Author: David Grider, Partner at FinalityCap

Compiled by: zhouzhou, BlockBeats

Editor’s note:This article discusses the proposal on Solana pledge reward adjustment. The arguments in the proposal are problematic, especially the impact of high pledge rewards on DeFi earnings and inflation on selling pressure. David refuted that there is a close relationship between pledge income and network security and market demand, and pledge returns should be determined by the market.

The following is the original content (the original content has been compiled for ease of reading and understanding):

I am very concerned about Solana’s proposed inflation-reduction measure SIMD-0228, especially the current version proposed by Tushar Jain and Kankanivishal from multicoincap and MaxResnick1, especially if some key risks and issues are not addressed.

After listening to the latest solana validator conference call, I think the arguments for implementing this change are deeply flawed.

Here is my summary of the arguments raised, and I will refute them one by one in the next tweet:

1: High pledge reward rate is not good for DeFi’s revenue

2: Inflation increases selling pressure and should be compared with network costs

3: High pledge rewards reduce demand for ETFs

4: Pledge returns are not as consistent with U.S. tax optimizations as capital gains

5: Higher pledge income will not lead to higher prices

6: The pledge formula will optimize the pledge ratio, thus solving the security issue (in my opinion, this is the most important security risk and the wrong approach)

Argument 1: High pledge rates are bad for DeFi’s earnings.

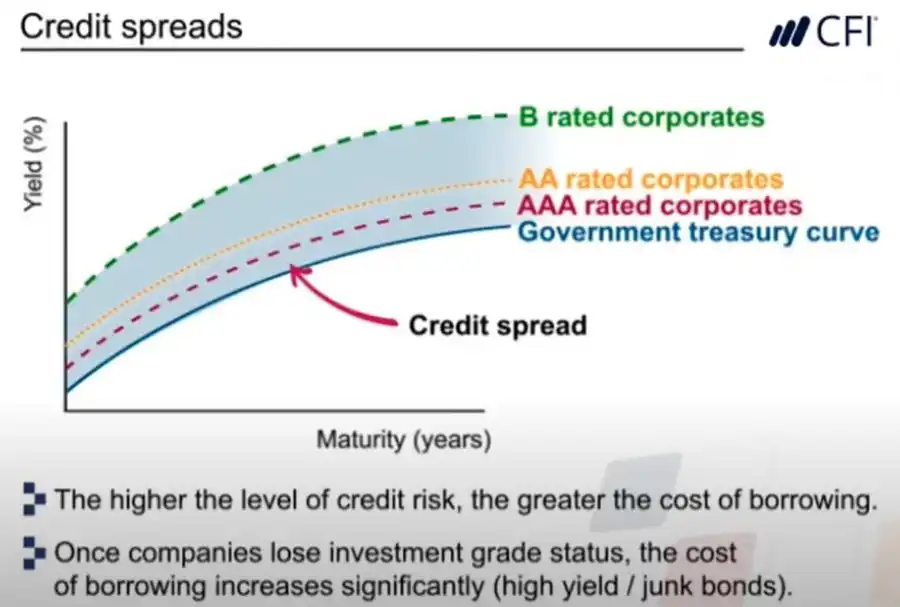

Rebuttal 1: The SOL pledge is Solana’s risk-free interest rate. Just as higher risk-free rates on government bonds cause interest rates to rise on the credit curve, higher pledge yields will drive up DeFi rates and profits.

Argument 2: Inflation increases selling pressure, which should be compared with costs.

Rebuttal 2: This does not hold true, just as unlocking does not necessarily bring selling pressure, whether to sell depends on the holder’s choice. The verifier can choose to re-deposit the pledge. Inflation has a smaller impact on liquidity than other supply factors. Rather than comparing selling pressure with costs, compare it with capital flows. You can look at Solana ETP’s capital flow as a measurable indicator, but the demand from funds and individuals is greater and more important.

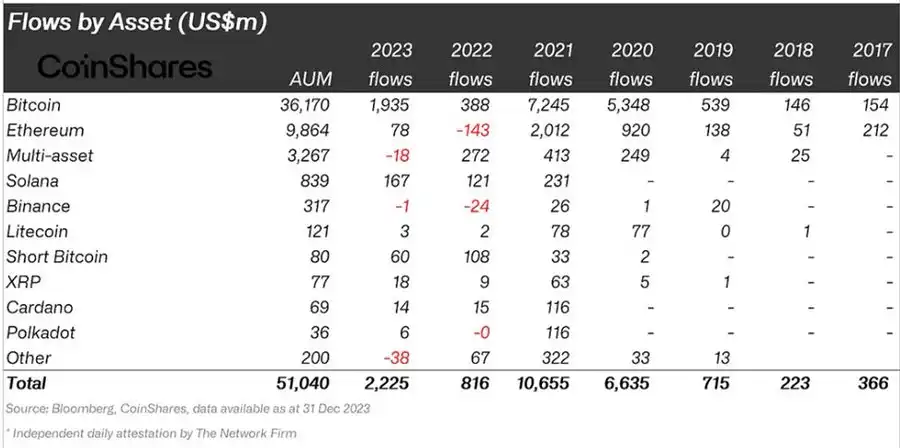

Argument 3: High pledge rewards reduce demand for ETFs.

Rebuttal 3: Just because someone uses this argument to explain weak ETH ETF demand doesn’t mean it applies to Solana. Looking at many European SOL ETPs, which take away the entire pledge proceeds and charge no fees, these products have attracted considerable capital inflows (see above). Moreover, ETFs in the United States are close to allowing pledges, so this argument does not hold true in the long run.

Argument 4: Pledge returns are not tax-optimized like capital gains.

Rebuttal 4: Solana is a global decentralized network. We should not optimize it just for the sake of U.S. tax policies, because tax policies can change at any time. This is like equity investors ignoring the impact of tax changes on stock valuations.

Argument 5: Higher pledge returns will not lead to higher prices.

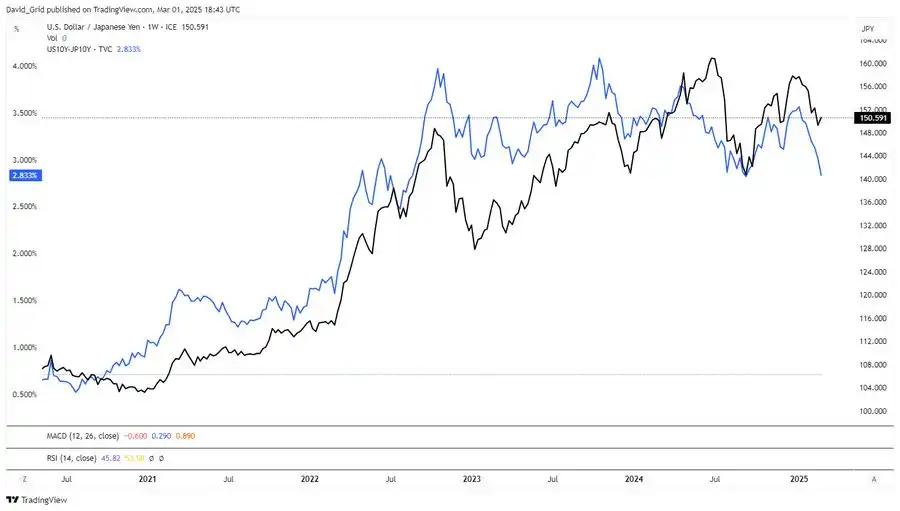

Rebuttal 5: The real world proves that this is not true. Just look at the pricing method of conventional currencies. The appreciation of one foreign exchange currency relative to another is usually based on interest rate differences. Relatively higher interest rates lead to a stronger currency. Here is an example chart of the spread between the U.S. dollar/yen and the U.S. 10-year Treasuries and Japanese 10-year Treasuries.

Argument 6: The pledge formula will optimize the pledge ratio to solve the security issue.

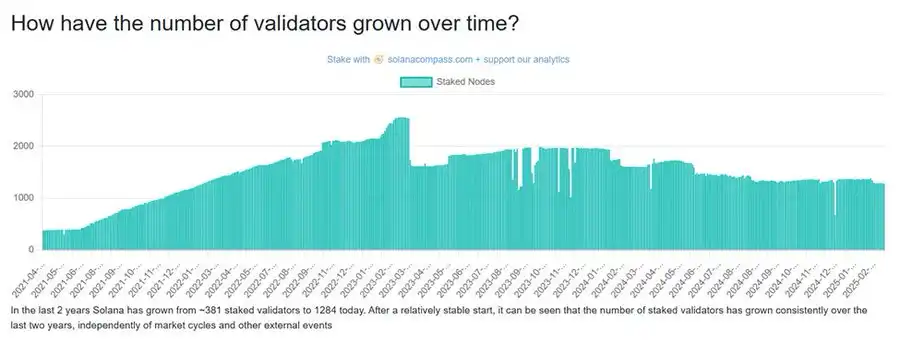

Rebuttal 6: It also needs to optimize the number of validators and pledge distribution. Running Solana verifiers is expensive, and the number of verifiers is already declining.

Rebuttal 6 (continued): The analysis that must be carried out in order to pass this proposal safely, but what I have not seen yet is:

Simulate how much of the currently active small validators will become unprofitable and exit under the new proposal. The analysis needs to be conducted under different network activity and SOL price assumptions, especially in a bear market scenario, taking into account the 80% decline in MEV, base fees and prices. Then check the list of current Solana validators to see how many current validators will become unprofitable and exit under these scenarios.

We can discuss how many validators Solana needs. It may not be artificially inflated to 100,000 like ETH, but we also don’t want Solana to become a Cosmos chain with only 100 validators.

And, because supporters have raised the U.S. tax argument to promote the proposal, we don’t know what the SEC’s decentralized testing criteria are, so we may want to keep the number of validators above 1000 so that SOL remains a commodity.

All in all, this proposal should not be passed unless someone at least completes the analysis.

The proposal does ask the right question: How much inflation is needed? But before we can make changes, we have other questions that need to be answered. I do agree that the number may be lower and should be more dynamic. Just as companies don’t need to pay a fixed amount to suppliers or provide a fixed return to financiers, the market should determine this number, so I support this direction. We just need to slow down and do more to understand the impact.

This may actually be a high-level solution to this risk.

My sincere advice is that we should not assume and generalize its impact. Data analysis should be performed to present all assumptions and data.

“Original link”