① Berezin, chief global strategist at BCA Research, predicts that the S & P 500 index may fall to 4200 points at worst by the end of this year;

② He predicts that the possibility of the United States falling into a recession is as high as 50%, and March may be the beginning of the recession;

③ He also believes that Trump’s tariff policy will exacerbate the economic recession, and even if Trump abandons the tariff agenda, U.S. stocks will still fall sharply.

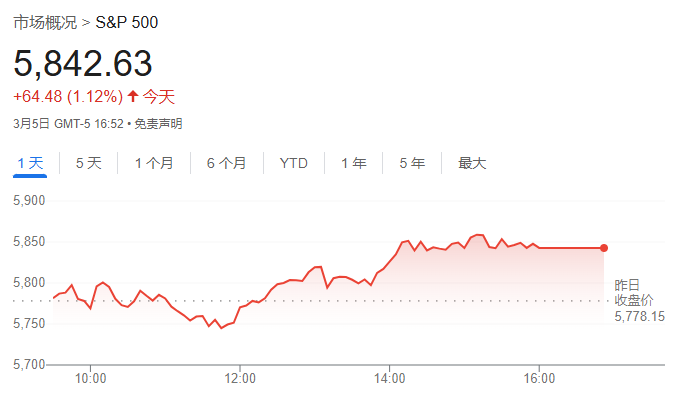

Cailian News, March 6 (Editor Ma Lan)After continuously breaking through historical highs, U.S. stocks have entered a rather fierce correction period this year, which has caused many short sellers to warn that a bear market is coming.

As one of the boldest Wall Street shorts, Peter Berezin, chief global strategist at BCA Research, is very worried about the trend of U.S. stocks this year. He predicts that the target price for the S & P 500 index at the end of this year will be 4450 points, which is a huge difference from the mainstream Wall Street price of 6500 points.

He pointed out that the looming U.S. economic recession will make U.S. stock investment dangerous. In the worst-case scenario, the PPS 500 index will fall to the bottom of 4200 points this year, nearly 30% lower than it is now. But this possibility is based on two assumptions: a reduction in the S & P 500 ‘s expected P/E ratio to 17 times from the current 21 times, and a 10% decline in earnings expectations.

He further emphasized that the economic recession will be the driving factor in this round of decline in U.S. stocks, and considering that income is highly correlated with the economy, multiple unfavorable factors will appear at the same time. He predicts that the possibility of the United States falling into a recession is as high as 50%, but it still needs further support from data, but March is likely to be the beginning of the recession.

Please stay away from US stocks

In mid-2024, Berezin was already bearish on the U.S. stock market, but he was not bearish for a long time at the time. In addition, Berezin also said he was one of the few people on Wall Street who believed that the U.S. economy was at no risk of recession in 2022 and was optimistic about 2023.

At the same time, BCA is also one of the few institutions on Wall Street to raise the odds of a recession after the U.S. election. Berezin said that the reason for this is that although Trump will bring positive impetus to the United States in some aspects, it will also have negative impacts, especially on trade.

He said he never agreed with Wall Street’s consensus after last year’s election that tariffs were just a negotiating tool.

He believes that Trump imposed tariffs because Trump is a protectionist at heart, coupled with the huge budget deficit of the United States, which makes him urgently need to “generate revenue.”

Berezin also warned that things were getting worse far faster than he imagined. He did not expect Trump to start imposing 25% tariffs on Canada and Mexico in March.

In response to the current investment situation, Berezin recommends that investors should stay away from U.S. stocks, even if they invest, they should avoid troubled technology stocks, consumer discretionary goods, industrial, materials, finance and other industries, as well as high-yield credit and cryptocurrencies. He advises people to turn to defensive themes such as consumer necessities, health care, utilities, etc.

In addition, he believes investors should hold more safe-haven assets such as bonds, cash and gold. Safe haven currencies such as the yen and the Swiss franc are also viable options. People will not make a lot of money on these assets, but at least they will not suffer large losses.

The only turning point to reverse Berezin’s pessimistic view may be for Trump to completely abandon his tariff agenda, but even so, Berezin still believes that U.S. stocks will fall sharply. This means that a major pullback is already inevitable in his view.