Asian markets have shown huge growth potential in the Bitcoin lending space.

Author: Tiger Research Reports

Compiled by: Shenchao TechFlow

abstract

-

Bitcoin mortgages provide users with a way to obtain funds without selling cryptocurrency, and innovations in this area by companies such as Vifield and Coinbase have led the industry.

-

Although this model has obvious advantages, it still faces major challenges such as high volatility of cryptocurrencies, mandatory clearing and regulatory uncertainty.

-

Asian markets have shown huge growth potential in the Bitcoin lending space, but the key to success lies in clear policies and regulations, widespread adoption by institutions and effective risk management.

1. introduction

Bitcoin mortgages are an emerging financial instrument that allows cryptocurrency holders to obtain funds without selling their assets. This model is gradually becoming popular, and professional organizations such as Vifield in Australia and Coinbase in the United States have launched related services.

Through this kind of loan, users can use Bitcoin as collateral while retaining the opportunity for its potential appreciation. With the popularity of digital assets, Bitcoin mortgages are becoming a powerful supplement to traditional financing.

However, this loan model is also accompanied by high risks. Unlike traditional collateral such as real estate, bitcoin prices fluctuate sharply, which can lead to forced liquidation of loans and cause losses to borrowers.

In addition, the regulatory environment for cryptocurrency lending is not yet clear. Governments and financial institutions are still exploring how to integrate such services into existing financial systems. Therefore, both lenders and borrowers need to move forward cautiously in this market full of opportunities and challenges.

This report will analyze classic cases of Bitcoin mortgages, explore their potential in Asian markets, and assess related risks and regulatory issues.

2. Case study from the West: Coinbase and Vifield’s crypto lending models

2.1 Vield: Integrating Bitcoin lending into traditional finance

Vifield’s CEO Johnny Phan led the $35 million cryptocurrency mortgage business last year. Source: afr.com.

The Australia-based loan company is working hard to establish itself as a crypto-native bank. Vifield offers Bitcoin mortgages and a hybrid loan product that combines digital assets and real estate mortgages, aiming to establish Bitcoin as a legal asset class in the financial system, similar to traditional mortgage securities. Unlike traditional banks that rely mainly on real estate as collateral, Vifield innovatively used Bitcoin and Ethereum as loan guarantees, creating a new asset class.

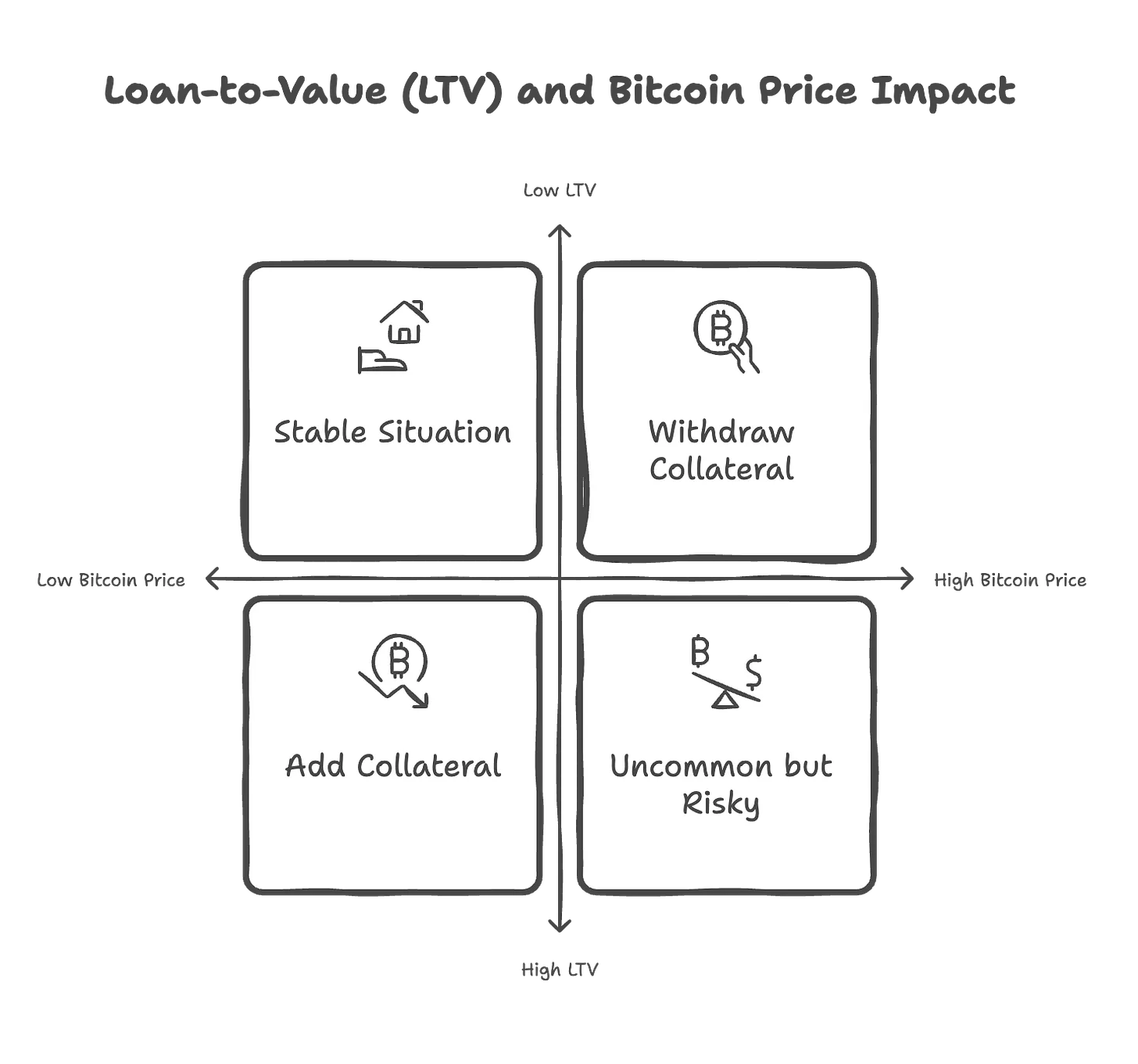

According to Tiger Research, Vifield offers loans ranging from $2,000 to $2 million, with a 12-month term and an annual interest rate of 13%, with a 2% handling fee. For example, for a loan averaging $120,000, the borrower needs to deposit 1.5 bitcoins (approximately $240,000) as collateral. If the price of Bitcoin falls, causing the loan-to-value ratio (LTV) to reach 75%, borrowers must add collateral to maintain the 65% LTV requirement. If the price of Bitcoin rises, borrowers can apply to withdraw some collateral.

To ensure the safety of funds, Vifield stores borrowers ‘collateral in a separate secure digital wallet and does not mix or divert these assets for other purposes. All collateral transactions can be traced via blockchain, further improving the transparency of loans. Currently, Vifield manages approximately $35 million in loans and has not experienced any defaults. This suggests that Bitcoin mortgages have shown real potential in the financial services sector, despite the volatility of the market itself.

However, traditional financial institutions still have doubts about this model. Many institutions refuse to accept cryptocurrencies as collateral, mainly because of their excessive price fluctuations and lack of intrinsic value. Economist Saul Eslake warned that under market pressure, bitcoin mortgages could exacerbate financial instability and force borrowers to undertake costly asset liquidations.

This phenomenon reflects the complexity of integrating cryptocurrencies into the mainstream financial system. Some institutions are beginning to accept digital assets, while others are cautious about them.

2.2 Coinbase: Bitcoin lending driven by DeFi

Source: Tiger Research.

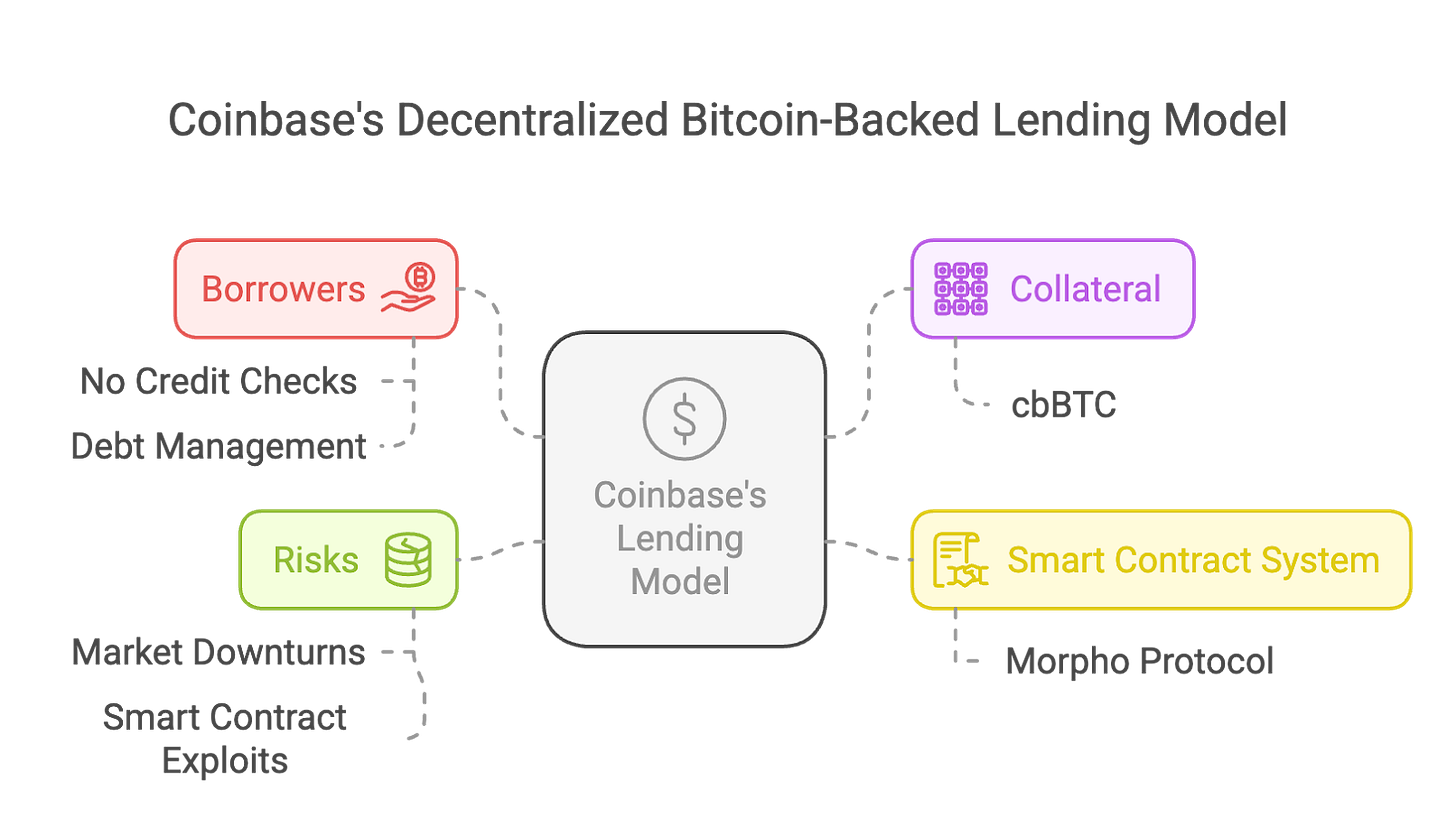

Coinbase has launched a decentralized Bitcoin mortgage service through integration with the Morpho protocol on the Base blockchain. Users can use Bitcoin as collateral to borrow up to $100,000 of USDC stablecoins. This model eliminates the need for credit checks and has no fixed repayment plan. Instead, it uses an enforced loan-to-value ratio (LTV ratio) to determine the amount of borrowing to ensure that collateral always covers outstanding debt.

Coinbase uses Coinbase Wrapped Bitcoin (cbBTC) to implement this model. cbBTC is a form of tokenized Bitcoin hosted in Morpho smart contracts. This design enhances liquidity and decentralization, but also introduces smart contract vulnerabilities and potential risks of attack.

For borrowers, the biggest risk is the automatic liquidation of assets. If the price of Bitcoin falls and the LTV ratio exceeds 86%, the system will automatically liquidate the collateral and impose an additional fine. Although this mechanism protects the interests of lenders, it also exposes borrowers to the risk of passive liquidation during market fluctuations. Unlike traditional loans, Coinbase’s automated clearing model requires borrowers to always pay attention to the value of their collateral to avoid asset losses.

From a regulatory perspective, Coinbase’s decentralized lending model has advantages and disadvantages. On the one hand, using the Morpho agreement improves transaction transparency and reduces counterparty risk; on the other hand, the legal and tax status of cbBTC is not yet clear, which may raise tax compliance issues. Although this model avoids the risk of failure of centralized platforms such as BlockFi and Genesis, it still faces regulatory, security and market stability challenges.

At the same time, concerns about financial stability remain. Economists point out that large-scale adoption of Bitcoin mortgages may pose systemic risks. If the price of Bitcoin suddenly plummet, it could trigger a large-scale liquidation, which in turn triggered a market sell-off. For lenders that rely on private funds, Bitcoin’s high volatility could lead to a liquidity crisis. In addition, regulatory pressure may intensify further as policymakers increase their requirements for investor protection and risk disclosure.

Still, if Bitcoin mortgages continue to develop, it could have a profound impact on traditional loan structures. However, its long-term sustainability will depend on its ability to properly manage risks and achieve compliance within a regulatory framework.

3. Asian market case study: Fintertech

Fintertech is a subsidiary of Daiwa Securities in Japan that focuses on cryptocurrency mortgage services. This is an important case in the field of cryptocurrency lending in Asia. Fintertech allows users to use Bitcoin or Ethereum as collateral to obtain loans in yen or U.S. dollars at an annual interest rate of 4.0% to 8.0%. Borrowers can obtain loans of up to 500 million yen (approximately US$3.3 million) in as soon as 4 working days, providing cryptocurrency holders with a quick and flexible financing option.

In Japan, Bitcoin mortgages are popular because of their tax advantages. According to Japanese tax law, the tax rate on cryptocurrency investment income is as high as 55%. Through Bitcoin mortgages, users can obtain working capital without selling cryptocurrency, thereby effectively reducing tax burdens. Whether it is a company or an individual, it can use this method to meet a variety of financial needs. This suggests that Bitcoin mortgages are an efficient financing tool in markets with higher tax rates.

Despite this, Fintertech’s model faces certain challenges compared with traditional financial products. Cryptocurrency prices fluctuate greatly, posing risks to lending institutions. To ensure the sustainability of the model, institutions need to establish a sound risk management framework and optimize the valuation system for collateral. If other Asian financial institutions can introduce a similar model, Bitcoin mortgages have the potential to become an innovative financial product and build a bridge between traditional finance and digital finance.

4. Advantages of Bitcoin Loan Services in Asia

With the popularity of cryptocurrencies in Asia, bitcoin mortgages are becoming an emerging source of income for financial institutions (FIs). According to forecasts, by 2030, the global cryptocurrency loan market will reach US$45 billion, with a compound annual growth rate (CAGR) of 26.4%. More and more investors and companies hope to obtain working capital in this way without having to sell their bitcoins.

Financial institutions in Singapore and Hong Kong have advantages in this area. This is due to their advanced regulatory frameworks, such as Singapore’s Payment Services Act and Hong Kong’s virtual asset service provider (VASP) licensing system. As of the beginning of 2024, cryptocurrency lending platform Ledn has achieved US$1.16 billion in loan business. This shows that similar services are also expected to achieve significant results in the Asian market.

In addition, traditional banks can attract more customers familiar with cryptocurrencies by working with cryptocurrency exchanges and financial technology companies. This kind of cooperation can not only expand the user base, but also increase revenue by charging loan interest, handling fees, and fiat exchange fees.

5. Key risks and regulatory challenges

The following table summarizes the main risks of Bitcoin mortgages and uses actual cases or hypothetical examples to help more intuitively understand these risks and regulatory challenges.

5.1. Risk factor: Regulatory compliance

The regulatory environment for Bitcoin mortgages varies significantly globally. Different countries have different attitudes towards cryptocurrency loans. For example, Japan has incorporated cryptocurrency lending into its existing financial regulatory framework, while China has completely banned such activities. To prevent illegal activity, companies must comply with anti-money laundering (AML), know your customer (KYC) and virtual asset service providers (VASP) regulations. example: South Korea has introduced stricter anti-money laundering policies due to concerns about the potential risks of cryptocurrency loans. This requires lenders to submit detailed compliance documents and conduct strict due diligence. Some companies were unable to meet these requirements and had to terminate their cryptocurrency lending businesses. This suggests that changes in regulatory policies may directly affect a company’s sustainable operations.

5.2. Risk factors: price fluctuations and liquidation risks

Bitcoin prices fluctuate sharply, posing significant challenges for both lenders and borrowers. When the price of Bitcoin suddenly falls, it may trigger margin calls or mandatory liquidation, putting financial pressure on borrowers. To reduce risk, lenders often require borrowers to provide overcollateralization and protect investments by monitoring the value of collateral in real time. example: A Singapore borrower used Bitcoin as collateral to obtain a US$100,000 loan. However, after the Bitcoin price suddenly fell by 30%, lenders quickly liquidate their Bitcoin collateral to make up for losses, causing borrowers not only to lose collateral, but also to face a huge financial gap. This situation highlights the potential impact of price fluctuations on borrowers.

5.3. Risk factors: asset custody and security

Ensuring the security of Bitcoin collateral is an important challenge facing lenders. Because cryptocurrencies are vulnerable to hacking or fraud, institutions need to adopt professional custody solutions and work with trusted custody service providers to ensure assets are properly protected. example: A decentralized financial (DeFi) lending platform was hacked due to a smart contract vulnerability, resulting in the theft of $50 million in Bitcoin collateral. This incident shows that technical security is a key issue that cannot be ignored in the cryptocurrency lending model.

5.4. Risk factor: Market liquidity

Large-scale Bitcoin loan business relies on high liquidity in the market. However, when markets fluctuate, lenders may be forced to liquidate large amounts of mortgage assets. If market liquidity is insufficient, asset prices will fall rapidly, triggering chain liquidations and even causing a serious impact on the entire market. example: After the FTX crash, Genesis and BlockFi declared bankruptcy because they were unable to cope with plummeting collateral values and massive withdrawal requests. They failed to sell cryptocurrency assets at reasonable prices, causing problems to spread across the industry and causing widespread market chaos. This incident shows that insufficient market liquidity is a major risk that cannot be ignored in the Bitcoin loan model.

6. Conclusion and future outlook

Bitcoin mortgages are a potential financial innovation that provides cryptocurrency holders with a solution to obtain liquidity without selling digital assets. However, this model still faces multiple challenges such as price fluctuations, regulatory uncertainty and security, which limit the sustainable development of the industry.

In the future, the growth of Bitcoin mortgages may be concentrated in areas with friendly regulatory environments such as Singapore and Hong Kong. These regions have sound regulatory frameworks and high cryptocurrency penetration rates, providing ideal conditions for financial institutions to innovate and generate revenue growth. Through Bitcoin mortgages, financial institutions can not only expand market influence, but also diversify their businesses and open up new growth channels.

For companies and financial institutions, the key to success lies in implementing effective risk management strategies. For example, adopting conservative loan-to-value ratios (LTV), requiring borrowers to provide overcollateralization, and choosing reliable custody solutions to ensure asset security. In addition, cooperation between traditional financial institutions, cryptocurrency platforms and regulators will also play an important role. This cooperation can build industry trust and lay the foundation for the long-term development of Bitcoin mortgages.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern