Global liquidity is an important factor in the price of Bitcoin. Its cyclical volatility and lagging effects reveal market trends more than absolute values. The current recovery in liquidity may push Bitcoin up at the end of March.

Author: Bitcoin Magazine Pro

Compilation: Vernacular blockchain

Bitcoin’s price trend is usually analyzed through on-chain data, technical indicators and macroeconomic trends. However, one seriously underestimated but extremely important factor is Global Liquidity. Many investors may underutilize this indicator and even have misunderstandings about how it affects Bitcoin’s cyclical trends.

1. The impact of global liquidity on Bitcoin

As discussions about global liquidity heat up on platforms such as Twitter (X), and analysts ‘in-depth interpretation of liquidity data, understanding the relationship between global liquidity and Bitcoin prices has become a required course for traders and long-term investors. However, recent trends deviate from traditional expectations, suggesting that the market may need a more nuanced analytical perspective.

The global M2 money supply refers to the sum of all liquid currencies, including cash, demand deposits and easily convertible quasi-monetary assets.

When global M2 expands, capital typically flows into high-yield assets, including bitcoin, stocks and commodities, driving prices up.

On the contrary, when M2 contracts, market liquidity tightens and risky assets often face pressure from declining valuations.

In the current market environment, the traditional relationship between liquidity and asset prices may be changing, which puts forward higher understanding requirements for investors.

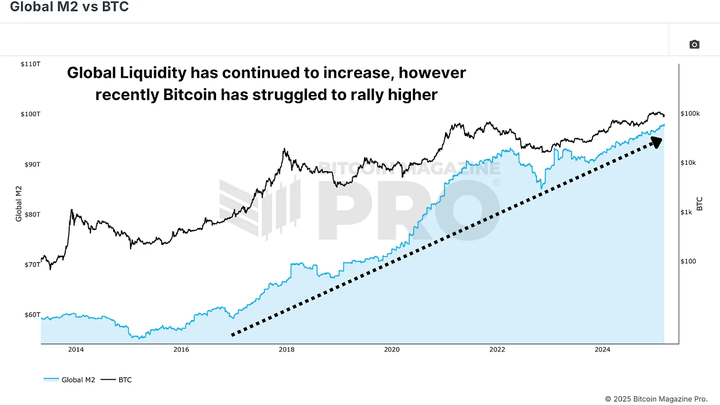

Figure 1: Global liquidity is rising, but Bitcoin prices have fallen recently

Historical trend: Bitcoin price diverges from global M2 trend

In the past, bitcoin prices generally rose as the global M2 money supply expanded, but came under pressure when liquidity contracted. However, during this cycle, we have observed a clear deviation: despite the continued growth of global M2, Bitcoin’s price movements have shown inconsistency.

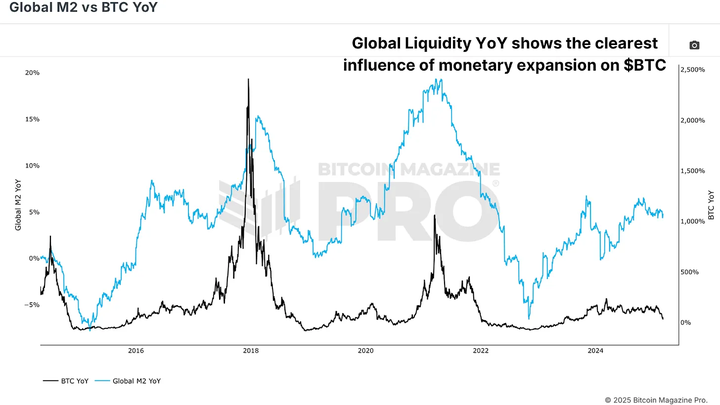

2. Year-on-year change: a more accurate measure of liquidity

Rather than simply focusing on the absolute value of global M2, a more insightful approach is to analyze its year-on-year rate of change (YoY). This indicator reflects the speed at which liquidity expands or contracts, revealing a clearer correlation between Bitcoin price performance and liquidity.

When we compare Bitcoin’s YoY Return with the global M2 YoY Change, we can see that the correlation between the two has increased significantly.

Bitcoin’s strongest bull markets often occur during periods of rapid expansion of liquidity.

Liquidity contraction usually precedes a correction or long-term shock consolidation in Bitcoin prices.

This finding suggests that investors need to pay more attention to changes in global liquidity growth, rather than just absolute levels of liquidity.

Figure 2: Annual rates of change in global liquidity can more clearly reveal the liquidity cycle

For example, during the consolidation phase of Bitcoin in early 2025, although global M2 grew steadily, its growth rate stabilized. Only when M2 ‘s expansion rate accelerates significantly will Bitcoin break through new highs.

3. The lag effect of liquidity

Another key observation is that the impact of global liquidity on Bitcoin does not take effect immediately. Research shows that Bitcoin prices typically lag behind changes in global liquidity by about 10 weeks.

If the global liquidity indicator is moved forward by 10 weeks, the correlation between Bitcoin’s price trend and it will be significantly enhanced.

After further optimization, it was found that the most accurate lag period was about 56 to 60 days, or about 2 months.

This lag effect means that investors need to consider time delays when analyzing the impact of liquidity on Bitcoin, rather than just focusing on current liquidity levels.

Figure 3: The correlation is strongest when liquidity data lags by two months

4. Bitcoin Outlook

For most of 2025, global liquidity entered a sideways phase, after strong expansion at the end of 2024 pushed Bitcoin to a new high. This liquidity sideways period coincides with Bitcoin’s consolidation and correction to approximately US$80,000.

However, if historical trends still work, the recent recovery in global liquidity is expected to bring a new round of gains to Bitcoin around the end of March.

Figure 4: Liquidity is surging, but it may be weeks before Bitcoin truly benefits

5. Conclusion

Global Liquidity is an important macro indicator for predicting the trend of Bitcoin. However, rather than relying on static M2 data, a more effective approach is to focus on the rate of change of M2 and understand the impact of Bitcoin prices that typically lag around two months.

As the global economic environment changes and central banks adjust monetary policies, bitcoin prices will still be affected by liquidity trends. The next few weeks will be crucial-if global liquidity continues to expand at an accelerated pace, Bitcoin may have a major rally.

原文链接