Article source: Fixed Focus One

Image source: Generated by AI

Image source: Generated by AI

The number one player in the AI circle has changed again, from Kimi last year to DeepSeek at the beginning of the New Year, and now it is Tencent Yuanbao’s turn.

On the evening of March 3, Yuan Bao surpassed DeepSeek and ranked first in the free App download list in Apple’s China App Store.

A month ago, Yuanbao was considered by the outside world to be the “most non-existent AI universal application.” QuestMobile data shows that in last year’s AI native App rankings, Yuanbao’s monthly active users only ranked 11th, while similar products such as Doubao, Kimi, and Wenxinyiyan occupied the top three respectively.

In May 2024, Yuanbao App was launched, and the web version was not launched until March this year. Last year, Doubao and Kimi were fiercely competitive in marketing, and Yuanbao was even more reluctant to participate.

Until this year, after Yuanbao connected to DeepSeek, the situation reversed.

Advertisements to “download Yuan Bao” have appeared in various major apps of Tencent, and even the always “stingy” WeChat Jiugong Grid has given Yuan Bao a place. In addition to promoting it on its own platform, Yuanbao has also invested a large amount of advertising on external platforms such as Weibo, Station B, and Douyin.

In just over half a month, Yuanbao has been updated seven times, including major changes such as accessing DeepSeek, launching of the self-developed deep thinking model Mixed Origin T1, and the fast thinking model Mixed Origin Turbo S. It also includes the addition of one-click export dialogue long picture, computer version online and other functions.

In this way, Yuan Bao came out.

In the long run, whether current traffic can be converted into user retention will be the key to determining Yuan Bao’s future fate. Otherwise, it may repeat Kimi’s mistake and only temporarily occupy the top spot.

Yuan Bao reached the top, where did he win?

At present, the outside world’s questions about Yuanbao are mainly focused on whether it has leapt from “small transparency” to the first place. Is it based on strength or marketing? Does this first place have any moisture?

Let’s first look at Yuanbao’s modeling capabilities.

More than one practitioner said thatdual model strategy(It is connected to the external DeepSeek and the self-developed Hunyuan model), which is Yuanbao’s biggest advantage. The two popular domestic AI general-purpose applications-Kimi and Doubao-currently only have built-in self-developed large models.

Tencent’s self-developed Hunyuan model (Mixed Origin T1/Turbo S) is exclusive to Yuanbao, these two models have been launched intensively recently. The Hybrid T1 was launched on February 17 this year, and the Turbo S was launched ten days later.

Since they all belong to closed-source models and there is no authoritative ranking, we mainly evaluate them based on the practitioners ‘experience and public papers.Mixed Origin T1 focuses on in-depth thinking, similar to DeepSeek-R1, but Jiang Shu, a senior AI industry practitioner, believes that its reasoning ability is not far behind other domestic companies.

A well-known expert in the field of large models also believes that judging from the launch time of the model and related paper reports, DeepSeek and Kimi are stronger in the domestic large reasoning model, compared with the Mixed Origin T1 is slightly weaker.

Turbo S is a fast thinking model, the main speed, the ability to achieve “return in seconds” and a 44% reduction in the first word delay are highlights.

However, practitioners believe that the current market focus is on the in-depth reasoning capabilities of large models, and fast thinking seems to have become “obsolete”. After all, Ali Qwen series models, Wenxinyan, Doubao, DeepSeek until the V3 version, and the previous GPT series models of the o1 series are all fast thinking.

They are more likely to believe thatYuan Bao topped the download list, and the main player was DeepSeek, many users download Yuanbao in order to try DeepSeek.

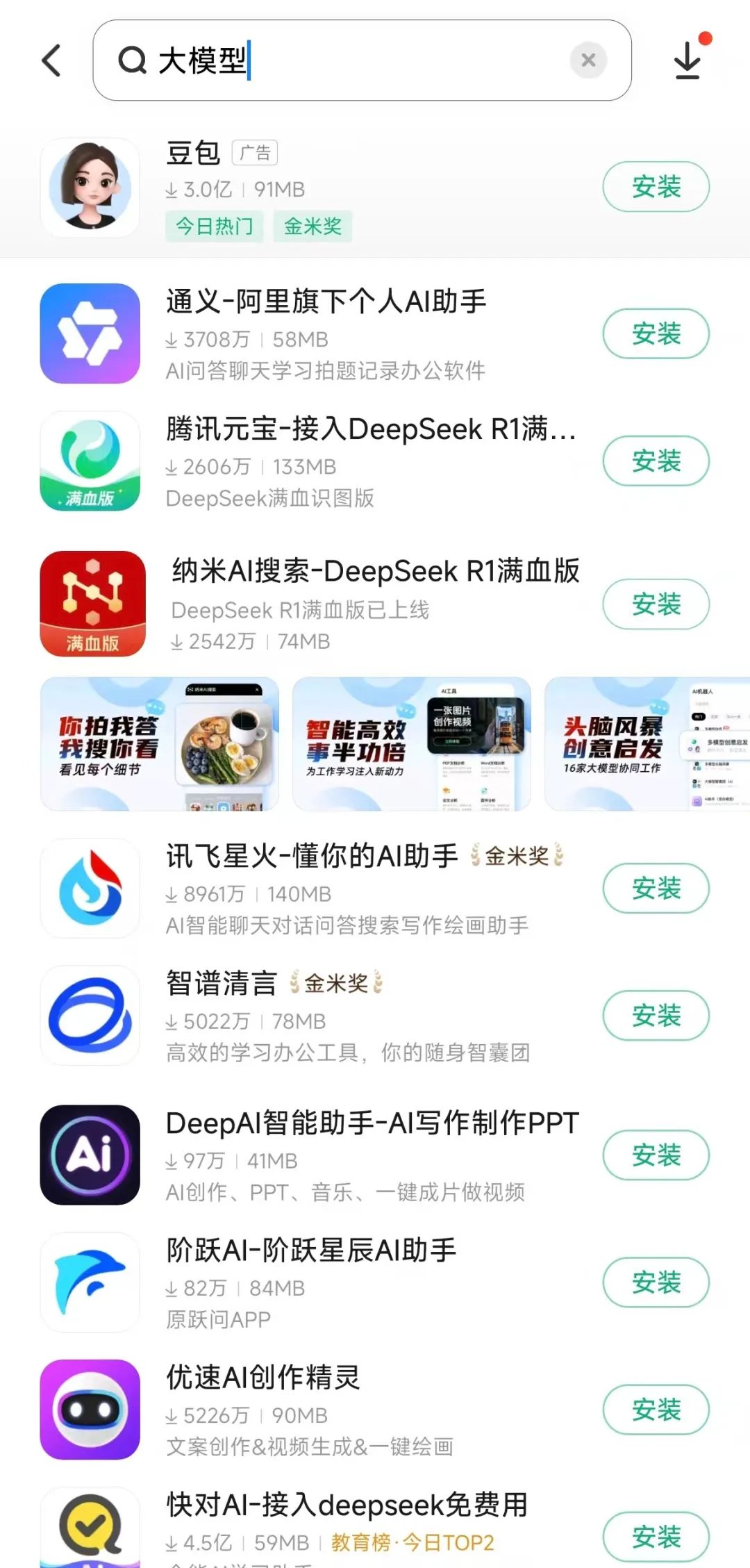

Photo source/App store APP screenshot

Let’s look at the investment.

This wave of investment by Yuanbao is very radical. On the one hand, it relies on internal ecology (Tencent advertising) and on the other hand, it relies on external channels (Douyin, Fast Hand, etc.). AppGrowing data shows that Yuanbao’s estimated investment amount in February exceeded 300 million.

AI software engineer Qin Xiang said that Yuanbao adopts a streaming strategy of spreading the Internet widely and reaching accurately. External channels such as Weibo, B Station, and Douyin are mainly to expand user coverage. The most important thing is to utilize the internal ecosystem (full coverage of Tencent apps such as WeChat search diversion, friend circle advertisements, and QQ browser). After all, these channels have high user trust and strong situational relevance, and the reach efficiency is extremely high.

Xiao A, who is engaged in search tool launch, also told “Focus One” that currentlyThe mainstream channel for AI search is Tencent advertising.

AppGrowing data shows that among the streaming channels in AI general-purpose applications (Yuanbao, Doubao, Kimi, Tongyi, Wenxinyiyan), the largest proportion isTencent advertising(WeChat, QQ, Tencent News, Tencent Video, QQ Browser),It can account for 70%-80% of the total investment channels.

This time, WeChat, as a trump channel, provided Yuanbao with strong traffic support. Search shows a jump link to download Yuanbao (experience DeepSeek-R1); Yuanbao is pushed in information stream advertisements in the circle of friends, at the bottom of public account articles, and on the opening pages of Mini programs; there is also embedded in the WeChat Jiugongge entrance.

In addition, Yuanbao emphasized in his promotion that its online search function has opened up the Weixin Official Accounts content library, which can retrieve more than 210 million historical articles in real time and include 1.8 million new tweets per day in 15 minutes. Xiao A feels that this move differentiates Yuanbao from other AI applications and can attract some users.

It is not difficult to find that advertising played a key role in Yuanbao’s ascent to the top, and the traffic support of Tencent’s ecosystem is an important cornerstone of its success.

Timing is also important for the rise of Yuanbao

In the field of AI applications, advertising has become an industry consensus. Previously, Kimi and Doubao seized many markets with their investment flows.

In particular, Kimi, as an application launched by a start-up company, relied on its own technological advantages and heavy investment to break through among many major manufacturers last year.

Practitioners believe thatStreaming is particularly effective in AI applications, because the threshold for AI application experience is not high, users are not too loyal, and it is easy to quickly convert through traffic.

Jiang Shu said that the current practicality of the large model is still not strong, and the users created to attract most of the early adopters are early adopters. After using it, they often give up quickly because the product falls short of expectations (not smart, not interesting, and not solving problems, etc.).

This user behavior pattern is why streaming can play a key role. Finding the right time to cast a stream can also achieve twice the result with half the effort.

Jiang Shu believes that DeepSeek’s explosion is characterized by breaking the circle and being universally oriented, indicating that the public’s understanding of the application of the AI model has been formed.Even when the DeepSeek-R1 official website was frequently busy, Yuanbao relied on its stable use advantage to take over DeepSeek users and further expanded its user coverage through streaming.

Moreover, Tencent also has unique advantages in terms of investment flow, that is, it has the support of the Tencent ecosystem and burns money more accurately.

Photo source/WeChat circle of friends screenshot

Judging from the investment amount of nearly 300 million yuan in February alone, Tencent’s launch speed, intensity and scale this time far exceed the previous Doubao and Kimi.

This strategy is also in line with Tencent’s consistent product thinking: it is not to act blindly in the early stages of the market, but to wait for the market to gradually mature and be verified by successful cases, and then find the right opportunity to make decisive moves. Its core strategy is to quickly occupy the market by investing heavily and mobilizing Tencent applications to coordinate operations.

For example, Tencent’s party game, Yuanmeng Star, also adopted a similar strategy. A year after Netease’s “Egg Boy Party” became popular, Tencent launched a similar game “Yuanmeng Star”. It not only adopted innovative gameplay, but also launched large-scale advertising on WeChat, QQ, Douyin, B Station, Xiaohongshu and other platforms. Cash strategies such as “10 billion yuan subsidy” attracted players to download, and announced a high-profile investment of 1.4 billion yuan in the first phase to build a game ecosystem incentive plan. This move quickly hit the peak of game downloads and estimated revenue, but this state only lasted for less than a month.

Due to the unclear commercial prospects of the general AI model, Yuanbao has kept a low profile since its launch on the market last year and belongs to Tencent’s defensive business. It was not until after connecting DeepSeek that large amounts of current investment began.

Why did Tencent choose to add more yuan at this time?

Based on the perspective of practitioners, Tencent’s mixed-source model appeared late, its model capabilities did not reach the level that could completely crush competitors, and TOC applications did not have a first-mover advantage. For example, Kimi was launched on the market as early as October 2023, and Yuanbao was released at the end of May 2024.

Without the first-mover advantage in ability and time, Tencent will not easily invest a large amount of traffic for Yuanbao, butDeepSeek’s open source has bridged the technological gap between major models, and the competition for TO C applications has also been pulled to the same level.This is a good opportunity for Yuan Bao to make a move.

In the early and mid-term stages of investment, Yuanbao also made technical preparations.

Qin Xiang said that DeepSeek-R1 provides Yuanbao with in-depth reasoning capabilities, supports multi-modal (such as image analysis), and enhances practical scene coverage. TurboS serves as a self-developed fast thinking model and performs benchmarking against DeepSeekKV3 in benchmarks such as knowledge and mathematics. This also makes the ingot with dual models significantly improve both its response speed and multimodal capabilities (picture understanding, file analysis), making it convenient for users to use.

Can Yuanbao retain users?

Although Yuan Bao briefly reached the summit, the challenges it faces cannot be ignored. What the market is most worried about is whether Yuanbao will repeat Kimi’s mistake and have a low user Retention rate after the end of high-investment advertising traffic.

As one of the most successful C-side AI applications in 2024, Kimi has always been accompanied by controversy over “burning money marketing” to change users.

AppGrowing data shows that starting from March 2024,Kimi puts tens of millions of yuan in advertising almost every month, and last year it was estimated to exceed 900 million yuan.Kimi once became a hot search for “burning 100 million yuan in 20 days.”

However, even so, Kimi’s market position did not remain for a long time, and DeepSeek quickly took over its limelight when it emerged.

QuestMobile data shows that from January 20 to January 26 (DeepSeek explosion period),Kimi’s weekly active user size increased by less than 28% month-on-month, while DeepSeek’s weekly active user size increased by more than 750% month-on-month.

The phenomenon of high marketing and low retention is not an isolated case.

Doubao, which ranks first in downloads among major AI application lists in China, has also relied on large-scale advertising to surpass the latecomers. AppGrowing data shows that the cumulative release of bean buns in 2024 exceeded 475 million yuan, but now most of the popularity has been taken away by DeepSeek.

Photo source/App store APP screenshot

In September last year, statistics from practitioners,The user Retention rate of large model applications (Doubao, Kimi, Wen Xiaoyan, iFlytek Spark, Yuanbao) 30 days after downloading is less than 1%.

Liu Cong, a well-known expert in the field of large models, pointed out that large model applications on the market are not highly sticky, and only a small number of professional practitioners will insist on using them every day. Most ordinary users are early adopters and try to download them after seeing the promotion. Once there is a more popular new application,”I just turn around and run away.”

Qin Xiang also said that at present, there is insufficient matching between large model applications and user needs,Most AI applications have single functions (such as only supporting Q & A) and cannot continuously meet the complex needs of users. The quality of generated content is unstable and lacks personalization (such as insufficient adaptation to vertical scenarios such as finance and education).

Although Yuanbao, which is currently gaining momentum, has been connected to the top-level large model DeepsSeek, it has not solved this problem. Jiang Shu believes that the development of AI in China is still in its early stages, and “there are not even basic requirements for obedience, stability, and unlimited requirements.”

In short, Yuanbao’s ascent to the top is more like the result of synergy between technology, flow and ecology, rather than relying solely on technological advantages.

Moreover, reaching the top is only the first step. With more users, it will receive more attention. Recently, Yuanbao was accused of containing a “overlord clause” in the user agreement, causing controversy.

The terms state that content uploaded by users to the platform will be granted to Tencent and its affiliates an irrevocable, permanent, free and unlimited license, covering storage, use, copying, editing, publishing, etc., and can be used for purposes such as model optimization, academic research and marketing.

In this regard, Tencent has publicly apologized, saying that the latest version of Yuanbao has added data management functions and added experience optimization switches, which are turned off by default. Input and output content will not be used for model optimization.

Qin Xiang pointed out that at this moment, Yuanbao not only needs to be further upgraded in technology, but also needs to find a balance between technical depth and user value. Only in this way can we avoid falling into the trap of “burning money for growth”.

How long can the number one download volume last? Everyone takes a wait-and-see attitude.