The prerequisite for increasing volume is to reduce costs, and only car companies have this ability.

How to view Xiaomi Xiaopeng and Wei’s coming to these car companies to accelerate their entry into the game?

Wen| brocade

In 1927, Westinghouse of the United States manufactured the world’s first humanoid robot, Tevox, and there were many attempts in the process. However, it was not until 2022, when Tesla planned to build Optimus that this concept reached the forefront of science and technology again after a century of ups and downs.

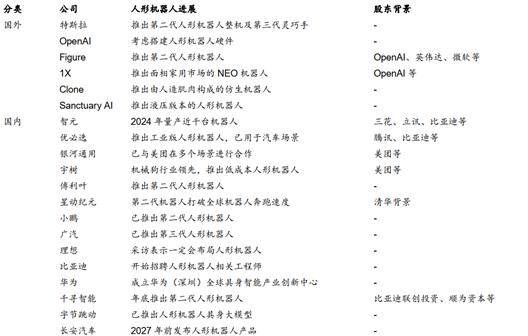

In addition, in 2024, Xiaopeng established the Robot Division internally, and in November 2024, Huawei personally went to the field to build a humanoid robot. In fact, among the early adopters of humanoid robots at home and abroad, half of the positions are occupied by car companies, either doing it themselves or investing first.

Picture: Domestic and foreign mainstream humanoid robot companies and progress source: Huatai Securities

Why are car companies rekindled the hope of the humanoid robot industry, and why are car companies collecting firewood for everyone? Is the key to the humanoid robot stargate really in the hands of car companies?

The technological frontier of humanoid robots has always been led by car companies

1. Honda and Tesla’s dialogue in the air

Before Tesla’s Optimus came out of the circle, Honda Asimo surprised everyone. In 2000, Honda launched Asimo, a humanoid robot that can jump and twist bottle caps. It has 57 degrees of freedom and a height of about 130cm. It is driven by a pure motor for the first time, and its power system is a lithium battery.

Its technical capabilities not only represented the highest level back then, but also pointed out the direction for the present. Today’s humanoid robots all have Asimo’s shadow. However, this product, which cost more than US$3 million, could not leave the exhibition hall and put it on the production line, and was eventually officially discontinued in 2018.

It was not until 20 years later that another car company Tesla took over, and the power of humanoid robots returned from other industries to the hands of car companies.

Figure: Comparison of parameters of well-known humanoid robot products Source: Guangfa Securities

Tesla’s history of developing humanoid robots:

In August 2021, AI Day proposed the concept of humanoid robots;

In September 2022, the prototype Optimus will be completed. It can only walk slowly and simply wave, which is relatively clumsy;

In December 2023, the second-generation Optimus will be released, which will increase walking speed by 30%, reduce weight by 10kg, and comprehensively enhance mechanical parts and sensors;

In November 2024, OptimusGen3 ‘s smart hands will be updated and displayed, and walking speed, motor skills and task execution flexibility will be further improved;

At the beginning of 2025, it is planned to enter the small-batch production stage, and by 2026, it is expected to produce 50,000 to 100,000 humanoid robots. It will increase 10 times in 2027; when the output is 1 million units that year, the unit cost will drop to less than US$20,000.

The Tesla humanoid robot concept started in 2021 and will soon enter the mass production stage in more than three years. The iteration speed is far beyond Asimo’s. And if the roadmap is implemented, the cost of having a stronger feature Optimus will be less than 1% of Asimo’s.

2. Domestic main engine factories have also begun to deploy humanoid robots

Although domestic and overseas giants including Nvidia, Google, OpenAI, Apple, Samsung, and Byte have all joined the battle of humanoid robots, they are more like the metaverse craze of those years. Nowadays, information is developed and high-tech personnel flow frequently, and innovation is increasingly following the trend and getting together.

In addition to giants, there are also excellent third-party humanoid robot companies such as Figure AI and Yushu Technology. However, compared with industrial robots, humanoid robots have a more advanced sensory interaction system and require higher sensing modules and software algorithms. The greater advantage of third-party companies is that they make single technological breakthroughs, and it is difficult to become a beacon to point out the direction.

What deserves more attention is the joining of car companies in groups. We believe that they are the group that best understands robots and are most likely to play the role of leaders and disruptors. The global leader in smart cars is naturally Tesla, followed by several domestic car companies. Most of them have begun to increase investment in humanoid robots.

Xiaopeng:

In 2020, it acquired Four-legged Robot Company and established Penghang Intelligent, which later became an internal business department. Like Yushu, his thinking developed from four-legged to humanoid.

The first intelligent robot horse will be released in 2021, achieving breakthroughs in power modules, motion control, intelligent interaction, etc.

In 2023, the first bipedal humanoid robot PX5 was launched, with a height of 178cm, a weight of 70 kg, and 62 degrees of freedom; it also used the Turing AI chip for the first time, equipped with an end-to-end large model (supporting 30B parameter large model) and Tianji AIOS, with independent thinking and reasoning ability.

It is planned to carry out work on some positions in the company’s P7 production line, such as shelf access and parts assembly. It is the car company in China that tracks Tesla’s progress most closely.

Huawei:

In April 2022, he began to pay attention to humanoid robots and signed a cooperation agreement with Data Robot to jointly tackle technical research. Later, in June 2023, he invested in the establishment of Jiemu Robot, focusing on AI technology applications and intelligent manufacturing solutions. In March 2024, it was equipped with Pangu The Leju robot of the large model was unveiled at the Huawei HDC conference.

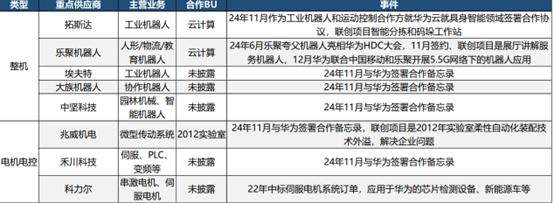

In November 2024, we joined the bureau, established an intelligent innovation center, and signed cooperation memorandums with 16 companies.

Picture: Sort out the key companies that Huawei signed a cooperation memorandum Source: Soochow Securities

Xiaomi and Xiaopeng have similar ideas. First, they released the four-legged robot dog Tiedan in 2021, and launched Cyberone, a humanoid robot in 2022 to show their attitude. However, the investment in research and development is not much, but Lei Jun said that he will increase his focus on humanoid robots in the future.

Others include: In December 2024, GAC Group released GoMate, the third-generation self-developed humanoid robot at the annual meeting of China Robot Network; Celis recently released recruitment information for robot engineers; and it is only a matter of time before BYD, Geely, Chery and other companies enter robots.

Transformers, Autobots from movies to reality

A few years ago, there was a saying that a smart car was a mobile phone + four wheels. Today, humanoid robots and smart cars have a lot in common; if we look to the future, it would be more accurate to say that smart cars are robots on wheels.

1. Power and Transmission System: Full electrification

The Tesla Optimus Gen1 is equipped with a 2.3kWh lithium-ion battery pack, and joints, dexterous hands, etc. use various types of motors, while eliminating the complex hydraulic systems in many traditional robots. Aren’t batteries, motors and electronic controls the three controls of today’s smart cars? This can also understand why Sanhua became a supplier of joint drive systems for T Company.

The maturity of solid-state batteries in the future will further improve the battery life and reduce weight of humanoid robots. In terms of powertrains, cars and humanoid robots have reached the same goal.

2. Decision-making and perception: the same as the intelligent base

As intelligent driving is fully rolled out, everyone suddenly discovered that the intelligent bases of humanoid robots and smart cars are common.

Still taking Tesley as an example, its intelligent driving FSD system is a platform for AI, machine vision and sensor fusion. It also adds real-time decision-making in the direction of current multimodal models. These technical scenarios are also suitable for humanoid robots such as avoiding obstacles.

The synergy between Optimus’s brain intelligence and FSD should not be too obvious. It is understood that Tesla’s mechanism for data acquisition and feedback has been directly extended to humanoid robot projects. The end-to-end base model of autonomous driving can also be directly applied to robots. The underlying computing power of robot model training is also based on Dojo Supercomputing platform.

As for the sensor solution, it is a pixel-level copy. Optimus and Tesla have always insisted on adopting a pure vision solution; domestic humanoid robots have adopted the same approach as cars, choosing a combination solution of vision + lidar + millimeter wave radar to use redundancy to make up for the technical gap. For example, Xiaomi Cyberone adopts a combination solution of Mi Sense spatial vision module and depth camera.

3. Technology reuse will only be higher in the future

As for high-value mechanical parts such as planetary roller screws, sensors, reducers, and dexterous hands, which are discussed much, these, like early cars, are not separated from the category of mechanical equipment, and only need to be miniaturized and customized. As smart car and humanoid robot technologies tend to be similar, car companies have strong technical reusability when making humanoid robots from a hardware technology perspective.

The technical reusability of the algorithm is even higher. AI will play a decisive role in the path of humanoid robot technology. In 2024, AI will drive a year of rapid progress in humanoid robots. Although OpenAI and Nvidia have begun to invest heavily in humanoid robots, in this vertical field, the advantages of car companies are too obvious:

The private domain data collected and marked by a large number of existing vehicles and the unique algorithms accumulated will directly become nourishment for humanoid robots.

The large number of production lines in the car factory provide the best practical training scene for humanoid robots. If the starting point is higher, the stamina will be more sufficient.

Robots are not only migrant workers in car companies, but also provide car companies with new terminal entrances to help them obtain user data. They are new Mobile device that car companies cannot give up.

The prerequisite for increasing volume is to reduce costs, and only car companies have this ability.

1. The prerequisite for increasing volume is to reduce costs

No matter how hype technology is, the prerequisite for increasing the volume of all technology products is to reduce costs. Scaling Law of AI next door is crumbling, which has instead given rise to expectations of a full-scale explosion in AI applications. Returning to the manufacturing industry itself, the complete history of accelerated penetration of industrial robots that have just passed provides the best reference.

From 1996 to 2021, the average import price of industrial robots in my country dropped from US$47,600/unit to US$13,400/unit, and the price dropped by more than 70%. This greatly promoted the prosperity of domestic industrial robot applications and indirectly helped China’s high-end manufacturing industry upgrade.

In addition, there is an unwritten standard in the manufacturing industry, that is, if a piece of equipment is equivalent to the salary of a skilled worker for a year, then a full-scale explosion period will be entered. The domestic demand for industrial robots has been booming since 2019, which has also given rise to five-fold bull stocks like Eston. At that time, the cost turning point was hit, that is, the price of robots is equal to a worker’s salary for one year. Another example is a sweeping robot. The price starts to enter a sweet period when it drops to around 5000 yuan, which is roughly equivalent to a year’s cleaning cost.

Figure: Comparison of industrial robot and labor costs Source: Minsheng Securities

2. Only car companies have this ability

Musk has long given guidance that after 1 million humanoid robots reach mass production, the selling price can be reduced to US$20,000 – 25,000, and the cost will be reduced to less than US$20,000. But after dividing up the main parts, most people think it is an impossible task.

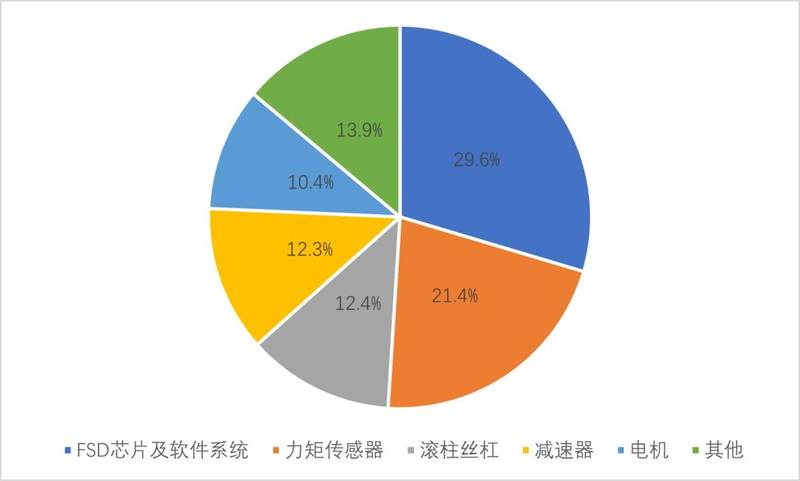

According to the summary of price information of various parts and components in the industrial chain, the current manufacturing BOM cost of Optimus is about US$71,000. It is extremely difficult to achieve a cost reduction of more than 70%. What’s more, the current Optimus Gen3 is not smart and smart enough. In the future, we will continue to pile up materials and increase data feeding training. The cost may increase instead of decreasing within a certain period of time.

Figure: Proportion of Optimus total software and hardware costs

Among all manufacturing categories, the largest are automobiles, 3C and home appliances. Only companies in these three fields may be able to complete the cost-reduction plan of humanoid robots with such ambitions.

Our most promising thing is still automobile companies to reduce costs for humanoid robots.

For home appliance companies, they are indeed manufacturing-intensive. For example, Midea acquired robot giant Kuka in order to try in this direction, but industrial robots and humanoid robots are completely different concepts. The strength of the 3C industry cannot be underestimated, but its strongest skill package lies in integration, so it is expected to become an important participant in the mass production stage of humanoid robots. For example, Lixun Precision and BYD Electronics both have reserves of humanoid robots.

The cost control capabilities of automobile companies are the strongest among all manufacturing industries. No matter what era, automobile companies are the peak of the engineering capabilities of assembly line operations: 10-20% gross profit margin for the automobile industry, 30-50% gross profit margin for the home appliance industry, and 20-40% gross profit margin for the 3C industry.

The automobile industry has Toyota’s lean production concept before, Tesla’s first principles exist, and all the words that reduce costs are carried forward by the automobile industry.

3. Assembly lines are natural training grounds

The assembly line in an automobile factory has four standard processes: stamping, welding, painting and final assembly, as well as some non-standard tasks. The working environment is highly closed and stable, and there is large-scale high-quality practical application data, so it is considered to be humanoid robots. An ideal scenario for early training and learning of humans, humanoid robots will be reliably trained and optimized. At the same time, they can also complete manual labor tasks, achieving win-win results with automobile production, forming a virtuous cycle.

We have observed that the implementation scenarios of mainstream humanoid robot manufacturers at home and abroad are all in the automobile industry. Tesla, Huawei and Xiaopeng go of it; third-party robot companies are also seeking to cooperate with automobile companies. Ubix WalkerS has entered the NIO Automobile Factory, and FigureAI will also put its products into the BMW factory for practical training this year.

From the perspective of demand, Tesla assumes that it will expand to an annual production capacity of 10 million vehicles in the long term. In theory, it will need to equip 500,000 workers. One robot will replace 2 workers. In the future, Tesla’s internal factory demand will be between 100,000 and 200,000 units. It can also be inferred that the demand for humanoid robots in the entire automotive industry is about 500,000 units, which is also the largest single downstream.

How to follow the trend of the times? Keep up with the footsteps of leading car companies

The trend of the humanoid robot industry is certain and upward, but it is difficult to grasp. In addition to the industry being still in the early stages of 0-1, it also has a lot to do with the personal style of leader Musk, which is often regarded as hype.

Apple, whether it is Jobs or Cook, basically only when its products are very mature and easy to use will it surprise everyone. It is the ultimate perfectionist. Musk, on the other hand, is an extreme idealist, so he always launches satellites first to set an unreachable goal, and finally realizes the cow he has blown through his strong engineering capabilities.

However, short-term setbacks are often encountered, resulting in huge fluctuations. Whether it is Tesla’s own stock price, SpaceX, or humanoid robots, this is the case.

As long as the leader remains Musk, fluctuations will continue in the future. We believe that a better tracking point in fluctuations is to follow the main line of deep integration of car companies and humanoid robots. Especially in 2025, the entry and progress of car companies will accelerate, which may better provide us with a treasure hunt for industrial progress. For example, many industrial chain information tells us that among the latest hardware developments, the most noteworthy thing is dexterous hands. The number of micro screws and brushless cogged motors may change to increase hand freedom and operating dexterity.

Of course, following in the footsteps of automobile companies and their industrial chains, there is also a dark line that has gradually surfaced, that is, Sino-US competition. There is not much gap between the humanoid robot track, the American camp represented by Tesla, and the China camp represented by Huawei, Xiaomi, Xiaopeng and others. Everyone is basically at the same starting point.

The United States emphasizes the return of manufacturing. The biggest bottleneck now is the high labor costs. The average annual salary of workers engaged in manufacturing in the United States is about US$60,000. If robots can be used to replace them, then China’s manufacturing advantages will be lost, so the urgency for China to develop humanoid robots is not low at all.

The domestic competitive advantage lies in the complete and powerful hardware industry chain, including roller screws, dense reducers, mechanical modules, motors, etc., and related companies all have strong cost reduction capabilities. Car companies dominate the wave of humanoid robots, which will also allow the hardware supply chain to highly overlap with the new energy vehicle supply chain. This is why Tesla chose Sanhua and Top as Tier1 suppliers.

With the tide of the times and the competition between China and the United States, the brilliance of humanoid robots has just begun. nbsp;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.