The top management is turbulent but the tasks remain unchanged. As the demand for high-end skin care products and cosmetics in the China market declines, Unilever needs to transform its business more effectively to adapt to changing consumer behavior.

Why Unilever dismissed its CEO in a flash

Wen| Current business

He announced his resignation on Tuesday, will step down on Saturday, and will leave the company completely in three months.

On February 25, Unilever’s top leaders were in turmoil: the board of directors reached a joint agreement with CEO Hein Schumacher, who resigned. This was almost a flash recall. Sima Han will step down on March 1, only a year and a half since he officially took office.

Unlike Nestlé, Starbucks, and Nike, which had changed CEOs before, after months of controversial discussions and signs of being perceived by the outside world, Unilever’s actions surprised many people.

At present, sources from Reuters and the Financial Times have disclosed two pieces of information: First, the decision to remove Sima Han was made at a board meeting on Monday. The board unanimously decided to remove Sima Han, including Nelson Peltz, a well-known activist investor who once strongly supported him. Peltz has been an important force in promoting Unilever’s reform in recent years.

Second, Sima Han himself was surprised by the board’s decision. After all, Unilever’s share price has performed well since he took office, rising about 10%.

More than 20 years ago, Sima Han worked for Unilever. He was hired as CEO of Royal Dutch Friesland. Before Friesland, he had worked for Heinz for more than 10 years, during which time he interacted with activist investor Peltz.

Sima Han first became a non-executive director of Unilever in October 2022; in early 2023, he was announced as a CEO candidate and took over the company in July of that year.

For more than a year, Sima Han acted in a high-profile manner and made drastic adjustments to his strategy to solve the company’s old problems; he formulated a cost-reduction plan, including splitting up the ice cream department, laying off thousands of people, and accelerating the pace of restructuring and asset sales.

Sima Han clarified the reform agenda and incentives, but at the same time, the reorganization brought internal turmoil within the company and many senior executives left. Many things have just begun, such as the long-troubled ice cream business that has not yet gone public, and now the board believes that Chief Financial Officer Fernando Fernandez is the right person to revitalize the company.

Fernandez, a 58-year-old Argentine who has worked for the company for 37 years, was in charge of the beauty and health business before taking over as CFO in early 2024 and is unlikely to be completely ignored in the last round of CEO selection.

In early February, Unilever just predicted that growth in 2025 would be between 3% and 5%. The month-on-month growth in the first quarter slowed down and profit margins in the first half of the year would decline. Even though the company said that growth in the second half of the year would be stronger than that in the first half, it still caused some concerns and the stock price fell.

It may be that this expectation aroused dissatisfaction among shareholders and directors, triggering subsequent high-level turmoil. After the resignation was announced, Sima Han wrote in a farewell letter to employees: I regret to leave Unilever earlier than expected, but I adhere to my work record and way of doing things.(I regret leaving Unilever earlier than anticipated but I stand by my record and approach.)& rdquo;;(The Board of Directors) is eager to accelerate the pace of implementation of our strategy.& rdquo;

in the fog

Unilever has many stories in recent years.

As one of the world’s largest consumer goods companies with a history of more than 100 years, Unilever started with soap and margarine, and at most had more than 400 brands. Dove, Lux, OMO, and Jinfang cover everything from food and health care products to personal care and home care products.

After 2015, Unilever’s aging brand and business slowdown have plagued Unilever. The company’s revenue has shown a downward trend and it has attempted business transformation several times; for example, selling mature businesses and purchasing smaller growth companies, but investors are worried that Unilever has lost its way.

Alan Jope, the former CEO who took office in early 2019, valued health and personal caretation-related products rather than mass foods such as mayonnaise and tea bags that the company used to be good at. He wanted the product portfolio to move towards higher profit margins, hoping to shape the company into a strong supplier of beauty and personal care products.

Simply put, even if people compared Unilever with Nestlé, Kraft Heinz, and P & G in the past, in Qiao Anlu’s plans, it may be compared with companies such as L’Oréal.

In 2021, as raw material costs soar, management is under pressure, saying it faces the most severe inflationary pressure in 10 years.& rdquo; In the first half of the year, the company’s operating profit margin dropped by 100 basis points to 18.8%; in the first half of 2022, the operating profit margin further dropped to 17%, which was further away from the management’s expectation of 20%.

At that time, management was careful to maintain multiple balances: one was the balance between price increases and consumer acceptance; the other was the balance of product mix, with mature but low-profit foods balanced with newly developed but high-profit health nutrition and personal care products; the third was the balance between profit and ESG (Environmental, Social and Governance), and investors blamed the company for missing development and profits.

Earlier CEO Paul Polman was passionate about ESG and proposed a mission statement to make sustainable living common. He had a good vision but was under great financial pressure.

2021-2022 In 2000, Unilever was busy and panicked: it made poor acquisitions of GlaxoSmithKline and Pfizer’s consumer health division, and failed bids and the ensuing stock price decline exposed the company to risk. In May 2022, activist investor Peltz joined the board of directors. At that time, analysts predicted that it would be difficult for Qiao Anlu to start a second term, even though he had worked for Unilever for 36 years.

Peltz has worked with too many large companies, a considerable number of which are well-known consumer goods giants. Heng, Cadbury, Kraft, DuPont, Monz, Pepsi and his team are capable and experienced. It is a bit too much to say that it makes executives feel scared, but it will definitely cheer them up.

In this case, Sima Han made his appearance.

drastic

Simahan was recognized by Peltz, whose hedge fund held approximately 1.5% of Unilever and was the fourth largest shareholder.

“The first time I met Hein was when I was a director of Heinz Corporation from 2006 to 2013. I was deeply impressed by his leadership skills and business acumen. rdquo;

After Sima Han took over the company, he focused on Unilever’s 30 largest brands because they provided 3/4 of its revenue and outperformed small brands. He also spun off the underperforming ice cream business and laid off a large number of jobs.

“I believe in less, bigger, better… This is the goal we have chosen to implement.& rdquo;

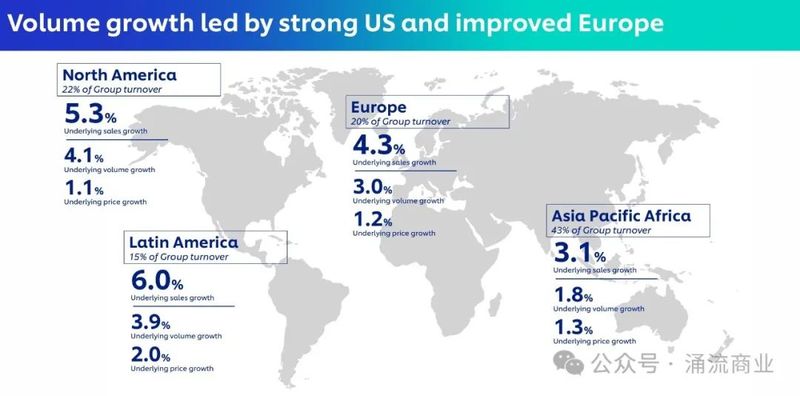

Unilever has unveiled a series of new strategic priorities, including focusing investment on the best-performing emerging markets such as India, Indonesia and Brazil, accelerating the growth of its high-end brands in the United States, and pushing its high-margin beauty and health business internationally. Unilever also sold four factories in Russia.

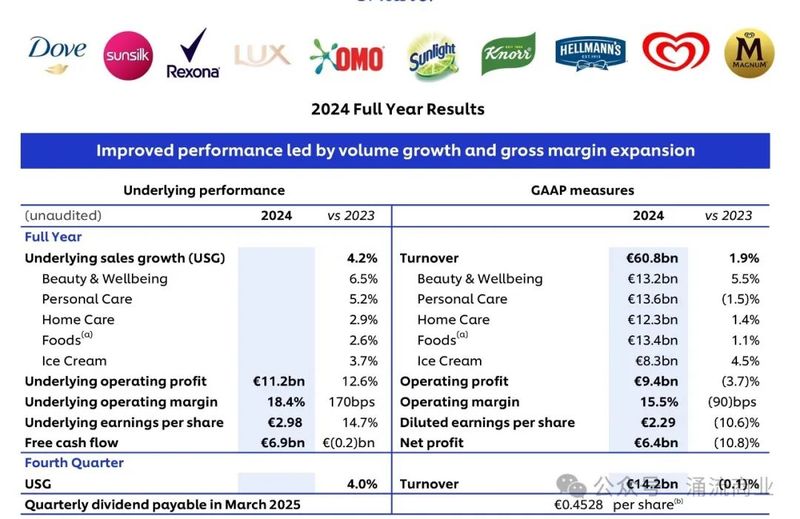

Unilever reiterated its medium-term goals of achieving mid-single-digit sales growth and a 2% sales growth; the company expects to save € 800 million in costs by the end of 2025.

Sima Han is trimming assets, including disposing of previously purchased brands, such as Dollar Shave Club, which Unilever acquired for $1 billion in 2016.

Over the past years, Unilever has been an industry role model in sustainable development, caring about biodegradable ingredients, deforestation, and the living expenses of cocoa growers. Sima Han is not obsessed with this and has scaled back some ESG goals. Even under some external pressure, investors welcome this cost awareness.

In the first half of 2024, Unilever’s performance improved, with revenue increasing by 2%, pre-tax profit increasing by 6%, and operating profit soaring by 17%. For the full year of 2024, revenue will increase by 1.9% to 60.8 billion euros, and underlying operating profit margin will increase by 170 basis points to 18.4%, which is still far from the 20% target.

In this performance, China did not add color to emerging markets. Emerging markets accounted for 58% of Unilever’s revenue, and underlying sales increased by 4.1%, but China market performance fell by the middle single digits, with all categories of markets weakening except food.

In August 2024, Sima Han brought Chen Ge, former subordinate and president of Friesland China, to Unilever. He was responsible for accelerating the high-end investment portfolio and transforming marketing methods against the background of weak market to effectively serve e-commerce channels and small stores in second-and third-tier cities.

The top management is turbulent but the tasks remain unchanged. As the demand for high-end skin care products and cosmetics in the China market declines, Unilever needs to transform its business more effectively to adapt to changing consumer behavior.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.