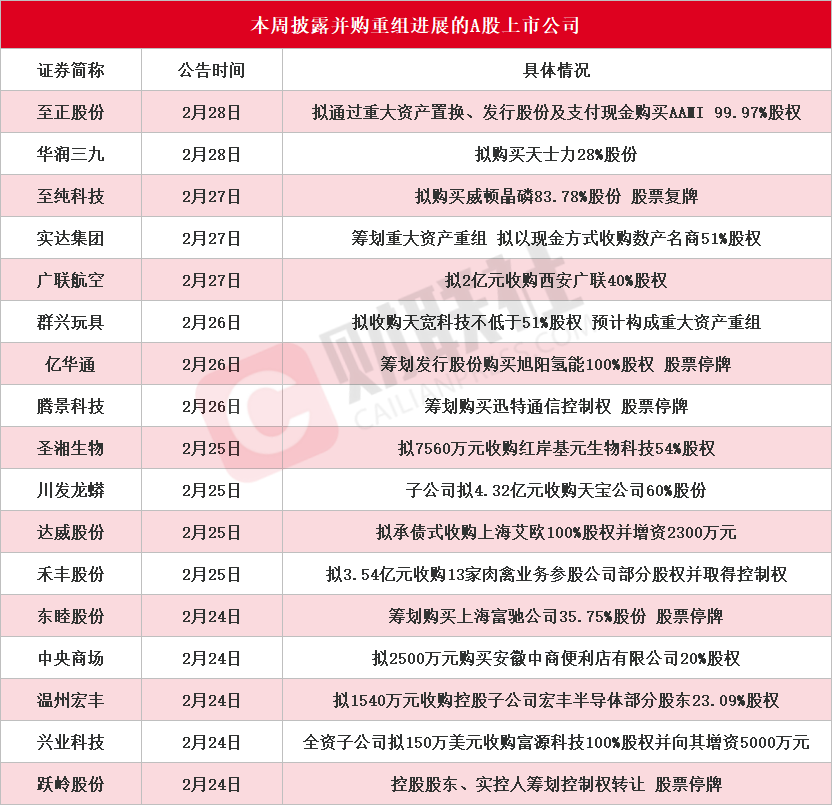

① According to incomplete statistics, as of press time, a total of 17 A-share listed companies have disclosed the progress of mergers and acquisitions this week (attached table);

② In terms of the secondary market, after the disclosure of the merger and acquisition assets announcement, Qunxing Toys closed on Friday with 3 boards in 5 days, and Shida Group and Zhichun Technology had daily limits.

Cailian News, March 1 (Editor’s Square)The A-share mergers and acquisitions craze continues. On the news front, the China Securities Regulatory Commission issued a reply to Recommendation No. 3472 of the Second Session of the 14th National People’s Congress. Next,We will continue to deepen the market-oriented reform of mergers and acquisitions, and take multiple measures to activate the M & A market, implement the “green channel” for mergers and acquisitions of technology-based enterprises that break through key core technologies,Promote absorption and merger among listed companies with high-quality leading companies as the “main force”。In addition, the relevant person in charge of the Shanghai Stock Exchange said at the exchange symposium on mergers and acquisitions of listed companies in Shanghai thatPriority should be given to supporting mergers and acquisitions of technology-based enterprises that carry out key core technology research, increase efforts to cultivate and strengthen leading scientific and technological enterprises and leading chain-oriented enterprises; continue to improve the market ecology,Actively create a market environment conducive to mergers and acquisitions。

According to incomplete statistics from the Financial Union, as of press time,A total of 17 A-share listed companies disclosed the progress of mergers and acquisitions this week, respectivelyZhizheng Shares, China Resources Sanjiu, Zhichun Technology, Shida Group, Guanglian Airlines, Qunxing Toys, Yihuatong, Tengjing Technology, Shengxiang Biological, Chuanfa Dragon Python, Dawei Shares, Hefeng Shares, Dongmu Shares, Central Shopping Mall, Wenzhou Hongfeng, Xingye Technology and Yueling Shares, the specific situation is as follows:

Mainly engaged in alcohol sales business, owned property leasing, property management and entrepreneurial park operation services businessqunxing toysIt was announced on February 26 that the company signed the “Equity Acquisition Framework Agreement” with shareholders of Tiankuan Technology.It is planned to acquire no less than 51% equity of Tiankuan Technology in cash。After the transaction is completed, Tiankuan Technology will become a controlling subsidiary of the company.This transaction is expected to constitute a major asset reorganization, but does not constitute a connected transaction.Tiankuan Technology’s main business is the construction and operation of artificial intelligence computing centersProvide industry customers with digital transformation service solutions, and provide customers with digital and intelligent products integrating end-cloud. Following the announcement,Qunxing Toys won two consecutive one-word boards, recording 3 boards in 5 days as of Friday’s close。

Mainly engaged in big data business, Internet of Things perimeter security businessShida groupIt was announced on February 27 that the company’s indirect controlling shareholder, Fujian Province Big Data Group Co., Ltd., plans to inject 51% of the equity of Fujian Digital Industry Mingshang Technology Co., Ltd. held by its subsidiary Fujian Big Data Industry Investment Co., Ltd. into Shida Group.The company plans to acquire 51% of the equity of famous digital merchants in cash, the main source of funds is self-owned or self-raised funds. The day after the announcement,Shida Group’s share price rose daily。

Domestic mainstream qualified suppliers in the field of high-purity process systems and semiconductor equipmentZhichun TechnologyIt was announced on February 27 that the company plans to purchase shares held by 24 counterparties including Beijing Witton International Trading Co., Ltd. by issuing shares and paying cash.83.78% shares of Witton Crystal PhosphorusAnd raise matching funds. After the completion of this transaction, Witton Crystal Phosphorus will become a holding subsidiary of the company. Trading in the company’s shares will resume on February 28 when the market opens. Witton Crystal Phosphorus is a company mainly engaged in the research and development, production and sales of high-purity electronic materials in the pan-semiconductor fields such as integrated circuits and photovoltaicsNational specialized and innovative “little giant” enterprise, this acquisition will help promote the company’s introductionHigh-purity electronic materials business in the pan-semiconductor field, further improve the company’s business landscape. The day after the announcement,Zhichun Technology’s share price rose to a daily limit。

Also,Trading was suspended this week after disclosing the progress of mergers and acquisitionsListed companies includeYihuatong, Tengjing Technology, Dongmu Shares, Yueling Shares。Tengjing Technology announced on February 26 that the company is planning to purchase control of Xunte Communications by issuing shares and paying cash.This transaction is expected to constitute a major asset reorganization, it is expected that some counterparties will hold more than 5% of the shares of the listed company. Xunte Communications ‘general business projects include communication equipment and accessories,Chips, optical modules, optoelectronic devices, optoelectronic products, communication power supply, power supply modules, optical cable components, etc. The company’s shares will be suspended from February 27, and the suspension period is expected to not exceed 5 trading days. Yihuatong, a pioneer in China’s hydrogen energy industry, announced on February 26 that the company is planning to issue sharesPurchase 100% equity interest in Dingzhou Xuyang Hydrogen Energy Co., Ltd.and assets and raise matching funds at the same time. The company’s shares have been suspended since the market opened on February 27, and the suspension period is expected to not exceed 5 trading days.

Tiaoyuling Co., Ltd., one of the key domestic automobile aluminum alloy wheel export companies, announced on February 24 that the company’s controlling shareholder and actual controller are planning the transfer of control of the company.It is expected that the equity ratio involved in this transfer will not exceed 24.57%, the counterparty is a private enterprise, and its controlling shareholder belongs to the organizational management service industry. The company’s shares were suspended from the market opening on February 25. Dongmu Co., Ltd., one of the largest manufacturers of powder metallurgy machinery parts in China, announced on February 24 that the company is planning to issue shares and pay cashPurchase 35.75% shares of Shanghai Fuchi CompanyAt the same time, it plans to issue shares to raise matching funds. The company’s shares will be suspended from February 25, and the suspension period is expected to not exceed 10 trading days.