29. Tiansheng Xincai: He was sued for maliciously filing an intellectual property lawsuit for damage liability, involving a total amount of 80.2 million yuan.

30. GAC Group: Car sales in January 2025 fell by 25.41% year-on-year.

31. Wolong Electric Drive: Robot-related products and applications account for approximately 2.7% of the overall operating income and will not have a significant impact on current operating results.

Overseas warning

1. Trump said he would announce a 25% tariff increase on steel and aluminum imports from all countries on Monday.

2. When U.S. President Trump met with visiting Japanese Prime Minister Shigeru Ishiba on February 7 local time, he said that reciprocal tariff measures would be announced next week. The relevant tariff measures would apply to all countries. The news may be released “next Monday or Tuesday”.

3. The three major U.S. stock indexes collectively closed down on Friday, with the Nasdaq falling 1.36%, the Dow falling 0.99%, and the S & P 500 index falling 0.95%. Most large technology stocks fell, with Amazon falling more than 4%, the largest one-day decline since December 18 last year; Tesla and Google fell more than 3%, Apple fell more than 2%, Microsoft and Intel fell more than 1%, and Netflix fell slightly; Nvidia and Meta rose slightly. Among them, Tesla fell nearly 11% last week, the largest decline since October last year.

4. Non-agricultural employment in the United States increased by 143,000 in January, which is estimated to increase by 175,000, and the previous value was an increase of 256,000. In January, the United States added 32,000 government jobs, 3,000 manufacturing jobs, and 111,000 private sector jobs.