① Data from Private Equity Rankings Network shows that there are 166 female fund managers in the private equity industry;

② Small and medium-sized private equity has become the main stage for women, and half of the female fund managers are concentrated in small private equity with less than 500 million yuan;

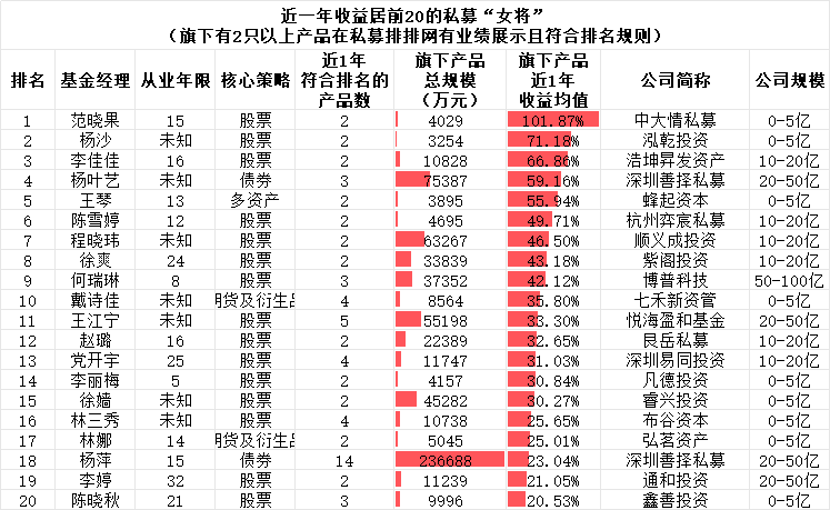

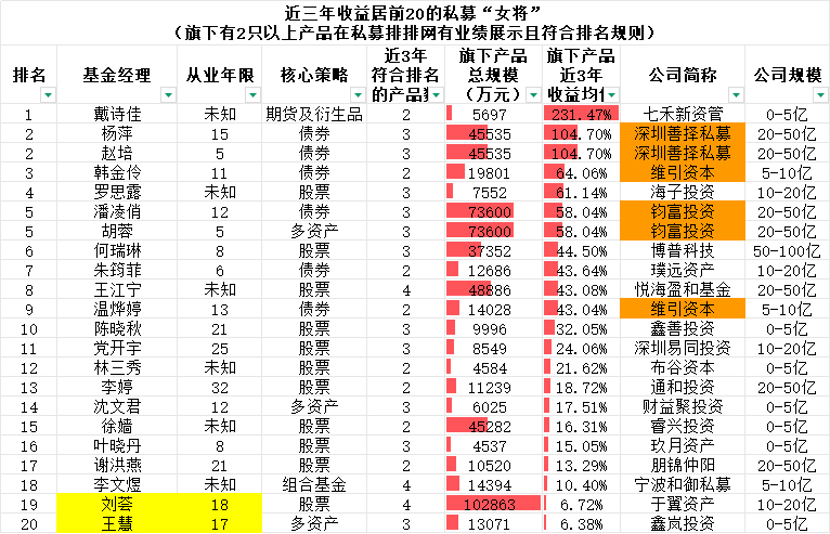

③ In terms of performance, Fan Xiaoguo, a private equity firm, topped the list with a revenue of 101.87% in the past year, and Dai Shijia’s revenue exceeded 200% in the past three years.

Cailian News Agency, March 8 (Reporter Wu Yuqi)The private equity industry has long been regarded as a male-dominated “battlefield”, but in recent years, this pattern is quietly changing. Names such as Li Bei, Pang Yingying, and Fan Xiaoguo frequently appear at the forefront of the performance list and have become the focus of industry attention.

As of February 2025, private equity placement network data shows that 166 female fund managers have emerged across the industry, 31 of whom are the actual controllers of private equity institutions. With their diversified strategic layout and steady management style, they promote the private equity industry into the era of “her power”.

Female fund managers use data to prove that the quality of investment performance has nothing to do with gender, but only connected to professional depth and market insight.

Small and medium-sized private placement has become the main stage for women

The geographical distribution of female fund managers in the private equity industry shows a distinct “agglomeration effect”. Shanghai tops the list with 52 female fund managers, accounting for nearly 30%, far surpassing financial cities such as Shenzhen (29th) and Beijing (18th).

From an institutional perspective, women are still scarce in head private placements (with a scale of more than 5 billion yuan). Only three women in the industry, namely Li Bei of Banxia Investment, Pang Yingying of Jiuying Assets, and He Ruilin of Bopu Technology, are among the top agencies.

In contrast, more than half of the female fund managers (92) come from small private equity companies with a scale of less than 500 million. Industry insiders also believe that this reflects two realities: on the one hand, the flexible mechanism and flat management of small and medium-sized private equity make it easier to accept female leaders; on the other hand, the hidden bias of head agencies on traditional gender roles has not yet been completely eliminated.

It is worth noting that the rise of female fund managers is not limited to a single strategic area. They are very active in sub-tracks such as stocks, bonds, futures and derivatives. For example, equity strategy has 83 female fund managers accounting for half of the country, while bond strategy and futures strategy have 21 and 20 female fund managers respectively.

Judging from the working years of fund managers, there are 88 private equity “female generals” who have worked for more than 10 years, and 20 have worked for more than 20 years; there are 5 have worked for more than 30 years. They are Xu Wei of Shanghai Chengyi Private Equity, Li Ting of Tonghe Investment, Liu Hong of Lu Bao Investment, Guo Rong of Xintaihe, and Ye Hong of Wanli Fidelity Investment. In addition, according to data from the Private Equity Rankings Network, a total of 31 of the 166 private equity “female generals” serve as private equity controllers.

Which “her power” is stronger?

If geographical and institutional distribution show women’s living status in the industry, then the performance list directly reflects their investment strength.

Among the list of the top 20 earnings in the past year, Fan Xiaoguo, a private equity firm in Zhongda, topped the list with a revenue of 101.87%, followed closely by Honggan Investment Yang Sha and Haokun Shengfa Asset Li Jiajia, with earnings both exceeding 60%.

Among the top 20 private equity “female generals” with income in the past year, 7 are private equity controllers. They are: Cheng Xiaowei of Shunyi Cheng Investment, Xu Shuang of Zige Investment, Zhao Lu of Yuyue Private Equity, Dang Kaiyu of Shenzhen Yitong Investment, Lin Sanxiu of Bugu Capital, Yang Ping of Shenzhen Shanze Private Equity, and Chen Xiaoqiu of Xinshan Investment.

In terms of earnings in the past three years, Dai Shijia of Qihe New Asset Management has earned more than 200%. Yang Ping and Zhao Pei, a subsidiary of Shenzhen Shanze Private Equity, jointly managed products, with consistent performance, tied for second place, at 104.70%. These data not only subverted the stereotype of “women have low risk appetite” and also proves women’s ability to make precise decisions in a complex market environment.

Breakthroughs in the field of bond strategy are equally eye-catching. In the list in the past three years, bond strategy fund managers occupy 6 seats. For example, Haizi Investment Luo Silu has achieved excess returns in low-volatility markets through refined credit bond mining. This trend shows that women’s advantages in risk control, detail control and long-term tracking are being recognized in more strategic areas.

In addition, five of the top 20 private equity “female generals” with earnings in the past three years are private equity controllers. They are: Yang Ping from Shenzhen Shanze Private Equity, Chen Xiaoqiu from Xinshan Investment, Dang Kaiyu from Shenzhen Yitong Investment, and Lin Sanxiu from Bugu Capital, and Xie Hongyan from Peng Jinzhong Yang.