Five effective strategies for post-sell scenarios, with examples, profit and loss analysis, and situational guidance.

Source: BitMEX

Welcome to our Weekly Options Alpha Series!

Bitcoin has just fallen sharply, falling by 10%. Your portfolio is losing money and you may think,”What should we do next? Is it panic, increase positions, or operate intelligently?”

Options strategies can help manage risk, take advantage of possible rebounds, or generate revenue. Here are five effective strategies for post-sell scenarios, with examples, P & L analysis, and situational guidance.

1. If you are worried that Bitcoin will continue to fall in March… What to do: Buy protective puts (your insurance strategy)

Let’s say you have a Bitcoin price of $89,000, but you have trouble sleeping because Bitcoin may fall to $75,000 in March. Don’t wait around-hedge yourself! Buy a put option to lock in a reserve price.

Example:

- Bitcoin price: US$89,000

- Buy a $85,000 put option (expiration date: March 28) with an option fee of $3,000.

Why it works:

If Bitcoin plummets to $75,000:

- Your put option pays $10,000 ($85,000-$75,000).

- After deducting the $3,000 option fee, you net $7,000. The money can be used to buy more bitcoin at a very low price, or to make up for losses in your portfolio.

If Bitcoin rises to $100,000:

You only lost $3,000 in options fees, but your spot position soared. For psychological comfort, this small price is worth it.

The worst-case scenario is: If Bitcoin remains at around $89,000 or only rises slightly, the put option will expire and you will lose $3,000 in premium, but your Bitcoin position may have increased. For protection and peace of mind, the cost is worth paying.

Summary: This is designed for investors who are biased towards the bulls but are worried about further market declines. You don’t want to sell Bitcoin, but you need downside protection. Think of it as an insurance premium to ensure you can sleep soundly.

2. If you think Bitcoin will hold steady in the next few weeks… What to do: Sell covered call options (you will cash in on boredom)

Let’s say you’re stuck in $89,000 in Bitcoin, but don’t expect a big move anytime soon. Then it’s better to let the market pay you while waiting! Sell call options to earn premium.

Example:

- Bitcoin price: US$89,000

- Sell a call option of $95,000 (expiration date: March 28) with an option fee of $2,600.

Why it works:

If Bitcoin remains at $89,000:

You earn $2,600. This is a 3% gain for doing nothing for 30 days.

If Bitcoin rises to $100,000:

You are still profitable:

- Sell at $95,000 (gain of $6,000)

- Reserve $2,600 in option fees

- Total profit was + US$8,600.

The worst-case scenario is to miss out on gains above $95,000. But honestly, after a sell-off, do you really expect a 20% gain in 30 days?

Summary: This is a “I’m willing to charge some free money” strategy. If you are slightly bullish on Bitcoin, or just want to reduce costs when holding positions, this is the perfect choice.

3. If you think there will be a rebound in Bitcoin (but not too crazy)… What to do: bull market bullish spread (cheap participation in the rebound)

You think Bitcoin has been oversold and expect to rebound by 10-20% but don’t want to take too much risk by buying call options. So, bull market bullish spreads are a budget-friendly option.

Example:

- Buy a call option for $85,000 at $7,200 (expiration date: March 28).

- Sell a call option for $90,000 at a price of $4,000 (expiration date: March 28).

- Net cost: $3,200.

Why it works:

If Bitcoin rises to $90,000:

The large profit was US$1,800 (US$5,000 spread-US$3,200 cost). This is equivalent to a return of more than 50%!

If Bitcoin remains below $85,000:

You lost $3,200. But that’s much smaller than buying a bare option alone for $7,200.

The break-even point was $88,200-up 4.8%.

Summary: This is a strategy designed for cautious optimists. You don’t expect Bitcoin to rise significantly, you just expect a small rebound. Less risk and better sleep.

4. If you are completely uncertain about the direction of Bitcoin (but expect large fluctuations)… Practice: Long-term straddle options (profit from chaos)

After a sell-off, Bitcoin may rebound sharply or continue to fall. If you are ready to gamble on volatility, buying both call and put options is an option.

Example:

- Bitcoin price: US$89,000

- Buy $88,000 call options and $88,000 put options (expiration date: March 28) for a total fee of $9,000.

Why it works:

If Bitcoin explodes to $100,000:

The call option made a profit of US$11,000 and earned a net profit of US$2,000 after deducting an option fee of US$9,000.

If Bitcoin drops to $70,000:

Put options made a profit of US$19,000, with a net profit of US$10,000 after deducting options fees of US$9,000.

Breakeven point: Bitcoin needs to fluctuate by more than 10%. This is very likely after the sell-off.

Summary: This is a strategy of “I don’t care about direction, only fluctuations”. Is the risk high? Yes. Is the return great? Absolutely big-if you guess right.

5. If you think the sell-off has been overreacted… Practice: Sell the bearish spread (bet on stability)

You think panic caused this sell-off and Bitcoin will stabilize or rebound. Sell put spreads, earn options fees, and identify risks.

Example:

- Sell $85,000 put options with an option fee of $2,500 (expiration date: March 28).

- Buy a $80,000 put option with an option fee of $1,500 (expiration date: March 28).

- Net income: US$1,000.

Why it works:

If Bitcoin remains above $85,000:

You retain the $1,000 option fee. This is a 100% gain.

If Bitcoin drops to $80,000:

You lose $5,000 ($85,000-$80,000), but you retain $1,000 in option fees, so the maximum loss is $4,000.

Summary:

This is a “smart contrarian” strategy. You earn the option premium by betting that the panic is only temporary. Just have cash ready in case you are forced to buy Bitcoin for $85,000.

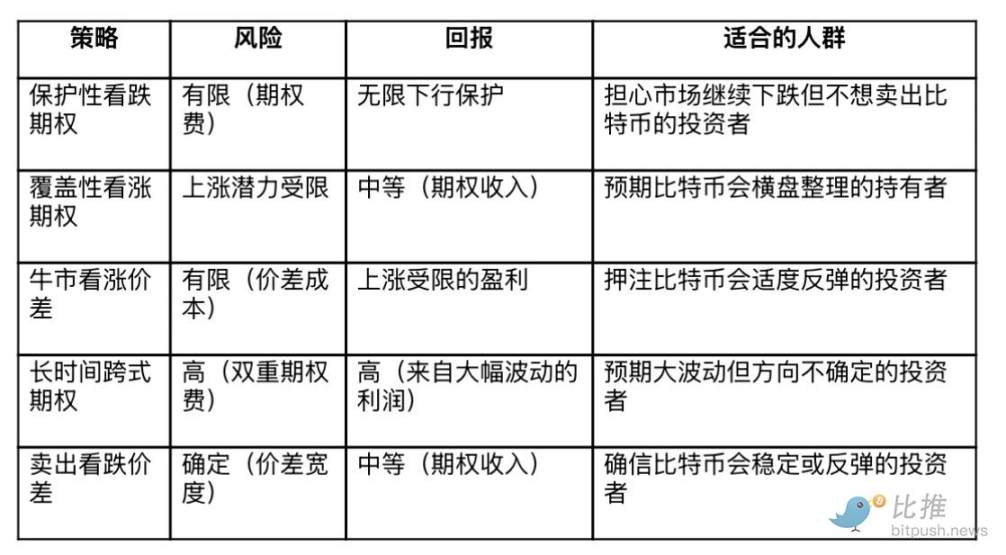

Summary: Overview of options strategies after bitcoin sell-off

After a massive sell-off in Bitcoin, your trading decisions should be consistent with your expectations for future market movements. Here is a quick summary of the option strategies we mentioned, including their risk/reward profiles and application scenarios:

Final summary:

After a sell-off, emotions are high, but smart traders are able to turn uncertainty into opportunities. The key is to evaluate your risk tolerance, market outlook and time frame, and then choose the right option strategy. Here’s how to think:

- If you are worried about falling again, buy protective put options.

- If you think Bitcoin will move sideways, sell the coverage call option.

- If you expect a rebound, choose a bull market call spread.

- If you expect large fluctuations, choose long-term straddle options.

- If you think the market is overreacting, sell the bearish spread.

No strategy is foolproof, so always manage risks and positions. If you are unsure, start small, hedge well, and let the market verify your judgment.