“One word $Doge ”- Elon Musk

Author: b12ny

It has always been regarded by the market as the leader of the meincoin. At the end of 2024, prices soared due to the Trump and Musk effect during the US election, but then entered a sharp correction and fell by more than 60%. This is consistent with the overall decline of the meincoin sector, showing its short-term momentum is dominated by market sentiment.

In terms of institutional layout, Grayscale launched the Dogecoin Trust Fund in January 2025 (a management fee of 2.5%). The trust is limited to qualified investors. Although the scale is still small (nearly US$2 million AUM), the significance exceeds the number itself. It represents that $Doge has officially entered the range of institutional investable assets and is also regarded as a key step in the transformation of Dogecoin from meme-oriented to institutional investment.

ETFs are promoted by Bitwise, and if approved by its $Doge ETF application with the SEC, it may further expand its market liquidity. However, there is no approval case yet, and future development still needs to observe changes in the regulatory environment.

$Doge has the potential for short-term speculative value and long-term application scenarios, and the price is highly correlated with Musk in the long run. Among them, X is actively exploring the integration of payment systems. If $Doge is included in the X payment system, it will be the largest since 2021. Market catalyst.

The future direction of development will depend on three key variables: payment applications, institutional investment and chip trends。

At present,$Doge is still biased towards speculative assets driven by the community. If X or Tesla expands payment applications, it may bring new market demand. In addition, the progress of ETF applications and regulatory policies will also affect the inflow of institutional funds and further change DOGE’s market structure. This article will use a historical review, narrative economy and in-depth analysis of chip structure to evaluate $Doge’s current positioning and potential opportunities in the future.

Historical Review

$Doge was born in 2013. It was originally founded by Billy Markus and Jackson Palmer to satirize the bubble of the cryptocurrency market, but it unexpectedly developed into the world’s highest market capitalisation memein.$ Doge’s historical development can be divided into several main stages:

2013 – 2017: Community Driven and Charity Culture

-

The Reddit community is promoting $Doge to become an online reward currency.

-

In 2014, he sponsored the Jamaica bobsleigh team to participate in the Winter Olympics.

-

Elon Musk first publicly expressed interest in $Doge in 2015.

2018 – 2020: Low liquidity and market marginalization

-

$Doge has remained low for a long time, and there is no obvious narrative driving the market.

-

The main liquidity comes from community transactions and has not received institutional attention.

2021 – 2022: Elon Musk and the Memo Wave

-

The GME incident and Musk’s post pushed $Doge up 100 times in four months.

-

The market value of $Doge once exceeded US$90 billion, becoming the top three cryptocurrencies.

-

$Doge is launched on Robinhood, Coinbase, Binance, and OKX.

2023 – 2025: Institutional capital mobilization and payment process

-

Sentiment of Elon Musk’s acquisition of Twitter (now X) drove $Doge higher.

-

Tesla began accepting $Doge for some items.

-

When Trump was elected president of the United States, his attitude changed to be cryptocurrency-friendly and may promote related policies.

-

The X Money code and related information have been circulated, and the market is expected to support cryptographic payments as $Doge.

-

Grayscale launches the $Doge trust fund, and Bitwise submits an application for the $Doge ETF.

narrative economy

The market value of $Doge is mainly driven by narratives, which determine the future development and source of liquidity of $Doge, and also affect the capital rotation model of institutions and retail investors. The following is the narrative that currently affects the market:

-

The leader of memin and the POW mechanism

-

The Musk Effect and $Doge the link

-

Payment narrative (Tesla, X Money)

-

Institutional investment and ETF application

The leader of memin and the POW mechanism

-

Memin leader

Since the birth of $Doge, it has been mainly promoted by the Reddit community to become an online reward function. Since the last bull market, due to Musk’s relationship, it has established the current largest memin leader. Although it is mainly influenced by overall market trends, it also has long-term correlation with other memocoins and has catalyzed the birth of other memocoins.

For example,$Shib and $Floki, which were born in 2021, and $Babydoge, which was the most popular at the time. It is worth mentioning that compared with other compatible/existing meme tokens on the public chain,$Doge is the largest POW meme coin (Coin) in market value (second only to $BTC), and the third place is $LTC.

-

POW mechanism

In the last round, I often heard the words Bitgold, Wright Silver, and Dog Bronze, because their technical architecture is POW and the codes are similar. The biggest difference between $Doge and them is the inflation mechanism. A fixed additional 5 billion tablets are issued every year, and the other two have a maximum supply ceiling. The table below shows a comparison of the information and mechanisms of the three:

In the early days of 2014, the computing power of $Ltc was as high as 600GH/s, while $Doge was less than 40GH/s. This resulted in DOGE’s cyber attack cost being very low. It was attacked by mining pools and the Dogecoin Wallet was hacked. The price quickly collapsed by 95.26%. In order to enhance security, LTC founder Charles Lee suggested that the $Doge community conduct joint mining (AuxPoW) with $Ltc. This suggestion caused heated debate, and finally the community chose to bind to $Ltc.

By sharing computing power,$Doge’s network-wide computing power continues to grow, increasing the cost of hackers attacking DOGE and ensuring the security of the chain. In addition, the $Doge revenue earned by miners has also become their main source of income (early $Ltc miners are also large holders of $Doge). Looking back, joint mining at that time did bring a win-win situation.

The Musk Effect and $Doge the correlation

Everyone knows that the biggest driving force behind the hype will be Musk again in 2021. As time went by,$Doge’s market influence and Musk’s connection has gradually expanded, including on April 28, 2021, Musk announced that he would appear on “Saturday Night Live”(SNL) and broadcast live on May 8.

Among them, when asked on the live broadcast what $Doge was, he responded with a smile: It’s a hustle (this is a scam), and the price dropped directly from $0.74 by 30%. At that time, Barry Silbert, head of Grayscale, even posted an article saying that he would short $Doge for US$1 million on FTX. Now that $Doge has become one of the currencies of gray trust funds, we can also see an obvious change in attitude.

Musk also strongly supported Trump in this round of elections. Last year, he even proposed that the Government Efficiency Department (abbreviated as D.O.G.E.) is mainly responsible for improving government efficiency and reducing expenses. In the early stages of the market, this move was tied to the price of $Doge. In early January this year, the official website was briefly changed to the $Doge logo.

However, looking back from the past to the present, we can find that the overall environment has changed. The market no longer pays for Musk’s simple slogans, memes or tweets, and puts rising expectations on Musk’s ability to further actually support $Doge through other methods.

Payment narrative (Tesla, X Money)

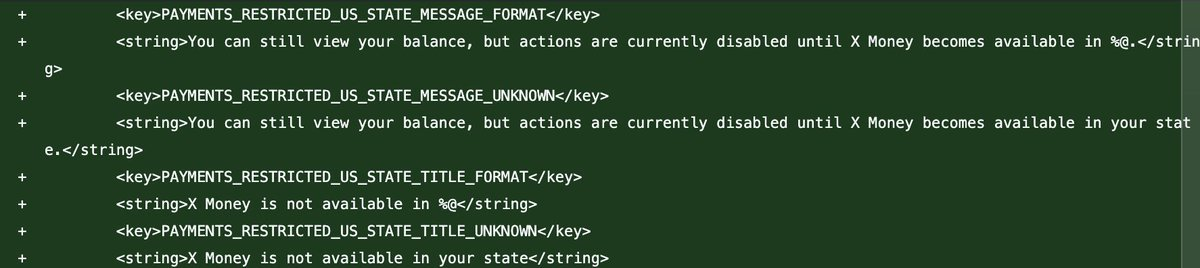

In 2025, X announced the upcoming launch of payment services X MoneyThis is a key step in Musk’s efforts to build X into an All-in-one program. According to the information currently available, it already has digital wallet, instant transfer, QR code payment and functions with Visa. It is expected that there may be a deeper integration system released next.

However, as a trader in Crypto, he is more concerned about whether the expected combination of X Money and $Doge can be realized. In addition, the existing Tesla payment method includes $Doge (limited to some products). Some news media pointed out that some super charging stations in the United States also support charging payments.

The following is an interpretation based on the information currently available to individuals:

-

Tesla

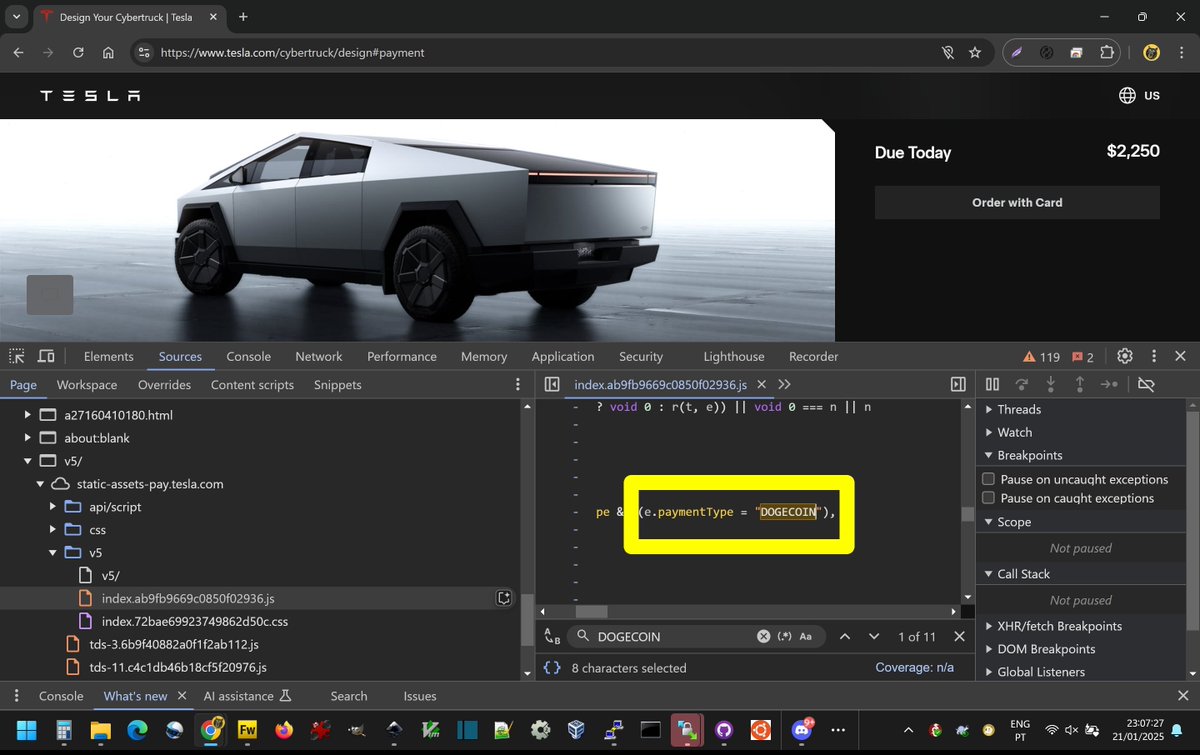

According to the@inevitable360 query on the front-end code, it was found that the DOGECOIN code could be found on the cybertruck page. During the period from 2022 to 2023, I personally also searched the front-end code to find related codes such as DOGEPAY and DOGECOIN. Subsequently, Musk issued an announcement to officially open the payment function. Therefore, judging from the perspective of this information, it is very likely that the option of supporting payment to buy vehicles will be realized this year.

-

X Money

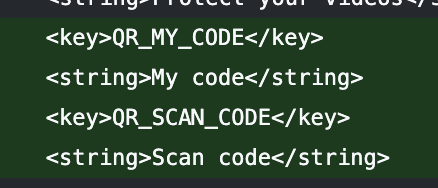

Information released by@aaronp613 shows that X is expected to launch X money in the United States first. Since X Money has not yet obtained full licenses from 50 states in the United States, it may choose to launch it first in the 39 states that have been approved. It will pass test verification in some states. In addition, it will also provide each user with a QR code, similar to scanning the code to make mutual transfers and remittances.

According to personal experience and interpretation of past research, it was in April 2023 that Musk changed the Bluebird logo to the dog logo of $Doge in order to fulfill his promise in 2022, including the D.O.G. E briefly changed the official website logo to a dog mentioned in the previous paragraph. I think Musk will keep his original promise or make a joke (the acquisition of Twitter is also the case).

On the practical level, assuming that X Money officially supports financial services, X can test the feasibility of payment services, and then optimize and expand based on market reactions, and supervision will become the subject of hype. Whether X Money can overcome regulatory obstacles may also become the focus of the market, attracting capital speculation in $Doge, which is one of the common methods to achieve cross-border payments.

The most well-known one is that in 2022, Vladimir Tenev, CEO of Robinhood, the largest $Doge holding address, issued a document saying: If Dogecoin wants to become an asset for daily payments and transactions in the future, it can increase the block size and reduce the block time. To solve the problem of too low transaction throughput, the co-founder of Dogecoin and Musk also expressed support for his views.

Tenev first mentioned that the transaction fee of Dogecoin is small enough to become a viable e-cash leader, but he believes that if it is to be more widely adopted, the block size and block time of Dogecoin are the main points that need improvement. Therefore, if the speed problem can be further reduced (I believe that Musk will have no problem if he wants to do it.) In addition, Tesla has now implemented the $Doge payment method, so the scenario towards matching X Money payment applications may be greatly expanded to the world.

Institutional Investment and ETF Applications

-

institutional investment

In addition to Grayscale’s launch of the Dogecoin Trust Fund (nearly US$2 million AUM) this year, which is seen as a key step in $Doge’s transformation from meme-oriented to institutional investment, the Dogecoin Foundation is also committed to promoting and supporting the development of Dogecoin.

The foundation also announced the establishment of a core development fund in early 2023, investing $5 million Doge (approximately $360,000) to support the work of the core developers of Dogcoin. In November 2024, the foundation issued a fundraising appeal to seek support from large sponsors to promote the large-scale adoption of Dogecoin in 2025. The funds will be used to build a decentralized payment infrastructure called Dogebox to assist small and medium-sized enterprises accept Dogecoin as a payment method.

In addition, it is also worth paying attention to the members of the foundation. In 2021, the foundation will be restructured. The members of the advisory committee include: Billy Markus, co-founder of Dogcoin, Max Keller, core developer, Ethereum founder, V God, and Musk’s long-term partner Jared Birchall. These figures are all well-known and influential celebrities.

-

ETF application

In early February, Bloomberg analysts James Seyffart and Eric Balchunas predicted the approval probability of the four major cryptocurrency ETFs: $Sol,$Doge,$Ltc and $Xrp:

$Doge(75%):As the largest memin coins, the 19b-4 documents filed by Gray and Bitwise have been recognized by the SEC, so they have a high probability of approval.

The institutional part is that Trump’s policies and speeches tend to reduce supervision and encourage market development, which also increases the probability of approval for the $Doge ETF. Therefore, the real question is not whether it will be passed, but when it will be passed.

Personally, I think that it must be approved at least before the end of this year, so that the positive effect of the ETF narrative will not decrease with the marginal effect. Currently, more and more currency ETFs may be applied for and submitted. We must grasp the approval before the end of the year, and the market will have to increase expectations for prices (in terms of liquidity order and amount).

Assuming that $Doge, as the leader of memin, is really approved as scheduled, its status and probability as a legal payment may be greatly improved. That is to say, whether Trump’s Crypto policy will really be promoted will also have a key impact on Musk’s $Doge payments and the development of financial markets.

chip structure

due to $Doge Chips are concentrated in a small number of addresses, with the top 115 holders accounting for 65.4% of total circulationEven Robinhood alone holds 21.06% of the chips, soIn-depth understanding and analysis of the impact of these chips on price ups and downs, you can usually find clues before the start and end of a market, which is also very helpful in terms of your past trading experience. The following table compares your past Top 20 and Robinhood holdings:

According to “Beyond Musk: The Real Price Driver of Dogecoin?! Look at chip allocation and price impact once! Quickly grasp the key signals before price surges “Analyze the on-chain transfer behavior of the top 20 holders of $Doge, especially smart money addresses, and we can find that the operating timing of these large $Doge addresses is highly related to price ups and downs. The following table shows the addresses with high correlation between article statistics and price:

The strategy of buying at low points and selling at high points can be referred to by address transfer behavior to assist trading planning, as well as the selling pressure caused by large-scale transfers, which often become reference signals for short-term market trends. For traders, paying attention to the movements of these addresses can provide analysis and assessment of future price movements, but their market behavior shows that the participation of large amounts of smart money makes their chip dynamics more complex.

$Doge’s current positioning and potential future opportunities

Judging from past prices and cycles, it is very likely that a relative low will form at 0.18 to 0.2 and break through the historical high again. Individuals also expressed in previous tweets that they are willing to buy large amounts at 0.18. If I have to give a price forecast, then I think the probability of reaching 1 dollar in this cycle is the highest, just like the historical significance of 100,000 to $Btc.

Current $Doge Still relying on market narrative and capital liquidity, it may still follow the overall market to maintain high volatility in the short to medium term. Assuming that key events such as X Money and ETF approval are realized as expected, then it may truly transform from memin to payment cryptocurrency.

This content is my in-depth understanding and analysis of dogcoin for five years since I joined the circle. If you like my content or want to communicate further, you are welcome to leave a message or like it and forward it.

See you on the moon.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern