Getting rich is only the first step.

Author:Loopify

Compiled by: Shenchao TechFlow

In the pursuit of wealth, the final result is the most important thing.

A person can make millions of dollars in a short period of time, but the wealth is often lost faster than the wealth is earned.

If you compare these events before and after, you will find that in most cases, the only difference is that the money earned is lost, and these losses are often dozens or even hundreds of times the original net assets. Many people forget to withdraw in time because they are addicted to casino games, and as a result, they continue to gamble all their money.

In another case, when most people make huge gains, the problem can be even more serious. Many people will withdraw large amounts of money, start to overconsume, and fall into so-called lifestyle inflation. This phenomenon is usually reflected in material consumption, especially when their main income comes from casinos (such as speculative markets). They tend to overestimate their future benefits and assume they can use them to maintain a luxurious lifestyle over the long term.

If you are unfamiliar with the concept of lifestyle inflation,It refers to the increase in net assets or income, so does people’s spending on living standards, eventually leading to the transformation of past luxuries into daily necessities.For example, a person with a net worth of US$50,000 in 2023 may spend US$100,000 a year renting a penthouse in Miami in 2024.

I entered the cryptocurrency space through the NFT industry a few months after the Covid crash. If you are not familiar with NFTs, they will be as popular as memocoins in the 2021 cryptocurrency cycle.

Over the next two years, I witnessed two extremes:Some people successfully cashed out and earned eight-figure net profits; while others earned money from holding NFT And they lost 7-8 figure assets, and even now these NFTs are still in their hands.

In a bull market, the market generally rises, and people feel chagrin because others make five times more money, because they only make twice. In a bear market, everyone faces losses of-50%,-75%, or even-99% and is depressed.

These two very different market environments shape your trading habits, holding patterns, and how you view money. This is why people often say that you need to go through 3 market cycles to be truly successful:

-

the first cycle: You may make a lot of money, but lose it back.

-

the second cycle: You will become very cautious, but you will miss many opportunities as a result.

-

the third cycle: You can find a balance between caution and boldness and respond flexibly to market changes.

If you are lucky, two cycles may be enough. But few people succeed in the first bull cycle.

This applies to any portfolio size, especially when you make millions of dollars.

“Holding an investment from $1,000 to $1,000,000 is called poor risk management. rdquo;

In fact, almost 99% of people can hold $1,000 to $1,000,000, but eventually make it fall back from $1,000,000.

When you are successful in casino games, especially high-risk speculative assets like Meme, you may feel there is no need to learn anything else. No matter what stage you think the market is at right now, I’ve seen a lot. Meme players try to apply their skills toleveraged tradingIn the end, he lost all his previous earnings. This also shows that we are closer to the end of the market cycle than the beginning.

Similar to the situation in 2021, many NFT players began to try to switch to trading cryptocurrencies.

That’s not to say you shouldn’t try, because in fact, adapting to market changes is very important. Meme cannot remain popular forever. In fact, in the recent project launches and the brief 24-hour attention paid to these projects, we have seen signs that the memin craze is fading.

However, you need to get into the field slowly and learn and understand the market as much as possible. Treat yourself as a novice rather than trading with a conceited attitude.

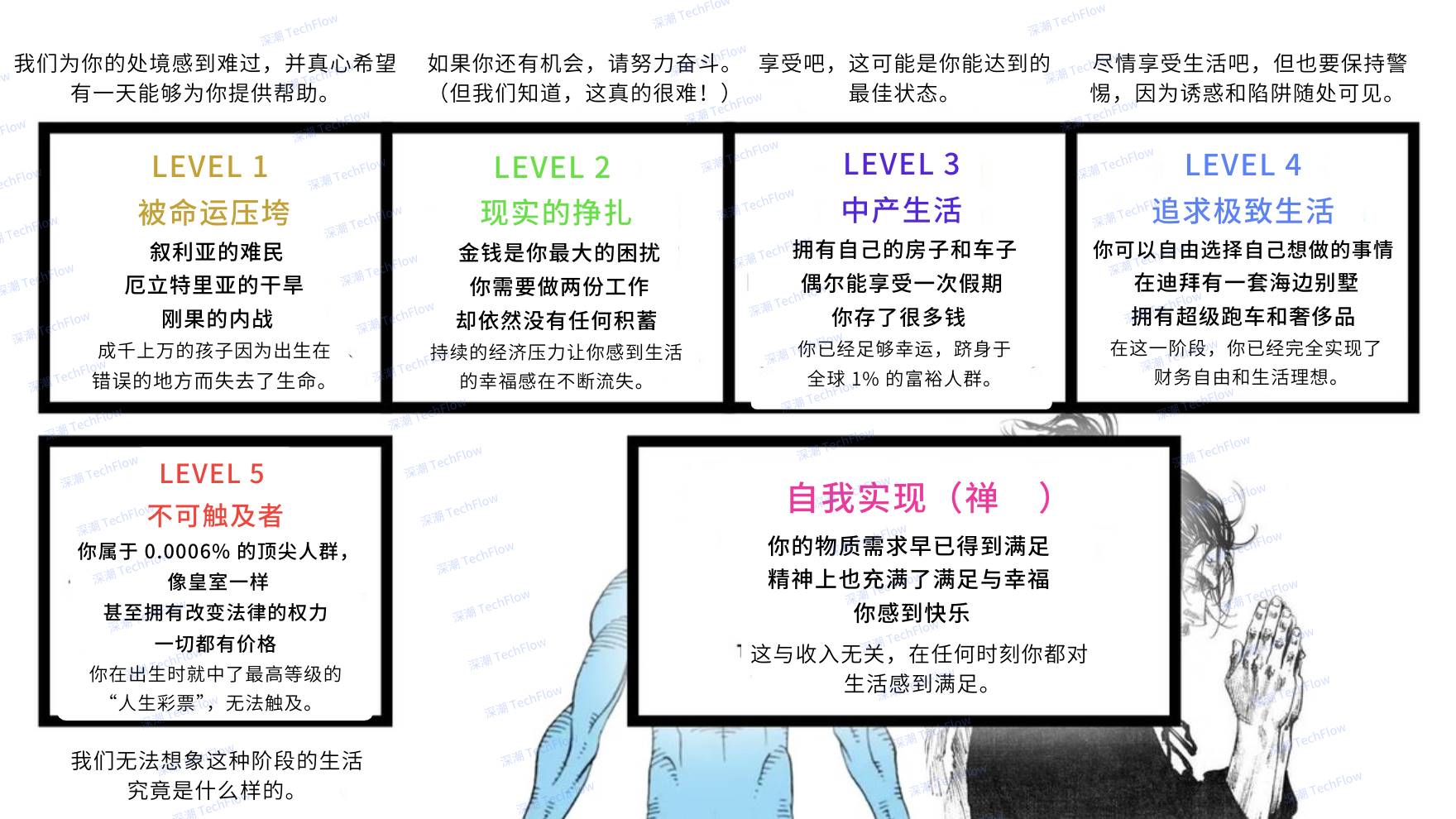

I delve deeper into the concept of hierarchy in this article, which I think is a useful framework for anyone who gets rich accidentally for the first time.

(Original picture comes from Loopify , compiled by Shenzhen TechFlow)

In the process of accumulating wealth, we can divide our lives into different levels. If you feel that the span between levels is too large, you can add a.5 status to it. For example, a 2.5 may mean that you have a stable job and a small savings, but you haven’t yet bought a house. This tiered approach helps you understand your situation more clearly and set goals for improving your quality of life.

When you are still in the casino, whether it’s the cryptocurrency market or other speculative markets, remember to withdraw your chips at any time and use it to improve your life. Every extraction is an upgrade for one’s life.

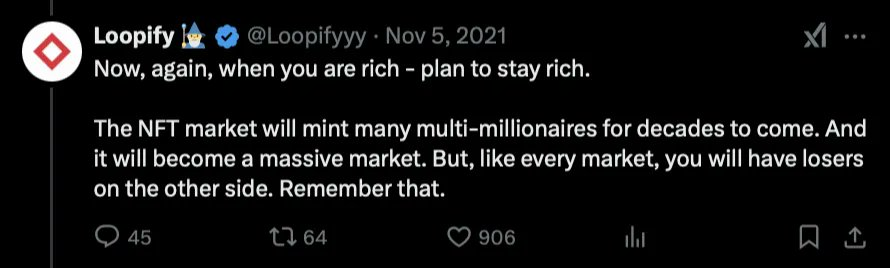

@ Loopifiyy: Remind again that when you have become rich, you must plan how to protect your wealth.

The NFT market will spawn many multi-millionaires in the next few decades, and it will also develop into a huge market. But remember, like any market, there will always be people who lose. Keep this in mind.& rdquo;

This experience comes from a tweet in November 2021, when the cryptocurrency market was at its peak, and the NFT craze lasted for nearly a year.

These experiences do not apply only to cryptocurrencies, but to all areas of wealth accumulation.Getting rich is only the first step, but the more important thing is how to preserve wealth.

How to protect wealth: practical advice

-

Continued profit-taking: Whether the market is up or down, gains should be cashed in regularly.

-

Profits must be turned into real money”: Funds are only real profits when they are deposited in a bank account. Otherwise, you may put your money back into the market, trying to bottom out or buy new hot investments, but the result is often that you can’t save it back after withdrawing cash.

-

Don’t be fooled by peaks: The top of your portfolio is just an illusory number and it is almost impossible to fully achieve it, so don’t make decisions based on that number.

-

Avoid expanding living standards: As your income increases, try to be frugal and don’t let past luxuries become daily necessities.

-

Priority repayment of debt: Whether it’s credit card debt or mortgage, paying them off as soon as possible can significantly improve your financial hierarchy.

-

Distinguish luck and ability: Clarify how much of your income comes from luck and how much comes from real investment ability. If you are not modest enough, the market will teach you a lesson sooner or later.

-

Avoid revenge deals”: Attempting to recover losses through aggressive trading after a loss often leads to greater failure or even a return to zero for the entire portfolio.

Survival is the prerequisite for success, and only by living can you have a chance of success.

“Not trading is also a trading strategy.

You don’t need to participate in every seemingly shining opportunity, nor do you need to feel anxious about other people’s huge profits and losses.

There is a situation in the market: Even if Bitcoin (BTC) rises to $1 million, many people are bankrupt before the end of the cycle because they made stupid decisions. Is this the person you want to be? Of course not, no one wants to do that.

So make sure you take your chips with you when you leave the casino to truly add value to your life.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern