Original title: “Bitcoin Miners ‘Life and Death Line: Transaction fees plummet and costs soared. Where will we go in the future?”

Original author: Alvis, MarsBit

If Bitcoin does not have new ecological hotspots now, it will really be “finished”. The survival pressure of miners has reached its limit. Transaction fees have plummeted and costs have soared. Many small miners have already considered shutting down. Once miners start to quit, computing power will decrease, block generation will slow down, and the security of the network will also be threatened. In addition, with unstable prices, if there are no new ecological developments to drive demand growth, Bitcoin will fall into an endless cycle.

Shrinkage in revenue: Miners ‘profits face multiple squeezing

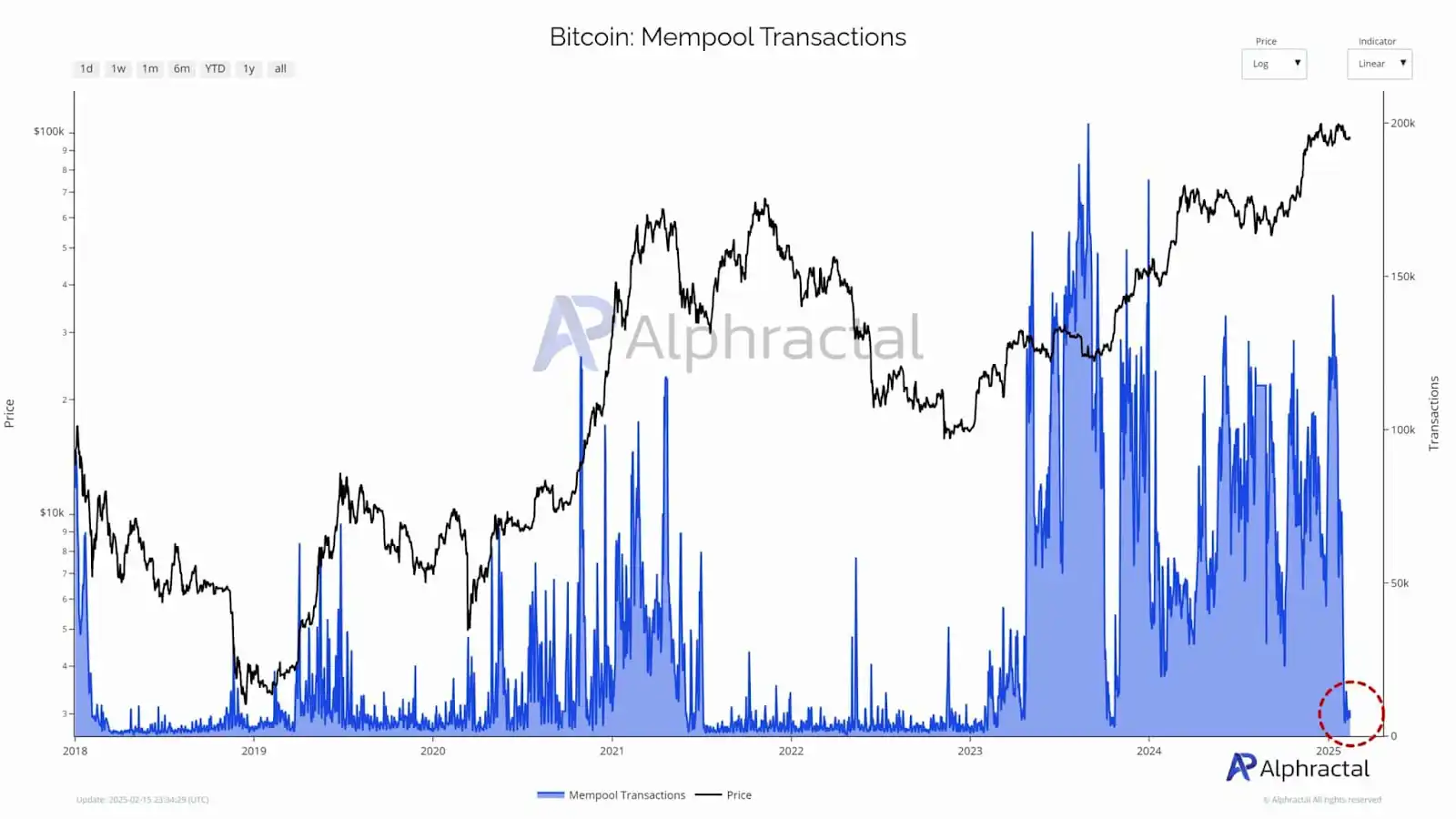

The profitability of Bitcoin mining has deteriorated significantly, with multiple key indicators indicating that profitability is weakening. First, the Bitcoin memory pool with unconfirmed transactions fell to a multi-year low, indicating weakening network demand and directly affecting miners ‘transaction fee income. Historically, reduced trading activity has often led to bear markets, which may not necessarily mean a fall in prices, but may imply a structural change in the network.

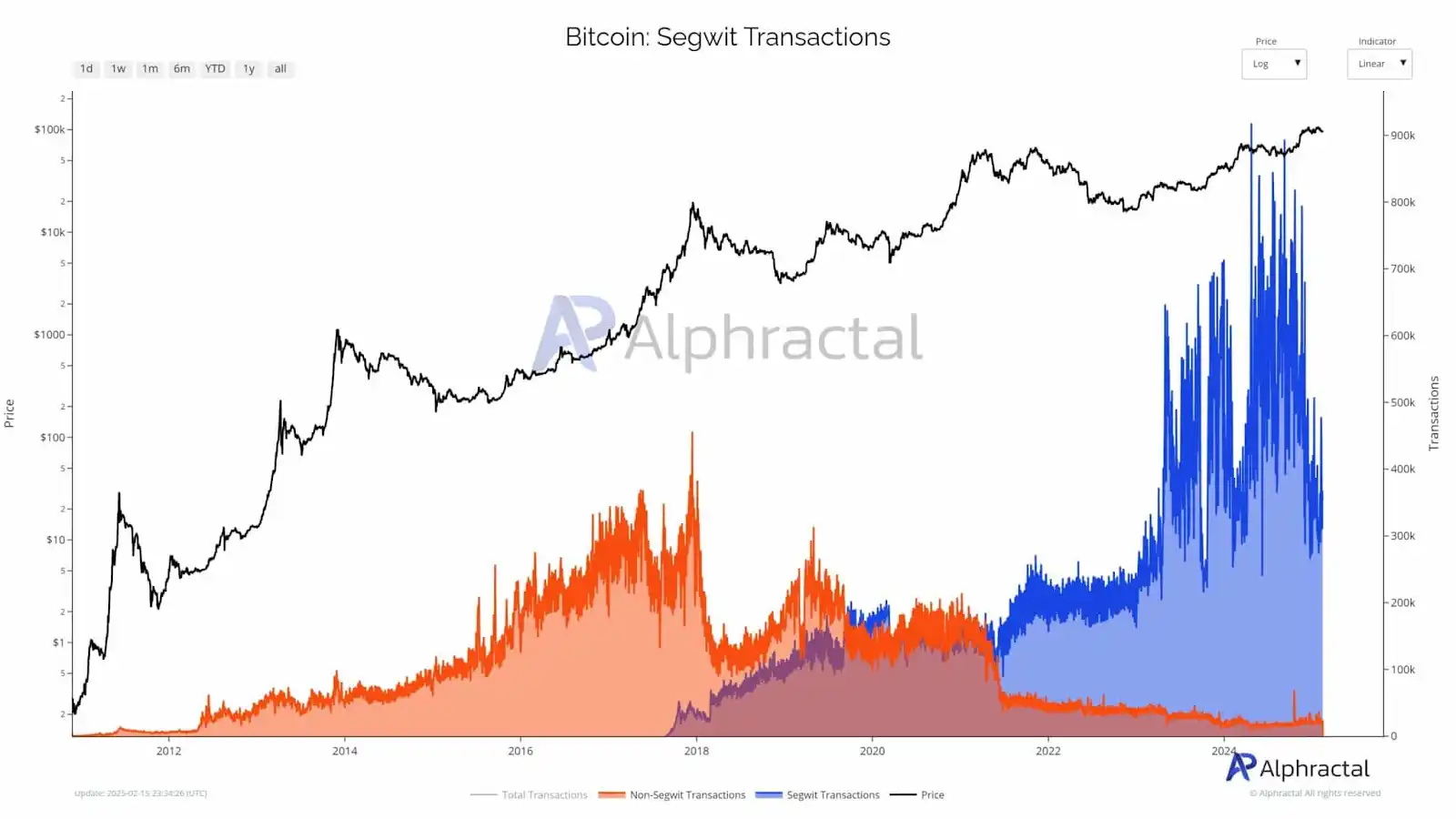

In addition, the gradual decline of SegWit transaction types has reduced network efficiency, further increased block space demand, and further compressed miners ‘income space. Despite the rise in Bitcoin prices, the trend of declining earnings highlights the impact of increased Internet difficulty and increased competition.

Industry consolidation accelerates: Small miners face exit risks

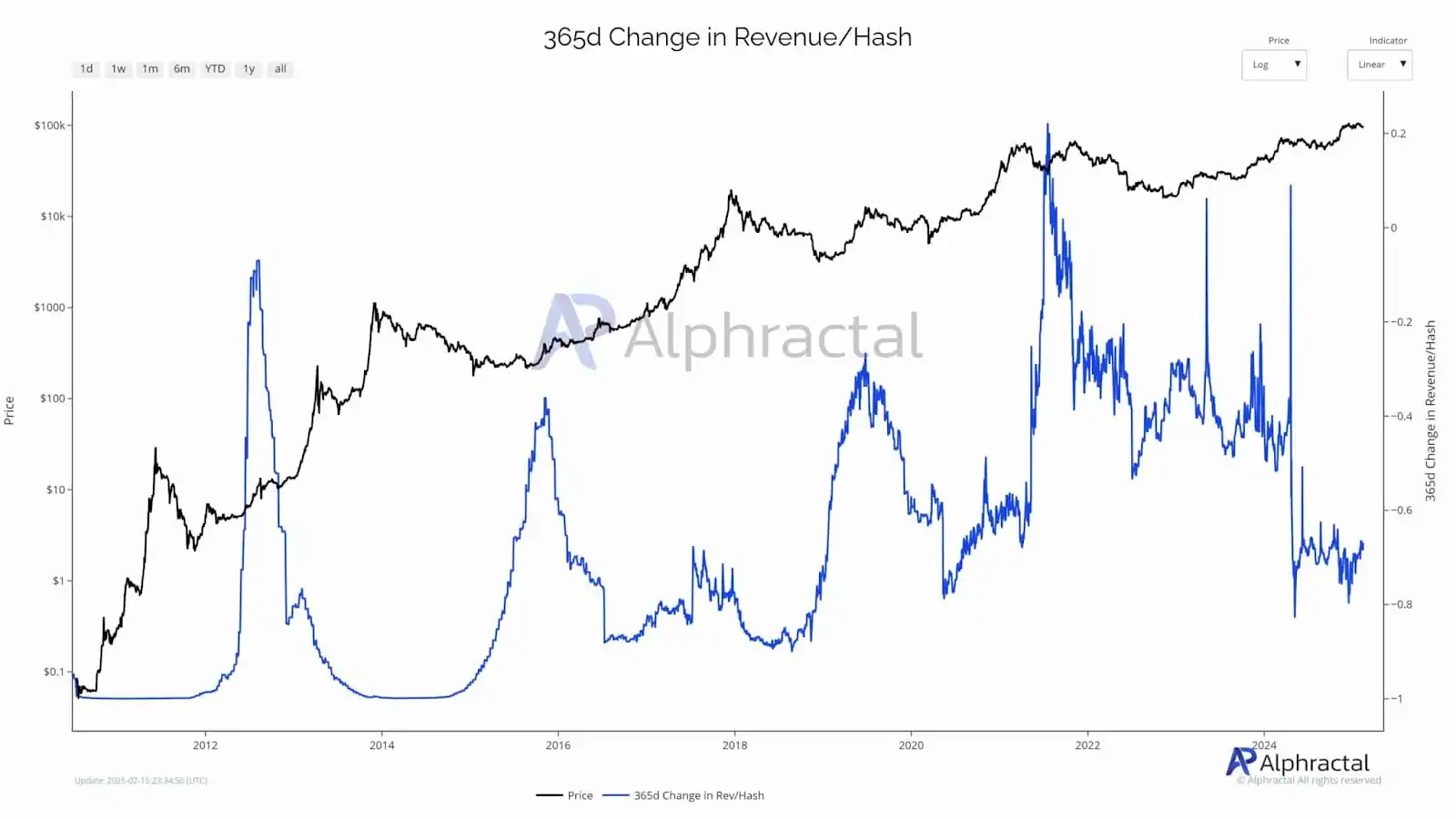

Income/hash rate, a key indicator for miners, is at historically low levels, and diminishing returns suggest that increased network difficulty and increased competition are eroding profitability.

As block rewards are halved, it is particularly stressful for small miners to survive. Declining profitability and reduced transaction fee income have put small businesses at risk of exiting the market, and industry integration has accelerated. In the future, only large miners with strong capital and advanced technology will be able to maintain competitiveness, resulting in increased market concentration.

Internet becomes more difficult: rising costs force miners to find a way to survive

The difficulty of the Bitcoin network has reached a new high, and miners are facing greater cost pressure. As energy and hardware costs rise, especially for small miners with outdated equipment, the pressure to survive increases. Some miners are turning to low-cost, sustainable energy sources such as hydropower or geothermal power, while some are seeking breakthroughs through diversification of revenue sources or mergers and acquisitions.

This trend may accelerate the concentration of the industry, with the most capitalized and efficient miners dominating, thus having an impact on the decentralized nature of Bitcoin. In the future, the geographical distribution of miners and mining security models may change, leading to concerns about cybersecurity.

Market rebalancing: industry thresholds have increased

As operating costs continue to rise, inefficient miners will be eliminated and the industry will undergo a natural “rebalancing.” This change may intensify the concentration of the industry, with only large miners able to survive fierce competition, further consolidating the nature of Bitcoin mining as a high-threshold industry.

However, market concentration has also raised doubts about the decentralization spirit of Bitcoin. The decrease in leading miners may lead to the concentration of network security in the hands of a few miners, which in turn affects the long-term stability and ability to resist censorship of the network.

Impact on Bitcoin

In the short term, bitcoin miners are facing dual pressures of falling transaction fees and rising costs, which may cause small miners to withdraw from the market, which in turn will lead to a decline in network computing power and a tight supply of bitcoin. The compression of miners ‘income may affect market confidence in Bitcoin, leading to increased price volatility in the short term, and the decentralized nature of the network may be threatened, increasing security risks.

In the long run, with technological innovation and energy cost optimization, miners may restore certain profitability and reduce operating costs, which will help ease profit pressure and stabilize the market. Although there may be downside price risks in the short term, as demand continues to grow and supply tightens, Bitcoin prices are likely to show an upward trend in the long term, especially as market demand for Bitcoin steadily rises.

Currently, Bitcoin urgently needs a new ecosystem. Obviously, it is not just a speculative transaction of “buy, buy”. It needs to be supported by more application scenarios, smart contracts, decentralized applications, and even a new financial system.

If Bitcoin does not have a strong enough ecological chain, once miners are unable to maintain profits, the operation of the entire network will become difficult, and the market’s trust in Bitcoin will also be shaken. The withdrawal of miners may become a “crisis” in Bitcoin’s prospects, and the prosperity of ecological construction is the key to Bitcoin’s future survival.

Disclaimer: This article does not constitute investment advice. Users should consider whether any opinions, opinions or conclusions contained in this article are consistent with their specific conditions and comply with relevant laws and regulations of the country and region where they are located.

original link